The sound of crunching metal is jarring enough. But the stress of a car accident skyrockets when you discover the other driver has no insurance. Suddenly, you’re facing a mountain of questions. Who pays for your medical bills? How will you get your car fixed? It’s a heavy burden when you should be focused on healing. At our firm, we cut through that complexity with a simple promise. As our lead attorney often says, it doesn’t matter who was at fault, if you’re in a car accident and need your injuries paid for, i’m there for you. simple as that. however, anything beyond your injuries and i can’t help you. This guide is built on that same direct approach, giving you clear, actionable steps to take.

Key Takeaways

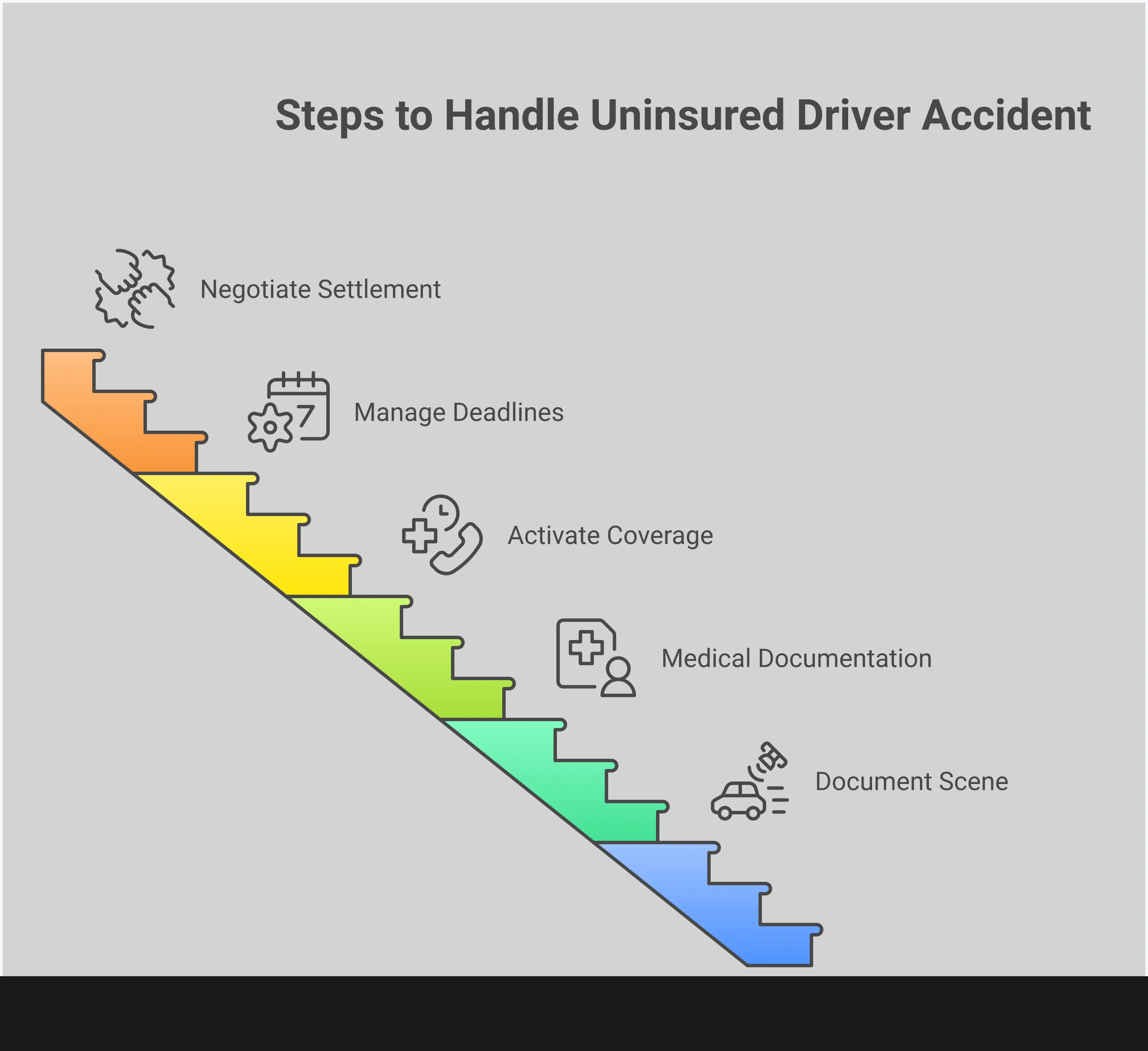

- Act Methodically at the Scene: Your first moves are critical. Focus on documenting everything with photos, getting an official police report, and seeking a medical evaluation to establish a clear record of the accident and your injuries.

- Look to Your Own Policy for Coverage: Don’t assume you’re out of options if the other driver is uninsured. Your Uninsured Motorist (UM) coverage is specifically designed for this situation and is often the key to covering your medical bills and other losses.

- Partner with a Lawyer to Handle the Complexities: You don’t have to deal with insurance adjusters and legal deadlines alone. A personal injury attorney acts as your advocate, managing the entire claims process and fighting for a fair settlement so you can focus on your recovery.

Hit by an Uninsured Driver? Here’s What to Do Next

The moments after a car accident are jarring and stressful, and finding out the other driver doesn’t have insurance only adds to the confusion. It’s easy to feel overwhelmed, but what you do next can significantly impact your ability to recover compensation for your injuries and vehicle damage. Taking a few specific, intentional steps can protect your rights and lay the groundwork for a successful claim. Think of this as your immediate action plan. By staying as calm as possible and focusing on these key tasks, you can gather the information needed to support your case, whether you’re dealing with your own insurance company or pursuing other legal options. These actions create a clear record of what happened and help ensure you have what you need to move forward.

Document the Scene Immediately

Your phone is one of the most powerful tools you have right after a crash. Before anything is moved, start taking pictures and videos. Make sure to get wide shots of the entire accident scene, close-ups of the damage to both vehicles, and photos of any visible injuries you or your passengers have. This visual evidence is incredibly valuable because it captures the immediate aftermath in a way that words can’t. Also, photograph the other driver’s license plate, the road conditions, any skid marks, and nearby traffic signs. This documentation creates a factual record that can be essential for your personal injury claim.

Get an Official Police Report

No matter how minor the accident seems, you should always call the police. When an officer arrives, they will assess the situation and create an official police report. This report is a neutral, third-party account of the incident, and it often includes details like the date, time, location, parties involved, and sometimes even a preliminary determination of fault. Having an official record is critical, especially when an uninsured driver is involved. Insurance companies rely heavily on these reports to process claims, and it will be a key piece of evidence if you need to take legal action to recover your losses.

Gather Contact Info from Witnesses

If anyone else saw the accident happen, their perspective can be a huge help. Other drivers, pedestrians, or people in nearby businesses might have seen exactly what led to the crash. Politely ask any witnesses if they would be willing to provide their name and phone number. Their testimony can corroborate your version of events and provide an unbiased account of what happened. This is particularly important if the uninsured driver disputes the facts. A witness statement can strengthen your claim and make it much harder for the at-fault driver to avoid responsibility.

Prioritize Your Health: See a Doctor ASAP

Your health should be your number one priority. Even if you feel fine, it’s important to get a medical evaluation right away. Some serious injuries, like whiplash or internal bleeding, don’t always show symptoms immediately. Adrenaline can mask pain, and you might not realize you’re hurt until hours or even days later. Seeking prompt medical attention ensures you get the care you need. It also creates a medical record that directly links your injuries to the accident, which is crucial for proving your damages and getting the compensation you deserve for your medical bills.

Notify Your Own Insurance Company

As soon as you are able, you need to notify your own insurance company about the accident. Let them know what happened and inform them that the other driver is uninsured. This is the first step to starting a claim under your own policy, specifically your uninsured motorist (UM) coverage if you have it. When you speak with them, stick to the facts of the accident. Avoid speculating about who was at fault or giving more information than necessary. This is also a good time to contact an attorney who can guide you through the process and handle communications with the insurance company on your behalf.

Debunking Myths About Uninsured Driver Accidents

After a car accident, misinformation can spread almost as fast as the news of the crash itself, especially when an uninsured driver is involved. You might hear that you’re out of luck if the other driver doesn’t have insurance, or that you have no rights if you were uninsured at the time. It’s easy to feel overwhelmed and hopeless when you’re bombarded with conflicting advice from well-meaning friends or online forums. But it’s crucial to separate fact from fiction so you can make informed decisions instead of acting on fear or confusion.

The truth is, you often have more options than you think. Many of the common “rules” you hear about uninsured driver accidents are simply myths that can prevent you from getting the help you need. Believing them can cause you to miss out on compensation you’re rightfully owed for your medical bills, lost wages, and vehicle repairs. Let’s clear up some of the most persistent misconceptions so you can understand your actual rights and take the right steps to protect yourself.

What Are Your Legal Rights After a Crash?

One of the biggest myths is that if you don’t have car insurance, you automatically lose your right to seek compensation after an accident. That’s simply not true. If another driver caused the crash, you can still file a claim against them for your injuries and property damage. Missouri law focuses on who was at fault for the accident, not just who has insurance. While driving without insurance comes with its own set of legal penalties, it doesn’t prevent you from holding a negligent driver accountable for the harm they’ve caused. Your right to pursue justice isn’t erased just because you lack coverage.

Can You Still Get Compensation?

It’s a common fear: the at-fault driver has no insurance, so you assume they have no money to pay for your damages. While this can make things more complicated, it doesn’t mean you can’t get compensation. This is exactly why Uninsured Motorist (UM) coverage exists. If you have this on your own policy, your insurance company can step in to cover your medical bills, lost wages, and other losses. An experienced attorney can help you explore all possible sources of recovery, including filing a claim with your own insurer or, in some cases, pursuing a direct lawsuit against the at-fault driver.

What Does Your Insurance Policy Actually Cover?

Many people don’t fully understand their own insurance policy until they need it. If you’re hit by an uninsured driver, your Uninsured Motorist (UM) coverage is your first line of defense. This is a specific part of your policy designed to protect you in this exact scenario. It covers costs like medical treatment, lost income, and pain and suffering up to your policy limits. Similarly, Underinsured Motorist (UIM) coverage helps if the at-fault driver has insurance, but not enough to cover all your damages. Understanding these parts of your policy is a key part of handling automobile accidents.

Should You Consider Taking Legal Action?

Feeling powerless after an accident with an uninsured driver is understandable, but you are not without options. The most important step you can take is to discuss your situation with a personal injury lawyer as soon as possible. An attorney can review the details of your case, explain your rights, and outline a clear strategy. This could involve filing a UM claim with your own insurance company or taking legal action against the responsible driver. Don’t assume it’s a lost cause. Getting professional legal advice will help you understand the best path forward to secure the compensation you deserve.

Understanding Your Insurance and Legal Options

After a car accident, especially one involving an uninsured driver, it’s easy to feel overwhelmed and unsure of what to do next. The good news is that you have rights, and there are specific insurance options designed to protect you in this exact situation. Understanding these rights and coverages is the first step toward securing the compensation you need to recover. Insurance policies can be complicated, and state laws add another layer of complexity, but you don’t have to figure it all out on your own.

The key is to know what your own insurance policy covers and what legal deadlines you need to meet. This knowledge empowers you to make informed decisions and protects you from missing out on the financial support you’re entitled to. Whether you’re dealing with medical bills, lost income, or vehicle repairs, knowing your options can make a significant difference in your recovery. Our firm handles a wide range of personal injury cases and can help you understand the specifics of your situation.

Fundamental Insurance Concepts to Know

Dealing with insurance companies can feel like learning a new language, filled with confusing terms and fine print. But you don’t need to be an expert to protect your rights. Understanding a few key concepts will empower you to have more productive conversations with adjusters and make sense of your options. Think of this as your cheat sheet for the most important insurance ideas you’ll come across after a crash. Knowing what terms like “liability” and “policy limits” actually mean gives you a solid foundation, helping you feel more in control during a stressful time and ensuring you know what to ask for.

What is Liability Insurance?

Liability insurance is the coverage the at-fault driver is legally required to have. Its purpose is to pay for the injuries and property damage they cause to other people. In short, if someone else hits you, their liability insurance is supposed to cover your medical bills and car repairs. It does not pay for their own injuries or vehicle damage; that’s what collision or health insurance is for. When the driver who hit you is uninsured, this essential source of compensation is missing, which is why you then have to turn to your own insurance policy’s Uninsured Motorist coverage to get the financial help you need.

Understanding Policy Limits

Every insurance policy has a maximum amount it will pay out for a single accident, known as the “policy limit.” For example, a driver might only have the minimum liability coverage required by the state, which can be quickly exhausted by serious injuries or extensive vehicle damage. If your total costs exceed the at-fault driver’s policy limits, you could be left with unpaid bills. This is where Underinsured Motorist (UIM) coverage on your own policy becomes critical. UIM coverage is designed to bridge the gap when the other driver has insurance, but just not enough to cover all of your losses from serious automobile accidents.

“At-Fault” vs. “No-Fault” States Explained

How you get compensation after an accident largely depends on the state where the crash occurred. Some states follow a “no-fault” system, where your own insurance policy’s Personal Injury Protection (PIP) is your first source of payment for medical bills, regardless of who caused the accident. However, it’s crucial to know that Missouri is an “at-fault” state. This means the person who is legally responsible for causing the collision is also responsible for paying for the resulting damages. Proving the other driver was negligent is the key to a successful claim in Missouri, making evidence from the scene and the police report incredibly important.

What if You’re Partially to Blame?

In many accidents, an insurance company might argue that both drivers share some of the blame. Missouri follows a legal rule called “pure comparative fault,” which means you can still recover damages even if you were partially responsible for the crash. However, your total compensation will be reduced by your percentage of fault. For example, if you have $100,000 in damages but are found to be 20% at fault, your final award would be reduced by 20%, leaving you with $80,000. Insurance adjusters may try to assign you a higher percentage of fault to reduce their payout, which is why having an experienced attorney to advocate on your behalf is so important.

Know Your State’s Minimum Insurance Requirements

In Missouri, as in most states, driving without liability insurance is illegal. All drivers are required to carry a minimum amount of coverage to pay for damages they might cause in an accident. If you’re hit by someone without insurance, they are breaking the law, but that doesn’t automatically solve your problems. And if you were driving without insurance yourself, you could face penalties, even if the accident wasn’t your fault. This is why it’s so important to not only have insurance but to understand what your policy includes. Following state law is your first line of defense and the foundation of a strong case.

Which Types of Coverage Can Help You?

When the at-fault driver has no insurance, you’ll likely need to turn to your own policy for help. This is where specific types of coverage become incredibly valuable. The most important ones in this scenario are Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage. These are designed to cover your expenses when the other driver can’t. Think of it as insurance against someone else’s lack of responsibility. Your own policy often becomes the primary source for compensation, covering everything from medical bills to lost wages that the uninsured driver should have paid for. It’s essential to review your policy to see what protections you have.

Why You Need Uninsured Motorist Coverage

Uninsured Motorist (UM) coverage is your financial safety net. You add it to your own auto insurance policy to protect yourself and your family if an uninsured driver causes an accident. If you’re injured, your UM coverage can step in to pay for your medical expenses, lost income, and even pain and suffering, up to your policy limits. Without it, you could be left paying for everything out of your own pocket or trying to sue a driver who has no assets. Having this coverage gives you a direct path to getting the financial support you need without having to rely on the at-fault driver’s ability to pay.

What is Personal Injury Protection (PIP)?

While Missouri doesn’t require Personal Injury Protection (PIP), many drivers have Medical Payments (MedPay) coverage, which works similarly. MedPay is an optional coverage that helps pay for your and your passengers’ medical expenses after an accident, regardless of who was at fault. It can cover costs like health insurance deductibles, co-pays, and other immediate medical needs before your other coverages, like UM, begin to apply. This can provide crucial, immediate financial relief so you can focus on getting the medical care you need without waiting for a settlement. Check your policy to see if you have this helpful coverage.

Don’t Miss the Deadline to File a Claim

Every state has a law called the “statute of limitations,” which sets a strict time limit on how long you have to file a lawsuit after an accident. In Missouri, you generally have five years from the date of the accident to file a personal injury claim. If you miss this deadline, the court will likely refuse to hear your case, and you will lose your right to seek compensation forever. This is why it’s so important to act quickly. Don’t wait to explore your legal options; contact a lawyer as soon as possible to ensure your rights are protected and every deadline is met.

Deadlines for Personal Injury vs. Property Damage Claims

In Missouri, the clock starts ticking on your right to file a claim from the very day of the accident. You have a five-year window, known as the statute of limitations, to file a lawsuit for both personal injuries and property damage. While that might sound like plenty of time, building a strong case requires gathering evidence, dealing with insurance companies, and preparing legal documents—all of which takes time. If you miss this five-year deadline, you lose your right to seek compensation through the courts forever. That’s why it is so critical to act quickly after an accident and connect with an attorney who can manage these deadlines for you.

What Happens in a Rental Car Accident?

An accident in a rental car adds another layer of complexity to an already stressful situation. If an uninsured driver hits your rental, the steps are similar to any other accident—you’ll likely file a claim under your own Uninsured Motorist (UM) coverage. If you were at fault, your personal auto insurance is usually the primary policy that pays for damages, provided it covers rentals. Any insurance you bought from the rental agency typically acts as secondary coverage. Figuring out which policy pays for what can be a real headache, which is why getting legal advice is so valuable when handling automobile accidents that involve multiple insurance companies.

How a Car Accident Lawyer Can Help

After an accident with an uninsured driver, you might feel like you’re facing an uphill battle alone. The legal and insurance systems can be confusing, and the stress of it all can be overwhelming when you should be focused on healing. This is where a personal injury lawyer steps in. They act as your advocate, handling the complexities of your case so you can concentrate on your recovery.

Hiring a lawyer isn’t just for situations that end up in a courtroom drama. From the very beginning, they work to protect your rights and build a strong foundation for your claim. They manage communication with insurance companies, gather crucial evidence, and ensure every deadline is met. An experienced attorney understands the specific challenges of automobile accident cases, especially those involving uninsured drivers, and can guide you toward the best possible outcome. They take the weight off your shoulders by managing the entire process, from the initial investigation to the final settlement.

Handling the Accident Investigation

One of the first things a lawyer will do is conduct a thorough investigation of the accident. While a police report is a good starting point, it doesn’t always tell the whole story. Your attorney will dig deeper to establish exactly who was at fault. This involves gathering evidence like photos and videos from the scene, obtaining witness statements, and reviewing traffic camera footage. In more complex cases, they may even hire an accident reconstruction expert to analyze the crash dynamics. This detailed investigation is essential for proving negligence and building a solid case to present to your insurance company or a court.

Identifying All Possible Sources of Compensation

A common worry after being hit by an uninsured driver is that there’s no way to cover your medical bills and other losses. A skilled lawyer knows exactly where to look for potential sources of compensation. Often, the primary source is your own auto insurance policy, specifically your Uninsured Motorist (UM) or Underinsured Motorist (UIM) coverage. This is coverage you pay for precisely for this type of situation. Your attorney will carefully review your policy to maximize your benefits. They will also explore other possibilities, such as whether a third party, like a government entity responsible for road maintenance, could share liability for the accident.

Negotiating with Insurers on Your Behalf

Dealing with insurance companies can be frustrating. Adjusters are trained to minimize payouts, and they may try to get you to accept a quick, lowball offer. When you have a lawyer, all communication goes through them. They will handle the negotiations on your behalf, armed with the evidence from their investigation and a clear calculation of your damages—including medical expenses, lost wages, and pain and suffering. An experienced attorney knows the tactics insurance companies use and won’t be intimidated. Their goal is to secure a fair settlement that truly covers the full extent of your losses, taking the pressure off you.

Managing the Mountain of Paperwork

A personal injury claim involves a surprising amount of paperwork, from filing initial claim forms to submitting medical records and managing correspondence with various parties. Missing a deadline or filling out a form incorrectly can seriously damage your case. A lawyer and their team will manage all of this for you. They ensure every document is filed correctly and on time, guiding you through the complex legal process. This administrative support is invaluable, as it prevents critical errors and allows you to focus your energy on getting better without the added stress of keeping track of endless paperwork.

Representing You in Court if Necessary

While most personal injury cases are settled out of court, sometimes filing a lawsuit is the only way to get the compensation you deserve. If the insurance company refuses to offer a fair settlement, your lawyer will be prepared to take your case to trial. They will file the necessary legal documents, represent you in all court proceedings, and argue your case before a judge and jury. Having a trial-ready attorney shows the other side you are serious about protecting your rights. If you’re ready to discuss your case, you can contact our office for a consultation.

How to Build a Strong Legal Case

After an accident, it’s easy to feel overwhelmed. But taking a few specific steps to organize your information can make a huge difference in the outcome of your case. Building a strong legal case is all about methodically gathering the proof you need to show what happened and how it has impacted your life, finances, and well-being.

Think of it as creating a clear, undeniable story for the insurance companies or, if necessary, the court. Every piece of evidence, every receipt, and every doctor’s note is a crucial part of that story. It’s your best tool for securing the compensation you need to recover and move forward. Taking these actions helps protect your rights and puts you in the best possible position for a fair resolution.

Keep Detailed Records of Your Medical Care

Your health should always be your first priority after an accident. Even if you feel okay, it’s vital to seek immediate medical attention, as some injuries can take hours or even days to appear. Documenting your medical treatment is also crucial for your legal case. It creates an official record that connects your injuries directly to the accident. Make sure to keep a dedicated folder for every doctor’s report, medical bill, physical therapy note, and prescription receipt. This paper trail is the foundation for establishing the extent of your injuries and justifying the care you require for your personal injury claim.

Track Every Expense and Lost Wage

The financial toll of a car accident can add up quickly. You can generally get money for “economic damages,” which includes things like your medical bills, the cost of repairing or replacing your car, and any income you’ve lost from being unable to work. Start a log right away to keep a detailed record of these expenses. Hold on to every receipt, invoice, and pay stub. This meticulous tracking is essential for your case because it provides concrete proof of the financial hardship the accident has caused, ensuring you can ask for the full amount you’re owed.

Keep a Daily Journal of Your Recovery

Beyond the receipts and medical bills, your personal experience is a powerful part of your story. Keeping a daily journal is one of the best ways to capture the day-to-day impact of your injuries, especially since some symptoms can take days to appear. Each day, take a few minutes to write down how you feel, both physically and emotionally. Did you have trouble sleeping because of the pain? Were you unable to lift your child or carry groceries? These details matter. This journal creates a consistent, personal account that goes beyond medical reports, providing powerful evidence of your pain and suffering. This documentation is a crucial step in building a strong case and getting the support you need from a personal injury attorney.

What Evidence Do You Need to Collect?

The more evidence you have, the stronger your case will be. Start by getting a copy of the official police report. If you were able to at the scene, photos and videos of the vehicle damage, your injuries, and the surrounding area are incredibly helpful. Be sure to also get the names and contact information of any witnesses. It’s also a good idea to save all emails and letters from insurance companies. When you collect important evidence like this, you help create a complete and accurate picture of what happened and who was at fault, leaving less room for dispute later on.

How to Prove the Full Cost of Your Damages

Simply having injuries and expenses isn’t enough—you have to prove they were a direct result of the accident. This is where an experienced attorney can be your greatest asset. A lawyer knows how to take all the evidence you’ve collected and assemble it into a clear, persuasive claim that proves your damages. They are skilled at handling the complex negotiations with insurance companies and will fight to ensure you don’t settle for less than you deserve. Their goal is to manage the legal complexities so you can focus on what matters most: your recovery.

Using Expert Witnesses to Strengthen Your Case

Sometimes, a case involves technical details or severe injuries that require specialized knowledge to explain. In these situations, an experienced car accident lawyer can identify and hire expert witnesses to strengthen your claim. These experts could be accident reconstruction specialists who can show how the crash happened, or medical professionals who can testify about the long-term effects of your injuries. Their insights provide additional credibility and can be incredibly persuasive. Having a lawyer who knows when to work with expert witnesses can be a game-changer in building the strongest case possible.

The Insurance Claim and Settlement Process Explained

The aftermath of a car accident is confusing enough without having to figure out the insurance claims process. It often feels like a maze of paperwork, phone calls, and legal terms. The goal is to get fair compensation for your injuries and damages, but insurance companies aren’t always on your side. Their primary objective is to protect their bottom line, which often means paying out as little as possible.

This process involves filing a claim, documenting your losses, negotiating with adjusters, and, in some cases, preparing to go to court. Each step has its own challenges, especially when an uninsured driver is involved. Understanding how it all works can help you feel more in control and make informed decisions. It’s about knowing what you’re entitled to and having a clear strategy to get there. Having a legal professional guide you through these steps can make a significant difference in the outcome, ensuring your rights are protected from start to finish.

How to File an Insurance Claim

After an accident, the first step is to report it to the appropriate insurance company. If the at-fault driver is uninsured, your options change. You’ll likely need to file a claim with your own insurance provider, using your uninsured motorist (UM) coverage if you have it. This coverage is designed specifically for these situations. If you don’t have UM coverage, your other options are to sue the driver directly for the costs or cover everything yourself, which can be financially devastating. It’s important to act quickly, as there are strict deadlines for filing claims.

What to Do if You Only Have Liability Coverage

If you only carry liability insurance, it’s important to understand its limitations. This type of coverage is designed to pay for the damages you cause to other people or their property—it does not cover damage to your own car. This means if you’re in an accident that isn’t your fault, your insurance company won’t step in to manage the claim for you. You are responsible for contacting the at-fault driver’s insurance company yourself to seek compensation for your vehicle repairs and any injuries. This process requires you to prove the other driver was at fault and negotiate directly with their adjuster, which can be a challenging and time-consuming task, especially while you’re trying to recover from the stress of an accident.

How Insurance Deductibles Work

A deductible is the amount of money you have to pay out of pocket before your insurance coverage begins to pay. How this works depends on which insurance company you file a claim with. If you file a claim directly with the at-fault driver’s insurance, you typically do not have to pay a deductible. However, if you choose to use your own collision or uninsured motorist coverage, you will likely have to pay your deductible first. Your insurance company will then try to recover that money from the at-fault party’s insurer through a process called subrogation. If they are successful, you will be reimbursed for your deductible, but this can take time.

What Kind of Damages Can You Claim?

When you file a claim, you can seek compensation for a variety of losses, known as “damages.” These typically include economic damages like your medical bills, lost wages from time off work, and the cost of repairing or replacing your vehicle. Depending on the severity of the accident, you may also be able to claim non-economic damages for pain and suffering. Understanding the full scope of your personal injury claim is key to ensuring you don’t settle for less than you deserve and that all your current and future needs are accounted for.

What to Expect During Negotiations

Once you’ve filed a claim, the negotiation phase begins. Be prepared for the insurance adjuster to offer a low initial settlement—it’s a common tactic. They might question the severity of your injuries or argue that some of your medical treatments weren’t necessary. Their goal is to settle your claim for the lowest amount possible. This is where having an experienced advocate is crucial. A lawyer can handle these negotiations for you, pushing back against lowball offers and fighting for a settlement that truly covers all of your losses.

When to Take Your Case to Court

Most personal injury cases are settled out of court. However, if the insurance company refuses to offer a fair settlement during negotiations, filing a lawsuit may be the only way to get the compensation you need. This doesn’t mean you’ll automatically end up in a lengthy trial; often, the act of filing a lawsuit prompts the insurer to come back to the table with a better offer. If you find yourself at a standstill with the insurance company, it’s time to discuss your options with an attorney who can represent you in court and hold the negligent driver accountable.

How to Choose the Right Car Accident Lawyer

After a car accident, especially one involving an uninsured driver, the attorney you choose can make all the difference. This isn’t just about finding someone with a law degree; it’s about finding a dedicated advocate who understands the specific challenges of your situation. The right lawyer will handle the legal complexities so you can focus on your recovery. But with so many options, how do you find the best fit? It comes down to asking the right questions and knowing what to look for.

Key Qualifications to Look For in a Lawyer

Not all lawyers are created equal. While many attorneys handle personal injury, you need someone with a proven track record in car accident cases. Look for a lawyer whose primary practice areas include automobile accidents and personal injury. This specialization means they are deeply familiar with traffic laws, accident reconstruction, and the tactics insurance companies use to minimize payouts. An experienced car accident attorney understands the evidence needed to build a strong case and has the courtroom experience to back it up if a fair settlement can’t be reached. Don’t be afraid to ask about their past results and experience with cases similar to yours.

Why Experience with Uninsured Motorist Cases Matters

An accident with an uninsured driver adds another layer of complexity to your claim. That’s why it’s crucial to find an attorney who has specific experience with uninsured and underinsured motorist (UM/UIM) cases. These claims are handled differently than a standard liability claim, as you’ll likely be dealing with your own insurance company. An experienced lawyer knows how to identify your best options and will manage every step of the process, from interpreting your policy to negotiating a fair settlement. They can help you prove your damages and ensure your insurer honors the coverage you’ve paid for.

How Do Car Accident Lawyers Get Paid?

Worries about cost should never prevent you from seeking legal help. Most reputable car accident lawyers work on a contingency fee basis. This means you pay no upfront fees, and the lawyer only gets paid if they successfully recover money for you. Their fee is typically a percentage of the final settlement or award. Before you sign anything, make sure you receive a clear, written agreement that outlines the fee structure and explains how case-related costs (like expert witness fees or court filing costs) are handled. A trustworthy attorney will be transparent about all potential expenses from the very beginning.

Questions to Ask Before You Hire a Lawyer

Your initial consultation is your opportunity to interview a potential lawyer and see if they’re the right fit. Come prepared with a list of questions to help you make an informed decision.

Here are a few to get you started:

- How many car accident cases involving uninsured drivers have you handled?

- What is your initial assessment of my case?

- Who will be my primary point of contact at your firm?

- How will you keep me updated on the progress of my case?

- What is your fee structure?

A good lawyer will welcome your questions and provide clear, thoughtful answers. If you’re ready to discuss your case, feel free to contact our office to schedule a free consultation.

Red Flags to Watch For

Just as important as knowing what to look for is knowing what to avoid. Be cautious of any lawyer who makes grand promises or guarantees a specific outcome. The legal process is unpredictable, and ethical attorneys will never guarantee results. Another red flag is a lack of communication; if it’s difficult to get a lawyer on the phone for a consultation, imagine how it will be once you’re a client. Finally, avoid anyone who pressures you to make a quick decision or sign a contract on the spot. You should feel comfortable and confident in your choice, not rushed.

Protecting Your Rights Throughout Your Claim

After a car accident, especially one involving an uninsured driver, you might feel overwhelmed and unsure of what to do next. It’s a chaotic time, but the steps you take immediately following the crash are critical for protecting your physical, financial, and legal well-being. Knowing how to handle common pitfalls, communicate with insurance companies, and manage your health can make a significant difference in the outcome of your case. The key is to be proactive and informed. Don’t let confusion or fear prevent you from taking the right steps to safeguard your interests. This means documenting everything, being cautious in your conversations, and prioritizing your health above all else. By staying organized and understanding your rights, you can build a strong foundation for your claim and ensure you’re in the best possible position to recover from the accident.

Avoid These Common Mistakes

One of the biggest mistakes you can make is assuming you have no options, especially if you were the one without insurance. If another driver caused the accident, you can still seek money for your injuries and property damage. Don’t let your insurance status stop you from pursuing justice. Another common error is admitting fault at the scene or apologizing. Even a simple “I’m sorry” can be misinterpreted as an admission of guilt. Stick to the facts when talking to the other driver and the police. Also, avoid downplaying your injuries. Adrenaline can mask pain, so it’s best to get a medical evaluation before saying you’re “fine.” Finally, don’t wait too long to act. There are strict deadlines for filing claims, and delaying can weaken your case.

How to Talk to Insurance Adjusters

When you speak with an insurance adjuster—even your own—remember that they work for a business focused on its bottom line. Their goal is often to settle your claim for the lowest amount possible. Be polite but cautious. Provide only the basic, factual information about the accident, such as the date, time, and location. You are not obligated to give a recorded statement, and it’s wise to decline until you’ve spoken with an attorney. Anything you say can be used to question the severity of your injuries or your version of events. Never accept a quick settlement offer without fully understanding the extent of your damages, including future medical costs and lost wages. It’s always a good idea to contact a lawyer before having any detailed conversations with an adjuster.

Should You Give a Recorded Statement?

You are not legally required to give a recorded statement to an insurance adjuster, and in most cases, it’s in your best interest to politely decline until you’ve consulted with an attorney. Adjusters are trained to ask questions in a way that might get you to say something that could be used to weaken your claim later. They might ask how you’re feeling, and if you say “fine,” they could use that to argue your injuries aren’t serious. Your words can be taken out of context to dispute the facts of the accident or the severity of your injuries. It’s much safer to let a lawyer handle these communications to ensure your rights are protected.

Common Reasons Your Claim Might Be Denied

It’s incredibly frustrating to have your claim denied, especially when you know you weren’t at fault. Insurance companies can deny claims for several reasons, often boiling down to protecting their own financial interests. They might argue that their driver wasn’t entirely to blame for the accident or that the incident isn’t covered under the at-fault driver’s policy. Other common reasons for denial include your losses exceeding the policy’s coverage limits or that you waited too long to report the accident or seek medical treatment. An attorney can help you challenge an unfair denial and fight for the coverage you are owed for your automobile accident.

Will a Claim Affect Your Insurance Rates?

Many people worry that filing a claim, especially with their own insurance company, will cause their rates to go up. This is a valid concern, but in Missouri, you have protections. Missouri is an “at-fault” state, which means the person who caused the accident is responsible for the damages. State law generally prevents your insurance company from raising your rates if you were not at fault for the crash. Filing an uninsured motorist claim should not negatively impact your premium, as you are using a benefit you paid for to protect yourself from a situation caused by another driver’s negligence. If you have questions about this, it’s a good idea to contact our office.

Managing Your Ongoing Medical Treatment

Your health should be your top priority. Seek immediate medical attention after an accident, even if you feel your injuries are minor. Some serious conditions, like whiplash or internal injuries, may not show symptoms right away. Going to the doctor creates an official record that links your injuries directly to the crash, which is essential for any personal injury claim. Follow your doctor’s treatment plan precisely, whether it involves physical therapy, medication, or follow-up appointments. Keep a detailed file of all your medical visits, bills, and prescriptions. This documentation is crucial evidence that demonstrates the impact the accident has had on your life and helps calculate the compensation you deserve.

Planning for Your Financial Recovery

A car accident can have serious financial consequences that extend far beyond vehicle repairs. If you caused an accident and don’t have insurance, you are personally responsible for all costs, including the other party’s injuries and property damage. This can lead to overwhelming debt and legal trouble. If you were the victim, you’re facing medical bills, lost income from time off work, and other unexpected expenses. An experienced attorney can help you identify all possible sources of compensation to cover these costs and secure your financial stability. By taking the right legal steps, you can focus on your recovery without the added stress of financial uncertainty. A dedicated lawyer can help you plan for what’s next and fight for the resources you need.

Related Articles

- What to Do After a Car Accident with an Uninsured Driver

- Hiring a Lawyer After a Car Accident Without Insurance

Frequently Asked Questions

What if I was the one without insurance, but the accident wasn’t my fault? This is a common worry, but in Missouri, the law focuses on who caused the accident. Even if you were uninsured, you still have the right to file a claim against the at-fault driver to cover your medical bills and vehicle damage. While you may face separate penalties for driving without insurance, it doesn’t take away your right to hold the responsible person accountable for their actions.

How am I supposed to pay for my medical bills right after the accident? Immediate medical costs are a major source of stress. If you have Medical Payments (MedPay) coverage on your auto insurance policy, it can help cover initial expenses like co-pays and deductibles, regardless of who was at fault. This coverage provides quick financial relief so you can get the care you need without delay. Later, a settlement from your Uninsured Motorist coverage or a claim against the other driver can cover the full extent of your medical treatment.

The other driver is uninsured, so does that mean I have to sue them personally to get any money? Not necessarily. This is exactly why Uninsured Motorist (UM) coverage is so important. If you have this on your policy, you can file a claim directly with your own insurance company to cover your losses, including medical bills and lost wages. This is often the most effective path to getting compensation. While suing the driver directly is sometimes an option, a UM claim is typically the first and best course of action.

Why do I need a lawyer if I’m just filing a claim with my own insurance company? Even though you’re dealing with your own insurer, their goal is still to pay out as little as possible. An insurance adjuster may try to downplay your injuries or offer a quick settlement that doesn’t cover your long-term needs. An experienced attorney acts as your advocate, handling all negotiations to ensure you receive a fair amount based on the full extent of your damages. They make sure your insurer honors the policy you’ve paid for.

Is there a time limit for filing a claim after an accident with an uninsured driver? Yes, and it’s very important to act quickly. In Missouri, you generally have five years from the date of the accident to file a personal injury lawsuit. This is known as the statute of limitations. If you miss this deadline, you will likely lose your right to seek compensation forever. Contacting an attorney soon after the accident ensures all deadlines are met and your rights are protected from the start.