Let’s clear up a common point of confusion: workers’ comp, FMLA, and short-term disability are not the same thing. Each program helps in a different way, and knowing which is which is the first step to getting the support you need. This guide focuses specifically on short term disability Missouri. It’s a benefit designed to replace a portion of your income when a non-work-related injury or illness keeps you from your job. We’ll cover how it differs from other benefits, what conditions qualify, and what to do if your injury happened at work.

Key Takeaways

- It’s Paycheck Insurance, Not Workers’ Comp: Short-term disability replaces a portion of your income for non-work-related health issues, while workers’ compensation is strictly for injuries that happen on the job. Knowing the difference is the first step to filing the correct claim.

- Organization is Key to a Successful Claim: A smooth claims process depends on you. Be prepared to provide detailed medical records from your doctor, meet all deadlines set by your policy, and fill out every piece of paperwork completely and accurately to avoid delays.

- Disability Benefits Don’t Equal Job Protection: Your short-term disability policy provides income, but it doesn’t legally protect your job. To secure your position while you’re on leave, you’ll likely need to apply for FMLA (Family and Medical Leave Act) at the same time.

What Is Short-Term Disability in Missouri?

If you’ve ever worried about how you’d pay your bills after an unexpected injury or illness, you’re not alone. That’s where short-term disability comes in. Think of it as a financial safety net that helps you stay afloat when you can’t work. In Missouri, short-term disability (STD) provides temporary income replacement for employees who are unable to work due to a non-work-related injury or illness. It’s not a government program but rather an insurance policy, often provided by your employer as part of your benefits package.

This insurance is designed to cover a portion of your lost wages for a limited time while you recover. Whether you’re dealing with a serious illness, recovering from surgery, or even welcoming a new baby, short-term disability can provide crucial support. It helps bridge the financial gap so you can focus on what matters most: getting better. Understanding how it works is the first step toward protecting yourself and your family from the financial strain of a temporary disability.

How Common Are Employer-Provided Plans in Missouri?

You might be wondering just how likely it is that your job offers this kind of coverage. The good news is that in Missouri, short-term disability is a pretty standard part of an employee benefits package. Research shows that more than 60% of companies provide it, and when it’s offered, about 98% of employees enroll—a clear sign of its value. What makes these plans even more appealing is that employers often cover the entire cost, so you get this safety net without a hit to your paycheck. When you need to use it, the plan typically replaces a significant portion of your income, usually between 50% and 100% of your regular salary. This support is designed to help you manage your bills while you focus on recovery, making it a crucial benefit to understand before you need it.

What Does Your Policy Actually Cover?

Before you can receive benefits, you’ll need to meet a few key requirements. To qualify for short-term disability in Missouri, you generally must be a resident, work for a Missouri-based company, and have a qualifying medical condition that keeps you from performing your job duties. While these are the basic pillars, every insurance policy is different. Your specific plan will have its own rules, including a waiting period (often called an “elimination period”) before your benefits kick in. It’s so important to read your policy documents carefully or speak with your HR department to understand exactly what’s needed to file a successful claim.

Waiting Periods for Accidents vs. Illnesses

When you file a claim, you’ll come across the term “elimination period,” which is simply the waiting period before your benefits begin. What you might not realize is that this waiting period isn’t always the same for every situation. Many policies treat accidents and illnesses differently. For instance, if an accidental injury keeps you from working, your benefits might start after just a day or two. But if you’re out with an illness, you could be waiting a week or more. This gap in time can significantly affect your finances, so it’s a critical detail to find in your policy.

This is where reading the fine print really matters, because every insurance plan has its own set of rules. The Missouri Department of Labor and Industrial Relations confirms that your specific plan dictates the waiting period before benefits kick in. Some short-term disability plans might have a uniform 7-day wait, while others could have a 1-day wait for accidents and a 15-day wait for illnesses. The only way to be certain is to review your policy documents or schedule a conversation with your HR representative. Taking this step will give you a clear picture of what to expect, helping you plan for any time you’ll be without a paycheck.

How Long Does Coverage Last?

As the name suggests, short-term disability is meant for temporary situations. The goal is to provide financial support during your immediate recovery period. In most cases, benefits typically last for up to 26 weeks, or about six months. This timeframe is designed to cover recovery from common issues like surgery, a complicated pregnancy, or a significant but non-permanent injury. If your condition prevents you from returning to work after your short-term benefits run out, you may then need to look into long-term disability options. Always check your policy for the specific benefit duration it offers.

What Kind of Policy Do You Have?

The best way to understand short-term disability is to think of it as “paycheck insurance.” It’s there to offer you money to replace part of your income if you can’t work due to an illness, an injury that happened outside of work, or childbirth. Most policies will pay a percentage of your regular salary, typically ranging from 50% to 70%. These plans are usually offered by employers as group policies, but you can also purchase individual policies on your own. The key feature is that it protects your income, giving you peace of mind when you’re medically unable to earn a paycheck.

How Is It Different from Workers’ Comp?

This is a common point of confusion, but the distinction is simple and important. Short-term disability insurance is different from workers’ compensation, which specifically covers injuries that happen in the workplace. If you slip on a wet floor at your office and break your arm, that’s a workers’ comp issue. But if you break your arm while skiing on a weekend trip, that would fall under short-term disability. Understanding which system applies is crucial for getting the right benefits. If you’re ever unsure about a work-related injury, exploring your legal practice areas can help clarify your options.

Do You Qualify for Short-Term Disability?

Figuring out if you qualify for short-term disability can feel like a puzzle, but it doesn’t have to be. Your eligibility really comes down to three things: your job, your medical condition, and the specifics of your insurance policy. Let’s walk through the key requirements so you can get a clearer picture of where you stand and what steps to take next.

How Your Employment Status Plays a Role

First things first, your job situation matters. To qualify for short-term disability in Missouri, you typically need to meet a few basic criteria. Generally, you must be a resident of Missouri and employed by a company within the state. Your specific policy will outline the work requirements, such as how long you needed to be with your employer before becoming eligible for coverage. The Missouri Department of Labor provides a helpful overview of the benefits available to workers, which can give you a foundational understanding of your rights and what to expect from state-level programs.

What Medical Conditions Are Covered?

A wide range of medical issues can qualify you for short-term disability benefits, and it’s not just for major accidents. According to Missouri State University, Short Term Disability (STD) is designed to cover illnesses, injuries that happen outside of work, and recovery from childbirth. This means everything from a serious flu or a broken leg from a weekend hike to necessary surgery could be covered. Both physical and mental health conditions can qualify, as long as a medical professional confirms that your condition prevents you from performing your job duties for a temporary period.

What About Pre-existing Conditions?

If you had a health issue before your insurance coverage started, it’s known as a pre-existing condition, and it can affect your claim. Many policies have specific rules about this. For example, you might have a waiting period before your policy will cover a condition you were already being treated for. It’s important to read your policy documents carefully to understand any limits on pre-existing conditions. This will help you avoid surprises and know exactly what to expect when you file a claim for a health problem you had before signing up for your plan.

Does Short-Term Disability Cover Pregnancy?

There’s a common myth that pregnancy doesn’t count as a disability, but that’s simply not true for most short-term disability plans. In fact, recovery from childbirth is one of the most common reasons women use their STD benefits. The policy typically covers a portion of your pay for a set number of weeks while you recover after giving birth. It’s a crucial benefit that allows you to focus on your health and your new baby without the added stress of a total loss of income. It’s helpful to read up on articles that debunk common myths surrounding this topic.

Common Eligibility Myths, Debunked

Let’s clear up a few more misconceptions. One of the biggest Short-Term Disability Insurance myths is that you have to be completely unable to function to qualify. In reality, you just need to be unable to perform your specific job. For example, a surgeon with a broken hand can’t work, even if they can do other things. Another myth is that disability is always a long-term or permanent condition. Short-term disability is designed for exactly the opposite—temporary issues that you are expected to recover from. Understanding these distinctions is key to knowing if you should file a claim.

What to Expect from Your Benefits

Once your short-term disability claim is approved, you can finally breathe a small sigh of relief. But that relief is often followed by practical questions: How much money will I get? How long will it last? Understanding the specifics of your benefits is the next critical step in managing your finances while you recover. The details are usually outlined in your policy documents, but the language can be dense and confusing. Let’s break down what you can generally expect from your short-term disability benefits in Missouri, from payment calculations to the payout timeline.

How Are Your Payments Calculated?

Most short-term disability plans in Missouri are designed to replace a portion of your income, not all of it. Typically, you can expect to receive about two-thirds (or 66 2/3%) of your average weekly wage earned before your disability began. To find your average weekly wage, your insurance provider will look at your earnings over a set period—often the last several months or the previous year—and calculate the average. This percentage-based approach helps provide a financial cushion to cover essential expenses while you’re unable to work. Always check your specific policy, as the exact percentage can vary.

Are There Caps on Your Weekly Payments?

While the two-thirds calculation is a great starting point, it’s important to know that there is a limit to how much you can receive each week. Missouri law sets a maximum weekly benefit amount for disability payments. This means that even if 66 2/3% of your average weekly wage is a very high number, your payment will be capped at the legal maximum. This cap is adjusted periodically, so it’s a good idea to check the current benefit amounts published by the Missouri Department of Labor and Industrial Relations. This ensures that the system remains sustainable while still providing meaningful support to injured workers.

How Long Will You Receive Payments?

As the name suggests, short-term disability is meant to cover temporary conditions. For most policies in Missouri, benefits typically last for a maximum of 26 weeks, or about six months. This period is intended to give you time to recover from a serious illness, injury, or surgery without the immediate pressure of returning to work. If your condition is expected to keep you out of work for longer than 26 weeks, you may need to look into applying for long-term disability benefits, which is a separate process with different requirements.

Are Your Disability Benefits Taxable?

Whether or not you have to pay taxes on your short-term disability benefits depends on who paid the policy premiums. It’s a simple rule: if you paid the premiums yourself using after-tax dollars, your benefits are generally not taxable. However, if your employer paid the premiums for you, the benefits you receive are considered taxable income. If you and your employer split the cost of the premiums, you would pay taxes on the portion of the benefit that corresponds to your employer’s contribution. You can usually find this information on your pay stub or by asking your HR department.

How and When Do You Get Paid?

Before you receive your first payment, you’ll have to get through a waiting period, also known as an “elimination period.” This is a short time, often one to two weeks after your disability begins, during which you won’t receive benefits. Once payments start, they are typically sent out on a weekly or bi-weekly basis. While most approved claims proceed smoothly, sometimes disputes arise with the insurance company. If your claim is disputed or denied, you may need to attend a hearing to resolve the issue. If you find yourself in this situation, it may be time to get in touch with an attorney to help protect your rights.

Does Using Disability Affect Your Sick Leave?

This is a great question, and the answer often depends on your specific employer’s policy. Many companies allow you to use your sick leave to supplement your short-term disability payments, but it’s not a given. For example, your disability benefit might cover 60% of your regular pay, and some employers will let you use accrued sick leave to cover the remaining 40%. This practice helps you maintain a more stable income while you recover. Because every company policy is different, the most important step is to check your employee handbook or speak with your HR department. The University of Missouri System provides a clear example of this policy for its employees. Getting this information upfront will help you plan your finances and reduce stress during your recovery.

How to File Your Disability Claim

Filing for short-term disability can feel like a mountain of paperwork, especially when you’re already dealing with a health issue. But if you break it down into manageable steps, the process becomes much clearer. The key is to be organized, thorough, and mindful of deadlines from the very beginning. Think of it as building a case for why you need this support—every form you fill out and every document you provide is a piece of that puzzle.

Getting your application right the first time can save you from the stress of delays or denials. We’ll walk through exactly what you need to do, from gathering your medical records to understanding your employer’s role. Taking a careful, step-by-step approach will give you the best chance of a smooth process and a successful claim.

What Paperwork Do You Need to Apply?

Before you can file, you need to collect all the necessary paperwork. The most important part of your claim is your medical documentation. Your insurance provider will need clear proof from your doctor that explains your condition and why you’re unable to work. This usually includes your diagnosis, treatment plan, and a professional opinion on your physical limitations. Start by requesting your medical records and ask your doctor to complete a statement for your disability claim. It’s also a good idea to have your job description handy, as it helps illustrate which specific duties you can no longer perform. Keeping everything in one place will make the application process much easier to manage.

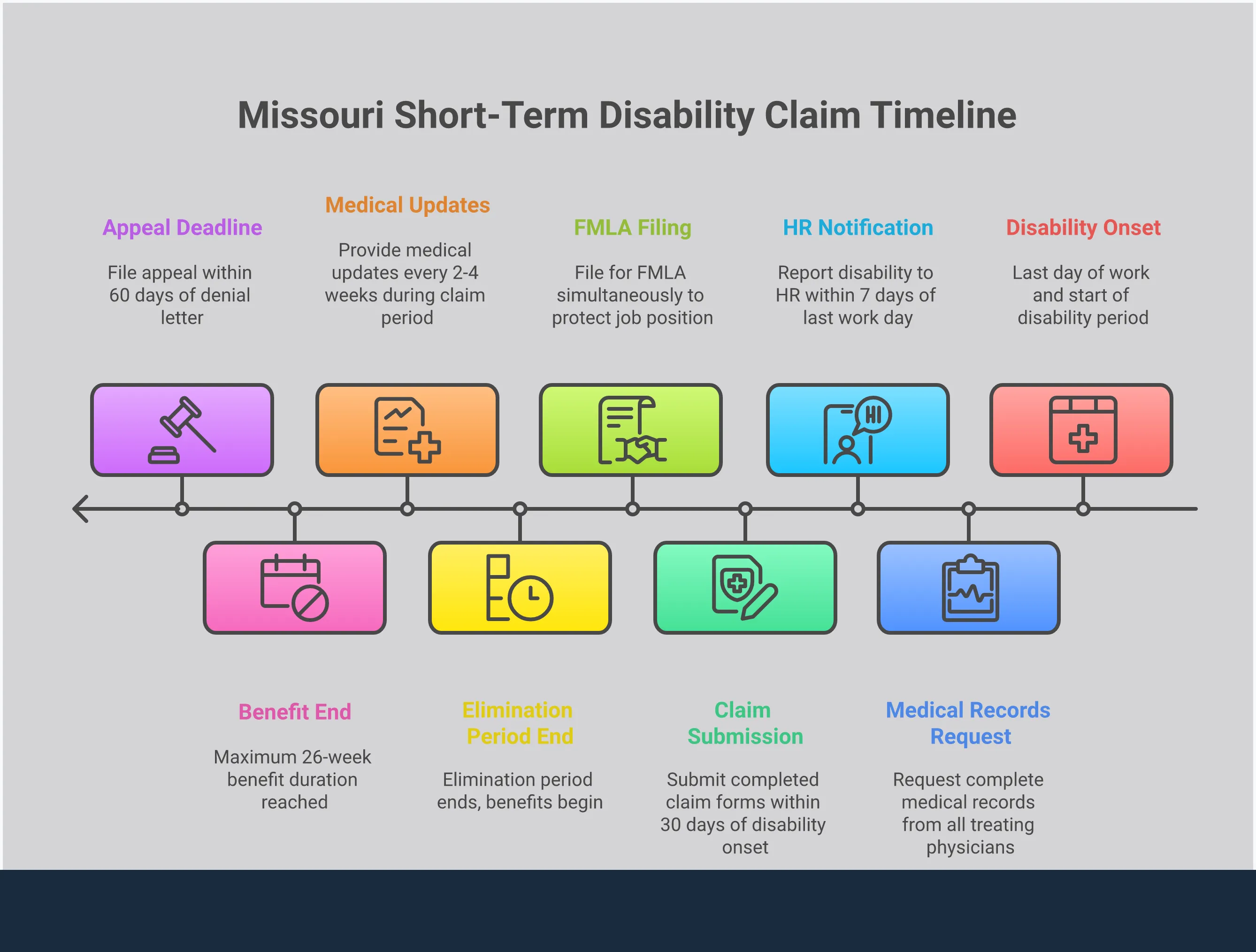

Important Filing Deadlines You Can’t Miss

Timing is everything when it comes to disability benefits. First, you need to be enrolled in a plan. Typically, you can sign up for coverage when you start a new job, during an annual open enrollment period, or within about a month of a major life event like getting married or having a child. Once you have a qualifying disability, you must report it and file your claim within a specific timeframe set by your policy—often within a week or two of your last day of work. Missing these deadlines can put your benefits at risk, so be sure to read your policy documents carefully and mark your calendar with any important dates.

What Is Your Employer’s Role in the Process?

Your employer is your first point of contact when you need to file a claim. Head to your human resources department to get the process started. They will provide you with the necessary claim forms and can explain the initial steps. Your employer also has a portion of the paperwork to complete, which usually involves confirming your employment details, salary, and job duties. Once you’ve filled out your section and your doctor has completed theirs, you’ll typically submit the entire package back to your employer, who then forwards it to the insurance company. Keeping open communication with your HR representative can help ensure everything is submitted correctly and on time.

Common Application Mistakes to Avoid

A simple mistake on your application can lead to frustrating delays or even a denial. One of the most frequent errors is submitting incomplete information. Double-check that you’ve filled out every field, signed and dated every required line, and included all requested documents. Vague or unclear answers can also be a problem, so be as specific as possible when describing your condition and how it impacts your ability to work. It’s also wise to make copies of everything before you submit it. That way, you have a complete record of what you sent in case anything gets lost or questioned later.

How to Appeal a Denied Claim

Receiving a denial letter can be disheartening, but it’s not the final word. You have the right to appeal the decision. Your denial letter should explain why your claim was rejected and outline the steps for an appeal, including the deadline. Use this information to strengthen your case. This might mean providing more detailed medical records or getting a second opinion from another doctor. If the process feels overwhelming or you believe your claim was unfairly denied, it may be time to get some legal advice. An experienced attorney can help you understand your rights and build a strong appeal.

Know Your Rights as an Employee

When you’re dealing with a health issue that takes you out of work, the last thing you want to worry about is your job security or unfair treatment. Understanding your rights is the first step toward protecting yourself and your livelihood. It’s important to know what your employer is legally required to do, how your job is protected (or isn’t), and what steps you can take if you feel your rights have been violated during this process.

Is Your Job Protected While You’re on Leave?

This is one of the most common questions, and the answer can be surprising. Short-term disability insurance is designed to replace a portion of your income; it does not inherently protect your job. While your policy provides financial support, it doesn’t guarantee your position will be waiting for you when you recover.

However, you may have job protection through the Family and Medical Leave Act (FMLA). FMLA is a federal law that provides eligible employees with unpaid, job-protected leave for specified family and medical reasons. If you qualify, FMLA guarantees your job will be there when you return. Many people use FMLA leave concurrently with their short-term disability benefits to secure both their income and their position.

What Does the Law Require of Your Employer?

In Missouri, employers have specific legal duties, especially when an injury is work-related. For instance, Missouri law requires employers to provide Temporary Total Disability (TTD) benefits to employees who can’t work due to a job-related injury. While your short-term disability policy might be separate, your employer must still comply with state workers’ compensation laws.

These obligations are a key part of our state’s personal injury law and are designed to protect workers. If your employer fails to meet these requirements or pressures you not to file a claim, they could be violating the law. It’s essential to understand what is required of them so you can ensure you receive the full benefits you are entitled to.

Understanding ERISA and Your Plan

If your short-term disability plan is provided by your employer, it’s likely governed by a federal law called the Employee Retirement Income Security Act, or ERISA. This is a big deal because ERISA sets strict, uniform rules for how benefit claims are handled, which can be very different from state laws. The procedures for filing a claim and appealing a denial are laid out in your specific plan documents, and you must follow them to the letter. The most important document you can have is your Summary Plan Description (SPD), which acts as the rulebook for your benefits. It will tell you everything you need to know, from filing deadlines to the exact steps for an appeal. You can learn more about your rights under this federal law from the U.S. Department of Labor.

Planning Your Return to Work

Coming back to work after a period of disability involves a few key steps. To qualify for disability benefits in the first place, your condition must require medical treatment and result in a temporary inability to perform your job. To return, you will likely need a doctor’s note clearing you to resume your duties.

Sometimes, you may be cleared to return with certain restrictions. Under the Americans with Disabilities Act (ADA), employers must provide reasonable accommodations for employees with disabilities, as long as it doesn’t cause undue hardship for the company. This could mean modified work hours, a different workstation, or adjusted job responsibilities to help you transition back safely and effectively.

What to Do If You Face Discrimination

It is illegal for your employer to discriminate against you because of your disability. This includes firing you, demoting you, reducing your hours, or otherwise retaliating against you for taking disability leave. If you believe you are facing discrimination, you have options.

You can start by documenting every incident, including dates, times, and what was said or done. You have the right to file a complaint with the Equal Employment Opportunity Commission (EEOC), the federal agency that enforces anti-discrimination laws. It’s also wise to seek legal counsel to understand your options and protect your rights. If you feel you’re being treated unfairly, please don’t hesitate to contact our office for guidance.

What Are Your Rights Under Missouri Law?

Beyond federal laws like the ADA and FMLA, Missouri has its own laws governing workers’ compensation and disability benefits. These state-level regulations provide important protections and establish clear procedures for handling claims and disputes.

If you and your employer or their insurance company disagree about your benefits, Missouri law provides avenues for dispute resolution to ensure a fair outcome. Navigating these specific statutes can be complex, as they involve detailed rules and deadlines. Understanding these local protections is crucial for ensuring your case is handled correctly from the start. You can find more information on related topics in our articles covering Missouri law.

How Other Benefits Affect Your Claim

When you’re unable to work, short-term disability can be a financial lifeline. But it’s rarely the only program in the picture. Your eligibility for STD can be affected by other benefits like workers’ compensation, FMLA, and even Social Security. Understanding how these systems interact is key to making sure you get the support you need without any surprises. Think of it as a puzzle—each benefit is a different piece, and they need to fit together correctly to complete your financial and legal protection. Let’s walk through how some of the most common benefits programs work with your short-term disability claim.

Short-Term vs. Long-Term Disability

The main difference between short-term and long-term disability is right in the name: the duration. Short-term disability insurance is designed to cover you for a limited period, typically from a few months up to a year, while you recover from a temporary injury or illness. In Missouri, these policies often last for 26 weeks and replace a portion of your income, usually around two-thirds of your average weekly wage.

If your condition prevents you from returning to work after your short-term benefits run out, long-term disability (LTD) is meant to take over. LTD policies provide income replacement for a much longer period—sometimes for several years or even until you reach retirement age, depending on your policy.

What If Your Injury Is Work-Related?

This is a critical distinction. Short-term disability policies are specifically for injuries or illnesses that are not related to your job. If you get hurt while on the clock, your claim should be filed under your employer’s workers’ compensation insurance. In this situation, you would apply for Temporary Total Disability (TTD) benefits, which are mandated by Missouri law for employees with work-related injuries that keep them from working.

Like STD, TTD benefits typically pay about two-thirds of your gross average weekly wage. It’s important to file the right claim from the start, as applying for STD for a work-related injury will lead to a denial and can delay the financial support you need.

Workers’ Compensation Waiting Periods

If your work injury requires you to miss time, you might wonder when you’ll start getting paid. In Missouri, there’s a brief waiting period. You won’t receive benefits for the first three business days you’re off work. Think of it as a deductible for your time. However, if your injury is serious enough to keep you out of work for more than 14 days, the system circles back to cover you. In that case, you will get paid for those initial three days you missed. This rule is designed to ensure that benefits are directed toward more significant injuries while still providing full support for those who need a longer recovery.

Are Workers’ Compensation Benefits Taxable in Missouri?

Here’s some good news that can offer a bit of relief during a stressful time: workers’ compensation payments are tax-free. Unlike your regular paycheck or even some short-term disability benefits (depending on who pays the premium), the money you receive from a workers’ comp claim is not considered taxable income by the IRS or the state of Missouri. This means the amount you’re approved for is the amount you’ll actually receive, without having to worry about setting a portion aside for taxes. It’s one less financial headache to deal with, allowing you to focus more of your energy on your recovery.

Other Types of Workers’ Compensation Disability Benefits

Beyond covering your medical bills and temporary lost wages, Missouri’s workers’ compensation system has provisions for more severe, long-lasting injuries. If your injury results in a permanent impairment, you may be entitled to permanent partial or permanent total disability benefits. These are designed to compensate you for the long-term impact the injury has on your ability to work and earn a living. Calculating these benefits can be incredibly complex, as it often involves medical impairment ratings and detailed legal formulas. Because so much is at stake, this is often the point where having an experienced attorney can make a significant difference in securing a fair outcome.

What Is the Second Injury Fund?

The Second Injury Fund is a unique part of Missouri’s workers’ compensation system designed to help workers who already had a pre-existing injury or disability. If a new work-related injury combines with your old one to create a greater overall disability, the Fund may provide additional benefits. The goal is to encourage employers to hire workers with disabilities without fearing they’ll be fully liable for a major claim down the road. However, accessing these benefits is a complicated legal process. The rules are strict, and proving eligibility often requires a deep understanding of the law, making it a challenging path to go down without professional guidance.

Survivor Benefits for Work-Related Fatalities

In the tragic event that a worker dies from a work-related injury, Missouri’s workers’ compensation system provides support for their family. These survivor benefits are designed to help ease the financial burden on those left behind. Certain family members, known as dependents, can receive weekly payments to replace a portion of the income their loved one would have earned. This is a critical safety net that acknowledges the profound financial and personal loss the family is experiencing. The process of filing for these benefits can be emotionally taxing, but it’s an important right that helps provide stability during an incredibly difficult time.

Funeral Expenses

When a work-related death occurs, the family is not only dealing with immense grief but also the immediate and unexpected cost of a funeral. To help with this, Missouri’s workers’ compensation law requires the employer or their insurance company to contribute to the funeral expenses. The law provides for a payment of up to $5,000 for reasonable burial costs. While this may not cover the entire expense, it is a significant and immediate form of support intended to help families honor their loved ones without facing the full financial strain on their own during such a challenging period.

Benefits for Dependents

Sometimes, an injured worker may pass away before they have received all the disability payments they were owed, such as for a permanent partial disability. In these situations, the benefits don’t just disappear. Instead, the remaining money is paid out to their dependents. Typically, this means the payments will go to the surviving spouse or children. This provision ensures that the compensation intended for the worker’s long-term impairment still serves its purpose by providing financial support to the family that relied on them. It’s a crucial detail that protects a family’s financial stability even after their loved one is gone.

Special Benefits for Public Safety Officers and Toxic Exposure

Missouri law provides special recognition for the risks faced by public safety officers. If a firefighter, police officer, EMT, or another qualifying public safety worker dies in the line of duty, their family may be eligible for a special death benefit. This is in addition to the standard workers’ compensation survivor benefits. The state also has specific provisions for workers who develop occupational diseases from toxic exposure, which can sometimes lead to fatal outcomes. These laws acknowledge the unique dangers of certain professions and aim to provide an extra layer of support for the families of those who make the ultimate sacrifice.

How FMLA Works with Your Disability Leave

People often confuse short-term disability with the Family and Medical Leave Act (FMLA), but they serve two very different purposes. Short-term disability is an insurance plan that replaces a portion of your income. FMLA, on the other hand, is an unpaid federal program that provides job protection for up to 12 weeks while you are on leave for a qualifying medical reason.

The good news is that you can often use them together. You might take FMLA leave to ensure your job is secure while you recover, and at the same time, receive STD benefits to cover your living expenses. This combination allows you to focus on your health without worrying about losing your income or your position at work.

How Social Security Disability Fits In

Social Security Disability (SSD) is a federal program for individuals whose medical conditions are so severe they are expected to last at least one year or result in death. Unlike STD, which is a private insurance policy, SSD has very strict eligibility rules. You must provide extensive medical evidence to prove your disability prevents you from working.

Many people mistakenly believe that only permanent conditions qualify for SSD, but that’s not always true. While the bar is high, some severe but temporary conditions may be covered. If your condition becomes long-term, you may transition from receiving STD benefits to applying for SSD. Because the process can be complex, getting guidance on your claim is often a wise first step.

Where to Get Help with Your Claim

Filing a short-term disability claim can feel like you’re navigating a maze alone, especially when you’re already dealing with a health issue. The good news is, you don’t have to. From state-run programs to legal professionals, there are resources available to help you get the support you need. Knowing where to turn can make all the difference in getting your claim approved and easing your financial stress.

Finding Legal Help in Missouri

Understanding the legal landscape is your first step. While most short-term disability plans are private insurance policies, they operate within state and federal laws that protect your rights. It’s helpful to have a basic grasp of how these laws work, especially if your disability is the result of an accident. Familiarizing yourself with Missouri’s personal injury laws can give you context for your situation. If your claim is complex or overlaps with a potential personal injury case, understanding your legal options is crucial for protecting your interests and ensuring you receive all the compensation you’re entitled to.

What State Assistance Is Available?

Your private disability policy isn’t the only potential source of support. Missouri offers various programs to help residents facing health challenges. A great place to start is the Missouri Disability Portal, a centralized website designed to connect people with state and federal services. While this won’t directly manage your private insurance claim, it can point you toward other resources you may qualify for, such as vocational rehabilitation or other financial assistance programs. Think of it as a directory for additional support systems that can help you while you’re unable to work.

Using the Missouri Disability Portal

The Missouri Disability Portal is more than just a list of links; it’s a comprehensive guide to living with a disability in our state. You can use the site to find specific information on topics like housing, transportation, and employment assistance, which can be incredibly helpful when your income is reduced. The portal also offers clear explanations of laws and your rights, empowering you to advocate for yourself. It’s a practical resource for finding the specific services you might need to supplement your short-term disability benefits and make your recovery period more manageable.

Contacting the Missouri Department of Labor and Industrial Relations (DOLIR)

If your injury happened at work, your point of contact will likely be the Missouri Department of Labor and Industrial Relations, or DOLIR. This is a key distinction because DOLIR oversees the state’s workers’ compensation system, which is separate from the private short-term disability insurance we’ve been discussing. Workers’ comp is specifically for on-the-job injuries. When you file a workers’ comp claim, the benefits are paid by your employer’s insurance company, not a personal policy. You can learn more about the types of help available on the DOLIR website, which is the best place to find official forms and information.

How to Communicate with Your Insurance Company

When you submit your claim, remember that insurance companies are businesses. They review every detail, and even small mistakes can lead to delays or denials. One of the most common reasons for a rejected claim is incomplete or inaccurate information. Before you submit anything, double-check every form for accuracy. Make sure your doctor has provided all the necessary medical documentation to support your claim. Keeping organized records and communicating clearly can prevent many common headaches. For more insights on handling legal documentation, you can review helpful legal articles to prepare yourself.

When Is It Time to Call a Lawyer?

If your claim is denied, don’t panic—but do act quickly. You have a limited window to appeal the decision, and the clock starts ticking the moment you receive the denial letter. In Missouri, you often have only 60 days to file an appeal. This is the point where professional help becomes essential. An experienced attorney can review your denial, gather the evidence needed for a strong appeal, and handle all communication with the insurance company. Taking this step ensures your appeal is filed correctly and on time, giving you the best possible chance of success. If you’ve received a denial, it’s time to contact a lawyer to discuss your next steps.

Related Articles

- Workers’ Compensation in Missouri: What You Need to Know

- Missouri Workers’ Comp Guide: Know Your Legal Rights

- Missouri Personal Injury Deadline – Statute of Limitations

- Finding the Right Workers’ Compensation Lawyer in Springfield, MO

- Injured at Work in Missouri: Your Comprehensive Guide on What to Do Next – The Law Office of Chad G. Mann, LLC

Frequently Asked Questions

Is my employer required to offer short-term disability insurance? No, employers in Missouri are not legally required to provide short-term disability insurance. It is offered as a benefit, much like a retirement plan or health insurance. If your employer doesn’t offer a group plan, you can still purchase an individual policy on your own to ensure you have income protection if you’re unable to work.

Will my job be safe while I’m on short-term disability? This is a really important distinction to understand. Short-term disability insurance provides income replacement; it does not legally protect your job. However, the Family and Medical Leave Act (FMLA) is a federal law that does offer job protection for eligible employees. Many people use FMLA leave at the same time they receive short-term disability payments to protect both their job and their income.

What’s the difference between short-term disability and FMLA again? It’s easy to mix these two up, but they do very different things. The simplest way to think about it is that short-term disability is “paycheck protection”—it’s an insurance policy that pays you a portion of your salary. FMLA is “job protection”—it’s a law that secures your position for you while you are on qualifying leave. They often work together, but one is about money and the other is about your job security.

Can I receive benefits if I can still work part-time? It depends entirely on your specific insurance policy. Some plans include a provision for partial disability, which allows you to receive a reduced benefit if you can return to work with limited hours or modified duties. You will need to review your policy documents or speak with your HR department to see if this is an option for you.

What is the most common reason a claim gets denied? The most frequent reason for a denial is incomplete or inconsistent information. This often happens when the medical records from your doctor don’t clearly support your claim that you are unable to perform your specific job duties. To avoid this, make sure your application is filled out completely and that your doctor provides a detailed statement explaining your limitations and how they directly prevent you from working.