When you get hurt at work, everyone has advice. Your coworker, your cousin, your neighbor—they all mean well. But a lot of what people think they know about Missouri workers compensation insurance is just plain wrong. Believing these myths can lead to simple mistakes that could seriously damage your claim. It’s time to set the record straight. We’re going to bust the biggest myths about the mo work comp process. We’ll cover everything from who really picks your doctor to what the law says about your pay, so you can feel confident about your next steps.

Key Takeaways

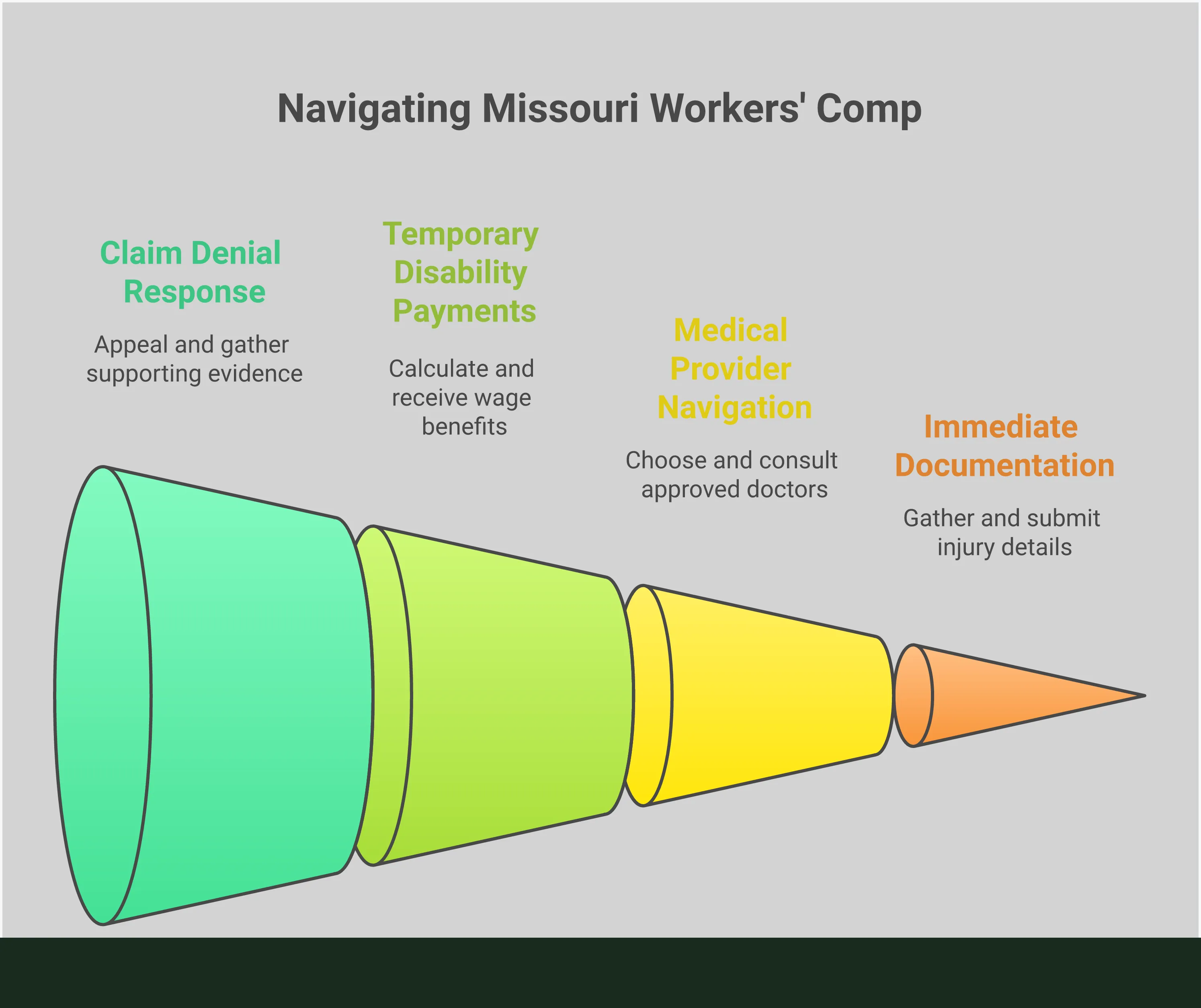

- Report Your Injury in Writing Immediately: Your first and most important step is to formally notify your employer of your injury in writing. This creates an official record and starts the clock on the claims process, which is essential for securing your benefits for medical treatment and lost wages.

- Understand the Key Rules of the System: Missouri’s workers’ comp system has specific guidelines you must follow. Your employer’s insurer chooses your doctor, and temporary disability benefits are designed to cover a portion—not all—of your lost income. Knowing these facts helps you set realistic expectations.

- Don’t Accept a Denial as the Final Answer: If your claim is denied or you run into disputes with the insurance company, you have the right to appeal. This is the point where the process can get complicated, and seeking advice from a legal expert can make a significant difference in protecting your rights.

How Does Missouri Workers’ Compensation Work?

If you’ve been hurt at work, you’ve probably heard the term “workers’ compensation,” but you might not be sure what it really means for you. Think of it as a safety net. It’s a type of insurance that most employers are required to have to protect their team. When an employee gets hurt or sick because of their job, workers’ comp is there to cover medical bills and lost wages. It’s a no-fault system, which means you don’t have to prove your employer did something wrong to receive benefits. This system is designed to help you get the care you need so you can focus on recovery, not on a legal battle.

Workers’ Comp 101: The Essentials

At its core, workers’ compensation is an agreement that benefits both employees and employers. When a job-related injury or illness happens, this insurance provides the employee with necessary medical treatment and wage replacement. In return, it generally protects the employer from being sued by the injured employee over the incident. This system ensures that you get help quickly without having to go through a lengthy court process to prove fault. It’s designed to be a more direct path to getting the support you need after a workplace accident.

Am I Covered by My Employer’s Insurance?

In Missouri, the law is very specific about which businesses need to carry this insurance. Generally, any employer with five or more employees must have workers’ compensation coverage. However, the rules are stricter for the construction industry. If a business does any construction work, they are required to have coverage if they have even one employee. These state requirements are in place to make sure that workers in most industries have a clear path to getting help if they are injured on the job. If you work for a company that fits these descriptions, you should be covered.

Common Exemptions from Coverage

While the law covers most employees in Missouri, it’s important to know that there are some specific exceptions. According to the Missouri Department of Labor and Industrial Relations, certain types of jobs fall outside the state’s workers’ compensation system. Understanding these exemptions can help you figure out where you stand if you’re injured. Some of the most common groups not covered include:

- Federal Employees: If you work for a federal agency, like the postal service or on a railroad, you’re covered by federal laws instead of Missouri’s state system.

- Some Agricultural and Domestic Workers: Farm laborers, certain seasonal workers, and people hired for domestic help in private homes, like housekeepers, are often exempt.

- Independent Contractors: Certain real estate agents, direct sellers, and other independent contractors may not be covered, depending on the specifics of their work agreement.

- Volunteers and Officials: In some cases, volunteers at non-profit organizations and officials for amateur sports programs are also not included under workers’ comp laws.

Does My Injury Qualify for Compensation?

Workers’ compensation covers more than just injuries from a single, sudden accident like a fall. It can also apply to illnesses that develop over time from your work conditions, such as lung problems from inhaling chemicals, or repetitive stress injuries like carpal tunnel syndrome from office work. The key factor is that the injury or illness must be directly related to your job duties. The system provides several types of workers’ compensation benefits, including payments for your medical care, compensation for the wages you lose while recovering, and even support for your family if a worker tragically dies.

What About Coverage for Business Owners?

This is a common point of confusion. In Missouri, sole proprietors and partners in a business are not automatically covered by workers’ compensation insurance, even if they have a policy for their employees. However, they do have the option to include themselves in the coverage. Choosing to be covered is a personal decision for a business owner, but it can provide a crucial financial safety net if they are injured while working. Without this elected coverage, a business owner’s personal health insurance would be the primary source for medical bills, but it wouldn’t cover any lost income.

How Payroll Impacts Your Workers’ Comp Claim

If a sole proprietor or partner decides to opt into workers’ comp coverage, there’s a specific rule for how their premium is calculated. Insurance companies don’t use their actual earnings. Instead, the state sets a minimum payroll amount to be used for calculating the cost of their coverage. For example, in recent years, that minimum has been set at $52,900. This standardized figure ensures that all business owners who elect coverage are rated on a level playing field. You can find the current payroll requirements to see how this might apply to your own business.

Missouri Workers’ Comp: Myth vs. Reality

When you get hurt at work, you’ll likely hear a lot of different opinions from coworkers, friends, and family about what to do next. While they mean well, there’s a lot of misinformation out there about workers’ compensation. Understanding the facts is the first step toward protecting your rights and getting the support you need to recover.

Let’s clear up some of the most common myths about the workers’ compensation process in Missouri. Knowing the truth can help you make informed decisions and avoid simple mistakes that could affect your claim. From who qualifies for benefits to how you get paid, here’s what you really need to know.

What Legally Defines an “Employee”?

One of the biggest points of confusion is who is actually eligible for workers’ comp benefits. Many people think that if you do work for a company, you’re automatically covered. The reality is that your employment classification matters. To receive benefits, you must be considered an employee, not an independent contractor. Your employer’s decision to classify you as an employee is the key factor. If you’re a gig worker or freelancer, you typically won’t qualify for these benefits, which is why understanding your work status from the start is so important.

How Missouri Counts Employees for Coverage Requirements

In Missouri, the rule is pretty straightforward: if a business has five or more employees, it must carry workers’ compensation insurance. The construction industry has an even stricter requirement—coverage is mandatory if there’s even one employee. When the state counts heads, they include everyone on the payroll: full-time, part-time, and even family members who work for the business. This broad definition ensures that most workers are protected. However, sole proprietors and partners don’t count toward this total for their own business. Understanding these specific coverage rules is key, as it determines whether you have a direct path to benefits or if you might face a more complicated situation if your employer isn’t required to be insured.

Can I Choose My Own Doctor?

It’s natural to want to see your own doctor after an injury—someone you know and trust. However, in Missouri, you don’t get to choose the physician for a work-related injury. Your employer or their workers’ compensation insurance carrier has the right to select the medical provider who will treat you. If you decide to see your own doctor without authorization, you could be responsible for the medical bills. Following the proper procedure ensures that your medical treatment is covered under the claim, allowing you to focus on your recovery without the stress of unexpected expenses.

Will I Get Paid While I’m Unable to Work?

A major worry after a work injury is how you’ll pay your bills if you can’t work. A common myth is that workers’ comp will replace your entire paycheck. In reality, if your injury prevents you from working, you are entitled to temporary disability benefits, but they don’t cover 100% of your lost income. These benefits typically pay about two-thirds (66.67%) of your average weekly wage, up to a state-mandated maximum. Understanding this helps you plan your finances while you’re off work and focus on getting better.

What if I’m an Independent Contractor?

The line between an employee and an independent contractor can feel blurry, but for workers’ compensation, the distinction is critical. As a rule, independent contractors are not eligible for workers’ comp benefits in Missouri. Companies are not required to provide this coverage for non-employees. This is why it’s so important to know exactly how you are classified by the company you work for. If you’ve been misclassified as an independent contractor but are treated like an employee, the situation can become complicated. It’s a detail that can determine your entire eligibility for benefits after an injury.

Is My Injury Considered “Work-Related”?

Not every injury that happens at your workplace is covered by workers’ compensation. For an injury to be compensable, it must “arise out of and in the course of” your employment. This means the injury must be directly related to your job duties or the conditions of your workplace. For example, tripping over a power cord in the office would likely be covered. However, an injury sustained during a personal argument with a coworker might not be. The cause of the injury is just as important as the location where it happened.

Are Sole Proprietors Eligible for Benefits?

If you own your own business, you might assume you’re automatically covered by a workers’ compensation policy. In Missouri, sole proprietors and partners in a partnership are not automatically included in workers’ comp coverage. However, they do have the option to purchase it for themselves. This is an important choice for business owners to make, as a work-related injury could leave them without medical coverage or wage replacement benefits if they haven’t elected to be covered under a policy. It’s a proactive step to protect your health and your livelihood.

How Do Pre-Existing Conditions Affect My Claim?

Many people worry that a pre-existing condition will automatically disqualify them from receiving workers’ compensation. This isn’t true. If a work-related accident aggravates or worsens a pre-existing injury or condition, you can still be eligible for benefits. The key is to show that the work incident was the prevailing factor that made your condition worse. These cases can be complex, as the insurance company may argue your pain is from the old injury. If you find yourself in this situation, understanding your rights is crucial to getting the benefits you deserve for all your personal injury needs.

Employer Requirements for Workers’ Comp in Missouri

While your focus is on your recovery, it’s helpful to understand the responsibilities your employer has under Missouri law. The workers’ compensation system isn’t just a set of guidelines for employees; it places strict legal duties on employers to ensure their team is protected. These requirements are not optional suggestions—they are mandatory obligations designed to create a safety net for everyone in the workplace. Knowing what the law demands of your employer can give you clarity and confidence as you move forward with your claim. It helps you understand whether they are holding up their end of the bargain and what your options are if they fail to do so.

How Employers Can Get Coverage

Missouri law requires most employers to secure workers’ compensation coverage, but it gives them a few different ways to do it. The path an employer chooses usually depends on the size and financial standing of their business. The vast majority of companies go the traditional route of buying an insurance policy, but that’s not the only option available. Understanding these methods can be useful, especially if you’re trying to figure out who is handling your claim—whether it’s a large insurance carrier or the company itself.

Buying a Policy from an Insurance Company

The most common way for a business to meet its legal obligation is by purchasing a workers’ compensation policy from a private insurance company. In Missouri, any employer with five or more employees is required to carry this insurance. The rule is even stricter for the construction industry, where coverage is mandatory for any business with one or more employees. This is the standard approach for most small and medium-sized businesses, as it transfers the financial risk of a workplace injury to an insurer that specializes in managing these types of claims and providing the necessary benefits.

Applying to Self-Insure

For some larger, more financially stable companies, self-insuring is a viable option. Instead of paying premiums to an insurance carrier, these employers get approval from the state to cover their own workers’ compensation claims directly. To qualify, a company must prove it has the financial resources to pay for all potential medical bills and lost wages for its injured employees without putting the business at risk. This option gives employers more control over their claims process but also means they assume all of the financial responsibility for workplace injuries.

The Assigned Risk Pool

What happens when a business can’t find an insurance company willing to sell them a policy? This can happen in high-risk industries or if a company has a history of frequent claims. To ensure these businesses can still get the required coverage, Missouri has a program known as the “assigned risk pool.” This program acts as an insurer of last resort, providing coverage to employers who have been turned down by the standard insurance market. It guarantees that all eligible employees are protected, regardless of their employer’s risk profile.

The Average Cost of Insurance

Many people are curious about how much workers’ compensation insurance costs employers. While there’s no single price tag, the average cost in Missouri is around $80 per month for a small business. However, this figure can be misleading because the actual premium an employer pays depends on several key factors. The industry is a major one—a construction company will pay far more than a small office because the risk of injury is much higher. Other factors include the size of the company’s payroll and its claims history. A business with a safe track record will earn lower rates over time.

Penalties for Not Having Insurance

Failing to carry workers’ compensation insurance is a serious offense in Missouri, and the state imposes significant penalties on non-compliant employers. This isn’t just a minor administrative oversight; it’s a violation of the law that can have severe financial and even criminal consequences. When an employer breaks this rule, it leaves their injured workers in a vulnerable position, often forcing them to follow a much more difficult path to get the medical care and benefits they need. This is a situation where having a knowledgeable advocate on your side becomes absolutely critical to protecting your rights.

Fines and Financial Penalties

The financial penalties for an employer who fails to carry workers’ compensation insurance are designed to be substantial. An uninsured employer can be fined up to three times the amount they would have paid for the annual insurance premium or up to $50,000, whichever is greater. This isn’t a small slap on the wrist; it’s a significant financial blow intended to ensure compliance. For an injured worker, this is important because it underscores how seriously the state takes this obligation. If your employer has broken this law, it changes the entire dynamic of your claim.

Potential Criminal Charges

Beyond the heavy fines, employers who knowingly fail to provide workers’ compensation insurance can face criminal charges. A first offense is considered a Class A misdemeanor. If an employer is caught a second time, the charge is elevated to a Class E felony, which is a much more serious crime with lasting consequences. These criminal penalties show that failing to protect employees is not just a civil matter. If you discover your employer doesn’t have the required insurance after you’ve been injured, it’s a clear sign that you’ll need help with the complex legal road ahead to secure your workers’ compensation benefits.

What Kind of Workers’ Comp Benefits Can I Get?

If you’ve been injured at work, you’re probably wondering what kind of support you can expect. Missouri’s workers’ compensation system is designed to provide a safety net, helping you cover costs and manage your life while you recover. The benefits you can receive depend on the nature of your injury and how it affects your ability to work. From covering your doctor’s bills to providing for your family in a worst-case scenario, these benefits are here to help you get through a difficult time. Let’s walk through the main types of support available to injured workers in Missouri.

Coverage for Your Medical Treatment

When you’re hurt, your first priority should be getting better, not worrying about how you’ll pay for treatment. Workers’ compensation is set up to cover all reasonable and necessary medical treatment for your work-related injury. This includes everything from initial emergency room visits and follow-up appointments with your doctor to hospital stays, physical therapy, and prescription medications. The system is intended to ensure you get the care you need to heal properly and, hopefully, make a full recovery so you can get back to your life and your job.

Payments for Temporary Time Off Work

If your injury temporarily keeps you from being able to work, you may be eligible for temporary disability payments. Think of this as a financial bridge to help you cover your bills while you’re out of commission. These payments are designed to replace a portion of your lost wages during your recovery period. This support allows you to focus on healing without the added stress of a complete loss of income. Once your doctor clears you to return to work, these temporary payments typically stop.

Compensation for a Permanent Disability

Sometimes, a work injury results in a permanent impairment that affects your ability to do your job long-term. In these more serious cases, you might qualify for permanent disability payments. If your injury causes a partial disability, you’ll receive payments based on the severity of the impairment. If you’re left completely unable to return to any kind of work, you could receive permanent total disability benefits. These payments provide crucial financial support when an injury permanently changes your ability to earn a living.

Financial Support for Your Family

It’s difficult to think about, but it’s important to know that workers’ compensation provides for your family if the unthinkable happens. If a worker passes away due to a work-related injury or illness, their dependents can receive death benefits. This support typically includes weekly payments to help the family manage financially after their loss. The benefits also cover a portion of the funeral expenses, offering some relief during an incredibly challenging time and ensuring your loved ones are cared for.

Funeral Expense Benefits

In the tragic event that a worker dies from a job-related injury, Missouri’s workers’ compensation system provides specific support for their family. Beyond the weekly death benefits paid to dependents, the law also addresses the immediate financial burden of final arrangements. The employer or their insurance carrier is required to cover the actual costs of the funeral expenses, up to a maximum of $5,000. This benefit is intended to provide direct financial relief during an incredibly difficult time, ensuring that a family can honor their loved one without facing the full weight of these sudden expenses on their own. It’s a crucial part of the system designed to care for a worker’s family when the worst happens.

Getting Help to Return to Work

The ultimate goal of workers’ compensation is to help you recover and return to a productive life. That’s why the system includes vocational rehabilitation services to assist you in getting back into the workforce. If your injury prevents you from returning to your old job, these services might include job retraining to help you learn new skills for a different role. It can also cover physical therapy and other treatments aimed at restoring your physical abilities so you can safely and confidently return to work.

What Does “Modified Duty” Mean for Me?

As you recover, your doctor might clear you to return to work but with certain restrictions. This is where modified or light duty comes in. It’s a temporary work assignment that’s adjusted to accommodate an injured worker’s limitations. For example, if you have a back injury, your employer might assign you to a desk job instead of tasks that require heavy lifting. This allows you to start earning your regular paycheck again while still giving your body the time it needs to heal, creating a safe and gradual transition back to your normal duties.

How to File a Workers’ Comp Claim in Missouri

Getting hurt at work is stressful enough without having to figure out a complicated claims process. The good news is that filing for workers’ compensation in Missouri follows a clear path. The most important thing is to act quickly and document everything. By understanding the steps and your responsibilities, you can make sure your claim is handled smoothly and you get the support you need to recover. Think of this as your roadmap—a guide to follow from the moment the injury happens to the day your claim is approved.

Your First Steps After a Workplace Injury

Your first priority is your health. If your injury is serious, get to the nearest emergency room right away. For less severe injuries, seek medical attention as soon as possible. Once you’ve been seen by a doctor, you need to report the injury to your employer in writing. This isn’t just a casual conversation; it’s an official notice. Your written report should clearly state when, where, and how the injury occurred, along with a description of what part of your body was hurt. After you’ve given your employer this notice, be sure to follow any specific reporting procedures your company has in place.

Don’t Miss the Injury Reporting Deadline

Timing is critical in a workers’ comp case. Once you notify your employer of your injury, a series of deadlines kicks in. Your employer has five days to report the injury to their insurance company. From there, the insurer has 30 days to file a “First Report of Injury” with the state. While these deadlines are for your employer and their insurer, your prompt action is what starts the process. Delaying your report can create complications and potentially jeopardize your claim. If you’re worried about deadlines or feel your employer is dragging their feet, an experienced attorney can help protect your personal injury rights.

What Paperwork Do I Need to File?

Filing a claim involves some paperwork, but don’t let it overwhelm you. You’ll typically need to complete a few key documents: an official injury report, a form detailing your wages, and a medical records release form that allows the insurance company to review your doctor’s notes. Your supervisor will likely have their own forms to fill out as well. Make sure you complete every form accurately and return them to the designated person, usually someone in Human Resources. It’s always a smart move to make copies of every single document you submit for your personal records.

How to Handle Your Medical Evaluation

One of the most important rules in a Missouri workers’ comp case is that you must see a doctor approved by your employer’s insurance plan. If you go to your own doctor without authorization, the insurer will likely refuse to pay the medical bills. Your employer should provide you with a list of approved physicians or clinics. When you go for your appointment, make it clear to the staff that your injury is work-related. This ensures they bill the correct insurance carrier and that your medical records properly document the connection between your injury and your job.

Following Up on Your Claim Status

After you’ve filed your claim, stay in touch with your supervisor and HR department. Your supervisor should be checking in with you regularly, especially if you’re out of work, but it’s a good idea for you to be proactive, too. Provide them with updates on your recovery and any work restrictions your doctor has given you. It’s helpful to document your communications. For example, if you have a phone call with your supervisor, you might send a brief follow-up email summarizing what you discussed. This creates a clear record and helps keep everyone on the same page.

What to Do if Your Workers’ Comp Claim Is Denied

Receiving a denial letter can feel like a major setback, but it’s not the final word. An insurer might deny a claim for many reasons, from a missed deadline to a dispute over whether the injury was truly work-related. If your claim is denied, you have the right to appeal the decision. This is often the point where the process becomes more complex, and having a legal expert on your side can make all the difference. If you find yourself in this situation, don’t hesitate to contact our office to discuss your options.

The Mandatory Mediation Process

If you and the insurance company can’t agree on your benefits, your case doesn’t immediately go to a formal hearing. In Missouri, there’s a required step in between called mediation. Think of it as a structured conversation rather than a courtroom battle. You, your attorney, the insurance company’s lawyer, and an administrative law judge will all sit down to discuss the facts of your case. The goal of this mandatory mediation session is to find a middle ground and reach a settlement. It’s an opportunity to resolve the dispute without the time and stress of a full hearing, and having a skilled advocate in your corner can make a huge difference in these negotiations.

Appealing a Judge’s Decision

If your case does go to a hearing and the judge issues a decision you don’t agree with, it’s not necessarily the end of the road. You have the right to an appeal, but you have to act fast. In Missouri, you have just 20 days from the date of the decision to formally ask the Labor and Industrial Relations Commission to review it. This is your chance to have a higher authority look at your case if you feel the initial outcome was unfair or didn’t properly consider the evidence. The appeals process has its own set of strict rules and deadlines, and this is often when having experienced legal guidance is most critical. If you need to appeal a decision, please contact our office so we can help you protect your rights.

Understanding Your Rights and Getting Help

Dealing with a work injury can feel overwhelming, but you don’t have to go through it alone. Missouri has systems in place to protect you, and knowing where to turn for help is the first step. Understanding your rights, key deadlines, and how to communicate effectively can make a significant difference in your recovery and the outcome of your claim. Think of this as your roadmap for getting the support you need, whether it’s from state agencies or a trusted legal advisor.

The Role of Missouri’s Division of Workers’ Comp

The main resource you should know about is the Missouri Division of Workers’ Compensation (DWC). This is the state agency that oversees the entire workers’ comp system. Their job is to help people who get hurt or become ill because of their work. The DWC’s role is to ensure that injured workers receive all the benefits they are entitled to under Missouri law. They are a neutral party dedicated to making sure the process is fair for everyone involved. Think of them as the official rule-keepers for workers’ compensation in the state, and their website is packed with helpful information.

What Are My Rights as an Injured Employee?

When you’re injured, knowledge is power. It’s so important to understand your rights and what you’re entitled to receive. The DWC website is an excellent place to start. You can learn exactly how to file a claim, what benefits you might be eligible for, and what to do if a problem comes up. Taking the time to understand your rights as an employee puts you in a much better position to handle the process. Don’t hesitate to explore their resources; they are there specifically to help you navigate your situation with confidence.

Should I Hire a Workers’ Comp Lawyer?

Sometimes, you might run into disagreements with your employer or their insurance company about your claim. The DWC can help you work through these disputes and even provides information on how to get a lawyer. If your claim is denied, if your benefits are stopped too soon, or if you feel the insurance company isn’t treating you fairly, it might be time to get professional advice. An experienced attorney can stand up for your rights and make sure your voice is heard. If you find yourself in a complicated situation, please don’t hesitate to contact our office for guidance.

Important Claim Deadlines You Can’t Afford to Miss

The workers’ compensation process runs on strict timelines, and missing a deadline can jeopardize your claim. After you report your injury, your employer has five days to notify their insurance company. From there, the insurance company must file a “First Report of Injury” with the state within 30 days of learning about your injury. These aren’t just suggestions—they are official requirements. Being aware of these key deadlines helps you know what to expect and allows you to follow up if things seem to be taking too long. Staying on top of the timeline is a simple way to protect your claim.

Tips for Talking to Your Employer About Your Injury

After an injury, clear communication with your employer is essential. The best way to protect yourself is to provide notice of your injury in writing. This creates a clear record that can be incredibly helpful later on. Your written notice should be simple and direct. Be sure to include the date, time, and location of the incident, as well as a description of how you got hurt and the nature of your injury. Putting everything in writing ensures there is no confusion about when you reported the incident, which is a critical first step in the claims process.

Where to Find More Help and Resources

If you have general questions or need to speak with someone at the Division of Workers’ Compensation directly, you can call them toll-free at 800-775-2667 or send an email to workerscomp@labor.mo.gov. They are a valuable resource for information and assistance. For personalized legal advice tailored to your specific case, the best step is to speak with an attorney who specializes in workers’ compensation. We are here to help you understand your options and fight for the benefits you deserve.

Related Articles

- Missouri Workers’ Comp Guide: Know Your Legal Rights

- Injured at Work in Missouri: Your Comprehensive Guide on What to Do Next – The Law Office of Chad G. Mann, LLC

- How to Choose a Work Comp Attorney in Springfield, MO

Frequently Asked Questions

What’s the most important first step after a work injury? Your immediate priority is to get the medical care you need. After you’ve seen a doctor, you must report your injury to your employer in writing as soon as possible. This written notice is a critical step that officially starts the claims process, so don’t rely on just a verbal conversation.

Can my employer fire me for filing a workers’ compensation claim? No. It is illegal in Missouri for an employer to retaliate against you for exercising your right to file a workers’ compensation claim. Your job is protected in this situation. If you feel you are being treated unfairly or are facing termination after reporting an injury, it’s a good idea to seek legal advice right away.

What if my injury was partially my fault? Can I still get benefits? Yes, you generally can. The workers’ compensation system is designed to be “no-fault,” which means it doesn’t focus on placing blame. As long as your injury arose out of and in the course of your employment, you are typically eligible for benefits, even if your own actions contributed to the accident.

My employer’s insurance company denied my claim. What now? A denial can be discouraging, but it isn’t the final word. You have the right to appeal the insurance company’s decision. The appeals process can be complex, so this is often the point where having an experienced attorney on your side can make a significant difference in protecting your rights and pursuing the benefits you deserve.

Do I have to see the company doctor, or can I go to my own? In Missouri, your employer and their insurance carrier have the right to choose the doctor who treats your work-related injury. While it’s natural to want to see your own physician, seeking unauthorized medical care could result in you being personally responsible for the bills. To ensure your treatment is covered, you must see the provider they select.