Riding without a helmet in Missouri is a choice—but it’s one with serious consequences. While the law allows some riders to go helmet-free, that decision can be used against you in an accident claim. Insurance companies may argue you’re partially at fault for your injuries, which can drastically reduce your settlement. So, do you have to wear a helmet in Missouri? The answer is complicated. This guide explains the current Missouri helmet laws, the risks involved, and how to protect your rights on the road. We’ll give you the facts you need to make the safest choice for yourself.

Key Takeaways

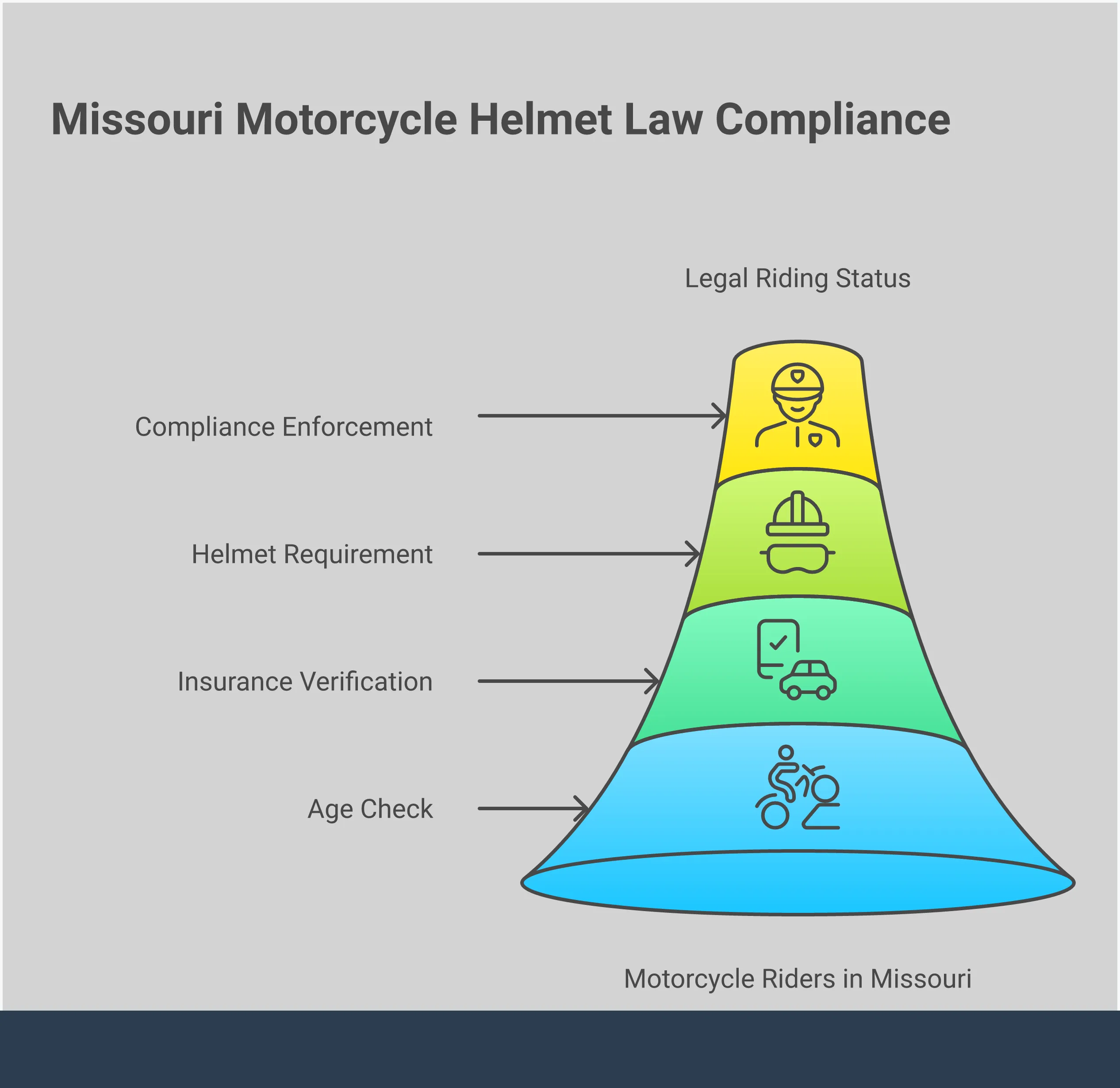

- Know the Law Before You Ride: In Missouri, helmets are required for all passengers and any rider under 26. If you’re 26 or older, you can only ride helmet-free if you carry proof of a health insurance policy that covers potential motorcycle accident injuries.

- Protect Your Financial Recovery: Choosing to ride without a helmet can be used against you in an injury claim. An insurer may argue you are partially at fault for the severity of your injuries, which could significantly reduce the compensation you receive.

- A Helmet is Your Best Defense: Regardless of the law, wearing a quality, DOT-approved helmet is the single most effective way to prevent a serious head injury. This simple choice protects your health and strengthens your legal standing if an accident happens.

What Are Missouri’s Motorcycle Helmet Laws?

Missouri’s motorcycle helmet law can feel a bit confusing because it isn’t a simple yes-or-no rule. The requirements change based on a rider’s age and insurance coverage, leaving many to wonder what’s actually expected of them on the road. Understanding these specifics is key to riding legally and protecting yourself, especially since the details can significantly impact your situation if you’re involved in an accident. Whether you’re a new rider or have been on the road for years, it’s important to know exactly where you stand with the current law. It’s not just about avoiding a ticket; it’s about making informed decisions for your safety and financial well-being. If you ever find yourself in a difficult situation after a crash, knowing the rules can make a major difference. Our firm handles many types of automobile accidents, and we’ve seen firsthand how these details play out. A simple misunderstanding of the law can complicate an injury claim, so getting clear on the facts now is one of the best things you can do for yourself. This guide will walk you through the essentials so you can ride with confidence, knowing you’re fully compliant and prepared. Let’s break down what the law requires, how it has evolved, and what you need to have on hand.

What Does the Law Actually Say?

The core of Missouri’s helmet law is built around an age benchmark. For riders and passengers under the age of 26, the rule is straightforward: you must wear a helmet at all times. There are no exceptions to this. However, for riders who are 26 and older, the law offers a choice. You can legally ride without a helmet, but only if you meet a specific insurance requirement. To do so, you must have a health insurance policy that provides medical benefits for injuries sustained in a motorcycle accident. This ensures you have a safety net for potential medical costs if you are ever in a crash.

What’s New with the Helmet Law?

If you remember a time when every motorcycle rider in Missouri had to wear a helmet, you’re not mistaken. The law was updated on August 28, 2020, to give experienced riders more freedom. Before this change, the helmet mandate applied to everyone, regardless of age or insurance status. The new law created the exception for riders 26 and older, shifting the legal landscape for many motorcyclists in the state. This update is why it’s so important to rely on current information, as outdated knowledge could lead to legal trouble or confusion after an incident.

A Brief History of the Law

For decades, Missouri’s motorcycle helmet rule was simple: everyone wore one. This universal helmet law had been in place since 1967, making protective headgear a standard requirement for all riders and passengers. That standard shifted on August 28, 2020, when the state revised the statute. The new law gave riders 26 and older the option to go without a helmet, provided they carried proof of health insurance. While the change was presented as a matter of personal freedom, it came with serious consequences. In the year that followed, Missouri saw a troubling increase in motorcycle accident fatalities, which highlights just how critical helmets are for rider safety. This history provides important context for the current law and underscores the real-world risks involved when deciding whether to wear a helmet.

What Documents Do You Need to Carry?

If you are 26 or older and choose to ride without a helmet, you must be able to prove you meet the legal requirements. This means carrying proof of two different types of insurance. First, you need to show you have standard vehicle liability coverage, which the state refers to as “financial responsibility.” Second, you must carry proof of your health insurance policy. An insurance card for each policy is typically sufficient. According to the official Missouri statute, you are required to present this proof to a law enforcement officer upon request, so it’s best to keep these documents with you whenever you ride.

Who Needs to Wear a Helmet in Missouri?

Missouri’s helmet law can feel a bit confusing because it isn’t a one-size-fits-all rule. The requirement to wear a helmet depends on your age, your insurance coverage, and whether you’re driving or just along for the ride. Understanding these specifics is key to staying compliant and protecting yourself, both on the road and legally. If you’re ever in an automobile accident, knowing these details can make a significant difference. Let’s break down exactly who needs to wear a helmet before hitting the road.

Are There Age Requirements for Helmet Use?

In Missouri, age is the first factor that determines whether you need to wear a helmet. The law is very clear for younger riders: anyone under the age of 26 operating or riding on a motorcycle or motor-tricycle must wear protective headgear. There are no exceptions to this rule.

For riders who are 26 and older, the law offers some flexibility. You are not legally required to wear a helmet, but this freedom comes with a condition. To ride without a helmet, you must have a health insurance policy that provides medical benefits for injuries you might sustain in a motorcycle crash. This is a critical detail that many riders overlook, so it’s important to confirm your policy’s coverage before you decide to ride without a helmet.

Which Vehicles Are Exempt From the Law?

When it comes to Missouri’s helmet law, the focus is almost entirely on the rider’s age and insurance status, not the type of vehicle they’re on. The law specifically applies to operators and passengers of motorcycles and motor-tricycles. This means that whether you’re riding a cruiser, a sport bike, or a touring motorcycle, the same rules about age and insurance apply across the board. There are no special exemptions for certain models or styles. It’s important to note that other two-wheeled vehicles, like motorized bicycles or scooters with smaller engines, often fall under different local ordinances or state statutes and may not be subject to the same helmet requirements. The key is to understand that if your vehicle is legally classified as a motorcycle in Missouri, this helmet law applies to you.

What Counts as Proof of Insurance?

If you are 26 or older and choose to ride without a helmet, you must be able to prove you meet the state’s insurance requirements. This isn’t just about having coverage; it’s about having the right documentation with you. The law requires you to maintain proof of financial responsibility—which is your standard vehicle liability insurance—as well as proof of your health insurance.

The best practice is to always carry your health insurance card with you whenever you ride. If you are pulled over, a law enforcement officer can ask for this proof. According to the official Missouri statutes, failing to provide it could result in a ticket. Make sure your health plan covers motorcycle accident injuries, as not all policies do.

Do Passengers Need to Wear a Helmet?

The rules for passengers are stricter and simpler than those for operators. In Missouri, all passengers on a motorcycle must wear a helmet, regardless of their age. This means that even if the driver is over 26 and has the required health insurance, any passenger they are carrying must have a helmet on. This rule is in place to ensure the safety of passengers, who are just as vulnerable in a crash.

Additionally, anyone—driver or passenger—who is riding with an instruction permit is required to wear a helmet, no matter how old they are. This applies to new riders who are still learning. The law treats passengers and permit-holders with extra caution, making helmet use mandatory for them in all situations.

Can You Legally Ride Without a Helmet?

Yes, in Missouri, you can legally ride a motorcycle without a helmet, but only if you meet very specific criteria. The law isn’t a simple green light for all riders to go helmet-free. It sets out clear conditions that you must satisfy before you can feel the wind in your hair without breaking the law. Think of it less as a repeal of the helmet rule and more as a conditional exception.

Understanding these rules is crucial, not just for avoiding a ticket, but for protecting yourself legally and financially if you’re ever in an accident. Before you decide to leave your helmet at home, let’s walk through exactly what the law requires.

What’s the Health Insurance Requirement?

The biggest piece of this puzzle is insurance. If you are 26 years of age or older, you can ride without a helmet, but you must have health insurance coverage. This can’t be just any policy; your health insurance must specifically cover medical expenses you might incur from a motorcycle accident. On top of that, you still need to maintain the standard liability insurance required for all motor vehicles in the state. The official Missouri statute lays this out clearly. Essentially, the state wants to ensure that if you are injured while riding helmetless, you have a way to pay for your medical care without relying on public funds.

Minimum Coverage Requirements

To ride legally without a helmet in Missouri, riders 26 and older must meet two key insurance requirements. First, you need a health insurance policy that explicitly covers medical benefits for injuries from a motorcycle crash. It’s important to check your policy details, as not all health plans include this specific coverage. Second, you must also carry the standard vehicle liability insurance required for all drivers in the state, often called “financial responsibility.” This coverage is crucial for protecting you and others on the road in the event of any automobile accidents.

It’s not enough to just have these policies in place; you must carry proof of both with you while you ride. If a law enforcement officer pulls you over, you’ll need to present documentation for your health and liability coverage. The Missouri statute is clear on this requirement, and failing to provide proof can lead to a ticket. Keeping your insurance cards with your license and registration is a simple way to make sure you’re always prepared and compliant with the law.

What Does “Financial Responsibility” Mean?

It’s not enough to just have the right insurance; you have to be able to prove it on the spot. If a law enforcement officer pulls you over for a traffic violation, they are entitled to ask for proof of your health insurance coverage. This means you should always carry your health insurance card with you, just as you would your driver’s license and vehicle registration. Failing to provide proof can result in a ticket, even if you are actually covered. Keeping your documents organized and accessible can save you a major headache during a traffic stop and is a critical step in protecting your rights on the road.

How to Prove You Meet the Exceptions

Here’s a detail that trips many people up: an officer cannot pull you over only because you aren’t wearing a helmet. They must have another primary reason for the stop, like speeding, running a stop sign, or having a broken taillight. However, once they have legally stopped you for that other violation, they can then inquire about your helmet and ask for proof of your health insurance. This nuance in the law makes enforcement tricky, but it doesn’t give you a free pass. If you’re stopped for any legitimate reason, you’ll need to be ready to show you’re compliant with the helmet law’s insurance requirements.

Myths About Missouri’s Helmet Law

A common myth is that Missouri’s helmet law is now so relaxed it’s basically nonexistent. While it’s true that the enforcement rules make it challenging for police to cite every non-compliant rider, the law is still on the books. Choosing to ride without a helmet and without the required insurance is still illegal. More importantly, this choice can have serious consequences if you are involved in an automobile accident. Insurance companies may look closely at whether you were following the law when determining fault and compensation, which can complicate your personal injury claim down the line. It’s always best to know the facts, not just the rumors.

Does Going Helmetless Affect Your Safety?

While Missouri law gives some riders the option to go without a helmet, it’s worth looking at what that choice means for your personal safety. The data and real-world experiences paint a clear picture of the risks involved. Understanding these risks is the first step in making an informed decision every time you get on your bike. It’s not just about following the rules; it’s about protecting yourself and your future.

What a Helmet Actually Does in a Crash

The primary job of a helmet is to protect your brain, and it does that job incredibly well. According to research, helmets reduce the risk of a head injury by a staggering 69%. During a crash, a helmet absorbs the force of the impact, spreading it out over a larger area and preventing it from concentrating on your skull. The soft padding inside cushions your head, reducing the jarring motion that can cause concussions and other traumatic brain injuries. It’s a simple piece of gear that can be the single most important factor in whether you walk away from an accident.

Can You Afford an Accident Without a Helmet?

An accident is always costly, but riding without a helmet can make the financial fallout much worse. You have a much higher chance of sustaining very serious head injuries, which come with extensive medical bills for emergency care, surgery, and long-term rehabilitation. If your insurance doesn’t cover everything, you could be left with a mountain of debt. A more severe injury also complicates your personal injury claim, as it raises the stakes for securing the compensation you need to cover lifelong care. The cost of a good helmet is tiny compared to the potential financial devastation of a serious head injury.

The Real-World Impact of the Law Change

When Missouri repealed its universal helmet law, the consequences were immediate and severe. In the year following the change, motorcycle accident deaths shot up by a shocking 800%. It’s a statistic that’s hard to ignore. Alongside this tragic increase in fatalities, the number of documented head injuries also jumped by 50%. These numbers show a direct link between the change in the law and a significant decline in rider safety across the state. The data confirms what safety experts have long known: helmets save lives and prevent devastating injuries.

Lessons from Other States That Repealed Helmet Laws

Missouri’s experience isn’t unique; we can look to other states that have traveled this road before to understand the potential consequences. The pattern is consistent and concerning. After repealing their universal helmet laws, states saw a significant rise in motorcycle fatalities: Kentucky experienced a 37.5% increase, Texas saw a 31% jump, and Arkansas reported a 21% increase. Beyond the tragic loss of life, the severity of injuries also escalated. In Texas and Arkansas, head and brain injuries nearly doubled after their laws changed, as injuries that might have been survivable with a helmet became fatal. This data from numerous motorcycle safety studies shows a direct link between relaxed helmet laws and a greater public health crisis, underscoring that while the choice may be legal for some, the physical risks are undeniable.

What Paramedics and Police See on the Road

Emergency medical services (EMS) personnel have a firsthand view of the aftermath of motorcycle accidents. A study that looked at crashes before and after the law changed found a big increase in serious head injuries and other severe trauma. First responders are the ones on the scene, providing critical care in the moments after a crash. Their observations confirm the data: they are treating more riders with life-altering head injuries since the law was repealed. This perspective from the front lines offers a powerful, real-world look at the impact of the helmet law repeal on the health and safety of Missouri’s motorcyclists.

What Happens If You Break the Law?

Understanding the rules is one thing, but knowing the real-world consequences is another. If you choose to ride without a helmet when the law requires it—or even when it doesn’t—the effects can extend far beyond a simple traffic stop. From fines to complicated insurance negotiations and personal injury claims, your decision carries significant weight. Let’s walk through what can happen if you don’t follow Missouri’s helmet law.

How Much Is the Fine for Not Wearing a Helmet?

Let’s start with the most direct consequence: the ticket. If an officer stops you for a traffic violation and finds you’re not complying with the helmet law, you can be cited. For a first-time offense, the penalty is relatively minor. You can expect a fine of up to $25. The good news is that a first-time helmet law violation does not add any points to your driving record. While the initial fine might not seem severe, it’s important to remember that it’s just the beginning of the potential financial and legal complications, especially if an accident occurs.

Will Your Insurance Rates Go Up?

This is where things get more complicated. Even if you meet all the legal criteria to ride without a helmet, your choice can still impact an insurance settlement after a crash. Insurance companies will look for any reason to reduce the amount they have to pay out. They may argue that by not wearing a helmet, you contributed to the severity of your own injuries. An insurer might claim that while another driver caused the accident, your head trauma would have been less severe with a helmet. This argument can lead to a lower settlement offer, leaving you with less money to cover your medical bills and other damages.

Could Riding Helmetless Hurt Your Injury Claim?

If your case goes to court, your decision to ride helmetless can significantly affect the outcome of your personal injury claim. Missouri follows a “pure comparative fault” rule. This legal doctrine means that if you are found partially responsible for your own injuries, your financial award will be reduced by your percentage of fault. For example, if a jury decides you are 20% at fault for the extent of your head injury because you weren’t wearing a helmet, your total compensation will be cut by 20%. This is why having an experienced attorney is so critical to protect your rights and ensure you receive the fair compensation you deserve.

The Role of Comparative Fault and Jury Perception

In Missouri, the legal system uses a rule called “pure comparative fault” to decide how compensation is awarded in an accident. This means your financial recovery can be reduced by your percentage of blame for your own injuries. This is where your choice to ride without a helmet can become a major issue in a personal injury claim. The other driver’s insurance company will argue that you share responsibility for the *severity* of your head injuries, even if their client was 100% at fault for causing the crash. Their goal is to convince a jury that your injuries would have been less severe if you had been wearing a helmet, thereby reducing the amount they have to pay.

It’s not just about legal arguments; it’s also about how a jury perceives you. A jury is made up of everyday people who may view a rider without a helmet as someone who takes unnecessary risks. This perception can easily translate into a higher percentage of fault being assigned to you. For example, if a jury decides you are 30% at fault for the extent of your head injury, your total compensation for that injury will be cut by 30%. This is a powerful tool for insurance companies, and it highlights why having strong legal representation is so important to counter these arguments and protect your right to fair compensation.

What Are Police Looking For?

It’s also helpful to understand how the helmet law is enforced on the road. In Missouri, not wearing a helmet is considered a “secondary offense.” This means a police officer cannot pull you over simply because you aren’t wearing one. They must first witness you commit a primary offense, such as speeding, running a stop sign, or having a broken taillight. Only after they have stopped you for that initial violation can they issue an additional ticket for not wearing a helmet. Knowing this helps you understand your rights during a traffic stop.

How to Choose a Safe Motorcycle Helmet

Whether you’re required by law to wear a helmet or not, choosing to wear one is the single most important safety decision you can make as a rider. But not all helmets are created equal. Picking the right one involves more than just finding a style you like; it’s about understanding safety standards, getting the right fit, and knowing how your choice can impact you if you’re ever in an accident. Think of your helmet as a critical investment in your well-being, both on the road and off.

What “DOT-Approved” Really Means

When you see a “DOT” sticker on the back of a helmet, it means the manufacturer certifies that it meets the Department of Transportation’s minimum safety standards. A legitimate DOT-approved helmet will have specific features you can spot. It should feel substantial, typically weighing around three pounds, with a thick inner foam liner that’s at least an inch thick. Check for a sturdy chin strap secured with solid rivets. Be wary of flimsy “novelty” helmets with fake stickers; they offer almost no protection in a crash. That sticker is your first sign that you’re looking at a piece of real safety equipment.

Safety Features That Are Non-Negotiable

Beyond the DOT sticker, consider the helmet’s design. Full-face helmets offer the most protection by covering your chin and jaw, while other styles offer less coverage. The most critical job of a helmet is to absorb and distribute the force of an impact, and studies show they are incredibly effective. In fact, helmets are estimated to prevent 37% of fatal injuries for riders. When you’re shopping, look for a helmet that feels solid and well-constructed. A quality helmet is a small price to pay for the protection it provides for your most vital asset.

How to Find a Helmet That Fits Perfectly

A helmet only works if it fits correctly. A helmet that’s too loose can shift or even fly off during a crash, while one that’s too tight will be uncomfortable and distracting. To find the right fit, try on several helmets in person. It should feel snug all around your head without creating pressure points. When you fasten the chin strap and shake your head, the helmet shouldn’t wobble or slide around. Your cheeks should be pressed slightly by the cheek pads. Taking the time to ensure a proper fit is just as important as choosing a high-quality helmet in the first place.

How Your Helmet Choice Can Affect Your Lawsuit

Wearing a helmet doesn’t just protect your head—it also protects your rights. If you’re injured in an accident, your decision to wear a helmet can significantly affect your personal injury claim. Missouri operates under a comparative fault rule, which means your compensation can be reduced if you’re found partially responsible for your own injuries. An insurance company might argue that by not wearing a helmet, you contributed to the severity of your head trauma. This could lower the amount of money you receive. Protecting yourself with a quality helmet is a key step in safeguarding your physical and financial future after a crash. If you find yourself in this situation, understanding your legal options is crucial.

What Insurance Do You Actually Need?

Deciding whether to wear a helmet in Missouri involves more than just your age; it’s also about having the right insurance coverage. The law is very specific about what you need to have in place before you can legally ride without one. Understanding these requirements is key to protecting yourself, both physically and financially. If you’re ever in an accident, having the correct policies can make a significant difference in your recovery. Let’s walk through exactly what kind of insurance you need to have.

What Is the Minimum Motorcycle Coverage in MO?

To legally ride a motorcycle without a helmet in Missouri (if you’re 26 or older), you need to meet two distinct insurance requirements. First, you must maintain what the state calls “financial responsibility.” This is the same standard liability coverage required for car owners, which helps cover costs if you’re at fault in an accident. Second, you must have a health insurance policy. The law sees these two policies as essential safeguards. Think of it as a two-part check: one policy for potential liability and another for your own medical needs. Both are mandatory if you choose to ride without a helmet.

What Kind of Health Insurance Qualifies?

Not just any health insurance plan will do. The law requires you to have a policy that provides medical benefits for injuries you might sustain in a motorcycle accident. Before you decide to go helmetless, it’s a good idea to review your health insurance documents or call your provider to confirm that you’re covered. Some policies have exclusions for injuries resulting from what they consider “high-risk activities,” and you don’t want to discover that yours is one of them after an accident has already happened. This confirmation is a crucial step in ensuring you are fully compliant with the law.

Common Gaps in Motorcycle Insurance Policies

Even with the required insurance, it’s important to understand the risks. Choosing to ride without a helmet significantly increases your chances of serious injury, like a traumatic brain injury, in a crash. While your health insurance may cover a portion of your medical bills, the costs associated with a severe accident can quickly exceed your policy limits. You could be left with substantial out-of-pocket expenses for long-term care, rehabilitation, and lost wages. Insurance is a safety net, but it doesn’t eliminate the devastating financial and personal impact that a serious automobile accident can have on your life.

What Documents Will Your Insurer Need?

If you are pulled over, you’ll need to be ready to prove you meet the insurance requirements. According to the Missouri statute, law enforcement can ask for proof of your health insurance coverage. The easiest way to do this is to carry your health insurance card with you, just as you would your driver’s license and proof of vehicle insurance. Keeping a physical or digital copy with you at all times ensures you can quickly show that you are following the law. It’s a simple step that can prevent a ticket and unnecessary hassle on the road.

Beyond the Law: Motorcycle Safety in Missouri

Beyond the legal requirements, it’s important to understand the real-world effects of Missouri’s helmet law. The changes made in 2020 didn’t just alter a rule; they had a measurable impact on riders, families, and the healthcare professionals who care for them. Looking at the data and listening to expert opinions gives us a clearer picture of what’s at stake every time a motorcyclist hits the road. This isn’t just about avoiding a ticket—it’s about protecting yourself and understanding the risks involved.

When you’re informed about the broader context, you can make the safest possible choices for yourself and your passengers. The statistics and stories from first responders paint a vivid picture of why rider safety is such a critical conversation in our state. If you’re ever in an accident, understanding these factors can also be relevant to your personal injury case.

What Do the Accident Numbers Say?

When Missouri repealed its universal motorcycle helmet law in 2020, the change was immediately felt in emergency rooms across the state. The data shows a direct correlation between the new law and rider injuries. One study found that the number of documented head injuries among motorcyclists increased by 50% after the repeal. This highlights the protective power of a helmet in preventing the most severe and life-altering types of harm.

Even more concerning is the impact on fatalities. While many factors contribute to accident statistics, some reports indicated a staggering increase in motorcycle accident deaths in the year following the law’s change. These numbers show that the decision to wear a helmet has life-or-death consequences that go far beyond legal compliance.

What Medical Professionals Want You to Know

The people on the front lines of accident response—doctors, nurses, and trauma surgeons—have a unique and valuable perspective. Many health and safety experts in Missouri have voiced their concerns, with some groups actively working to bring back the universal helmet law. They see the devastating results of accidents where riders were unhelmeted and understand the long road to recovery that follows a traumatic brain injury.

These professionals also point out a practical problem with the current law: it’s difficult to enforce. An officer can’t know if a rider has the required health insurance just by looking at them. This enforcement challenge leads many experts to feel that the current law is nearly the same as having no law at all, leaving riders vulnerable.

The Ripple Effect of Motorcycle Accidents

The consequences of the helmet law repeal extend beyond individual riders. The increase in severe injuries and fatalities places a heavy burden on the entire community. Hospitals and emergency services face greater strain, and families are left to deal with emotional and financial devastation. The repeal has been directly tied to a rise in motorcycle fatalities, creating a public health issue that affects everyone.

While it’s true that the total number of motorcycle crashes seen by EMS also went up, some of that may be due to more people traveling after COVID-19 lockdowns ended. However, the sharp increase in the severity of injuries, particularly head trauma, points directly to the change in the helmet law as a significant contributing factor.

Practical Tips for Staying Safe on Your Bike

Ultimately, your safety is in your hands. Even though the law gives some riders a choice, the evidence overwhelmingly shows that wearing a helmet is the single most effective way to protect yourself. Helmets are proven to greatly reduce your risk of death and traumatic brain injury, which can save you from a lifetime of hardship and overwhelming medical bills.

Beyond the physical protection, wearing a helmet can also protect you legally. If you are in an accident caused by someone else’s negligence, the other party’s insurance company may try to argue that your injuries were worse because you weren’t wearing a helmet. This tactic, known as comparative fault, could reduce the compensation you receive. Choosing to wear a quality, DOT-approved helmet is a smart decision for your health and your potential injury claim.

Related Articles

- Missouri’s Car Booster Seat Laws Explained

- Missouri Seatbelt Regulations – The Law Office of Chad G. Mann, LLC

- Missouri Car Seat Laws 2025: Guide | Chad G. Mann Law

- MO Seat Belt Laws: Booster & Car Seat Rules – The Law Office of Chad G. Mann, LLC

- Seatbelt Laws in Missouri – The Law Office of Chad G. Mann, LLC

Frequently Asked Questions

Can I legally ride without a helmet if I’m over 26? Yes, but you have to meet specific conditions. The law requires you to have a health insurance policy that covers medical care for injuries from a motorcycle accident. You also need to carry proof of this coverage with you whenever you ride. It’s not an automatic green light based on age alone; the insurance requirement is the key part of the exception.

If I’m in an accident without a helmet, can it be used against me? Absolutely. Even if another driver is 100% at fault for causing the crash, their insurance company will likely argue that your injuries are more severe because you chose not to wear a helmet. Under Missouri’s comparative fault system, this could lead to a reduction in the compensation you receive for your medical bills and other damages.

Do my passengers also need to wear a helmet? Yes, always. The legal exception for riders over 26 does not extend to passengers. In Missouri, anyone riding as a passenger on a motorcycle must wear a helmet, regardless of their age. This rule is in place to protect the person who has the least amount of control during the ride.

What kind of health insurance do I need to ride without a helmet? The law specifies that you must have a health insurance policy that provides medical benefits for injuries sustained in a motorcycle accident. It’s smart to review your policy documents or call your provider to confirm you have this specific coverage. Not all plans automatically include it, as some may have exclusions for activities they consider high-risk.

Since the law changed, is it really that much riskier to ride without a helmet? The statistics are very telling. After Missouri repealed its universal helmet law, the state saw a sharp and immediate increase in both severe head injuries and motorcycle-related deaths. While the law now offers a choice to some riders, the data confirms that wearing a helmet is still the most effective way to protect yourself from a life-altering injury.

What About Bicycle Helmet Laws in Missouri?

While much of the conversation around helmet laws focuses on motorcycles, it’s just as important to understand the rules for bicyclists. Cyclists are some of the most vulnerable people on the road, and an accident involving a car can be devastating. Unlike the motorcycle helmet law, the rules for bicycles are much more localized, which can create confusion for riders. Knowing the specific ordinances in your area and the general rules of the road is the best way to stay safe and protect your rights if you’re ever involved in an accident.

State vs. Local Bicycle Helmet Ordinances

One of the most common questions is whether Missouri has a statewide law requiring bicycle helmets. The answer is no. The state does not mandate helmet use for cyclists of any age. Instead, the authority to create these rules falls to individual cities and counties, which means the law can change just by crossing a city line. For example, some municipalities like St. Louis County require helmets for riders under 17 in public parks, while others, such as Creve Coeur, require them for all riders on public roads. Because these rules vary so widely, it’s essential to check the local ordinances for your specific town or any area where you plan to ride.

How Effective Are Bicycle Helmets?

Regardless of what the law in your town says, the safety benefits of wearing a helmet are undeniable. The data clearly shows that a helmet is the single most effective piece of safety gear a cyclist can use. According to the Insurance Institute for Highway Safety, helmets reduce the odds of a head injury by about 50 percent. They also lower the risk of a serious head injury by over 60 percent. In the event of a crash, a helmet works by absorbing the impact and protecting your skull and brain from severe trauma. Making the choice to wear one is a simple step that can prevent a life-altering injury.

General Rules of the Road for Bicyclists

Beyond wearing a helmet, staying safe on a bike means understanding your role on the road. In Missouri, a bicycle is legally considered a vehicle, which means you have the same rights and responsibilities as a car driver. You are expected to obey all traffic signals, ride in the same direction as traffic, and use hand signals to indicate turns. It’s also important to remember that in most areas, riding on the sidewalk is prohibited. Following these rules not only keeps you safe but also strengthens your position if you are ever in an accident caused by a negligent driver. If you find yourself in that situation, understanding your rights is the first step in pursuing a personal injury claim.