Getting hit by an uninsured driver is bad enough. But the real fight often begins with your own insurance company. You’ve paid for Uninsured Motorist coverage, but now they’re giving you the runaround. It’s a common tactic to protect their bottom line, not you. Don’t let them convince you that you have no options. You have specific legal rights in this exact situation. Here, we’ll cover your protections, the compensation you’re entitled to, and how to manage the claims process. We’ll also show you how a missouri uninsured motorist accident lawyer can level the playing field and fight for what you’re owed.

Key Takeaways

- Lean on your own insurance policy: Your Uninsured Motorist (UM) coverage is specifically designed for this situation, covering everything from medical bills to lost income. Review your policy now to confirm you have adequate protection, as state minimums are often not enough.

- Document everything from the start: The strength of your claim depends on the evidence you gather immediately after the accident. Prioritize getting a police report, taking detailed photos of the scene, and seeing a doctor to officially link your injuries to the crash.

- Don’t go it alone against your insurer: Filing a claim with your own insurance company isn’t always simple, as their goal is to pay out as little as possible. Working with an attorney levels the playing field, ensuring your rights are protected and you receive a fair settlement that covers all your losses.

Hit by an Uninsured Driver? Here’s Your Next Move

Getting into a car accident is stressful enough, but discovering the other driver doesn’t have insurance adds a whole new layer of complication. Suddenly, you’re left wondering who will cover your medical bills, car repairs, and lost wages. While it’s a frustrating situation, it’s not a hopeless one. Understanding your rights and the protections available to you is the first step toward getting the compensation you deserve. It’s important to know that you have options, and you don’t have to figure them out alone.

How Common Are Uninsured Drivers?

It’s a fact of life on the road: not everyone follows the rules. Despite state laws requiring every driver to carry liability insurance, a significant number of people drive without it. When one of these drivers causes an accident, the victims are put in a tough spot. Without an insurance company to file a claim against, getting money for your injuries and property damage becomes much more difficult. You’re left dealing with the aftermath of a collision that wasn’t your fault, and the person responsible has no way to pay for the harm they’ve caused. This is why it’s so important to be prepared for this scenario before it ever happens.

The Numbers: Uninsured Drivers in Missouri

Uninsured drivers are a bigger problem on Missouri roads than most people realize. While state law requires every driver to have liability insurance, many don’t comply. In fact, some estimates suggest that as many as 1 in 4 drivers in Missouri are uninsured or underinsured, posing a serious risk to everyone else on the road. This isn’t just a minor issue; it’s a widespread problem that can turn a straightforward accident claim into a complex ordeal. This alarming statistic highlights why it’s so important to understand your own insurance policy and the protections you have in place before you ever need them.

This isn’t a new problem, either. Data from the Missouri Department of Revenue showed that over 6,000 accidents involved uninsured drivers in a single year, and the issue has persisted. The reality is that many people are driving illegally without the required coverage. This not only complicates the claims process for those who are injured, but it also places a heavy burden on responsible drivers. When the at-fault party can’t pay, you’re often left to rely on your own insurance, which is why having adequate Uninsured Motorist (UM) coverage is absolutely essential for your financial protection.

Seeing these numbers can be unsettling, but the goal isn’t to cause alarm. It’s to prepare you. Knowing the risks allows you to take proactive steps to protect yourself and your family. The most powerful tool you have in this situation is your own auto insurance policy, which is designed to step in when the other driver’s coverage is non-existent. Understanding how to use this coverage effectively can be the difference between a frustrating, drawn-out process and a successful recovery. You have options, and you don’t have to face the insurance company’s adjusters on your own.

How Does an Uninsured Driver Impact Your Claim?

So, what happens when the at-fault driver has no insurance? Your first thought might be to sue them directly, and you certainly have the right to do that. The problem is, a person who can’t afford car insurance likely doesn’t have the money or assets to cover your losses, even if you win in court. This can feel like a dead end, leaving you with mounting bills and no clear path to recovery. This is precisely why your own insurance policy becomes so critical. Your ability to handle your personal injury claim often shifts from relying on the other driver’s coverage to depending on your own.

What Legal Protections Do You Have?

Thankfully, there’s a safety net for this exact situation: Uninsured Motorist (UM) coverage. This is a part of your own auto insurance policy designed to protect you when you’re hit by an uninsured driver. In Missouri, insurance companies are required to offer you this coverage. It steps in to pay for your medical expenses, lost income, and other damages, just as the at-fault driver’s insurance would have. However, dealing with your own insurance company isn’t always straightforward. They may try to deny your claim or offer less than you deserve. If you find yourself in a dispute, it’s wise to get legal advice to ensure your rights are protected.

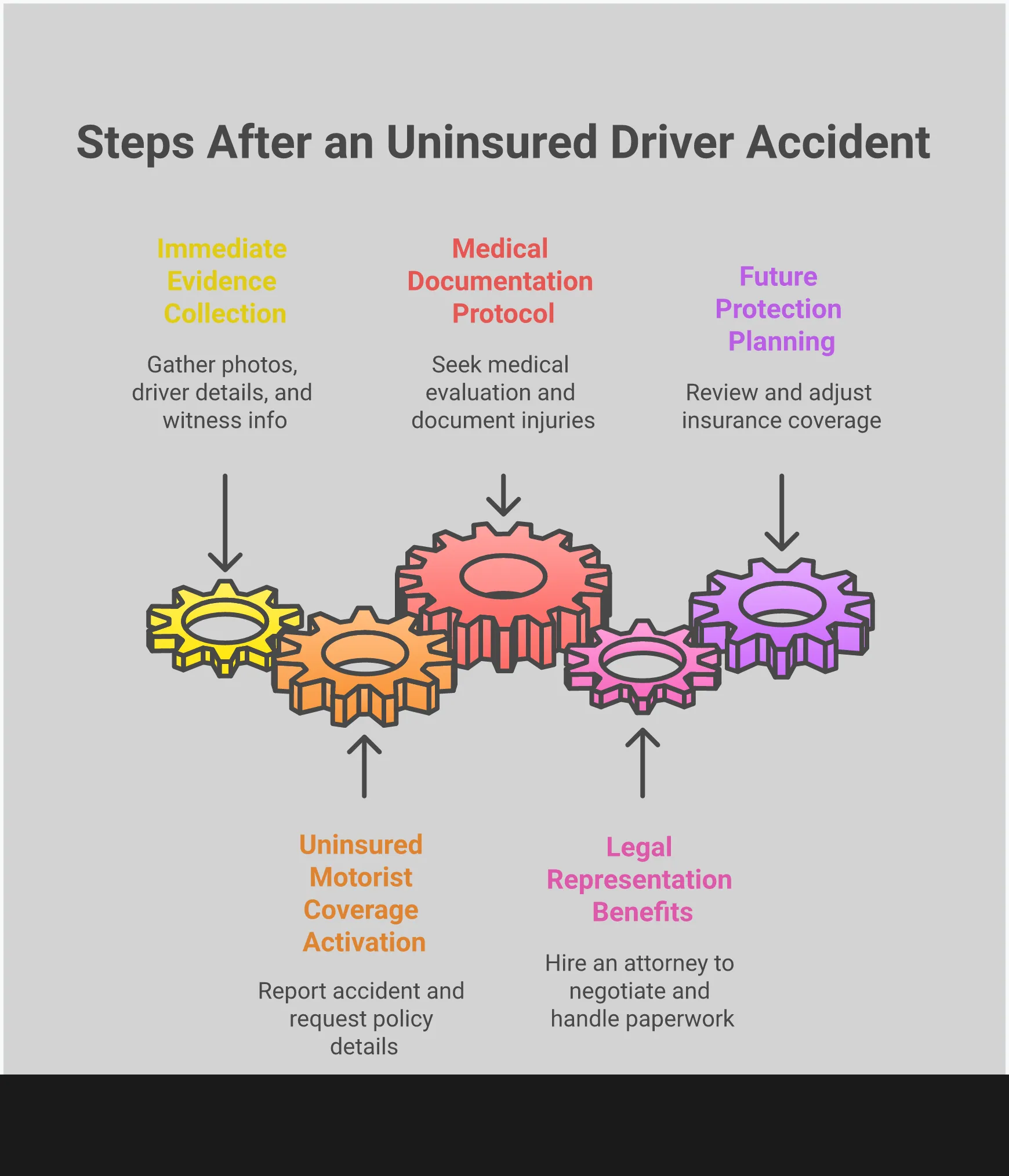

Your Checklist After an Uninsured Motorist Accident

The moments after a car accident are chaotic and stressful, and finding out the other driver is uninsured only adds to the confusion. Knowing what to do right away can protect your health and your ability to get fair compensation. Taking a few key actions at the scene and in the days that follow will build a strong foundation for your claim. Think of these steps as your guide to getting through the initial shock and setting yourself up for a smoother recovery process.

What to Do at the Scene

Your first priority is safety. Call 911 immediately to report the accident and request medical help for anyone who needs it. Even if the crash seems minor, a police report provides an official record of the incident, which is essential for your insurance claim.

Once you’ve confirmed everyone is safe, exchange information with the other driver. Be sure to get their full name, address, phone number, and driver’s license number. Also, write down their license plate number and vehicle information. It’s important to stay calm and stick to the facts. Avoid discussing who was at fault; just focus on gathering the necessary details.

Document Everything

Evidence is your best friend after an accident. Use your phone to take plenty of photos and videos of the scene from different angles. Capture the damage to both vehicles, your injuries, and any relevant details like skid marks, traffic signs, or road conditions. These visual records can be incredibly powerful later on.

In addition to photos, write down everything you can remember as soon as possible. Note the time, location, weather, and a detailed account of how the accident happened. If you spoke with a police officer, get their name and badge number. The more details you can preserve while they’re fresh in your mind, the better you can support your claim down the road.

Prioritize Medical Care

Even if you feel fine, see a doctor as soon as you can. Some serious injuries, like whiplash or internal damage, don’t show symptoms right away. Getting a medical evaluation creates an official record that connects your injuries directly to the accident, which is crucial for any personal injury claim. Don’t wait for the pain to become severe. Your health is the most important thing, and a prompt medical check-up protects both your well-being and your legal rights. This documentation will be vital when seeking compensation for medical bills and other damages.

How to Talk to Your Insurance Company

You should notify your own insurance company about the accident as soon as you can. Most insurance policies have strict time limits for reporting an incident and filing a claim, so don’t delay. When you call, explain that the other driver was uninsured. This will likely mean you need to file a claim under your own Uninsured Motorist (UM) coverage, which is designed for exactly this situation. Provide them with the basic facts of the accident, but be careful not to give a recorded statement or accept any blame until you’ve had a chance to speak with an attorney.

Avoid These Common Mistakes

It’s easy to make missteps when you’re dealing with the stress of an accident. One of the biggest is trying to handle everything on your own. Insurance companies, even your own, are businesses focused on paying out as little as possible. Avoid giving a recorded statement or accepting a quick settlement offer before you understand the full extent of your damages. Many people worry that hiring a lawyer will be complicated or slow things down, but an experienced attorney can protect you from lowball offers and manage the entire claims process. Before you make any decisions, it’s wise to get in touch for legal advice.

Know Your Rights and Legal Options

When you find out the driver who hit you doesn’t have insurance, it’s easy to feel like you’re out of options. You might be wondering how you’ll ever cover your medical bills or repair your car. The good news is that you have more rights than you think. The legal system has protections in place for responsible drivers who find themselves in this frustrating situation. Understanding these rights is the first step toward getting your life back on track.

Navigating the aftermath of an accident involves understanding what compensation you’re entitled to, how your own insurance policy can help, and the critical deadlines you need to meet. Missouri law provides specific avenues for recovery, and knowing how to use them is key. While the path forward might seem complicated, you don’t have to walk it alone. Working with a lawyer who understands the ins and outs of personal injury claims can make all the difference, ensuring you can focus on your recovery while someone else handles the legal heavy lifting.

What Compensation Can You Receive?

After an accident with an uninsured driver, you can still seek compensation to cover your losses. This isn’t just about getting your car fixed; it’s about addressing all the ways the accident has impacted your life. You can pursue payment for your current and future medical bills, from the initial emergency room visit to ongoing physical therapy. If you’ve had to miss work, you can recover those lost wages. Compensation also covers non-economic damages like pain and suffering and emotional distress, which acknowledge the physical and mental toll the accident has taken on you.

What Does Your Insurance Policy Actually Cover?

This is where your own insurance policy becomes your most valuable asset. Missouri law requires all drivers to carry Uninsured Motorist (UM) coverage. This specific part of your policy is designed for this exact scenario. It steps in to cover your expenses when the at-fault driver has no insurance to pay for the damages they caused. Think of it as a safety net you’ve been paying for. Review your policy to understand your UM coverage limits, as this will determine the maximum amount your insurer will pay for your injuries and, in some cases, property damage.

Missouri’s Minimum UM Coverage Requirements

Missouri law requires every driver to have uninsured motorist coverage, which is a relief when you’re in a crash with someone who doesn’t have insurance. This means your own insurance company is responsible for paying for your injuries and damages, even though someone else was at fault. The state sets minimum coverage amounts, which are currently $25,000 for bodily injury per person and $50,000 for bodily injury per accident. While it’s good that this protection is mandatory, these minimums are often not enough to cover serious injuries, which is why it’s a good idea to review your policy and consider purchasing higher limits for your own peace of mind.

Who Is Protected by Your UM Policy?

One of the best things about UM coverage is that it protects more than just the person who pays the insurance bill. Your policy typically extends to cover family members who live with you, whether they were in the car or not. It also protects any passengers who were in your insured vehicle at the time of the accident. The protection can even apply if you or a family member are a pedestrian, bicyclist, or motorcyclist and are hit by an uninsured driver. This broad scope ensures that you and your loved ones have a safety net in a wide range of scenarios, making it a truly valuable part of your auto insurance.

Understanding “Stacking” for More Coverage

If you have UM coverage on more than one vehicle, Missouri law allows you to “stack” these policies to increase your potential benefits. Stacking means you can combine the coverage limits from each policy to create a larger pool of money to draw from. For example, if you insure three cars and have $100,000 in UM coverage on each one, you could potentially access up to $300,000 for your injuries. This is a powerful tool that can make a huge difference in cases involving severe injuries and high medical costs. Understanding how to leverage stacking is complex, and it’s an area where an experienced attorney can provide critical guidance.

What About Property Damage?

While UM coverage is a great help for bodily injuries, its role in covering vehicle damage is more limited. Missouri requires a minimum of $10,000 in uninsured motorist property damage coverage. However, this coverage typically applies to property other than your own vehicle, like a fence or mailbox you might hit when swerving to avoid an uninsured driver. It usually does not cover damage to your own car unless you have specifically purchased that additional coverage. For your own vehicle repairs, you will likely need to rely on your collision coverage, which is a separate part of your auto insurance policy.

Don’t Miss Your Filing Deadline

In Missouri, you generally have five years from the date of the accident to file a personal injury lawsuit. This is known as the statute of limitations. While five years might sound like a long time, it can pass quickly when you’re dealing with medical treatments and insurance claims. If you miss this deadline, you lose your right to seek compensation through the court system forever. That’s why it’s so important to act promptly. Speaking with a legal professional early on ensures all necessary steps are taken well before the deadline approaches, protecting your right to a fair recovery.

The Statute of Limitations for UM Claims in Missouri

While the five-year deadline applies to suing the at-fault driver, your Uninsured Motorist claim is a different matter. A UM claim is a contract claim against your own insurance company, not a personal injury lawsuit against the other driver. In Missouri, the statute of limitations for breach of a written contract is ten years. This longer timeframe can provide some breathing room, but it’s crucial not to get complacent. Insurance policies often include their own specific, and much shorter, deadlines for filing a claim or a lawsuit against them. These deadlines are legally binding and can be as short as one or two years.

This is why you can’t simply rely on the state’s ten-year statute of limitations. You must review your insurance policy carefully to understand the exact time limits that apply to your situation. Missing a deadline written into your policy can result in losing your right to compensation, even if you are well within the state’s legal timeframe. Because these policies can be complex, having an attorney review the details ensures you don’t miss a critical date. Acting quickly protects your ability to pursue all your legal options and build the strongest possible personal injury claim.

Missouri’s Uninsured Motorist Laws

Missouri’s laws are set up to protect you. The state mandates that every driver must have both liability insurance and Uninsured Motorist (UM) coverage. This requirement exists because, unfortunately, not everyone follows the rules. The law anticipates that responsible drivers might be hit by those who are uninsured. Your UM coverage is your first line of defense, allowing you to file a claim with your own insurance company to cover your damages. Having an experienced attorney who is deeply familiar with these state-specific laws can help you effectively manage your claim and stand up for your rights.

Penalties for Insurers: Vexatious Refusal to Pay

It’s frustrating enough to deal with an uninsured driver, but it’s even worse when your own insurance company refuses to pay your valid claim. In Missouri, there are specific protections for this scenario. If an insurer denies your claim without a reasonable cause or a legitimate dispute, it’s known as a “vexatious refusal to pay.” This isn’t just bad customer service; it’s a violation of your rights. Under Missouri law, an insurance company acting in this manner can be ordered to pay not only what they originally owed you but also additional penalties and your attorney’s fees. This statute serves as a powerful tool, ensuring that insurance companies are held accountable for unfairly delaying or denying the benefits you’ve paid for.

How a Missouri Uninsured Motorist Lawyer Can Help

After an accident with an uninsured driver, you might feel like you’re out of options. You’re dealing with injuries and car repairs, and the person at fault has no insurance to cover your costs. This is precisely when a lawyer can step in to manage the complexities of your case. Instead of facing your own insurance company alone, you’ll have a dedicated advocate fighting for your rights and ensuring you get the compensation you deserve.

Is Hiring a Lawyer Worth It?

Trying to handle an uninsured motorist claim by yourself can be overwhelming. You’re recovering from an accident, and the last thing you need is the stress of legal paperwork and difficult phone calls. “Hiring a lawyer ensures that your case is handled professionally, giving you peace of mind and the best chance at securing fair compensation.” An experienced attorney understands the process inside and out and can protect you from making costly mistakes. They take the burden off your shoulders so you can focus on what truly matters: your health and recovery. Having a professional on your side shows you are serious about your claim.

How a Lawyer Handles the Insurance Company

Many people don’t realize that after an accident with an uninsured driver, you’ll be filing a claim with your own insurance company. It might seem strange, but “your own car insurance might cover your costs, even if the other driver doesn’t have insurance,” provided you have Uninsured Motorist (UM) coverage. However, your insurer may not make the process easy. An attorney can manage all communications with your insurance provider, submitting the necessary paperwork and ensuring every deadline is met. They know how to present your case effectively to get your claim approved without unnecessary delays, handling all aspects of your automobile accident claim.

Securing the Settlement You Deserve

Insurance companies are businesses, and their goal is to protect their bottom line. This means they often offer initial settlements that are far less than what you’re entitled to. When you have a lawyer, you send a clear message that you won’t be taken advantage of. As one expert notes, “When you hire a personal injury lawyer, you show the insurance companies that you take your claim seriously.” Your attorney will calculate the full extent of your damages—including medical bills, lost wages, and pain and suffering—and negotiate aggressively for a fair settlement that covers all your losses.

Building a Strong Case with the Right Evidence

A strong claim is built on solid evidence. While you should always try to “call the police to get an official report, take photos of injuries, car damage, and the accident scene,” a lawyer will take this a step further. They will work to gather all the crucial evidence needed to prove your case, such as witness statements, medical records, and expert testimony. They know what to look for and how to piece everything together into a compelling narrative that supports your claim for compensation. This thorough approach ensures no detail is overlooked and strengthens your position during negotiations.

Countering Insurance Company Tactics

Even your own insurance company can be difficult to deal with in a UM claim. “Insurance companies often try to pay as little as possible or even deny claims, especially when an uninsured driver is involved.” They might argue that your injuries aren’t as severe as you claim or that some of your medical treatment wasn’t necessary. An experienced uninsured motorist lawyer anticipates these tactics and knows how to counter them effectively. They will build a strong, evidence-based case to challenge any lowball offers or unfair denials. If you’re ready to get help, you can contact our office for guidance.

How to Maximize Your Compensation

Getting into an accident is stressful enough, but finding out the other driver is uninsured can feel like a dead end. You might be wondering how you’ll ever cover your medical bills and car repairs. The good news is that you have more options than you think. Securing the compensation you need is entirely possible, but it requires a strategic approach. It starts with understanding where to look for coverage and being meticulous with your records.

From the moment the accident happens, every step you take can influence the outcome of your claim. This means knowing what information to gather, what damages you’re entitled to, and how to handle conversations with insurance companies. It’s about building a strong case for yourself, piece by piece. While your own insurance policy is often the first place to turn, there may be other avenues for recovery. Let’s walk through the key steps you can take to ensure you get the fair compensation you deserve.

How to Review Your Policy for Maximum Payout

Before you do anything else, pull out your own auto insurance policy. It might feel like reading a foreign language, but there are a few key terms you’re looking for: Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage. This is coverage you pay for specifically to protect yourself in this exact situation. Your UM coverage steps in to pay for your expenses when the at-fault driver has no insurance. Understanding the limits and specifics of your policy is the first, most critical step in knowing what financial support is available to you. If you’re unsure what your policy includes, now is the time to contact your insurance agent for a clear explanation.

What Paperwork Does Your Claim Need?

Think of yourself as a detective building a case—the more evidence you have, the stronger your claim will be. Your documentation is the foundation of your compensation request. Start by getting a copy of the official police report. You’ll also need the other driver’s name and contact information, photos of the accident scene and vehicle damage, and contact details for any witnesses. Keep a detailed file of all your medical bills, repair estimates, and records of any time you missed from work. Providing your insurance company with a complete and organized set of documents from the start can streamline the process and show them you’re serious.

What Damages Can You Recover?

When you file a claim, you’re not just asking for money to fix your car. You are entitled to seek compensation for a wide range of losses, often called “damages.” This includes all of your medical expenses, from the initial emergency room visit to any future physical therapy you might need. It also covers lost wages if you were unable to work because of your injuries. Beyond these direct financial costs, you can also recover compensation for your physical pain and suffering and emotional distress. If you were involved in an automobile accident, it’s important to account for every way the crash has impacted your life.

Negotiation Strategies That Actually Work

Dealing with insurance companies can be intimidating. Their goal is often to pay out as little as possible, and they have experienced adjusters and lawyers working for them. This is where having a legal professional on your side can make a significant difference. An experienced attorney understands the tactics insurance companies use and can handle all negotiations on your behalf. They will build a compelling case based on your documentation and fight to ensure the settlement offer is fair and covers all of your damages. This allows you to focus on your recovery instead of battling with an insurer.

Are There Other Ways to Get Compensation?

While your UM coverage is the most common path to compensation, it may not be the only one. In some cases, it might be possible to file a lawsuit directly against the at-fault driver. If the uninsured driver has personal assets, such as a steady job, a home, or a business, you may be able to recover money through actions like wage garnishment or placing a lien on their property. An attorney can investigate the driver’s financial situation to determine if this is a worthwhile option. Pursuing this path can be complex, but it’s an important possibility to explore with legal counsel to ensure no stone is left unturned.

Claims Against the At-Fault Driver’s Employer

Here’s another important possibility to consider: if the uninsured driver was working at the time of the crash, their employer could be held responsible for your damages. This legal principle holds businesses accountable for the actions of their employees while they are on the job. For example, if you were hit by a delivery driver, a contractor traveling to a job site, or a salesperson on their way to a client meeting, you may be able to file a claim against their company. This opens up a critical path to recovery, as businesses are required to carry commercial insurance policies that typically have much higher coverage limits than personal auto insurance. An experienced attorney can investigate the circumstances of the accident to determine if this is a viable option for your automobile accident case.

What to Expect When Working with Your Lawyer

After an accident, the idea of hiring a lawyer can feel overwhelming. You’re already dealing with injuries, car repairs, and insurance calls—adding legal matters to the mix can seem like too much. But working with an attorney isn’t about adding another burden; it’s about handing one over to a professional who can manage it for you. Think of it as a partnership where you have an expert in your corner. Your lawyer becomes your advocate, your guide, and your strategist, handling the complex legal work so you can put your energy where it’s needed most: on your recovery.

Understanding what this partnership looks like from the start can take away a lot of the uncertainty. When you know what to expect, the legal process feels less like a mystery and more like a clear path forward. It empowers you to ask the right questions and make informed decisions about your case. From finding the right person for the job and understanding the costs to knowing how communication will work, being prepared helps you feel more in control of your situation. Let’s walk through the key stages of working with a lawyer on your uninsured motorist claim.

How to Choose the Right Attorney

Finding the right attorney is the most important first step. You want someone who not only has experience in personal injury law but also makes you feel heard and respected. When you hire a lawyer, you’re sending a clear message to the insurance companies that you are serious about your claim. Look for an attorney who is transparent about their process and communicates clearly. During your initial consultation, ask about their experience with cases like yours. It’s also a great opportunity to see if your personalities mesh. You’ll be working closely together, so it’s important to find someone you trust to guide you.

How Much Does an Accident Lawyer Cost?

One of the biggest myths about hiring a lawyer is that it’s unaffordable. The reality is that most personal injury attorneys work on a contingency fee basis. This means you don’t pay any attorney fees unless you win your case. The lawyer’s fee is a percentage of the settlement or award you receive. This arrangement makes it possible for anyone to get quality legal representation, regardless of their financial situation. All costs should be clearly explained in a written agreement before you commit, so you’ll know exactly what to expect. Don’t let fear of costs stop you from getting the help you deserve.

How Often Will Your Lawyer Be in Touch?

Clear and consistent communication is the backbone of a strong attorney-client relationship. Your lawyer should keep you updated on the status of your case, explain what’s happening at each stage, and be available to answer your questions. In turn, it’s important for you to be open and honest with your attorney. Share all details about the accident and your injuries, even if they seem minor. Regular updates help you stay informed and reduce the stress of the unknown. A good lawyer will make sure you understand the strategy for your case and will always be working with your best interests in mind.

What Is the Case Timeline?

Every personal injury case follows its own unique timeline, so it’s hard to predict exactly how long yours will take. Some cases settle relatively quickly, while others can take months or even longer, especially if a lawsuit is necessary. The duration depends on factors like the severity of your injuries, the complexity of the accident, and how willing the insurance company is to negotiate a fair settlement. Your attorney will guide you through each phase, from the initial investigation and evidence gathering to settlement negotiations. They can give you a better idea of a potential timeline once they’ve reviewed the details of your case.

What Documents Should You Give Your Lawyer?

To build the strongest possible case for you, your lawyer will need some key documents. It’s helpful to start gathering these as soon as you can. This includes the official police report from the accident, all of your medical records and bills related to your injuries, and photos or videos of the accident scene, your vehicle, and your injuries. You should also keep a record of any lost wages from time off work and any correspondence you’ve had with insurance companies. Providing these documents helps your attorney accurately assess your damages and fight for the full compensation you’re entitled to. If you have questions about what you need, you can always contact our office for guidance.

Protect Yourself in the Future

Going through an accident with an uninsured driver is stressful enough. The last thing you want is to worry about it happening again. While you can’t control other drivers, you can take proactive steps to protect yourself and your family financially. It all starts with having the right insurance coverage in place long before you ever need it. Think of it as your financial safety net for the unexpected moments on the road. Taking a little time now to review your policy can make a world of difference if you’re ever in another collision.

Is Your Insurance Coverage Enough?

In Missouri, all drivers are required to carry Uninsured Motorist (UM) coverage. This is designed to cover your injuries if you’re hit by a driver with no insurance at all. However, the state-mandated minimums are often not enough to cover the costs of a serious injury.

That’s why it’s a smart move to purchase more than the minimum UM coverage. It’s also wise to add Underinsured Motorist (UIM) coverage to your policy. UIM coverage kicks in when the at-fault driver has insurance, but their policy limits are too low to cover all of your damages. These coverages are crucial for all types of automobile accidents.

Practical Ways to Prepare for an Accident

An accident with an uninsured or underinsured driver can leave you in a tough spot. Without the right coverage, you could be personally responsible for your medical bills, lost wages, and other expenses. Your health insurance might cover some medical costs, but it won’t help with lost income or pain and suffering. Relying on the other driver to pay out-of-pocket is rarely a viable option. UM and UIM coverage shifts this risk from you to your own insurance company. It’s a relatively small addition to your premium that provides significant peace of mind, ensuring you have a direct path to financial recovery when you need it most.

Planning Ahead for Your Long-Term Needs

When choosing coverage limits, think about the potential long-term consequences of a serious accident. A collision can result in more than just immediate medical bills. You might need ongoing physical therapy, future surgeries, or long-term care. If your injuries prevent you from returning to work, the loss of income can be devastating for your family. The minimum insurance policies are exhausted quickly in these scenarios. By investing in higher UM and UIM limits, you are protecting your long-term financial stability and ensuring you have the resources needed to focus on your recovery without the added stress of mounting debt.

What Other Protections Should You Consider?

Beyond UM and UIM coverage, it’s worth looking into other optional protections. Medical Payments coverage, often called MedPay, is a great example. MedPay helps cover medical expenses for you and your passengers after an accident, regardless of who was at fault. It can be used to pay for health insurance deductibles, co-pays, and other immediate costs while your claim is being processed. Take some time to sit down and review your current auto policy. If you’re unsure what your coverage includes or what you might need, don’t hesitate to contact our office to discuss how your policy might apply in an accident scenario.

How to File Your Uninsured Motorist Claim

Filing an uninsured motorist claim can feel overwhelming, especially when you’re trying to recover from an accident. The process involves working with your own insurance company, which can be just as complex as dealing with another driver’s provider. But by taking a methodical approach, you can build a strong case and work toward the compensation you deserve. Breaking the process down into clear, manageable steps makes it much easier to handle.

What Documents to Gather First

The first thing you should do after an accident with an uninsured driver is call the police. An official police report is a critical piece of evidence, especially if it notes that the other driver lacked insurance. If you are able, take photos of the damage to all vehicles, the surrounding area, and any visible injuries. Be sure to exchange contact information with the other driver and any witnesses. Once you seek medical attention, keep every bill, report, and receipt. These initial documents form the foundation of your claim, so organizing them from the very beginning will save you a lot of stress later on.

A Step-by-Step Guide to the Claims Process

You need to notify your own insurance company about the accident as soon as possible. Most insurance policies have strict deadlines for reporting accidents and filing claims, and missing one could jeopardize your ability to recover compensation. When you call, state the facts clearly and inform them that the at-fault driver is uninsured. Your agent will explain the specific steps for filing an uninsured motorist claim under your policy. Follow their instructions carefully and submit any requested forms promptly. Remember, even though it’s your own insurer, they are still a business, so it’s important to protect your interests throughout the personal injury claim process.

Meeting Key Legal Filing Deadlines

In Missouri, you generally have five years from the date of the accident to file a personal injury lawsuit. This is known as the statute of limitations. While you might think this deadline only matters if you sue the other driver, it’s also crucial for your uninsured motorist claim. If your insurance company refuses to offer a fair settlement, your only remaining option may be to take legal action against them. Waiting too long can eliminate this option entirely, giving the insurance company all the leverage. That’s why it’s so important to act quickly and understand your legal deadlines from the start.

Tips for Managing Your Claim Effectively

Your own uninsured motorist (UM) coverage is designed to cover your costs when the at-fault driver can’t. This includes medical bills, lost wages, and pain and suffering, up to your policy limits. To manage your claim effectively, keep a detailed file of everything related to the accident. This includes a log of every conversation with your insurance adjuster, copies of all correspondence, and all your medical records and bills. Staying organized shows the insurance company you’re serious and helps ensure you account for all your losses. If the paperwork and follow-up become too much to handle, don’t hesitate to contact a lawyer for guidance.

How to Follow Up on Your Case

After you’ve filed your claim, consistent follow-up is key. Don’t assume the insurance company is working diligently on your behalf. Check in with your assigned adjuster regularly for status updates. If you feel the process is stalling or you receive a settlement offer that seems too low, it’s time to push back. You can write a demand letter that outlines your expenses and justifies the amount you are seeking. An experienced attorney can be a powerful ally in this stage, handling all communications and negotiations to ensure the insurance company treats you fairly and offers a settlement that truly covers your damages.

Related Articles

- Hiring a Lawyer After a Car Accident Without Insurance

- Car Accident Attorney: What To Do If Driver Has No Insurance – The Law Office of Chad G. Mann, LLC

- Car Accident Lawyer – No Insurance? We’ve Got You Covered

- What to Do After a Car Accident with an Uninsured Driver

Frequently Asked Questions

Will my insurance rates go up if I file an uninsured motorist claim? This is a very common concern, and thankfully, there’s good news. In Missouri, your insurance company is generally prohibited from raising your rates for filing a claim after an accident that wasn’t your fault. Since an uninsured motorist claim is used when the other driver is at fault, using this coverage should not negatively impact your premium. You’ve been paying for this protection, and you have every right to use it when you need it.

What happens if my medical bills and other costs are more than my UM coverage limits? This can be a challenging situation, but you may still have options. Once you’ve exhausted your Uninsured Motorist (UM) coverage, the next step is to investigate whether the at-fault driver has any personal assets that could be used to cover your remaining damages. An attorney can help determine if pursuing a personal injury lawsuit against the driver is a practical option. This process can be complex, but it’s an important avenue to explore to ensure you’ve pursued all possible sources of recovery.

Do I still have a case if the accident was partially my fault? Yes, you very likely still have a case. Missouri follows a “pure comparative fault” rule, which means you can still recover damages even if you were partially to blame for the accident. Your final compensation award would simply be reduced by your percentage of fault. For example, if you were found to be 10% at fault, your total recovery would be reduced by 10%. Don’t assume you can’t get help just because you think you might share some of the responsibility.

Why can’t I just sue the uninsured driver directly to get my money? While you absolutely have the legal right to sue the at-fault driver, the challenge isn’t winning the lawsuit—it’s actually collecting the money. A person who drives without insurance often doesn’t have the savings, property, or other assets to pay a court judgment. Your Uninsured Motorist (UM) coverage provides a much more reliable and direct path to getting compensation for your injuries and other losses without having to chase down payment from someone who can’t afford it.

How long does it typically take to resolve an uninsured motorist claim? The timeline for every case is different, as it depends on several factors. The severity of your injuries is a major one, as it’s often best to wait until you have a clear understanding of your long-term medical needs before settling. Other factors include how cooperative your insurance company is and the complexity of the accident itself. While some straightforward claims can be resolved in a few months, more complex cases can take longer. The goal is always to secure a fair settlement that covers all your damages, not just a fast one.