You have insurance for your car and home, so you’re completely covered, right? Not always. While insurance is your first line of defense, every policy has its limits. A serious accident can easily result in costs that go far beyond what your policy covers, putting your personal assets—your savings, your home, your future—at risk. Understanding when you can be held liable for personal injury is crucial for true financial protection. This guide is about empowerment, not fear. We’ll cover the proactive steps you can take to safeguard everything you’ve worked so hard for.

Key Takeaways

- Liability extends beyond direct fault: You can be held financially responsible for an injury caused by your own negligence, an unsafe condition on your property, or even the actions of an employee working for you.

- Know your insurance policy’s limits: Your insurance is your first line of defense, but if the damages from an accident exceed your coverage, your personal assets are at risk. Understanding your policy is the best way to protect your finances.

- Proactive measures can reduce your risk: You can protect yourself from liability by regularly maintaining your property to prevent accidents, choosing insurance that fully covers your assets, and seeking legal advice early if you’re involved in a serious incident.

What Does It Mean to Be Liable for a Personal Injury?

When someone gets hurt, the conversation quickly turns to who is at fault. In legal terms, this concept is called liability. Being financially liable for an injury means you are legally responsible for the damages and costs that result from it. This responsibility isn’t just a moral one; it has real financial consequences. If a court finds you liable, you could be required to pay for the injured person’s medical bills, lost income, and even their pain and suffering.

Liability in personal injury cases can come from a few different places. It might be because of your direct actions, like causing a car crash by texting while driving. It can also stem from inaction, such as a store owner failing to clean up a spill, leading to a slip-and-fall accident. In some situations, liability is assigned even if you weren’t directly careless, a concept known as strict liability. Understanding what it means to be liable is the first step in figuring out your rights and responsibilities after an accident occurs.

Key Legal Terms You Should Know

The legal world has its own language, but a few key terms are essential to understanding liability. The most common is negligence, which simply means someone failed to act with reasonable care, and that failure led to an injury. Think of it as not doing what an ordinary, careful person would do in a similar situation.

Another important term is vicarious liability. This is when one person or company is held responsible for the actions of another. The most common example is an employer being held liable for the negligence of an employee who was on the clock, like a delivery driver causing an accident while making a delivery.

Fault vs. Liability

You might hear the words “fault” and “liability” used interchangeably, but they have distinct meanings in a legal context. Fault is about who is to blame for an accident. Liability, on the other hand, is about who is legally and financially responsible for the consequences. In a personal injury case, liability means the other person is legally obligated to cover your damages because their actions—or failure to act—directly caused your harm. While the person at fault is often the one held liable, it’s not always that simple. The key takeaway is that liability is the legal determination that requires someone to pay for the injuries and losses they caused.

The Burden of Proof

In any personal injury claim, the responsibility for proving the case falls on the injured person. This is known as the “burden of proof.” It’s your job, as the plaintiff, to present strong evidence showing that the other person’s carelessness directly led to your injury. You can’t just say it happened; you have to prove it. This is done by gathering evidence like police reports, medical records, witness statements, and photos of the scene. The standard in civil cases is called a “preponderance of the evidence,” which means you must show that it is more likely than not that your version of events is true.

The Statute of Limitations

Every state sets a strict deadline for filing a personal injury lawsuit, known as the statute of limitations. In Missouri, you generally have five years from the date of the accident to file your claim. This may sound like a lot of time, but investigating an accident and building a strong case can be a lengthy process. If you miss this critical deadline, the court will almost certainly refuse to hear your case, and you will lose your right to seek compensation forever. That’s why it’s so important to act quickly. If you’ve been injured, you should speak with an attorney as soon as possible to protect your legal options.

Common Liability Myths, Debunked

There are a lot of misconceptions about what happens in a personal injury case. One of the biggest myths is that the at-fault person has to pay for everything out of their own pocket. In reality, insurance policies—like auto or homeowner’s insurance—are typically the first source of compensation.

Another common belief is that you have to go to trial to get a settlement. The truth is, most personal injury cases are resolved through negotiations long before they reach a courtroom. Finally, many people assume insurance companies will be fair and helpful. While they can be, it’s crucial to remember they are businesses focused on their bottom line, which is why having an experienced attorney on your side is so important.

What Are the Different Types of Liability?

When someone gets hurt, the law looks for who is responsible, or “liable.” Liability isn’t a one-size-fits-all concept; it comes in a few different forms. Understanding these types can help you make sense of your situation and see how a legal professional might approach your case. Let’s walk through the most common ways liability is determined in personal injury law.

Negligence: When Carelessness Makes You Liable

This is the most common type of liability in personal injury claims. Think of it as someone failing to act with reasonable care, which then causes harm to another person. To prove negligence, you and your attorney must show four things: the other person had a duty to act carefully, they failed in that duty, their failure directly caused your injuries, and you suffered actual damages as a result. A classic example is a driver who runs a red light and causes a crash. They had a duty to follow traffic laws, they failed, and that failure led to an accident and injuries. Most automobile accident cases are built on proving negligence.

What Is Strict Liability?

In some situations, you don’t have to prove someone was careless to hold them responsible. This is called strict liability. It applies to specific activities that are considered inherently dangerous or to certain product-related injuries. For instance, if a company sells a defective product that injures a consumer, the company can be held liable even if they took steps to be careful. Another common example is a dog bite; in many places, the owner is automatically responsible for the harm their dog causes, regardless of whether the dog had been aggressive before. The focus here is on the act itself, not the person’s level of care.

Examples of Strict Liability Cases

Strict liability often comes up in cases involving defective products. Imagine a new power tool that has a manufacturing flaw, causing it to malfunction and injure the user. Under strict liability, the manufacturer can be held responsible for the injuries, regardless of how careful they were during production. The focus is on the fact that they released an unsafe product into the market. Another common scenario involves animal attacks, particularly dog bites. In Missouri, dog owners are often held strictly liable if their dog bites someone, meaning the victim doesn’t have to prove the owner was negligent. These types of personal injury claims are unique because they remove the burden of proving carelessness, holding certain parties accountable simply because of the nature of their product or activity.

Can You Be Liable for Someone Else’s Actions?

Sometimes, a person or entity can be held responsible for the actions of someone else. This is known as vicarious liability. The most frequent example involves an employer and an employee. If an employee causes an accident while on the job—like a delivery driver hitting a pedestrian—their employer can be held liable for the damages. This is because the employer is responsible for their employees’ actions when they are working. This principle ensures that the party who benefits from the employee’s work also bears responsibility for the potential harm caused during that work.

When Breaking a Law Means You’re at Fault

This is a legal rule that can make proving a case a bit more straightforward. “Negligence per se” applies when someone is injured because another person violated a safety law or regulation. For example, if a driver is speeding in a school zone and hits a child, their violation of the speed limit can be used as direct proof of negligence. The law was designed to protect children from this exact type of harm. In these cases, you don’t have to argue about what a “reasonable person” would have done; the law has already set the standard of care, and the other party broke it.

How Is Fault Determined in an Injury Case?

When you’re injured because of someone else’s actions, proving they are financially responsible is the core of your personal injury claim. It’s not enough to simply state that they were at fault; you have to build a case that legally establishes their liability. Think of it like constructing a building—you need a solid foundation and the right materials to make it stand. In a legal sense, this means proving a few key points and backing them up with solid evidence.

Successfully proving liability is what allows you to recover compensation for your medical bills, lost income, and other damages. The process involves a clear, methodical approach to show exactly how the other party’s carelessness led directly to your injuries. It also requires an honest look at the circumstances of the incident, as even your own actions can play a role in the outcome. Understanding these components is the first step toward building a strong case and getting the justice you deserve. Our firm handles a wide range of personal injury cases and can help you navigate this process.

Why You Need to Act Quickly

After an injury, it’s easy to feel overwhelmed, but time is not on your side. The success of a personal injury claim often depends on preserving crucial evidence, and the longer you wait, the more likely it is that this evidence will disappear. Security camera footage gets erased, accident scenes are cleaned up, and physical evidence can be lost. Just as importantly, people’s memories of the event can fade or change over time. What a witness remembers clearly the day of an accident might become hazy a few months later. The burden of proof is on you, the injured person, to provide strong evidence that someone else’s carelessness caused your injury. Acting quickly ensures you can gather the freshest, most accurate information to build a solid foundation for your case.

Identifying All Potentially Liable Parties

Figuring out who is at fault isn’t always as simple as pointing to one person. In many cases, multiple parties could share responsibility for your injuries. For example, if you were hit by a delivery driver, both the driver and their employer could be held liable under a legal principle called vicarious liability. The law recognizes that the employer is responsible for the actions of their employees while they are on the job. Similarly, if a faulty car part caused the accident, the car manufacturer could also be at fault. A thorough investigation is essential to identify every person or company that may have contributed to the incident. Exploring all avenues of liability is key to ensuring you can recover the full compensation you need for your recovery.

The 4 Elements of a Successful Liability Claim

To win a personal injury case, you and your attorney must prove four specific things. These are often called the “elements of negligence,” and all four must be present for your claim to be successful.

- Duty of Care: First, you have to show the person who harmed you had a legal duty to act with reasonable care. For example, every driver on the road has a duty to obey traffic laws and drive safely.

- Breach of Duty: Next, you must prove they failed in that duty. A driver who runs a red light or texts while driving has breached their duty of care.

- Causation: You then need to connect their failure directly to your injury. The driver’s act of running the red light must be the cause of the collision that injured you.

- Damages: Finally, you must demonstrate that you suffered actual harm—like medical bills, lost wages, or pain and suffering—as a result of the injury.

What Evidence Proves Who’s at Fault?

A claim is only as strong as the evidence that supports it. To prove the four elements of liability, your attorney will gather crucial pieces of evidence to build your case. This isn’t just one single document but a collection of facts that paint a clear picture of what happened. Key evidence often includes medical records detailing the extent of your injuries, police reports from the scene of the accident, and photos or videos of the incident and its aftermath.

Eyewitness testimony can also be incredibly powerful. In more complex cases, we may even bring in expert witnesses, like accident reconstruction specialists or medical professionals, to provide their professional opinions. Gathering this information is a critical step, so it’s important to contact an attorney who can help preserve and organize the evidence needed for your claim.

Maintenance and Inspection Records

If you own a home or business, your maintenance logs are more than just a way to track repairs—they’re a crucial part of your legal defense. Think of these records as your proof that you’re a responsible property owner. In a slip-and-fall case, for example, showing a log of regular floor inspections can be a game-changer. It helps demonstrate that you took reasonable steps to keep the area safe, which directly counters a claim of negligence. A claim is only as strong as the evidence that supports it, and these documents serve as tangible proof of your commitment to safety. They can establish that you fulfilled your duty of care, potentially protecting your assets from a costly lawsuit.

What Happens if You’re Partially to Blame?

It’s important to know that in Missouri, you can still recover damages even if you were partially at fault for the accident. This is based on a legal rule called “pure comparative fault.” However, your final compensation will be reduced by your percentage of fault. For example, if you are awarded $100,000 in damages but are found to be 20% responsible for the accident, your award would be reduced by 20%, leaving you with $80,000.

Because of this rule, the other party’s insurance company will often try to shift as much blame as possible onto you to reduce what they have to pay. This is why having a skilled advocate on your side is so important. An experienced attorney like Chad G. Mann can fight back against unfair accusations and work to ensure liability is assigned correctly.

Missouri’s Pure Comparative Fault Rule

Missouri’s approach to shared blame is actually one of the most forgiving in the country. We follow a rule called “pure comparative fault,” which means you aren’t automatically blocked from receiving compensation just because you were partially responsible for what happened. Instead, your final award is simply reduced by whatever percentage of fault is assigned to you. For example, if a court awards you $100,000 but finds you were 30% at fault, you would receive $70,000. This system holds every party accountable for their share of the blame, and it applies even if you were 99% responsible—you could still recover 1% of your damages.

Other States: Contributory and Modified Comparative Fault

It’s helpful to know that Missouri’s rule is quite favorable to injured people, as many other states follow much stricter systems. A few states use a harsh rule called “contributory negligence,” where being found even 1% at fault for an accident completely bars you from recovering any compensation. The most common system is “modified comparative fault,” where you can only recover damages if your fault is below a certain threshold—usually 50% or 51%. If your share of the blame exceeds that limit, you get nothing. Understanding these differences highlights why it’s so important, even in Missouri, to have a legal advocate who can effectively argue your percentage of fault and protect your right to fair compensation.

What Damages Could You Be Liable For?

If you’re found financially liable for someone’s injury, you are responsible for covering their “damages.” This is a legal term for the losses the injured person suffered because of the accident. Damages aren’t just about the obvious costs, like a hospital bill. They are meant to compensate the person for the full impact the injury has had on their life, from their finances to their well-being. These costs can be broken down into a few key categories.

Compensation for Property Damage

Accidents don’t just cause physical injuries; they often leave a trail of damaged property. If you are found liable for an incident, you are also responsible for the cost of repairing or replacing any property you damaged, whether it’s another person’s car, a fence, or even a mailbox. This is where the property damage liability portion of your insurance policy becomes essential. This specific coverage is designed to pay for these costs, up to your policy’s limit. It’s crucial to know what that limit is. While your state has a minimum requirement, repair costs can easily exceed that amount, especially in a serious accident. If the damages are higher than your coverage, you could be required to pay the difference yourself, putting your personal assets at risk.

Covering Medical Bills and Lost Wages

The most straightforward damages are the direct financial losses the injured person has incurred. This includes all medical bills related to the injury—from the initial ambulance ride and emergency room visit to surgery, physical therapy, and prescription medications. If the injury prevented them from working, you could also be responsible for their lost wages. This compensates them for the income they couldn’t earn while they were recovering. These costs, often called economic damages, are calculated based on actual bills, receipts, and pay stubs.

What About Pain and Suffering?

Not all losses come with a price tag. If you are found liable, you may also have to compensate the injured person for non-economic damages. This category covers the human cost of an injury, such as physical pain and suffering, emotional distress, and mental anguish. It can also include compensation for a “loss of enjoyment of life,” which addresses the ways an injury might prevent someone from participating in hobbies, activities, or relationships they once valued. While harder to quantify, these damages are a critical part of making the injured person whole again.

Examples of Non-Economic Damages

To make this idea more concrete, let’s consider a few scenarios. Non-economic damages could cover the chronic back pain someone experiences after a rear-end collision, which makes it impossible to get a full night’s sleep. It could also include the anxiety a person feels every time they get behind the wheel after a serious crash. For a parent, it might be the emotional toll of not being able to lift their young child. Or, for an active individual, it could be the loss of joy from no longer being able to go on their daily run. These are the real, human costs of an injury, and the legal system recognizes that they deserve compensation just as much as a medical bill.

When Do Punitive Damages Come into Play?

In some rare cases, another type of damages may be awarded: punitive damages. Unlike the other categories, these are not meant to compensate the victim for a loss. Instead, their purpose is to punish the at-fault party for extremely reckless or intentional behavior and to deter others from acting in a similar way. Think of cases involving a drunk driver who causes a serious crash. Because they are reserved for situations of gross negligence or willful misconduct, punitive damages are not awarded in most personal injury cases.

The Purpose of Punitive Damages

The main goal of punitive damages isn’t to help the injured person pay their bills; that’s what compensatory damages are for. Instead, the purpose is to send a strong message. These damages are designed to punish a defendant whose actions were especially harmful or reckless and to discourage others in the community from doing the same thing. Think of it as the civil court’s way of making an example out of someone. For instance, if a company knowingly sells a dangerous product that injures people, a court might award punitive damages to penalize the company’s blatant disregard for safety and to warn other corporations against similar behavior. It’s a financial penalty meant to address conduct that society finds completely unacceptable.

Are You Liable for Future Medical Costs?

Serious injuries often require ongoing medical attention long after the initial accident. A settlement or court award can include compensation for the estimated cost of future medical care, such as additional surgeries, long-term rehabilitation, or in-home nursing assistance. For injuries resulting in permanent disability, these damages are essential for ensuring the person’s needs are met for the rest of their life. Calculating these future costs is complex, which is why having experienced legal guidance is so important. If you have questions about your potential liability, it’s wise to contact an attorney to discuss your case.

Who Can Be Held Liable for an Injury?

When an injury happens, figuring out who is responsible for the costs isn’t always simple. The person who directly caused the harm might not be the only one held accountable. The law often extends responsibility to other people, businesses, or property owners, depending on the circumstances. Understanding who can be held liable is a crucial first step in any injury case.

Liability for Individuals

This is the most straightforward scenario. If someone’s careless actions directly cause your injury, they are legally and financially responsible for the resulting damages. A common example is a distracted driver who causes a car crash. Because their negligence led to the accident, they are liable for the victim’s medical bills, lost income, and other costs. This principle is the foundation of most personal injury claims, ensuring the person at fault is held accountable for the harm they’ve caused.

Liability for Businesses and Employers

Sometimes, a business can be held responsible for an employee’s actions through a legal concept called “vicarious liability.” This applies when an employee causes an injury while on the clock and performing their job duties. For instance, if a delivery driver for a company runs a red light and hits another car, the company itself can be held liable. The logic is that employers have a duty to properly hire, train, and supervise their staff. This provides an important path for victims to recover damages, especially when an individual employee may not have the resources to cover them.

Liability for Property Owners

Property owners have a legal duty to keep their premises reasonably safe for visitors. This area of law, known as premises liability, holds owners accountable for accidents caused by unsafe conditions they knew or should have known about. Common examples include injuries from a slip and fall on a wet floor, a trip over a broken step, or an assault in a poorly lit parking garage. When a property owner fails to fix a hazard or warn visitors about it, they can be held financially responsible for any injuries that occur as a result.

How Insurance Protects You from Liability Claims

When you’re found financially liable for someone’s injury, the first line of defense for your personal assets is your insurance policy. Whether it’s from a car crash or an accident on your property, having the right insurance is designed to cover the costs of the other person’s damages, so you don’t have to pay out of pocket. It acts as a financial shield, handling everything from medical bills to legal fees, up to the limits of your policy.

However, not all insurance plans are created equal. The amount and type of coverage you have can make a huge difference in how protected you are. Simply having a minimum policy might not be enough to cover the expenses from a serious accident, potentially leaving you responsible for a significant sum. Understanding your policy is the first step toward safeguarding your financial future. If you’re ever in a situation where you might be at fault, your insurance company will be the one to step in, negotiate, and pay the claim, but only up to a certain point.

Understanding Bodily Injury Liability Coverage

Bodily injury liability is a key part of your car insurance. If you cause an accident that hurts someone else, this coverage helps pay for their expenses. Think of it as the insurance that takes care of the other person. It’s designed to cover their medical bills, from the initial hospital stay to ongoing physical therapy. It also helps compensate them for any wages they lose from being unable to work.

Beyond the direct medical costs, this coverage can also pay for the injured person’s pain and suffering and any legal fees they might have if they decide to file a lawsuit against you. Most states require drivers to carry a minimum amount of bodily injury liability coverage, but as you’ll see, the minimum often isn’t enough to fully protect you in a serious automobile accident.

Check Your Policy for Limits and Coverage Gaps

Every insurance policy has a limit, which is the maximum amount the company will pay for a single claim or accident. It’s crucial to know what your limits are because if the damages from an accident exceed them, you could be held personally responsible for the rest. For example, if your policy limit is $50,000 but the injured person’s medical bills and lost wages total $80,000, you may have to pay the remaining $30,000 yourself.

This is an often-overlooked detail that can have a massive financial impact. Take a close look at your insurance documents to understand your coverage. Identifying these potential gaps ahead of time allows you to make more informed decisions about the level of protection you need across all practice areas of potential liability.

Getting Extra Protection with an Umbrella Policy

For more complete protection, you can look into additional coverage options. Uninsured/Underinsured Motorist (UIM) coverage is one important type—it protects you if you’re hit by a driver who has no insurance or not enough to cover your bills. Another powerful tool is an umbrella policy. This provides an extra layer of liability coverage that kicks in after your standard auto or homeowners insurance limits have been reached.

An umbrella policy is a cost-effective way to protect yourself from a major claim that could otherwise jeopardize your savings and assets. If you’re concerned about your current coverage or have questions about your specific situation, it’s always a good idea to contact a legal professional to review your options.

What Happens When Insurance Isn’t Enough?

It’s a scenario no one wants to imagine: you’re found liable for an accident, and the costs of the other person’s injuries are higher than your insurance policy limits. This situation, often called an “excess judgment,” is more common than you might think, especially in cases involving serious injuries that require long-term medical care. When your insurance policy isn’t enough to cover the full damages, the injured party can seek the remaining amount directly from you. This is where a seemingly straightforward accident can turn into a significant financial crisis.

When the insurance payout is exhausted, the focus shifts to your personal finances. The injured person’s attorney will look for every possible avenue to cover their client’s losses, which could mean pursuing your assets. This is a critical moment where having experienced legal guidance is essential. An attorney can help you understand the full scope of the claim against you and explore every option to manage the situation, from challenging the amount of damages to negotiating a fair resolution. Understanding your options and the potential risks is the first step toward protecting your financial future when your insurance coverage falls short. Our firm handles a wide range of personal injury cases and can help you understand the complexities of your situation.

Are Your Personal Assets on the Line?

Yes, if you are found liable for damages that go beyond your insurance coverage, your personal assets could be at risk. This means that a court judgment could allow the injured party to go after your savings accounts, investments, and even your property to satisfy the debt. It’s a sobering thought, but it highlights the importance of having adequate insurance coverage in the first place. Things like your home, vehicles, and other financial resources can all be considered assets that could be used to pay a judgment. This is why a personal injury claim that exceeds policy limits should be taken very seriously from the start.

Can You Negotiate a Settlement or Payment Plan?

If you find yourself owing more than your insurance will pay, it doesn’t automatically mean you’ll have to liquidate all your assets. Often, there’s room for negotiation. An experienced attorney can work with the other party to negotiate a settlement for the outstanding amount. This could involve reaching a lump-sum agreement that is less than the total judgment or setting up a structured payment plan that allows you to pay off the debt over time without facing financial ruin. These negotiations are delicate and require a deep understanding of personal injury law, making professional legal help invaluable. If you need to discuss your options, you can contact our office for guidance.

Is Bankruptcy an Option After a Judgment?

In some severe cases, the judgment from a personal injury lawsuit can be so large that the at-fault person has no realistic way to pay it. In these situations, filing for bankruptcy might be an option to consider. Bankruptcy can provide relief from overwhelming debt, and in many cases, a personal injury judgment can be discharged. However, this is a major financial decision with long-lasting consequences for your credit and financial standing. It’s not a simple fix, and it’s crucial to understand all the implications before proceeding. You can find more information on various legal topics in our articles.

Simple Ways to Protect Yourself from Liability

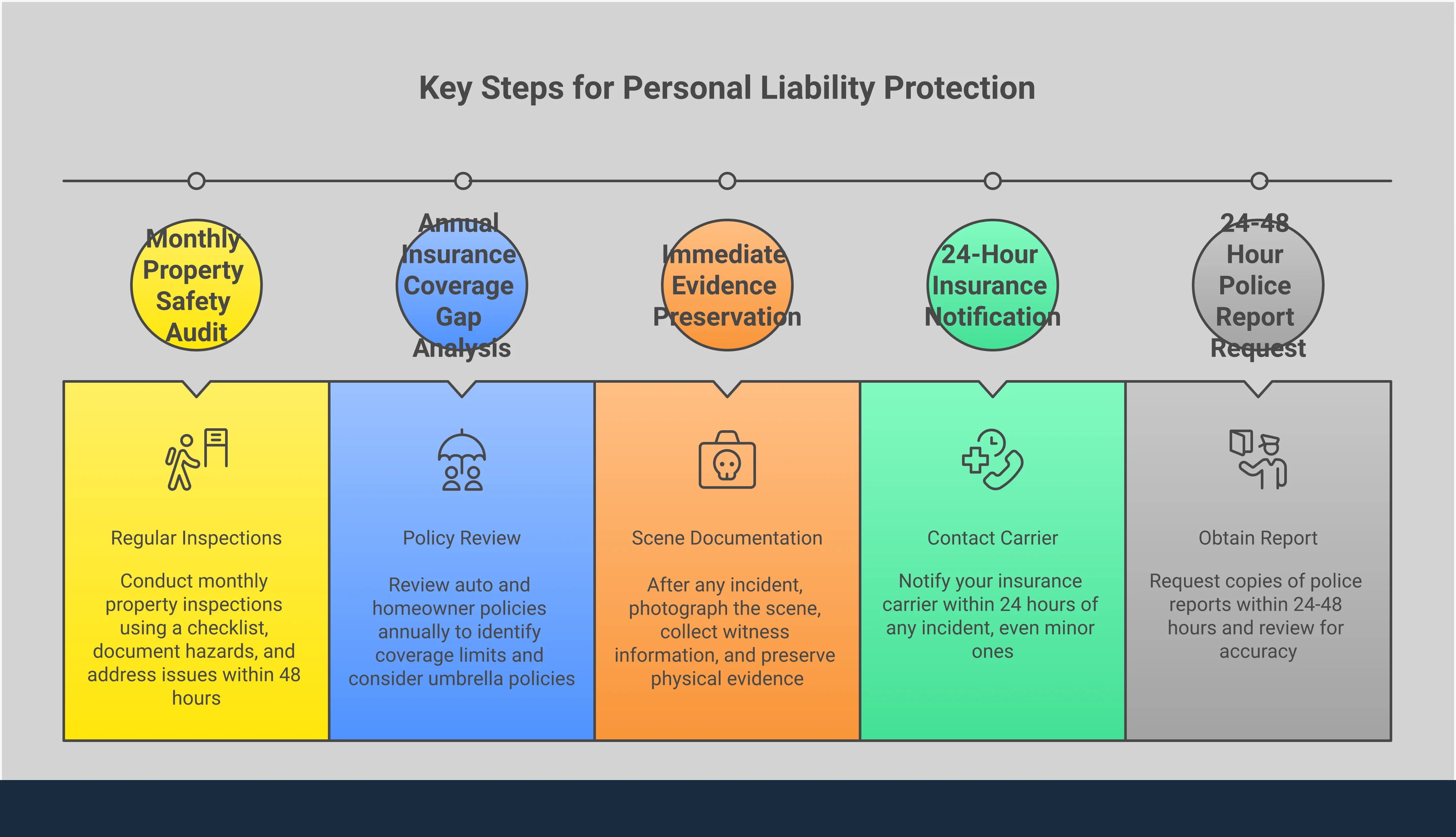

No one wants to imagine being responsible for someone else’s injury. The financial and emotional toll can be overwhelming. But instead of worrying about the what-ifs, you can take concrete, proactive steps to protect yourself and your assets. Being prepared isn’t about expecting the worst; it’s about creating a safety net so you can handle unexpected situations with confidence. By maintaining your property, securing the right insurance, and knowing when to seek legal advice, you can significantly reduce your risk and safeguard your financial future.

Tips for Property Owners to Prevent Accidents

As a property owner, you have a responsibility to maintain a reasonably safe environment for visitors. This area of law, known as premises liability, holds you accountable for injuries that happen on your property due to negligence. The best way to protect yourself is to prevent accidents before they happen. Regularly inspect your property for hazards like broken steps, uneven walkways, or poor lighting, and address them promptly. To further reduce risk, you can take proactive measures to secure your space. For example, you could install a fence around your property to keep unwanted visitors or animals out, which helps minimize the chances of an accident occurring in the first place.

Choosing the Right Insurance to Protect Yourself

Your insurance policy is your primary financial shield against a liability claim. However, not all policies are created equal. Selecting the right insurance coverage is crucial, and it involves more than just finding the lowest price. Look for a provider with a strong reputation for financial stability and positive customer service. When you’re comparing options, read the policy terms carefully to understand exactly what is covered and, more importantly, what isn’t. Ensuring you have adequate coverage limits can prevent a devastating financial blow. If your policy limit is too low to cover the damages in a serious accident, you could be held personally responsible for the remaining amount.

When Is It Time to Call a Lawyer?

Insurance is essential, but it has its limits. If you’re facing a claim where the damages might exceed your policy’s coverage, it’s time to seek legal advice. Understanding the impact of insurance policy limits is critical, because if the at-fault party’s insurance is insufficient to cover all the damages, your personal assets could be at risk. An attorney can help you understand your position and explore every possible avenue for resolving the claim. Don’t wait until it’s too late. Getting professional guidance early on can help protect your rights and finances. If you’re unsure about your liability or how to proceed, contact a lawyer to discuss your specific situation.

Related Articles

- Understanding Imputed Liability in MO Car Accident Cases

- Personal Injury Attorney Guide – Find the Right Advocate

- Top-Rated Personal Injury Lawyers: A Practical Guide – The Law Office of Chad G. Mann, LLC

- When to Hire a Premises Liability Lawyer – The Law Office of Chad G. Mann, LLC

- Premises Liability Law Guide – Find Expert Attorneys

Frequently Asked Questions

What’s the difference between being “at fault” and being legally “liable?” Think of it this way: being “at fault” is the general idea of who caused an accident. Legal “liability,” however, is the official, enforceable responsibility for the financial consequences of that accident. To be found liable, someone has to prove in a legal setting that your actions (or inaction) directly led to their injuries and damages. It’s the step that turns a simple “it was their fault” into a legal obligation to pay.

If I’m found liable for an injury, will I have to pay for everything out of my own pocket? This is a common fear, but it’s not usually how it works. The first line of defense is your insurance policy, whether it’s for your car or your home. Your insurance company is responsible for paying for the damages up to your policy’s coverage limits. Your personal assets only become a target if the total cost of the damages is higher than what your insurance policy will cover.

How is the amount for “pain and suffering” actually calculated? There isn’t a simple calculator for this, as every person’s experience is unique. Instead, attorneys and insurance companies look at several factors to determine a fair amount. They consider the severity of the physical injury, the length and difficulty of the recovery process, and the long-term impact the injury will have on the person’s daily life and well-being. It’s a way of acknowledging the very real human cost of an injury that goes beyond medical bills.

Can I be held responsible if an accident happens on my property but I wasn’t even there? Yes, you can. As a property owner, you have a legal duty to keep your property in a reasonably safe condition for visitors. This is known as premises liability. If someone is injured because of a hazard you knew about, or should have known about—like a broken step or an icy walkway you failed to salt—you can be held liable for their injuries, regardless of whether you were physically present when the accident occurred.

What happens if I’m in an accident and we both share some of the blame? In Missouri, you can still receive compensation even if you were partially at fault for the accident. The state follows a “pure comparative fault” rule. This means your final settlement or award will be reduced by whatever percentage of fault is assigned to you. For example, if you are found to be 10% at fault, your total compensation would be reduced by 10%. You aren’t completely barred from recovery just because you share some responsibility.