The most expensive will is often the one that was done cheaply—or not at all. A small mistake in a DIY template or a misunderstanding of state law can lead to major legal headaches and family disputes down the road. When people ask, “how much does a will cost in Missouri?,” they’re often just thinking about the upfront price. But the real cost is tied to getting it right. This article will break down the typical costs of creating a will, from online services to working with a lawyer. More importantly, we’ll explore the hidden risks of cutting corners and show you how a proper investment now can protect your family from far greater expenses later.

Key Takeaways

- Match Your Method to Your Needs: The cost of a will in Missouri depends on your approach, from a simple DIY kit to a comprehensive plan with a lawyer. Your choice should reflect the complexity of your finances and family life to ensure you get the right level of protection.

- Invest in a Lawyer for Complex Situations: While DIY wills seem affordable, they carry the risk of costly errors. If you have significant assets, a business, or a blended family, working with an attorney is the best way to ensure your wishes are legally protected and your family is spared future disputes.

- Having No Will Means Having No Say: Without a will, Missouri law dictates who inherits your property, and it likely won’t align with your intentions. A will is the only way to guarantee you have control over how your assets are distributed and who cares for your minor children.

How Much Does a Will Cost in Missouri?

Figuring out the cost of a will in Missouri can feel a bit like asking, “How much does a car cost?” The answer really depends on what you need. The price can range from a few dollars for a basic template to several thousand for a comprehensive plan, based on your finances and family situation. You generally have three paths: a do-it-yourself kit, an online service, or working directly with an attorney. Each has its own price tag and level of security. Let’s break down what you can expect to pay for each option.

The Price of DIY Will Kits and Online Services

If you’re looking for the most budget-friendly option, DIY will kits and online templates are where you’ll start. You can find downloadable kits for as little as $13, with most falling in the $4.50 to $100 range. Online services, which offer more guidance, typically cost between $100 and $200. While these tools are accessible, they are designed for the simplest of situations and often provide limited instructions. If you have any unique assets or family circumstances, a generic template might not give you the protection you need, potentially creating expensive problems for your family later.

The Price of a Simple Will with a Lawyer

For peace of mind and professional guidance, many people choose to work with an attorney. In Missouri, a simple will drafted by a lawyer typically costs between $300 and $1,000. This is perfect for individuals with straightforward finances—like owning a home, a retirement account, and needing to name a guardian for children. Attorneys may charge a flat fee or bill hourly, with rates often from $200 to $800 per hour. While it costs more upfront than a DIY kit, you’re paying for expertise and the assurance that your will is legally solid and reflects your wishes.

The Price of a Complex Estate Plan

If your financial picture is more complicated, you’ll need more than just a simple will. For those with business assets, multiple properties, or blended families, a comprehensive estate plan is a must. The cost for these plans usually starts around $1,000 and can go up to $5,000 or more. This price typically covers not just a will but also other crucial documents like trusts. For very high-net-worth individuals, a detailed plan could cost between $6,000 and $8,000. In these situations, working with an experienced estate planning attorney is essential for protecting your assets and providing for your loved ones.

What Factors Change the Price of a Will?

The cost of creating a will in Missouri isn’t a single, fixed number. Think of it less like buying a product off the shelf and more like a personalized service. The final price tag depends entirely on your unique circumstances. A straightforward will for a young, single person with minimal assets will naturally cost less than a detailed plan for a couple with a blended family, multiple properties, and a business.

Several key elements influence the cost, from the complexity of your finances to the family dynamics you need to address. The type of professional you work with and even where they’re located can also play a role. Understanding these factors will help you get a clearer picture of what to expect and find the right approach for your needs and budget. It’s all about matching the level of service to the complexity of your life, ensuring your final wishes are clearly and legally documented without any surprises.

Your Estate’s Complexity and Family Situation

The single biggest factor affecting the cost of your will is how complex your life is—both financially and personally. A simple will might be enough if you have a small estate and straightforward wishes. However, the price will increase if your situation includes more moving parts. For example, if you have a blended family, are remarried, or have minor children who will need a guardian, your will requires more careful planning. The same is true if you own investment properties, want to leave specific, valuable items to certain people, or need to set up trusts. These details add layers that require more legal time and expertise to get right.

Your Lawyer’s Location and Experience

Just like with many professional services, where your lawyer is located and how much experience they have will influence their rates. Attorneys in larger metropolitan areas often have higher overhead costs, which can be reflected in their fees, compared to those in smaller towns. An experienced estate planning lawyer may also charge more than someone new to the field. While it might be tempting to go with the lowest price, remember that you’re paying for expertise. A seasoned attorney’s guidance can provide incredible peace of mind and help you avoid costly mistakes that could cause problems for your family later on.

Other Legal Documents You Might Need

A will is a cornerstone of any estate plan, but it’s rarely the only document you need. To create a truly comprehensive plan that protects you and your assets, you’ll likely want to include a durable power of attorney for financial matters and a healthcare directive (or living will). These documents appoint people you trust to make decisions for you if you become unable to do so yourself. Many attorneys offer an estate planning package that bundles these essential documents together. This approach is often more cost-effective than creating each one separately and ensures all your legal protections work in harmony.

Your Three Main Options for Creating a Will

When you decide to write a will, the next big question is how you’ll actually create the document. There isn’t a single right answer, as the best path depends entirely on your unique circumstances. Think about the complexity of your finances, your family situation, and your comfort level with legal documents. Generally, you have three main routes to choose from: a do-it-yourself kit, an online service, or working directly with an attorney. Each option comes with a different price tag and level of support.

A DIY kit is the most hands-off approach, leaving you to fill in the blanks on a generic template. An online service offers a bit more guidance, walking you through a digital questionnaire. Hiring an estate planning lawyer is the most personalized and secure option, giving you tailored advice and a professionally drafted document that accounts for the nuances of Missouri law. Understanding the pros and cons of each can help you make a confident choice that protects both your assets and your loved ones.

Using a Do-It-Yourself Will Kit

Do-it-yourself will kits are the most affordable option, with prices often ranging from $15 to $100. You can find these as downloadable templates or physical kits in office supply stores. While the low cost is tempting, it comes with significant risks. These kits are one-size-fits-all and can’t provide the specific advice needed for your situation. The instructions are often vague, and it’s easy to make a mistake without realizing it—an error that could invalidate your will or create serious legal headaches for your family down the road. If you have any assets beyond a simple bank account or have complex family dynamics, a generic template is unlikely to cover all your bases.

Using an Online Will Service

Online will services are a step up from DIY kits and have become a popular middle-ground option. These platforms guide you through a series of questions about your assets and beneficiaries to generate a will. For someone with a very straightforward estate—for instance, a single individual with no dependents and minimal assets—this can be a cost-effective choice. You can learn more about how to make an online will and see if it fits your needs. However, these services still can’t replace the advice of a real person. They can’t ask follow-up questions or identify potential legal issues you might not have considered, especially when it comes to unique family situations or specific bequests.

Working with an Estate Planning Lawyer

Working with an estate planning lawyer is the most comprehensive and secure way to create a will. While it’s the most significant investment upfront, you’re paying for expertise and peace of mind. A lawyer won’t just fill out a form; they will listen to your wishes, analyze your financial situation, and advise you on the best way to achieve your goals while minimizing taxes and avoiding potential legal challenges. They can handle complexities like blended families, business succession, or setting up trusts for minors. This personalized guidance ensures your will is not only legally valid in Missouri but also perfectly tailored to your life. If you want to ensure your final wishes are carried out exactly as you intend, exploring professional estate planning services is your best bet.

Making Your Missouri Will Legally Binding

A will is more than just a piece of paper outlining your wishes; it’s a legal document that has to follow specific state rules to hold up in court. If it doesn’t meet Missouri’s requirements, your instructions might not be followed, which is the last thing you want. Think of these rules as a checklist. Getting them right ensures your will is ironclad and that your final wishes are honored exactly as you intended. Let’s walk through what it takes to make your will official in Missouri.

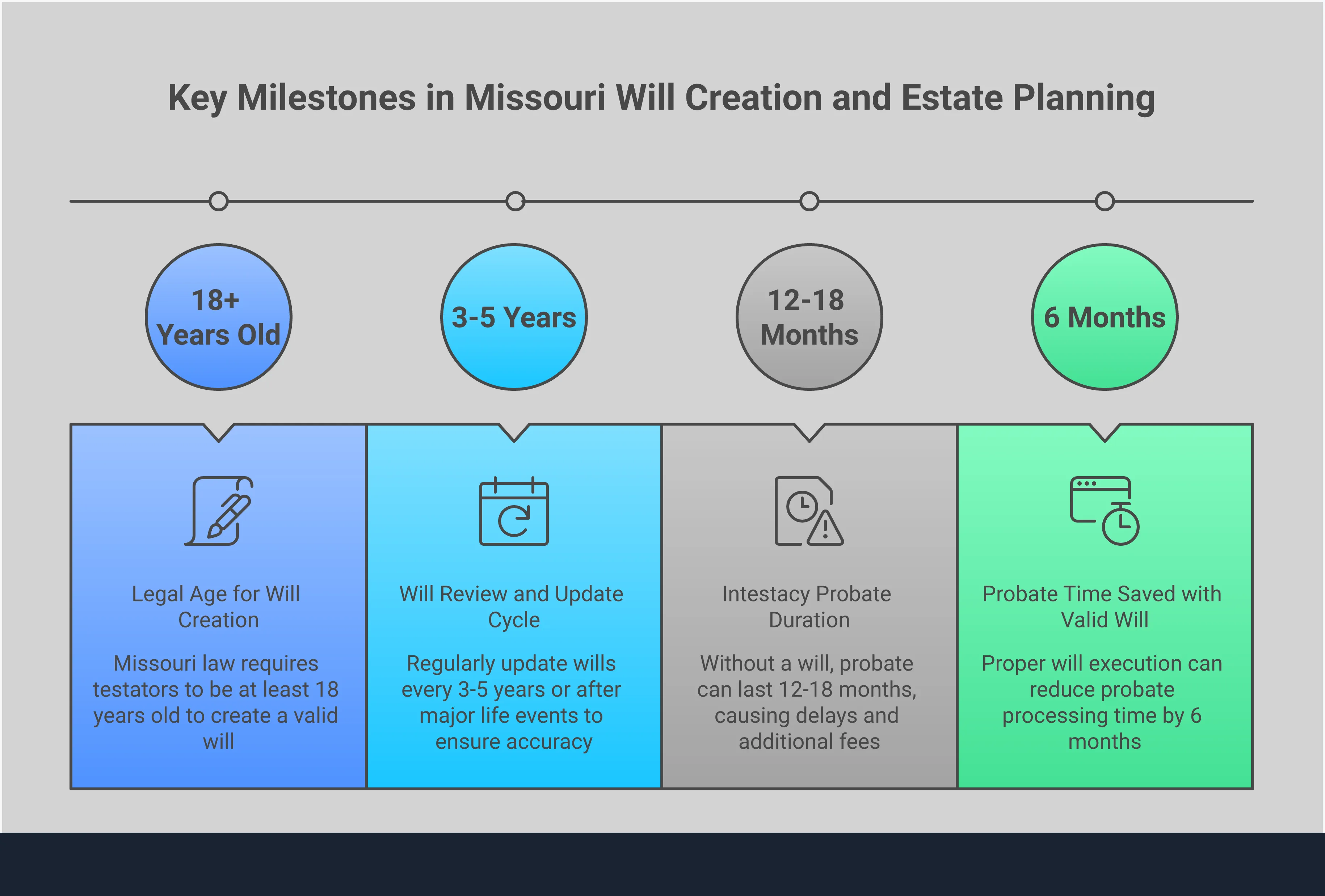

The Core Requirements: Age, Sound Mind, and Writing

First things first, you need to be at least 18 years old to create a will in Missouri. Next, you must be of “sound mind,” which is a legal way of saying you have the mental capacity to make these important decisions. This means you understand that you’re creating a document to distribute your property after you die, you have a general idea of what assets you own, and you know who your family members and natural heirs are. Finally, the will must be in writing. An oral agreement or a video recording won’t cut it in a Missouri court, so make sure every detail is clearly documented on paper.

Getting the Signatures and Witnesses Right

This is a critical step where many DIY wills go wrong. For your will to be legally valid in Missouri, you (the testator) must sign it in the presence of two witnesses. These witnesses also have to sign the will in your presence. It’s a group activity—everyone needs to be in the room, watching each other sign. While you don’t technically need to have your will notarized, it’s a really good idea. A notarized will becomes “self-proving,” which can make the probate process much smoother for your family down the road by preventing any challenges to the authenticity of the signatures.

Common Myths About Will Requirements

There are a few persistent myths about wills that can cause serious problems. One of the biggest is thinking that not having a will is no big deal. If you die without one, Missouri law decides how your assets are divided, and it might not be how you would have wanted. Another common mistake is assuming a generic DIY form will cover all your bases. These templates can be risky because a small error could invalidate your will. Finally, don’t underestimate the importance of choosing the right executor. Appointing someone who isn’t organized, trustworthy, or up to the task can create delays, disputes, and unnecessary stress for your loved ones.

DIY Will vs. a Lawyer: Which Is Right for You?

Deciding how to create your will is a big step, and it’s smart to weigh your options. On one hand, DIY will kits and online services seem fast and affordable. On the other, working with a lawyer provides personalized guidance and legal expertise. The right choice really comes down to your specific life circumstances. While a simple, templated will might work for some, many people find that the peace of mind that comes with professional legal advice is well worth the investment. Let’s look at when it makes sense to call a lawyer and the potential pitfalls of going it alone.

When It Pays to Hire a Lawyer

If your financial or family situation has any complexity, hiring an estate planning lawyer is the safest path forward. Think about whether you have significant assets, own a business, or have a blended family with children from previous relationships. A lawyer can help you address these nuances with precision. They do more than just draft a document; they offer strategic advice on how to structure your estate, minimize tax burdens, and ensure your wishes are legally airtight. For situations involving minor children, beneficiaries with special needs, or property in multiple states, professional legal guidance is essential to prevent future complications for your loved ones.

The Hidden Risks and Costs of a DIY Will

The main appeal of a DIY will is the low upfront cost, but this approach comes with hidden risks. A simple mistake in wording or a failure to follow Missouri’s specific legal requirements can render your will invalid. These errors often aren’t discovered until after you’re gone, leaving your family to deal with the consequences. An ambiguous clause could lead to disputes among your heirs, potentially resulting in costly and stressful legal battles that drain the very assets you meant to protect. As Investopedia notes, a lawyer can help prevent costly mistakes by ensuring your will is clear, comprehensive, and legally sound from the start.

The Long-Term Cost of a Simple Mistake

A poorly drafted will can create lasting problems for your family. The money saved on a DIY kit is quickly overshadowed by the legal fees required to sort out a contested or invalid will in probate court. More importantly, it can create emotional turmoil for the people you care about most. A professionally prepared will provides immense peace of mind, giving you confidence that your final wishes will be honored and your family will be cared for. Investing in a lawyer to get it right the first time is one of the most thoughtful things you can do for your loved ones. If you’re ready to discuss your options, our team is here to help you get started.

How to Save Money When Creating Your Will

Creating a will is a smart financial move, but that doesn’t mean it has to be expensive. With a little planning, you can make the process more affordable without cutting corners. Thinking through a few key areas before you speak with a lawyer can save you time and money, ensuring you get the protection you need at a price that fits your budget. Here are a few practical ways to keep the costs of creating your will in check.

Prepare Your Documents Ahead of Time

One of the most effective ways to manage legal fees is to walk into your lawyer’s office prepared. Attorneys often bill by the hour, so the less time they spend organizing your information, the more money stays in your pocket. Before your first meeting, gather all your asset information to streamline the process. This includes a list of your bank accounts, real estate, investments, and significant personal property. You should also decide on your beneficiaries, an executor, and a guardian for any minor children. Doing this homework before you schedule a consultation makes the entire process smoother and more affordable.

Bundle Your Estate Planning Services

A will is often just one piece of a complete estate plan. You’ll likely also need a durable power of attorney for finances and a healthcare directive. Instead of creating these documents one by one, ask about bundling them. Buying an estate planning package that includes a will, power of attorney, and healthcare directive often gives you better value than buying each document separately. This approach is not only more cost-effective but also ensures your entire plan is cohesive and all your bases are covered at once. It’s a proactive way to protect yourself and your family while being smart with your money.

Know Exactly What You Need

Understanding your own situation is key to choosing the most cost-effective path. If you have a very simple financial situation—a small savings account, no real estate, and no children—a basic will might be all you need. However, for more complex situations involving business ownership, blended families, or significant assets, a DIY approach can lead to costly mistakes. Being honest about your needs helps you find the right solution. A brief consultation can help you clarify what level of planning is necessary, ensuring you only pay for the services that truly benefit you.

What Happens If You Die Without a Will in Missouri?

If you pass away without a will in Missouri, you don’t get to decide who gets your property. Instead, the state steps in and makes those decisions for you based on a set of rules called “intestacy laws.” This legal process means a court will divide your assets according to a predetermined formula, which often doesn’t match what you would have wanted. Your personal wishes, no matter how clearly you expressed them to your family during your lifetime, won’t be legally binding without a will. Think of it this way: the state has a plan for your property, but it’s almost certainly not your plan.

This one-size-fits-all solution can create real problems for the people you leave behind. The law dictates how assets are split between your spouse and children, but the division can get complicated, especially if you have children from a previous relationship. Maybe you wanted to leave a special heirloom to a niece or give a larger share to a child with greater financial needs. Without a will, those intentions are ignored. The court simply follows the letter of the law, which can lead to unintended consequences and painful family disputes. Taking the time for proper estate planning is the only way to ensure your assets are distributed exactly as you see fit, giving you control and your family clarity during a difficult time.

How Missouri Law Divides Your Property

Under Missouri’s intestacy laws, your property is distributed based on a strict family hierarchy. If you’re married with children, your spouse doesn’t automatically get everything. Instead, they receive a portion of your estate, and the rest is divided among your children. If you don’t have a spouse or kids, your assets will typically go to your parents. If they aren’t living, the state looks to your siblings, and so on. This rigid framework doesn’t account for your unique family dynamics or relationships, which is why making a will is so important for ensuring your true wishes are honored.

The Financial Toll on Your Family

Dying without a will doesn’t just create emotional stress; it can also place a significant financial burden on your family. The probate process often becomes far more lengthy and complex without a clear will to guide it. This can lead to higher legal fees, court costs, and other administrative expenses that eat away at the value of your estate. These are costs that could have been easily avoided with a solid plan. Ultimately, the delays and expenses can diminish the inheritance your loved ones receive, adding financial strain to an already heartbreaking situation. If you have questions, it’s always best to contact an attorney to get them answered.

Related Articles

Frequently Asked Questions

Why is there such a big price range for a will? The cost of a will varies so much because it’s a personalized document, not a one-size-fits-all product. The final price depends on the complexity of your life. A simple will for someone with minimal assets and a straightforward family structure will be on the lower end of the spectrum. However, if you own a business, have properties in different states, or need to plan for a blended family, the legal work required is more involved, which is reflected in the cost. You’re paying for the time and expertise needed to make sure your specific wishes are legally protected.

Is a cheap online will good enough for me? An online will can be a suitable option if your financial and family situations are extremely simple—for example, you’re single, have no dependents, and own very few assets. However, these services can’t provide legal advice or account for unique circumstances. They can’t ask follow-up questions to spot potential issues you might not see. The risk is that a small, overlooked detail could create significant legal and financial problems for your family later on, which often ends up being far more expensive than hiring a lawyer from the start.

My situation seems simple. Do I really need to pay for a lawyer? Even if your situation feels straightforward, working with a lawyer provides a crucial layer of security. An experienced attorney does more than just fill out a form; they ensure the language used is precise and legally sound according to Missouri law. They can also help you spot potential complications you might not have considered, like how to properly name a guardian for your children or plan for future possibilities. Think of it as an investment in peace of mind, ensuring there are no ambiguities or errors that could cause trouble for your loved ones down the road.

Is a will the only document I need for my estate plan? A will is the foundation of an estate plan, but it typically isn’t the only document you need. A will only takes effect after you pass away. To protect yourself during your lifetime, you should also have a durable power of attorney for financial decisions and a healthcare directive (or living will) to outline your medical wishes. These documents appoint people you trust to make decisions on your behalf if you become unable to. Most attorneys offer these as part of a complete estate planning package, which is often the most effective way to cover all your bases.

What happens if I make a mistake on my will? Unfortunately, a mistake on your will often isn’t discovered until after you’re gone, which is when it’s too late to fix it. A simple error, like not having the right number of witnesses or using unclear language, could cause a judge to declare the entire document invalid. If that happens, the state of Missouri will step in and distribute your assets according to its own laws, which may not align with your wishes at all. This can lead to family disputes and costly court proceedings, creating the very stress and confusion you were trying to avoid.