A car accident is a blur of twisted metal and adrenaline. It’s hard to think clearly. But the steps you take right after a crash can make or break your recovery. Insurance companies have a playbook designed to pay you as little as possible, and simple mistakes can cost you dearly. This guide cuts through the confusion. We provide clear, actionable steps to protect yourself, document damages, and handle tricky calls from adjusters. Think of this as your roadmap to understanding your injuries rights accident claim and securing the full compensation you deserve.

Key Takeaways

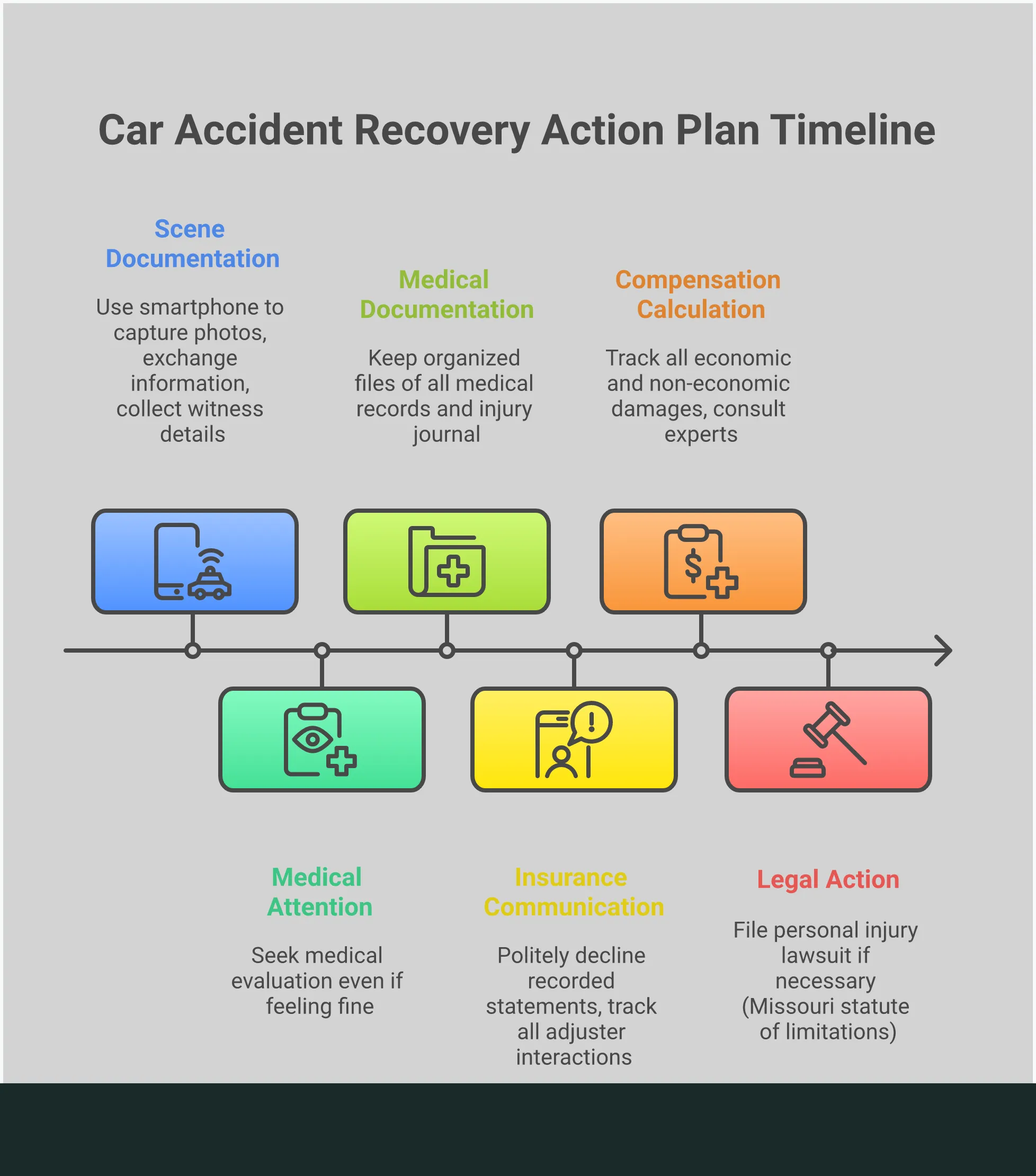

- Protect Your Health and Your Claim from the Start: Immediately after an accident, prioritize safety by calling 911. Then, protect your legal rights by thoroughly documenting the scene with photos and exchanging information with the other driver, but never admitting fault.

- Create a Clear Record of Your Injuries and Losses: Your recovery story needs evidence. Seek immediate medical attention to link your injuries to the crash, and keep a detailed journal of your pain, medical bills, and lost wages to prove the full extent of your damages.

- Understand the Insurance Company’s Goal and Know When to Get Help: Insurance adjusters aim to minimize payouts. Protect your claim by politely declining recorded statements and lowball settlement offers. If your injuries are serious or the insurer is being unfair, consulting an attorney can level the playing field.

What to Do Immediately After a Car Accident

A car accident is jarring. In the moments that follow, it’s completely normal to feel shaken, confused, and unsure of what to do. Your adrenaline is pumping, and your first thought is rightly on making sure everyone is okay. But the actions you take right at the scene can have a significant impact on your health and your ability to get fair compensation later on. It’s tough to think clearly under that kind of stress, but focusing on a few key steps can protect you and your legal rights. Think of this as your immediate action plan. By staying as calm as possible and methodically working through these steps, you can secure the scene, gather crucial information, and avoid common mistakes that insurance companies often use to deny or reduce a claim. This isn’t about being confrontational; it’s about being prepared and protecting your future. From ensuring everyone’s safety to knowing what to say (and what not to say), each step builds a foundation for a strong case, should you need to pursue one. These initial actions create the official record of what happened and can be the most important evidence you have.

Prioritize Your Safety and Call for Help

Your safety, and the safety of others, is the absolute first priority. If you can, move your vehicle out of the flow of traffic to the shoulder of the road to prevent another collision. Turn on your hazard lights. Before you do anything else, check on yourself and your passengers for injuries. Even if you feel fine, the shock can mask pain. Next, call 911 immediately. This is critical for two reasons: it gets medical help on the way for anyone who needs it, and it dispatches the police to the scene. A police report is an official, objective document that provides a record of the accident, which is incredibly important for any future automobile accident claims.

Gather Key Evidence at the Scene

If you are physically able, start documenting the scene while you wait for the police to arrive. Your smartphone is your best tool here. Take photos and videos of everything from multiple angles. Capture the damage to all vehicles involved, their license plates, and their positions on the road. Don’t forget to photograph the wider scene, including any skid marks, debris, traffic signals, and road conditions. These details can be vital for reconstructing what happened. Also, make a note of the police report number and the responding officer’s name and badge number. This information will help you obtain a copy of the official report later, which is a cornerstone of any personal injury case.

If You Must Move Your Vehicle

Your first instinct after a crash might be to get your car out of the road, especially if it’s blocking traffic. While that impulse is understandable, it’s best to pause and think first. The exact position of the vehicles after impact is critical evidence that helps police reconstruct the accident and determine fault. Moving your car can erase that evidence, potentially complicating your claim later. The safest rule is to leave your vehicle where it is unless it poses an immediate danger to other drivers. If you absolutely must move it to prevent another collision, take a moment to snap several photos of the scene from different angles first. Then, turn on your hazard lights and carefully pull over to the shoulder. While Missouri law requires drivers to avoid obstructing traffic, your safety and the need to preserve evidence are also top priorities.

What Information Should You Exchange?

You’ll need to exchange information with the other driver or drivers involved. It’s easy to forget what to ask for when you’re under stress, so try to get a clear photo of their documents if possible. Be polite but firm in gathering the essentials. You should collect their full name, address, and phone number, as well as their driver’s license number. You also need their insurance company name and policy number. Jot down the make, model, color, and license plate number of their vehicle. If there are any witnesses, ask for their names and contact information. An independent witness can provide an unbiased account of the accident, which can be incredibly valuable if the other driver’s story changes later.

Choose Your Words Carefully

In the aftermath of a crash, it’s natural to want to be polite or even apologize. However, you must be very careful with your words. Never admit fault for the accident, even if you think you might have been partially to blame. Saying something as simple as “I’m so sorry” can be interpreted as an admission of guilt by insurance companies and used against you. Stick to the facts when speaking with the other driver and the police. You can express concern for their well-being without taking responsibility for the collision. Let the police conduct their investigation and determine fault. Once you’ve left the scene, it’s wise to contact an attorney before giving any statements to an insurance adjuster.

Know Your Rights After a Car Accident

After a car accident, you might feel overwhelmed and unsure of what to do next. Insurance companies can add to the confusion, often making you feel like they hold all the power. But you have specific rights designed to protect you during this process. Understanding these rights is the first step toward ensuring you are treated fairly and receive the support you need to recover. It’s about leveling the playing field so you can focus on what matters most: your health and well-being.

Your Right to Compensation for Your Injuries

If someone else’s negligence caused your accident, you have the legal right to seek compensation for your losses. This isn’t just about covering the damage to your car; it’s about making you whole again. Fair compensation can include payment for medical bills, lost income from time off work, and the physical and emotional pain you’ve endured. Pursuing a personal injury claim is your way of holding the responsible party accountable and securing the financial resources necessary for your recovery. Don’t let an insurance company convince you that you’re only entitled to the bare minimum.

Choosing Your Own Doctor and Repair Shop

An insurance adjuster might suggest you visit a specific doctor or take your car to one of their “preferred” repair shops. It’s important to know that you are not obligated to follow their recommendations. You have the right to choose your own medical providers and the auto body shop you trust to fix your vehicle. Your priority should be getting quality care and repairs from people you feel comfortable with. The insurance company is still required to pay for all reasonable costs associated with your treatment and repairs, regardless of who you choose to provide those services.

How State Laws Can Affect Your Claim

The rules that govern car accident claims aren’t the same everywhere. The laws in the state where your accident occurred play a huge role in determining who is at fault, how much compensation you can recover, and how long you have to file a claim. What might be a straightforward case in one state could be far more complex just across the border. Understanding these key differences is essential, as they can significantly impact the outcome of your case. This is why having a lawyer who is deeply familiar with local statutes is so important for protecting your rights and building a strong claim.

Comparative vs. Contributory Negligence Rules

One of the biggest legal differences between states is how they handle shared fault. A few states follow a strict rule called “contributory negligence.” Under this system, if you are found to be even 1% responsible for the accident, you can be barred from recovering any money at all. Thankfully, Missouri uses a much fairer system known as “pure comparative fault.” This rule allows you to seek compensation even if you were partially at fault for the crash. Your final settlement or award is simply reduced by your percentage of fault. For example, if you were found to be 20% at fault, you could still recover 80% of your damages.

Varying Deadlines: The Statute of Limitations

Every state sets a strict time limit, called a “statute of limitations,” for filing a personal injury lawsuit after a car accident. These deadlines vary significantly; for instance, some states give you only three years from the accident date. In Missouri, the statute of limitations for most automobile accident claims is five years. While that might sound like a long time, building a strong case involves gathering evidence, interviewing witnesses, and negotiating with insurers, all of which takes time. If you miss this deadline, you lose your right to sue forever, no matter how strong your case is. It’s a critical date that you absolutely cannot ignore.

Police Reporting and Duty to Assist Laws

State laws also dictate when you are required to report an accident to the police. In some states, you must call law enforcement if property damage exceeds a certain amount, like $1,000. In Missouri, you are legally required to report a crash if there is an injury, a death, or property damage that appears to be more than $500. You must also report it if one of the drivers is uninsured. This is why calling 911 is always the safest bet—it ensures you meet your legal obligations and that an official police report is created, which is a vital piece of evidence for your claim.

How Seatbelt Use Can Impact Your Case

Many people worry that if they weren’t wearing a seatbelt, it will hurt their ability to get compensation. While the laws on this vary, Missouri has a rule that is very favorable to accident victims. In our state, the fact that you weren’t wearing a seatbelt generally cannot be used against you in a civil lawsuit to reduce your compensation. While you can still get a small ticket for it, the other driver’s insurance company can’t argue that your injuries are your own fault for not buckling up. Of course, wearing a seatbelt is always the safest choice, but it’s good to know that a simple mistake won’t prevent you from seeking justice.

Dealing with the Insurance Company

While an insurance adjuster may sound friendly and helpful on the phone, their primary goal is to protect their company’s bottom line. This often means finding ways to pay you as little as possible. Be mindful that anything you say can be used against you to minimize or deny your claim. Simple apologies or casual remarks about the accident can be twisted to imply fault. You are not required to provide a recorded statement, and it’s often wise to decline until you’ve spoken with an attorney. Protecting your claim starts with carefully managing your communication with the insurer.

Don’t Miss Missouri’s Filing Deadlines

Every state has a time limit for filing a lawsuit after an injury, known as the statute of limitations. In Missouri, you generally have five years from the date of the accident to file a personal injury claim. While that might seem like a long time, building a strong case requires gathering evidence, collecting medical records, and negotiating with insurers, all of which takes time. If you miss this deadline, you lose your right to seek compensation in court forever. It’s critical to act quickly to protect your legal options and start the process on the right foot.

What to Do When the Insurance Company Calls

Sooner or later, you’ll get a call from an insurance adjuster. It might be from the other driver’s insurance company or even your own. While it may seem like a routine step, this conversation is a critical moment for your claim. The adjuster’s job is to protect the insurance company’s bottom line, which often means paying you as little as possible. They are trained professionals who handle these calls every day, and they know what to say to minimize the value of your claim. Knowing how to handle this call is key to protecting your rights and ensuring you receive the compensation you deserve. Here’s what you need to do.

How to Handle the First Call

When the phone rings, take a deep breath and remember to stay calm and polite. Your goal for this first call is simple: provide basic facts, not a detailed story. Stick to the essentials, like your name, contact information, and the date and location of the accident. Keep the conversation brief. It’s also a great idea to have a notebook handy to jot down the adjuster’s name, phone number, and any key details they share. This initial call sets the tone for all future interactions, so being prepared and professional can make a big difference. If you feel overwhelmed or unsure what to say, it’s perfectly fine to tell them you need to speak with your attorney first and will call them back.

Why You Should Decline a Recorded Statement

The insurance adjuster will almost certainly ask you to provide a recorded statement about the accident. You should always politely decline. You are not legally required to give a recorded statement to the other party’s insurance company. Adjusters are trained to ask leading questions that can be confusing or cause you to say something that could be misinterpreted later. These recordings can be used to find inconsistencies in your story or to downplay your injuries, ultimately hurting your claim. Protecting your interests is the top priority. An experienced attorney can handle all communications with the insurance company for you, ensuring your rights are protected from the start.

Why the First Settlement Offer Is Usually Too Low

It can be tempting to accept the first settlement offer you receive, especially when medical bills are piling up. However, this initial offer is rarely the best one. Insurance companies often start with a lowball amount, hoping you’ll take it and close the case quickly. This offer may not cover the full extent of your damages, including future medical treatments, lost wages, or long-term pain and suffering. Before you even consider accepting, take time to understand the true cost of your accident. It’s always wise to have a legal professional review any offer to make sure it’s fair. Remember, once you accept a settlement, you can’t ask for more money later, even if your injuries turn out to be more serious than you first thought.

Recognizing Common Insurance Company Tactics

Insurance adjusters can be friendly and seem genuinely concerned, but it’s important to remember their primary loyalty is to their employer. Their goal is to resolve your claim for the lowest possible amount. Be aware of common tactics, such as rushing you into a settlement by creating a false sense of urgency or downplaying the severity of your injuries. They might also suggest that hiring an attorney will just slow things down or cost you more money. Recognizing these pressure tactics can help you stay focused on what’s best for you. Having a skilled personal injury attorney on your side levels the playing field and shows the insurance company you are serious about receiving fair compensation.

Handling Car Repairs and Property Damage

Beyond the immediate shock and concern for your health, a car accident leaves you with a very practical problem: a damaged vehicle. Dealing with car repairs and insurance adjusters can feel like a full-time job, filled with confusing terms and frustrating negotiations. Whether your car has a few dents or is a total loss, you have rights when it comes to getting it fixed or replaced. The goal is to restore your property to its pre-accident condition, but insurance companies may try to cut corners to save money. Understanding the process—from diminished value claims to your right to a rental car—is essential. This knowledge empowers you to advocate for yourself and ensure you receive a fair outcome for your property damage claim.

Claiming Diminished Value for Your Car

Even after your car has been perfectly repaired, its market value has likely dropped. This loss in resale value is known as “diminished value.” Why? Because a vehicle with an accident history is simply worth less to a potential buyer than one without. You have the right to be compensated for this difference. Insurance companies won’t volunteer this payment; you have to ask for it. This is especially important for newer or high-value vehicles where the drop in value can be significant. To make a successful claim, you’ll need to document the car’s value before the accident and get an appraisal of its post-repair value to prove the loss.

What Happens When Your Car Is “Totaled”?

An insurance company will declare your car a “total loss” if the cost to repair it exceeds a certain percentage of its pre-accident value. While some states set a specific threshold, the general rule is that a car is totaled if the repair costs plus its salvage value are more than what the car was worth right before the crash. If this happens, the insurer won’t pay for repairs. Instead, they are required to pay you the Actual Cash Value (ACV) of your vehicle. This amount should be enough to buy a comparable replacement. It’s a good idea to research used car values for your specific make, model, and year to ensure the offer you receive is fair.

Your Right to a Rental Car

Being without your car is a major disruption to your daily life. If the other driver was at fault for the accident, you are generally entitled to a rental car while yours is in the shop. The at-fault driver’s insurance policy should cover the cost of a reasonably similar rental vehicle. If a rental isn’t practical, you may be able to claim compensation for “loss of use,” which is a payment for the inconvenience of not having your car. Don’t let the insurance company leave you stranded. Make sure to ask about your rental car options as soon as you file your property damage claim so you can get back on the road.

Understanding the Use of After-Market Parts

When your car is being repaired, the insurance company may authorize the use of after-market parts instead of Original Equipment Manufacturer (OEM) parts from your car’s maker. As an example of how this is regulated, the North Carolina Department of Insurance states that insurers can do this, but only if the parts are of like kind and quality—meaning they must fit, perform, and be as durable as the originals. You have the right to question the quality of the parts being used on your vehicle. If you have concerns, discuss them with your chosen repair shop and the insurance adjuster to ensure your car is restored properly and safely.

Resolving Disputes Over Repair Costs

What happens if you and the insurance company can’t agree on the cost of repairs? You don’t have to accept an estimate that you believe is too low. Most insurance policies include an “Appraisal Provision” that you can use to resolve the dispute. This process typically involves you and the insurer each hiring an independent appraiser. Those two appraisers then select a neutral third party, called an umpire. A decision agreed upon by any two of these three individuals becomes binding. This can be a complex process, and if you find yourself at a standstill with the insurer, it may be time to seek legal advice to protect your interests.

Are You Making These Car Accident Claim Mistakes?

After a car accident, you’re dealing with a lot—shock, potential injuries, and the stress of a damaged vehicle. It’s a confusing time, and it’s easy to make simple mistakes that can seriously impact your ability to get fair compensation. Insurance companies are businesses, and their goal is often to resolve claims for as little money as possible. A few missteps on your part can give them the opening they need to question the severity of your injuries or even deny your claim altogether.

Understanding these common pitfalls is the first step toward protecting your rights. From saying the wrong thing at the scene to posting on social media too soon, your actions in the hours and days following a crash matter more than you might think. It’s not about being deceptive; it’s about being careful and ensuring the facts of your case are presented clearly and accurately. We’ll walk through some of the most frequent errors people make so you can be prepared. Knowing what not to do is just as important as knowing what to do, and it can make all the difference in the outcome of your personal injury claim. Being mindful of these issues from the start helps you build a stronger foundation for your case.

Mistake #1: Admitting Fault or Saying Too Much

In the immediate aftermath of an accident, it’s a natural human response to say, “I’m so sorry,” even if the crash wasn’t your fault. But you should never admit fault or apologize at the scene. An apology can be legally interpreted as an admission of guilt, which an insurance adjuster will use to argue that you were responsible for the accident. This can significantly reduce or even eliminate the compensation you receive. When speaking with the other driver, the police, or an insurance company, stick to the facts of what happened. Don’t speculate on who was to blame or offer more details than necessary. It’s best to provide your name, contact information, and insurance details, and let the evidence speak for itself. Before giving a detailed statement, it’s wise to contact an attorney to understand your rights.

Mistake #2: Delaying Medical Treatment for Your Injuries

Even if you feel fine right after a car accident, you should see a doctor as soon as possible. The adrenaline from the crash can mask pain and hide serious injuries like whiplash or internal bleeding, which may not show symptoms for hours or even days. Getting a prompt medical evaluation is crucial for your health and for your legal claim. Delaying medical care gives the insurance company an opportunity to argue that your injuries weren’t caused by the accident. They might claim that if you were truly hurt, you would have sought treatment immediately. A medical record created right after the crash provides a clear link between the incident and your injuries. This documentation is one of the most important pieces of evidence you can have when seeking compensation for your medical bills.

Mistake #3: Signing Documents Without Legal Advice

Shortly after the accident, you will likely be contacted by the other driver’s insurance company. They may ask you to sign documents, such as a medical release form or an early settlement offer. Be extremely cautious. Never sign anything without fully understanding what it means for your claim. Signing a broad medical release can give the insurer access to your entire medical history, which they can use to find pre-existing conditions and blame your injuries on them. Similarly, accepting a quick settlement offer might seem tempting, but it’s usually far less than what you deserve. Once you sign, you forfeit your right to seek any further compensation, even if your injuries turn out to be more severe than you initially thought. Always have an experienced attorney review any paperwork before you sign.

Mistake #4: Posting About Your Accident Online

In our connected world, it’s second nature to share life updates online, but after a car accident, it’s best to stay off social media entirely. Insurance adjusters regularly search claimants’ social media profiles for anything they can use to dispute a claim. Even an innocent post can be taken out of context. A photo of you smiling at a family gathering could be used to argue that your injuries aren’t as painful or limiting as you claim. Avoid posting any details about the accident, your injuries, or your recovery process. It’s also a good idea to ask friends and family not to post photos of you or tag you in posts while your claim is ongoing. The safest approach is to set all your social media profiles to private and refrain from posting until your case is fully resolved.

Mistake #5: Overlooking the Details in a Property Damage Release

Getting your car back from the repair shop is a huge relief. But before you get the keys, the insurance company will likely ask you to sign a property damage release. It’s easy to glance at it and sign without a second thought, but this can be a costly error. You must read this document carefully to ensure it *only* releases the insurance company from claims related to your vehicle’s damage. Some releases contain broad language that could unintentionally waive your right to pursue compensation for your injuries as well. Signing a general release could prevent you from recovering money for medical bills, lost wages, and pain and suffering. Make sure the document you sign is strictly for property damage and nothing more. If the wording seems confusing or overly broad, don’t sign it until you’ve had an attorney review it.

Mistake #6: Pleading Guilty to a Traffic Ticket

If the police issued you a traffic ticket at the scene of the accident, your first instinct might be to just pay it and move on. However, paying a ticket is the legal equivalent of pleading guilty. While a traffic violation is separate from a civil personal injury claim, that guilty plea can be used as evidence against you. The other driver’s insurance company will argue that by admitting guilt for the ticket, you have also admitted you were at fault for the accident. This can make it much harder to get fair compensation for your injuries. Before you plead guilty or pay any fines, it’s crucial to understand the potential consequences for your automobile accident claim. It is always best to consult with an attorney to discuss your options for handling the ticket in a way that protects your rights.

How to Document Your Injuries and Damages

After a car accident, your focus is rightly on healing. But taking the time to carefully document your injuries and related damages is one of the most powerful steps you can take to protect your future. Think of it as building a clear, detailed story of how the accident has affected your life. This evidence is the foundation of a successful personal injury claim and ensures that you can account for every cost, from medical bills to the personal impact on your daily routine.

Strong documentation removes guesswork and provides concrete proof to insurance companies and legal teams. It substantiates your claim for fair compensation and demonstrates the full extent of your physical, emotional, and financial losses. Keeping organized records from day one will make the entire process smoother and help your attorney build the strongest possible case on your behalf.

Keep a File of All Medical Records

Your medical records are the cornerstone of your injury claim. It’s essential to keep a detailed file of every document related to your treatment. This includes hospital visit summaries, doctor’s notes, physical therapy reports, prescription receipts, and bills for any medical equipment you need. These records create an official timeline of your injuries and the care you’ve received, directly linking them to the accident. This paper trail is critical for proving the cost of your medical expenses and showing the severity of your injuries. Make a habit of asking for copies of all reports and keeping everything together in one place.

Track Your Recovery in an Injury Journal

While medical records show the clinical side of your recovery, an injury journal tells the personal story. This is your space to document your day-to-day experience. Write down your pain levels, any physical limitations you’re facing, and the emotional impact of the accident. Did you miss a family event because you were in too much pain? Are you struggling with anxiety when you get in a car? These details illustrate how the accident has affected your quality of life. A consistent journal provides invaluable insight that can be used to demonstrate the extent of your pain and suffering, which is a key part of your personal injury claim.

Beyond Your Journal: Proving Pain and Suffering

While your personal injury journal is a powerful tool for tracking your daily struggles, it’s just one piece of the puzzle. In a legal sense, “pain and suffering” is a type of damage that compensates you for the physical discomfort and emotional distress caused by an accident. To build a compelling case, you need more than just your own words. You need objective evidence that shows an insurance company or a jury the true impact the accident has had on your life. This is where an experienced attorney can be invaluable. They know how to gather different forms of proof to create a comprehensive picture of your suffering, turning your personal experience into evidence that supports your personal injury claim.

Statements from Friends and Family

The people who know you best can often provide some of the most compelling evidence. Statements from your spouse, close friends, or even coworkers can paint a vivid “before and after” picture of your life. They can talk about the changes in your personality, your inability to enjoy hobbies you once loved, or your struggles with simple daily tasks. This kind of testimony helps to illustrate the emotional toll of the accident in a way that medical records alone cannot. Hearing how your injuries have affected your relationships and your role in your family provides a human element that makes the impact of your suffering clear and relatable.

Testimony from Medical Experts

To add weight and credibility to your claim, your attorney may bring in expert witnesses. These are professionals who can offer an objective opinion on your condition and its cause. Your treating physician can explain the extent of your physical injuries, but other experts can shed light on different aspects of your suffering. For example, a psychologist can testify about the emotional trauma you’ve experienced, such as anxiety or PTSD. A vocational expert can explain how your injuries will affect your ability to work and earn a living in the future. This expert testimony can support your claim by providing a clear, professional link between the accident and the full scope of your damages.

Photograph Your Injuries and Property Damage

A picture truly is worth a thousand words. Visual evidence is incredibly compelling, so take clear photographs of your injuries right after the accident and continue to document them as they heal. This creates a visual timeline of your recovery process, showing everything from initial bruises and cuts to any scarring that may remain. You should also take extensive photos of the damage to your vehicle from multiple angles. These images serve as undeniable proof of the accident’s severity and can help establish the connection between the impact and the injuries you sustained.

Collect Witness Information and Other Key Evidence

The evidence you gather at the scene can be vital. If you spoke to any witnesses, make sure you have their names and contact information. A statement from an impartial third party can significantly strengthen your account of what happened. Also, keep any other related documentation, like the police report, receipts for towing services, or any correspondence you receive from the insurance companies. Every piece of information helps build a comprehensive picture of the accident and its aftermath. If you feel overwhelmed, an experienced attorney can help you gather and organize this crucial evidence.

What Kind of Compensation Can You Receive?

After a car accident, the path to recovery can feel overwhelming, especially when you’re dealing with medical bills and time away from work. The legal term for the money you can recover is “damages,” and it’s designed to cover the losses you’ve suffered because of someone else’s negligence. The goal is to help you get back to the financial position you were in before the accident occurred.

Understanding what you’re entitled to is a critical step in protecting your rights. Compensation isn’t just about the immediate hospital bills; it can cover a wide range of impacts, from lost wages to the physical pain and emotional stress you’ve endured. These different types of compensation fall into specific categories, and knowing them can help you and your attorney build a strong case. Our firm handles these types of personal injury cases and can help you identify all the damages you are owed.

Covering Medical Bills and Lost Income

Economic damages are the most straightforward type of compensation because they cover your direct financial losses. Think of these as the tangible costs that have a clear paper trail. This includes every medical expense related to the accident, from the ambulance ride and emergency room visit to follow-up appointments, physical therapy, and prescription medications. It’s also crucial to account for any lost wages if your injuries kept you from working. If your ability to earn a living in the future is affected, that loss of earning capacity can be included, too. This is why keeping every single bill, receipt, and pay stub is so important—they are the evidence needed to prove these costs.

Compensation for Pain and Suffering

Not all injuries are visible or easy to calculate. Non-economic damages are meant to compensate you for the intangible, personal hardships you experience after an accident. This includes the physical pain, emotional distress, anxiety, and the overall loss of enjoyment of life. For example, you may no longer be able to participate in hobbies or activities you once loved. While you can’t put a price tag on these experiences, they are a very real part of your recovery. Insurance companies often try to minimize these damages, which is why having a dedicated advocate fighting for what you’ve been through is essential to receiving a fair settlement.

How Pain and Suffering Is Calculated

Pain and suffering is the legal term for the physical and emotional distress you experience after an accident. Unlike economic damages, which cover clear-cut costs like medical bills and lost wages, this part of your claim is more subjective. It aims to compensate you for the human impact of your injuries—the chronic pain, the anxiety, the sleepless nights, and the loss of enjoyment in your daily life. Because there isn’t a simple receipt for this kind of suffering, calculating its value can be complex. This is where insurance companies often try to downplay your experience. Having a skilled attorney who can effectively tell your story and demonstrate the true extent of your suffering is vital to ensuring you are compensated fairly for everything you’ve been through.

The Multiplier Method

One of the most common ways to calculate pain and suffering is the multiplier method. This approach starts by adding up all your economic damages, such as medical bills and lost income. That total is then multiplied by a number, typically between 1.5 and 5. The multiplier isn’t random; it reflects the severity of your injuries, the expected length of your recovery, and the overall impact on your life. For instance, if you have $40,000 in economic damages and your case warrants a multiplier of 3 due to the seriousness of your injuries, your pain and suffering damages would be calculated at $120,000. This method provides a structured way to assign a monetary value to the significant, non-economic impact of an accident.

The Per Diem Method

Another approach, though used less often, is the per diem method. “Per diem” is Latin for “per day,” and this method assigns a daily dollar amount to your suffering. This daily rate is often based on your daily earnings, working on the idea that enduring the pain from your injuries is at least as difficult as going to work each day. This amount is then multiplied by the number of days you experienced pain and suffering, from the date of the accident until you reach maximum medical improvement. This method requires meticulous documentation, making the injury journal we discussed earlier an incredibly powerful tool. It provides a clear, day-by-day account of your experience, justifying the timeline used for the calculation.

Planning for Future Medical Needs

Serious injuries often have long-lasting consequences that go far beyond the initial treatment. If your recovery requires ongoing medical care, your compensation should cover these future costs. This could include things like future surgeries, long-term physical therapy, chronic pain management, or necessary medical equipment. In some cases, victims may need to make modifications to their homes, like installing a ramp for a wheelchair, or require in-home assistance. Accurately projecting these expenses often requires input from medical and financial experts to ensure your settlement is sufficient to cover your needs for years to come, not just for today.

What Are Punitive Damages?

In some rare situations, you may be able to receive punitive damages. Unlike the other types of compensation, which are meant to cover your losses, punitive damages are intended to punish the at-fault party for exceptionally reckless or malicious behavior. This might apply in a case involving a drunk driver who was significantly over the legal limit or a driver who intentionally caused the crash. These damages are not awarded often, as the conduct must be truly outrageous. Missouri law has specific rules governing when punitive damages can be awarded, making it a complex aspect of a personal injury claim that requires skilled legal guidance.

Proving Hard-to-Document Injuries

Some of the most severe injuries from a car accident are the ones you can’t see. While broken bones show up clearly on an X-ray, injuries like concussions, chronic pain, and emotional trauma are invisible. Insurance companies often try to downplay these conditions because they are harder to prove with a single medical test. They might argue that your pain isn’t as bad as you say or that your anxiety is unrelated to the crash. However, these injuries are very real and can have a devastating impact on your life. Proving them requires consistent medical documentation, detailed personal records, and often, the help of a legal professional who understands how to demonstrate their true effect on your well-being.

Traumatic Brain Injuries (TBIs) and Whiplash

Traumatic brain injuries and whiplash are common in car accidents, yet they are notoriously difficult to document. A TBI can range from a mild concussion to a severe injury with long-term cognitive effects, and symptoms like headaches, dizziness, or memory problems may not appear for days. Similarly, whiplash is a soft tissue injury to the neck that doesn’t show up on an X-ray but can cause debilitating pain and stiffness. Because there isn’t a simple diagnostic image, insurance adjusters may be skeptical. This is why seeking immediate medical attention and consistently following up with your doctor is so important. A detailed medical record that tracks your symptoms over time becomes crucial evidence to validate your injury and its connection to the accident.

Chronic Pain and PTSD

The impact of a car accident can linger long after the physical wounds have healed. Some people develop chronic pain conditions like fibromyalgia or Complex Regional Pain Syndrome (CRPS), which cause widespread, persistent pain that is difficult to manage and prove. The emotional trauma can be just as debilitating. It’s common for accident victims to experience Post-Traumatic Stress Disorder (PTSD), anxiety, or depression, making it difficult to get back behind the wheel or even leave the house. These psychological injuries are completely internal, but they are just as real as a physical one. Proving them requires a diagnosis from a mental health professional and a clear record of how the condition has impacted your daily life, from your relationships to your ability to work.

Other Sources of Compensation

When you’re injured in an accident, it’s natural to assume the at-fault driver’s insurance will cover everything. While that is the primary source of compensation, it may not be the only one available to you. Depending on your own insurance policy and the circumstances of the accident, there may be other avenues to help cover your medical bills and other losses. Exploring all potential sources is key to ensuring you have the financial support you need for a full recovery, especially if the other driver is uninsured or their policy limits are too low to cover the full extent of your damages. Knowing where to look can provide critical relief when you need it most.

Medical Payments (MedPay) Coverage

One of the most helpful but often overlooked sources of compensation is your own auto insurance policy. If you have Medical Payments coverage, commonly known as MedPay, it can help pay for your and your passengers’ medical bills, regardless of who was at fault for the accident. This coverage is designed to provide immediate funds for things like ambulance rides, hospital stays, and doctor visits, so you don’t have to wait for the at-fault driver’s insurance to process your claim. MedPay can be a financial lifeline, allowing you to get the care you need right away without worrying about how you’re going to pay for it. It’s a good idea to review your own policy to see if you have this valuable protection.

Wrongful Death Claims

In the most tragic circumstances, a car accident can result in the loss of a loved one. When a person’s death is caused by the negligence or wrongful act of another driver, their surviving family members may be able to file a wrongful death claim. This type of legal action seeks compensation for the devastating losses the family has suffered. This can include covering funeral and burial expenses, the loss of the deceased’s future income and benefits, and the loss of their companionship, guidance, and support. These are incredibly complex and emotionally difficult cases, and pursuing one requires the guidance of a compassionate and experienced attorney who can handle the legal burdens while your family focuses on grieving and healing. Our firm is here to help you understand your options during this difficult time.

Do You Need to Hire a Car Accident Attorney?

Deciding whether to hire an attorney after a car accident can feel like a big step, especially when you’re already dealing with injuries and vehicle repairs. While not every fender-bender requires legal action, certain situations make having a professional advocate in your corner essential. If you’re feeling overwhelmed, confused by the claims process, or pressured by an insurance company, it’s probably a good time to consider getting legal advice. An experienced attorney can handle the complexities of your case, allowing you to focus on what truly matters: your recovery. Think of it as bringing in an expert to manage the details so you don’t have to. They understand the tactics insurance companies use and know how to build a strong case to protect your rights and secure the compensation you deserve.

If You’ve Suffered Serious Injuries

If you’ve suffered significant injuries like broken bones, internal damage, or a traumatic brain injury, your case is immediately more complex. Serious injuries often require long-term medical treatment, rehabilitation, and may even affect your ability to work in the future. Calculating the full cost of these damages isn’t as simple as adding up current medical bills. An experienced attorney knows how to account for future medical needs, lost earning capacity, and the physical and emotional pain you’ve endured. They work with medical experts to build a comprehensive claim that reflects the true impact of the accident on your life, ensuring you don’t settle for less than you need for a full recovery. Handling these types of personal injury cases is what we do best.

When Fault Is Unclear or Disputed

Things can get complicated quickly when the other driver denies responsibility or tries to shift the blame onto you. In Missouri, if you are found partially at fault, your compensation can be reduced. This is why it’s so important to have someone who can investigate the accident and clearly establish what happened. An attorney can gather crucial evidence, such as police reports, witness statements, and traffic camera footage, to build a solid case on your behalf. They understand Missouri’s comparative fault rules and can effectively argue against any unfair accusations, protecting your right to compensation. Don’t let a dispute over fault prevent you from getting the support you need.

If the Settlement Offer Feels Unfair

It’s common for an insurance company to make a quick settlement offer, sometimes just days after the accident. While it might be tempting to accept the money and move on, these initial offers are often far less than what your claim is actually worth. Insurance adjusters are trained to minimize payouts, and they’re counting on you not knowing the full value of your damages. Before you accept anything, it’s wise to consult with an attorney. We can help you understand what your case is worth by evaluating all your losses, including medical expenses, lost wages, and pain and suffering. We’ll handle the negotiations to ensure the final settlement is fair and covers all your needs.

If the Insurance Company Isn’t Playing Fair

While insurance adjusters may seem friendly and helpful, their primary loyalty is to their employer, not to you. Their goal is to resolve your claim for the lowest possible amount. If you feel like the insurance company is delaying your claim, ignoring your calls, or pressuring you into giving a recorded statement, it’s a clear sign you need an advocate on your side. An attorney can take over all communication with the insurer, shielding you from unfair tactics and intimidation. We will make sure your claim is taken seriously and that the insurance company honors its obligations. If you’re getting the runaround, it’s time to reach out for a consultation and let a professional handle the fight.

How Is a Car Accident Settlement Calculated?

After an accident, it can feel like the insurance company holds all the cards, using a mysterious formula to decide what your claim is worth. While it’s not exactly simple, understanding the basics of their valuation process can help you feel more in control. Insurance companies aren’t just picking a number out of thin air; they are looking at specific, concrete details to calculate a settlement offer. Their primary goal is to protect their bottom line, which means they often look for ways to pay out as little as possible. Knowing what they focus on is the first step in building a strong case for the compensation you deserve.

Key Factors That Affect Your Settlement Amount

An insurance adjuster’s main job is to assess three key things: liability, damages, and insurance coverage. First, they determine who was at fault for the accident. Then, they calculate the costs associated with your injuries and property damage, which includes everything from medical bills and lost income to the cost of future care. Finally, they review the limits of the applicable insurance policies. Adjusters often gauge the value of similar injuries by looking at past settlements to come up with a starting figure. Because so many variables are at play, it’s a complex process where every detail matters.

Why Strong Medical Documentation Matters

Your medical records are the most powerful evidence you have. Insurance companies rely heavily on this documentation to verify the severity of your injuries and justify the costs of your treatment. Think of every doctor’s note, test result, and physical therapy report as a building block for your claim. Clear, consistent, and comprehensive medical records create a direct link between the accident and your injuries, making it much harder for an insurer to downplay your suffering. If your documentation is vague or you have gaps in your treatment, the insurance company may use that as a reason to offer a lower settlement.

Why Insurers Deny or Undervalue Claims

It’s a frustrating but common reality: insurance companies often try to deny or undervalue legitimate claims. One of their most frequent tactics is to make a quick, low settlement offer, hoping you’ll accept it before you know what your claim is truly worth. They might also argue that you were partially at fault for the accident to reduce the payout, a concept known as comparative negligence. Adjusters will scrutinize your statements and records for any inconsistencies they can use against you. If you feel an insurer is using unfair tactics, it may be time to get a professional opinion on your case.

How We Can Help With Your Accident Claim

Navigating the aftermath of a car accident can feel isolating, but you don’t have to handle it alone. Having a dedicated legal partner on your side can make all the difference in protecting your rights and securing the compensation you need to recover. At The Law Office of Chad G. Mann, we focus on providing clear guidance and strong advocacy for every client, ensuring your story is heard and your case gets the attention it deserves.

Personalized Legal Guidance for Your Case

When you’re dealing with an injury, the last thing you need is to feel like just another case number. We understand the unique challenges that accident victims face right here in Southwest Missouri. That’s why we offer personalized legal support tailored to your specific situation. We take the time to listen to your story, understand your concerns, and build a strategy that aligns with your goals. Our commitment is to you and your recovery, providing a local advocate who is genuinely invested in achieving justice on your behalf. You can learn more about our approach and dedication to serving our community.

Putting Our Personal Injury Experience to Work for You

Experience matters, especially when it comes to personal injury law. We have a deep understanding of how to build a strong case, starting with gathering and preserving crucial evidence. Details like police reports, witness statements, and medical records are the foundation of a successful claim, and we know how to use them effectively to prove fault. Our extensive experience across various practice areas means we can anticipate the insurance company’s tactics and counter them with a well-prepared case, putting you in the best possible position from the start.

Our Focus Is on You and Your Recovery

We operate on a simple but powerful philosophy: “The truth doesn’t always speak for itself — evidence does.” Our client-first approach is all about transforming your truth into undeniable proof. We meticulously handle every detail of your case, ensuring that your side of the story is presented clearly and persuasively. From investigating the accident to negotiating with insurers, we are your dedicated advocates every step of the way. If you’re ready to work with a team that puts your needs first, we encourage you to contact us for a consultation.

Related Articles

- WHAT TO DO AFTER A CAR ACCIDENT? – The Law Office of Chad G. Mann, LLC

- What to Do After a Car Accident in Springfield, MO

- Auto Injury Attorneys: Protecting Your Rights After an Accident – The Law Office of Chad G. Mann, LLC

- Best Legal Strategies for Your Rear-End Collision Case

- Proving Fault in a Rear-End Collision: Top Legal Strategies – The Law Office of Chad G. Mann, LLC

Frequently Asked Questions

I feel fine after the crash. Do I really need to see a doctor? Yes, you absolutely should. The adrenaline and shock from an accident can easily mask serious injuries like whiplash or internal issues that may not show symptoms for hours or even days. Getting a medical evaluation right away is not only crucial for your health but also creates an official record that links your injuries directly to the accident. This documentation is essential if you need to file a claim later, as it prevents an insurance company from arguing your injuries happened sometime after the crash.

What if the other driver’s insurance company offers me a settlement right away? It’s wise to be cautious with quick settlement offers. Insurance companies often make low initial offers hoping you’ll accept before you understand the full extent of your injuries and damages. This first amount rarely covers future medical needs, ongoing lost wages, or the full impact of your pain and suffering. Before you sign anything, it’s best to have the offer reviewed by an attorney to ensure it’s fair. Once you accept a settlement, you can’t ask for more money later.

How much does it cost to hire a personal injury attorney for a car accident case? Most personal injury attorneys, including our firm, work on a contingency fee basis. This means you don’t pay any attorney’s fees upfront. Instead, the fee is a percentage of the settlement or award we recover for you. Simply put, we only get paid if you get paid. This arrangement allows you to get experienced legal help without worrying about the cost while you’re trying to recover.

What if the other driver was uninsured or fled the scene? This is a stressful situation, but you still have options. Your own auto insurance policy may include Uninsured or Underinsured Motorist (UM/UIM) coverage, which is designed to protect you in these exact circumstances. Filing a claim against your own policy can be complicated, and an attorney can help you understand your coverage and handle the process to ensure you receive the benefits you’re entitled to.

How long will it take to resolve my car accident claim? There isn’t a set timeline, as every case is different. The duration depends on several factors, including the severity of your injuries, how long your medical treatment lasts, and how willing the insurance company is to negotiate a fair settlement. A straightforward case might resolve in a few months, while a more complex one could take longer, especially if a lawsuit becomes necessary. The priority is always to secure a fair outcome, not a fast one.