Let’s be clear: insurance companies are businesses, and their primary goal is to protect their bottom line. While they promise to be there for you, their adjusters are trained to minimize payouts. So, when you receive a denial, it’s often a calculated business move, not a final judgment on your case. If you’ve discovered that an insurer won’t pay your insurance claim Missouri without a fight, you’re not alone. This is a common tactic. The key is to understand their playbook so you can build a stronger counter-strategy. We’ll explore the common reasons for denials and show you how to hold them accountable.

Key Takeaways

- Don’t take ‘no’ for an answer: An insurance denial is a starting point, not a final decision. Immediately request the denial reason in writing, then systematically gather all your evidence—like the police report, photos, and medical bills—to build a strong, fact-based appeal.

- Use the system to your advantage: Missouri law provides a clear path for challenging an insurer. Start with a formal internal appeal, and if that fails, file a complaint with the Missouri Department of Commerce & Insurance to hold the company accountable.

- Know when to bring in an expert: If your claim involves serious injuries, a complex fault dispute, or signs of bad faith, it’s time to consult an attorney. Most personal injury lawyers work on a contingency fee, so you won’t pay anything unless they win your case.

Understanding the Insurance Claim Process

The moments after an accident are chaotic, and the last thing you want to think about is paperwork. But the insurance claim process is your path to getting the compensation you need to recover. It can feel like a maze of forms, phone calls, and waiting, but it becomes much more manageable when you know the basic steps. Think of it as a formal conversation with your insurance company where you present your side of the story, backed by solid facts and documentation. Knowing what to expect and what to do first can make a huge difference in how smoothly the process goes and, ultimately, in the outcome of your claim. It’s about taking control of the situation by being prepared.

The Basics of an Insurance Claim

At its core, an insurance claim is a formal request you send to an insurance company, asking for payment based on the terms of your policy. It’s the official start of a process to cover your losses from a car accident or another personal injury. The process generally follows a clear path. First, you’ll need to review your policy to understand exactly what’s covered. Next, you’ll gather all the necessary information—this includes the police report, photos of the damage, contact information for everyone involved, witness statements, and any medical records or bills. Once you have your evidence organized, you can formally file the claim with the insurer, which kicks off their investigation and evaluation of your request.

What to Do Immediately After an Incident

Your first move after ensuring everyone is safe should be to contact your insurance company as soon as possible. Don’t wait. The sooner you report the incident, the sooner they can begin their process. Be sure to take photos of the damage *before* making any temporary fixes. While you wait for an adjuster, you should take reasonable steps to prevent any further damage, like covering a broken car window with a tarp. These are considered temporary repairs, and you must keep every single receipt for materials you buy. These small costs are part of your claim and show the insurer that you acted responsibly to mitigate the damage following the incident.

If you start to feel that the insurance company is dragging its feet, giving you the runaround, or not handling your claim in good faith, remember that you have rights. In Missouri, you can hold them accountable. If you believe your insurer is treating you unfairly, you can file a complaint with the Missouri Department of Commerce & Insurance (DCI). This state agency oversees insurance practices and can investigate your case. While the DCI is a powerful resource, navigating complex claims involving serious injuries or disputed fault often requires a deeper level of expertise. When the stakes are high, having a dedicated advocate on your side can ensure your rights are fully protected and you receive the fair settlement you deserve for your personal injury case.

Why Was My Car Insurance Claim Denied?

Receiving a denial letter from an insurance company after a car accident can feel like a punch to the gut. You’ve paid your premiums and trusted them to be there for you, only to be told “no” when you need help the most. It’s frustrating and confusing, but it’s important to know that a denial isn’t always the final word. Insurance companies are businesses, and they often deny claims for specific reasons—some valid, some not.

Understanding why your claim was denied is the first step toward fighting back. The reason is usually buried in the technical language of the denial letter. Let’s break down some of the most common reasons insurers give for refusing to pay, so you can figure out your next move. From policy details to disputes over who was at fault, knowing what you’re up against is crucial for building a strong appeal.

Your Policy Had Exclusions or Coverage Gaps

One of the most straightforward reasons for a denial is that your specific situation isn’t covered by your policy. Every insurance policy has a “fine print” section that lists exclusions, which are specific events or circumstances the policy won’t pay for. For example, your claim might be denied if the person driving your car was specifically excluded from your policy, or if you were using your personal vehicle for a commercial purpose like food delivery. It could also be something as simple as a lapsed policy due to a missed payment. Before you do anything else, pull out your insurance documents and read them carefully to see if the company’s reasoning holds up.

You Didn’t Provide Enough Evidence

Insurance adjusters need concrete proof before they can approve a claim. If you don’t provide enough evidence to support your case, they have an easy reason to deny it. This could mean you didn’t submit a police report, you don’t have clear photos of the accident scene and vehicle damage, or you haven’t provided medical records that connect your injuries to the crash. The insurer might argue that you didn’t provide enough documentation, like repair estimates, to justify the amount you’re claiming. Keeping a detailed file with every single document is one of the most powerful things you can do to protect your claim from the start.

They’re Disputing Who Was at Fault

This is a big one. The other driver’s insurance company will almost always look for ways to argue their client wasn’t at fault—or, better yet, that you were. In Missouri, a rule called “comparative fault” means you can still recover damages even if you were partially to blame, but your compensation will be reduced by your percentage of fault. Insurers often use this to their advantage by exaggerating your role in the accident to reduce their payout or deny the claim entirely. Proving fault in automobile accidents can get complicated, and this is often where having a legal advocate becomes essential.

They Claim Your Injuries Were Pre-Existing or You Delayed Care

If you waited a few days or weeks to see a doctor after the accident, the insurance company will likely question the severity of your injuries. Their argument is simple: if you were truly hurt, you would have sought medical attention immediately. They may also claim that your injuries were from a pre-existing condition and not the crash itself. This is why it’s so important to get a medical evaluation as soon as possible after any accident, even if you feel fine. A doctor’s report creates a clear, time-stamped record that links your injuries directly to the incident, making it much harder for the insurer to dispute.

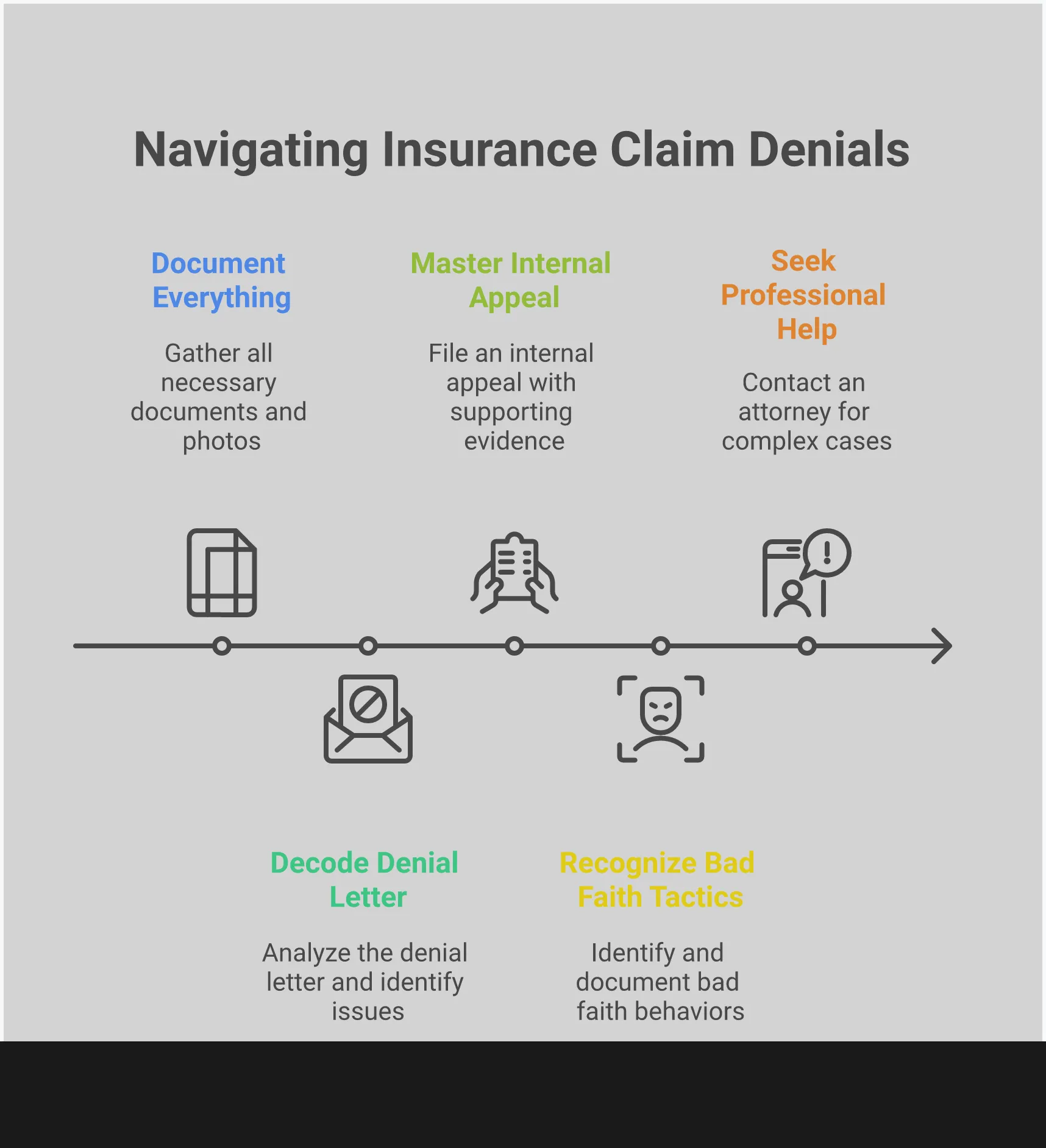

Claim Denied? Here’s What to Do First.

Receiving a denial letter from an insurance company can feel like hitting a brick wall. It’s frustrating and disheartening, especially when you’re trying to recover from an accident. But a denial is not the end of the road; it’s the start of a new process. Before you panic or give up, take a deep breath and focus on a few immediate, practical steps. Taking control of the situation starts with being organized and informed. These first actions will build the foundation for a successful appeal or any further legal steps you might need to take.

Ask for a Written Denial Letter

If an insurance adjuster calls you to deny your claim, your first response should be to request a formal denial letter. A verbal denial isn’t enough. You need the insurance company’s official reason for the denial in writing. This document is a critical piece of evidence because it locks the insurer into a specific justification. It prevents them from changing their story later on and gives you a clear target to address in your appeal. This letter will outline the exact policy language or evidence they are using to justify their decision, which is information you absolutely need to plan your next move.

Gather and Organize Your Paperwork

Now is the time to gather every piece of information related to your accident and claim. Create a dedicated folder—physical or digital—and start collecting everything. This includes the official police report, photos and videos from the accident scene, and contact information for any witnesses. You’ll also want to add all your medical records, bills, and repair estimates for your vehicle. Having all your evidence in one place makes it easier to see the full picture and build a strong, fact-based argument against the denial. This organized file will be essential whether you’re filing an appeal yourself or seeking legal representation.

Document Every Phone Call and Email

Don’t rely on your memory when it comes to conversations with the insurance company. Start a claim journal immediately. In a notebook or a digital document, log every phone call and email. For each entry, write down the date, time, the name of the person you spoke with, and a summary of what was discussed. This detailed record creates a timeline of your claim and can be incredibly valuable. It helps you track promises made by the adjuster and can highlight inconsistencies in their communications. This log is a powerful tool for holding the insurance company accountable.

Reread Your Insurance Policy’s Fine Print

Your insurance policy is a legal contract between you and the insurer. It’s time to read it carefully, paying close attention to the declarations page, definitions, and exclusions. The denial letter should reference specific parts of your policy, so find those sections and read them yourself. Does the language truly support the company’s reason for denial? Sometimes, claims are denied based on a misinterpretation of the policy’s terms. Understanding your coverage and your responsibilities under the policy is a crucial step in determining whether the insurance company has treated you fairly.

What is “Bad Faith” Insurance? (And How to Spot It)

You pay your insurance premiums faithfully, trusting that your provider will be there for you after an accident. But what happens when they refuse to hold up their end of the bargain? While insurance companies can deny claims for legitimate reasons, sometimes their refusal is unfair and unreasonable. When an insurer fails to honor a valid claim without a good reason, it’s known as acting in “bad faith.”

This isn’t just poor customer service—it’s a violation of the legal duty your insurance company owes you. Every insurance policy is a contract, and part of that contract is an implied promise that the insurer will act in good faith and deal fairly with you. This means they must investigate your claim properly, evaluate it honestly, and pay what they owe in a timely manner. If they intentionally look for ways to deny, delay, or underpay your claim, they are breaking that promise. Spotting bad faith can be difficult, but it often involves a pattern of behavior that shows the company is putting its own financial interests ahead of its legal obligations to you.

Signs Your Insurer Is Acting in Bad Faith

Not every denied claim is an act of bad faith. An insurer might have a valid reason based on your policy’s terms. However, you should be on the lookout for certain red flags that suggest the company isn’t treating you fairly.

Some common bad faith tactics include:

- Taking an unreasonable amount of time to investigate or pay your claim.

- Failing to conduct a thorough and objective investigation into the accident.

- Misrepresenting the facts or the language in your insurance policy to avoid paying.

- Refusing to provide a clear, written explanation for denying your claim.

- Offering a settlement that is significantly less than what your claim is reasonably worth.

- Ignoring clear evidence that supports your claim.

Your Protections Under Missouri’s Bad Faith Laws

In Missouri, insurance companies are legally required to operate under a “duty of good faith and fair dealing.” This isn’t just a suggestion; it’s a legal standard they must meet when handling your claim. This duty requires them to treat you and your claim with fairness and honesty.

When an insurer violates this duty, they are not just breaking a promise—they are breaking the law. This legal protection is vital because it gives you a way to hold your insurance company accountable. The state recognizes the power imbalance between a large insurance corporation and an individual policyholder, and these laws are in place to ensure you are not taken advantage of during a vulnerable time. Our firm handles these types of personal injury cases and can help you understand your rights.

How a Bad Faith Insurer Can Hurt Your Claim

If your insurance company has acted in bad faith, you have the right to take legal action against them. A bad faith lawsuit is separate from your original insurance claim. It allows you to seek compensation for the damages caused by the insurer’s unfair conduct.

In a successful bad faith case, you may be able to recover the full amount of your original claim, plus additional damages. This can include compensation for emotional distress, attorney’s fees, and other financial losses you suffered because of the delay or denial. In some cases, courts may also award punitive damages, which are intended to punish the insurance company for its behavior and deter it from happening again. If you believe you are a victim of bad faith, it’s important to contact an attorney to discuss your options.

How to Appeal a Denied Insurance Claim in Missouri

A denied claim isn’t the end of the road. It’s frustrating, but you have clear steps to challenge the insurance company’s decision. The appeal process is your formal opportunity to present your case again with a more complete picture of the facts. By approaching it systematically, you can push back effectively and fight for the payment you deserve.

Start with an Internal Appeal

Your first move is to ask the insurance company to reconsider its decision through an internal appeal. This process requires you to formally dispute the denial. Before you do, make sure you fully understand why they denied your claim—the denial letter should spell this out. Your goal is to address those specific reasons head-on with clear, compelling evidence. You’re not just asking them to look again; you’re building a stronger case that shows why their initial decision was wrong. Present your argument calmly and professionally, focusing on the facts and the documentation you have to support your position.

What Paperwork Do You Need for Your Appeal?

A strong appeal is built on solid evidence. Start by gathering every document related to your accident. The insurance company’s denial letter is your roadmap, as it outlines the reasons you need to counter. You’ll also need the official police report, photos from the scene, and any witness statements. Your medical records are crucial for proving the extent of your injuries and the cost of treatment. Organizing these documents helps you build a logical argument that refutes the insurer’s reasons for denial and demonstrates the true value of your claim.

Don’t Miss Your Appeal Deadlines

Time is a critical factor, and Missouri has rules to keep things moving. Insurers generally have 30 days to complete their investigation and must notify you of their decision within 15 working days after you’ve submitted all required paperwork. When you file an appeal, keep a close eye on the calendar. Note the date you send your appeal and follow up if you don’t hear back within a reasonable timeframe. Missing a deadline can jeopardize your claim, so staying organized and proactive is essential to protecting your rights throughout the process.

Filing a Complaint with Missouri’s Insurance Department

If your internal appeal doesn’t work or you believe the insurer is being unfair, you have another powerful option. You can file a formal complaint with the Missouri Department of Commerce & Insurance (DCI). This state agency regulates insurance companies and ensures they follow the law. The DCI will investigate your complaint to determine if the insurer has acted in bad faith or violated your rights. This step adds official pressure and can often prompt an insurer to re-evaluate your claim more seriously. It’s a free and important tool for holding them accountable.

Contacting the Consumer Hotline

If your internal appeal doesn’t produce the results you need, it’s important to know you have other powerful resources at your disposal. One of your best next steps is to reach out to the Missouri Department of Commerce and Insurance (DCI) Consumer Hotline. This state-run service is specifically designed to help people who are dealing with insurance issues, including unfair claim denials. They provide valuable assistance, helping you understand your rights and the official steps you can take to challenge an insurer’s decision, giving you a clear path forward when you feel stuck.

Getting in touch is simple. According to the Missouri Department of Commerce and Insurance, “You can call the DCI Consumer Hotline at 800-726-7390 or visit insurance.mo.gov for help.” This hotline can guide you through the process. If you believe your insurance company isn’t handling your claim correctly, you can also file a complaint with the DCI. This prompts an official investigation to determine whether the insurer has followed Missouri law. Using these resources can empower you to take action and hold your insurance company accountable for its decisions.

Know Your Rights Under Missouri Law

When you’re up against an insurance company, it can feel like they hold all the cards. But Missouri law provides important protections for people who have been injured in an accident. Understanding your rights is the first step toward getting the fair treatment and compensation you deserve. Here are a few key Missouri laws that can impact your claim.

Understanding Missouri’s Fault and Coverage Rules

Missouri follows a “pure comparative fault” rule, which is good news for accident victims. This rule means you can still recover damages even if you were partially at fault for the crash. For example, if a court finds you were 20% responsible, you can still collect 80% of your damages. However, it’s also important to know that Missouri’s required minimum liability coverage is quite low—just $25,000 per person for bodily injury. For serious injuries, that amount can be exhausted quickly, which is why understanding all your options for automobile accident claims is so critical.

How Long Do You Have to File a Claim in Missouri?

Time is a crucial factor in any personal injury case. In Missouri, you generally have five years from the date of the accident to file a lawsuit. While that might sound like a long time, it can pass quickly when you’re focused on recovery. If you miss this deadline, you unfortunately lose your right to seek compensation through the courts forever. It’s always better to act sooner rather than later, as evidence can disappear and memories can fade. Don’t wait until the last minute to contact an attorney to discuss your case.

Exceptions to the Five-Year Rule

While the five-year deadline is a firm rule for most cases, there are a few important exceptions. For instance, if a child is injured in an accident, the clock doesn’t start until their 18th birthday—giving them until they are 23 to file a claim. Another key exception applies if an injury isn’t discovered right away. If a doctor diagnoses a serious condition months after the crash, the five-year period begins from the date of discovery, not the date of the accident. Similarly, if someone is left incapacitated, perhaps in a coma, the statute of limitations is paused until they regain the mental ability to act. These nuances show why understanding the specifics of your personal injury case is so important.

What if Your Primary Insurance Isn’t Enough?

A claim denial from the at-fault driver’s insurance company isn’t necessarily the end of the road. Your first step is to appeal their decision, but you may have other options as well. For instance, you might be able to file a claim under your own insurance policy. Many drivers carry underinsured motorist (UIM) coverage, which can help pay for your expenses if the at-fault driver’s policy isn’t enough to cover your bills. It’s worth reviewing your own policy or checking the Missouri consumer auto insurance guide to see what other coverage might be available to you.

Your Right to Sue for Bad Faith

Insurance companies have a legal duty to act in “good faith,” which means they must investigate and pay claims in a fair and timely manner. If your insurer unreasonably denies or delays your valid claim without a legitimate reason, they may be acting in bad faith. This is a serious issue, and Missouri law allows you to sue the insurance company for it. If you win a bad faith lawsuit, you could be awarded more than your original claim amount, including compensation for legal fees and other damages caused by the insurer’s actions.

Handling Special Claims in Missouri

Filing a Claim Against a Government Body like MoDOT

Filing a claim against a government entity like the Missouri Department of Transportation (MoDOT) is a different process than dealing with a private citizen’s insurance. Governments often have special legal protections, which means you have to follow a very specific and strict procedure to seek compensation. If your car was damaged by a pothole or you were injured due to unsafe road conditions, you can’t just send a bill. You have to use MoDOT’s official claims process. They will investigate the incident thoroughly, but it’s important to know that submitting a claim is no guarantee of payment. You have to build a strong case from the very beginning.

To file a claim, you must provide detailed information about the incident. This includes the exact date, time, and location, including the road and your direction of travel. You’ll need to give a clear description of what happened and what caused the damage. Be as specific as possible. After you submit your claim online, you’ll receive a confirmation email for your records. Because these cases can be complex and require precise documentation, getting it right the first time is critical. For significant injuries or damages, understanding all your options for these types of personal injury claims can make a major difference in the outcome.

Your Legal Options When an Insurer Refuses to Pay

When an insurance company denies your claim, it can feel like you’ve hit a dead end. But a denial isn’t the final word. You have several legal avenues to get the compensation you deserve, depending on whether it’s your insurer or the other driver’s who is refusing to pay. Understanding these paths is the first step toward fighting back. From taking the at-fault driver to court to holding your own insurance company accountable, let’s walk through the routes you can take.

Suing the At-Fault Driver Directly

Because Missouri is an “at-fault” state, you have the right to directly sue the driver who caused the accident. This is often the next step when their insurance company denies your claim or makes an offer that doesn’t cover your medical bills, lost wages, and vehicle repairs. Filing a lawsuit allows you to present your evidence in court and have a judge or jury decide the outcome. Pursuing a personal injury lawsuit can be a complex process, but it ensures you have a chance to hold the responsible party accountable for their actions and get the compensation you need to move forward.

Filing a bad faith claim against your insurer

Sometimes, the problem isn’t the other driver’s insurance—it’s your own. When an insurance company refuses to pay a valid claim without a good reason, it’s known as acting in “bad faith.” Your insurer has a legal duty to act fairly and honestly with you. If they unreasonably deny or delay your claim, you can sue them for more than just the original claim amount. A successful bad faith lawsuit can help you recover what you were owed, plus additional damages for emotional distress and legal fees. Proving an insurer acted in bad faith requires a deep understanding of insurance law.

Tapping Into Your Own Uninsured/Collision Coverage

Don’t forget to look at your own insurance policy for other sources of coverage. If the at-fault driver doesn’t have insurance or their provider denies the claim, your uninsured motorist (UM) coverage can step in to cover your damages. This is exactly what this coverage is for. Additionally, your collision coverage can help pay for repairs to your vehicle, regardless of who was at fault. While you’ll likely have to pay a deductible, using your own coverage can be a faster way to get your car fixed while you sort out the liability dispute with the other party.

When to Call a Lawyer for Your Denied Claim

While you can certainly start the appeals process on your own, there are moments when bringing in a legal professional is the smartest move you can make. An insurance company has a team of adjusters and lawyers working to protect its bottom line, and sometimes, you need an expert in your corner to level the playing field. If your case involves serious injuries, significant financial loss, or an insurer that simply won’t cooperate, it’s time to consider getting help. Recognizing these key moments can be the difference between walking away with nothing and securing the compensation you deserve.

When You Suspect Bad Faith or Liability is Unclear

If your claim denial stems from a complicated argument over who was at fault, a lawyer can be your best advocate. This is especially true in multi-car pile-ups or accidents involving commercial vehicles where liability is murky. An even clearer sign you need legal help is if you suspect the insurance company is acting in bad faith. This isn’t just a simple disagreement; it’s when an insurer uses deceptive, unfair, or dishonest tactics to avoid paying a valid claim. If your insurer is ignoring your calls, misrepresenting your policy, or offering an insultingly low settlement, it’s time to act. Missouri law allows you to sue an insurance company for acting in bad faith, which can help you recover the money you’re owed and potentially additional damages.

When Medical Bills and Lost Wages Are Piling Up

The financial strain after an accident can be overwhelming. If you’re watching medical bills stack up and losing income because your injuries keep you from working, the stakes are too high to go it alone. A good rule of thumb is to call a lawyer if your medical bills exceed $1,500 or if you’ve missed any amount of work. An experienced attorney can calculate the full extent of your losses—not just the bills you have today, but future medical needs, lost earning capacity, and pain and suffering. They ensure nothing is overlooked, fighting for a settlement that covers the complete financial impact of your automobile accident.

Can You Afford to Hire a Lawyer?

Many people hesitate to call a lawyer because they’re worried about the cost. It’s a valid concern, but most personal injury attorneys work on a “contingency fee” basis. This means you don’t pay any legal fees upfront. Instead, the lawyer’s fee is a percentage of the settlement or award they win for you. If they don’t win your case, you don’t owe them a fee. This arrangement makes expert legal representation accessible to everyone, regardless of their financial situation. It allows you to get the help you need without any out-of-pocket risk, so you can focus on your recovery while a professional handles the fight with the insurance company.

How The Law Office of Chad G. Mann Can Support You

After an accident, you shouldn’t have to fight an uphill battle just to get the benefits you’ve paid for. Hiring an attorney is about having a dedicated advocate on your side who understands the system and is committed to protecting your rights. At The Law Office of Chad G. Mann, we take that role seriously. We handle the complex communications with the insurance company, gather the necessary evidence to build a strong case, and fight for the full and fair compensation you need to move forward. If your insurance claim has been denied, contact us to discuss your situation. We can help you understand your options and decide on the best path forward.

How to Build a Stronger Insurance Claim

After a car accident, it’s easy to feel overwhelmed and powerless, especially when an insurance company is giving you the runaround. But the actions you take right after the crash can significantly influence the outcome of your claim. By being proactive and organized, you can build a strong foundation for your case and protect your right to fair compensation. Think of this as your playbook for taking control of the situation. It’s about gathering the right information, avoiding common pitfalls, and understanding the clock you’re up against.

Handling the aftermath of an accident involves careful documentation and strategic communication. While it might seem like a lot to manage when you’re also trying to recover, these steps are crucial. They provide the proof you need to counter an insurer’s arguments and demonstrate the true extent of your damages. If the process feels too daunting, remember that you don’t have to do it alone. Getting guidance on complex personal injury claims can make all the difference.

What Evidence Should You Collect After a Crash?

The more evidence you have, the harder it is for an insurance company to dispute your claim. Your goal is to create a detailed record of the accident and its impact on your life. Start by taking photos and videos of everything at the scene: damage to all vehicles, skid marks, road conditions, and any visible injuries. Get a copy of the official police report, as it provides an objective account of the incident. If there were witnesses, get their names and contact information. Their statements can be incredibly valuable. Finally, keep a meticulous file of all medical records, repair estimates, and receipts for any related expenses, like rental cars or prescriptions.

Avoid These Common Mistakes That Hurt Your Claim

Insurance adjusters sometimes look for reasons to deny a claim, and certain missteps can unfortunately give them one. A major mistake is waiting too long to seek medical attention. Even if you feel fine, some injuries don’t show up right away. Delaying a doctor’s visit can lead an insurer to argue your injuries aren’t related to the crash. Another common error is not providing enough documentation to support your claim. Always keep copies of everything you submit. Also, be careful what you say to the adjuster—never admit fault or give a recorded statement without thinking it through. If your claim is denied, your first step should always be to ask for a detailed explanation in writing.

What to Do and When: Your Missouri Action Plan

In Missouri, time is of the essence. The state has a statute of limitations, which is a legal deadline for filing a lawsuit. For personal injury claims resulting from a car accident, you generally have five years from the date of the crash to file. While that might sound like a long time, building a strong case takes effort, so it’s best not to wait. Insurance companies also have deadlines they are supposed to follow. They typically must acknowledge your claim within 10 working days and complete their investigation within 30 days. Knowing these timelines helps you hold them accountable and ensures you don’t miss your window to pursue legal action if you need to contact our office for help.

Related Articles

- Auto Coverage & Injury Claims in Missouri – Know Your Rights

- How to Navigate Insurance Claims After Missouri Accidents

- How to Find Vehicle Accident Information in Missouri

- Find Accident Details and Cause: A Missouri Guide

- Auto Insurance & Injury Claims | Chad G. Mann Law Office

Frequently Asked Questions

What if I think I might have been partially at fault for the accident? This is a common worry, but it doesn’t automatically prevent you from getting compensation. Missouri law uses a “pure comparative fault” rule, which means you can still recover damages even if you were partly responsible. Your final compensation is simply reduced by your percentage of fault. Insurance companies often try to inflate your level of blame to pay less, so it’s important to have a clear understanding of the facts before accepting their assessment.

Do I have to accept the insurance company’s first settlement offer? Absolutely not. In fact, you should be very cautious about the first offer you receive. Insurance companies are businesses, and their initial offers are often intentionally low to see if you’ll agree to a quick and cheap resolution. It’s best to wait until you know the full extent of your injuries, medical bills, and lost wages before even considering a settlement. A fair offer should cover all of your past, present, and future costs related to the accident.

If I sue the at-fault driver, am I suing them personally or their insurance company? This is a great question that confuses a lot of people. While the lawsuit is technically filed against the individual driver who caused the crash, it is their insurance company that has the legal and financial duty to defend them. The insurer is responsible for paying any settlement or court judgment up to the driver’s policy limits. The goal is to hold the responsible party’s insurance accountable, not to cause personal financial hardship for the driver.

How can I prove the insurance company is acting in “bad faith”? Proving bad faith is less about a single disagreement and more about showing a pattern of unreasonable behavior. The best way to do this is through meticulous documentation. Keep a detailed log of every phone call, save every email, and send important requests in writing. This creates a paper trail that can demonstrate unreasonable delays, a failure to investigate your claim properly, or attempts to misrepresent your policy. This evidence is key to showing they aren’t treating you fairly.

Will I have to go to court if I hire a lawyer? Most people are relieved to hear that the vast majority of personal injury cases are settled out of court. Hiring an attorney doesn’t mean you’re automatically headed for a trial. Often, just having a lawyer on your side signals to the insurance company that you are serious about your claim. This can motivate them to offer a fair settlement to avoid the time and expense of a lawsuit. A good lawyer prepares every case as if it’s going to trial, but their goal is to get you the best possible outcome, which is often achieved through negotiation.

Make Temporary Repairs, But Wait for the Adjuster

After an accident, your first instinct might be to fix everything right away. While it’s smart to prevent more damage, you need to be strategic. Go ahead and make small, temporary repairs—like covering a shattered car window with plastic to keep rain out. This shows the insurance company you’re being responsible. However, hold off on any major, permanent repairs until after the insurance adjuster has inspected the damage. The adjuster needs to see the full extent of the initial impact to accurately assess your claim. If you fix it all before they see it, you risk giving them a reason to downplay the severity and underpay you. Be sure to keep every single receipt for materials you buy for these temporary fixes; you’ll need them for reimbursement.

Be Wary of Unsolicited Contractors

In the chaotic aftermath of an accident or severe weather, you might find contractors appearing out of nowhere, offering to handle repairs and even your insurance claim. Be very careful. These unsolicited offers can come from “storm chasers” or scammers who perform shoddy work, overcharge, or disappear with your money. Never sign a contract or pay for services under pressure. Instead, take your time to research and get estimates from several reputable, local companies. Before agreeing to anything, check their credentials and references. Rushing into a repair agreement can seriously complicate your insurance claim and leave you with a bigger mess. If you feel pressured or unsure about your next steps, it’s always a good idea to seek professional advice.