Estate planning often feels like a choice between two extremes: hiring an expensive attorney or trying to figure it all out on your own. Online platforms like Trust & Will aim to create a middle ground. They provide a structured, user-friendly way to generate legally valid documents without the high price tag of traditional legal services. But is it a reliable substitute? In this review, we’ll examine the features, costs, and limitations of their service. We want to give you a clear picture of what a will and trust.com platform can and cannot do, helping you make an informed decision for your family’s future.

Key Takeaways

- Online services are best for simple estates: Trust & Will is a solid choice for creating essential documents if your assets and family structure are straightforward and you don’t require personalized legal strategy.

- Complex situations need an attorney: If you own a business, have significant assets, or have a blended family, working directly with a lawyer ensures your unique circumstances are properly addressed.

- The final steps are your responsibility: Creating the documents online is just the first step; you must print, sign, and have them witnessed and notarized according to your state’s laws to make them legally valid.

What Exactly Is Trust & Will?

If you’ve started looking into estate planning, you’ve likely come across Trust & Will. It’s an online platform designed to help people create legal documents like wills and trusts without needing to hire an attorney right away. The main idea is to make the process more accessible, straightforward, and affordable for everyone. Think of it as a guided, do-it-yourself tool for mapping out your future.

Instead of sitting down in a law office, you answer a series of questions on their website. Based on your responses, the platform generates the legal documents you need to protect your family and assets. While this approach offers a lot of convenience, it’s important to understand exactly what services they provide and how the process works to figure out if it’s the right fit for your specific needs. For many, it’s a great starting point, but it’s not a one-size-fits-all solution for every family’s situation.

A Look at Their Core Services

Trust & Will focuses on the foundational documents of estate planning. Their main offerings are broken down into two key categories: Wills and Trusts. A Will is a document that outlines your final wishes, including who gets your property and who would become the guardian for your minor children. A Trust is a more complex legal arrangement that holds your assets for your beneficiaries and can help your family avoid the time and expense of probate court.

Beyond these core documents, their plans also include other essential paperwork. You’ll typically get a HIPAA authorization, which allows medical providers to share your health information with specific people, and a living will, which details your wishes for medical treatment if you can’t communicate them yourself. They also provide a power of attorney, letting you appoint someone to manage your financial affairs if you become incapacitated.

How Does the Platform Work?

The process of using Trust & Will is designed to be simple and fast. Once you create an account and choose a plan, the platform guides you through a detailed questionnaire. You’ll answer questions about your family, your assets, your beneficiaries, and your final wishes. The website is user-friendly, and you can usually complete the initial draft of your documents in under 30 minutes.

As you provide your answers, the software uses them to populate state-specific legal forms. After you finish, you can download and print your documents. To make them legally binding, you’ll still need to sign them according to your state’s laws, which usually requires witnesses and a notary. While the platform makes document creation easy, it’s up to you to ensure the final steps are completed correctly.

Exploring Trust & Will’s Services and Features

Trust & Will offers a suite of online tools for the core parts of estate planning. The platform is built around a guided, question-based process that simplifies creating essential documents. Whether you need a basic will, a more complex trust, or a plan for your digital assets, their services are designed to cover the fundamentals. Let’s look at what they offer and how they handle your private information.

Wills for Individuals and Couples

At its most basic, Trust & Will helps you create a legally valid will online. The platform is known for being easy to use, walking you through the process with simple questions instead of confusing legal terms. It’s a direct way to state your final wishes, name guardians for your children, and appoint an executor. The service is available in all 50 states. A CNBC review notes that an individual will costs $199, while a plan for two people, designed for couples, is priced at $299.

Options for Creating a Trust

For those looking for more control over their assets, Trust & Will provides tools to create a living trust. A trust can be a great way to manage your property and help your family avoid the often lengthy and public probate court process. The platform makes this option accessible and more affordable than traditional routes. Like its will service, the process is guided and straightforward. An individual trust costs $499, and a joint trust for a couple is $599, making it a competitive choice for online estate planning.

Managing Your Digital Assets

Your online life—from social media accounts and photos to cryptocurrency and email—is a valuable part of your estate. Trust & Will helps you create your own digital estate plan to account for these assets. By including them in your plan, you protect your online presence from risks like identity theft and ensure your digital property is passed on or managed according to your wishes. This feature allows you to appoint someone to handle your digital legacy, just as you would for your physical property.

How They Protect Your Information

Using an online service for estate planning means sharing sensitive information, so security is key. Trust & Will explains that they protect your information with bank-level security and encryption to keep your data safe. The company is also clear about its privacy policy, stating that it does not sell or share your personal details with outside parties. This focus on security and confidentiality is essential for giving you confidence that your private information will be handled responsibly throughout the process.

How Does Trust & Will Stack Up Against Competitors?

When you start looking into online estate planning, you’ll quickly see that Trust & Will isn’t the only option out there. The digital legal space is filled with platforms promising to make creating a will or trust simple and affordable. Big names like LegalZoom often come up, offering a huge menu of legal services for both personal and business needs. So, where does Trust & Will fit in?

The main difference is focus. While some competitors try to be a one-stop shop for everything from business formation to real estate deeds, Trust & Will dedicates its entire platform to one thing: estate planning. This specialized approach can be a major advantage if you’re looking for a streamlined, guided experience without the distraction of other legal services. It’s designed to walk you through the specific steps of creating a will or trust.

However, this specialization also means it’s not the right tool if you have broader legal needs. The choice really comes down to what you’re trying to accomplish. To help you decide, let’s break down how Trust & Will compares to other services when it comes to key areas like features, pricing, and access to attorney advice. Understanding these differences is the first step in figuring out if an online service or a dedicated estate planning attorney is the right fit for your family.

Comparing Features with LegalZoom and Others

Trust & Will is known for its user-friendly interface. The platform works by asking you a series of simple questions to gather the information needed to build your documents. This question-and-answer format is designed to feel less like filling out a legal form and more like a guided conversation, which can make the process feel much more approachable.

In contrast, larger platforms like LegalZoom offer a wider variety of legal documents but may not have the same level of focused guidance specifically for estate planning. Because Trust & Will concentrates only on wills and trusts, its entire workflow is built to support that goal. This can result in a smoother, more intuitive process for users who know exactly what they need and don’t want to get lost in a sea of other legal options.

A Look at the Price Differences

Pricing is often what draws people to online services in the first place. Trust & Will is transparent with its costs, typically charging a flat fee for its products. For example, you can expect to pay around $199 for an individual will or $499 for an individual trust. These prices are competitive within the online market and are certainly lower than the upfront cost of hiring a traditional attorney.

However, it’s important to see this price in context. The fee covers the generation of your documents based on the information you provide. It doesn’t include personalized legal advice tailored to your unique financial situation or family dynamics. While the cost is attractive, it reflects a different level of service than what you receive when you work directly with a lawyer who can offer strategic guidance.

Variations in the Attorney Review Process

What if you want a lawyer to look over your documents? Most online platforms, including Trust & Will, offer some form of attorney access as an add-on service. For an additional fee—often a few hundred dollars—you can have an attorney review your completed documents to check for errors or inconsistencies. This can provide an extra layer of confidence.

But this review process is very different from having an attorney represent you from the start. An add-on review is typically limited to the documents you’ve already created. It’s not a comprehensive consultation where a lawyer gets to know your situation and helps you build a plan from scratch. If you have complex assets, a blended family, or concerns about protecting beneficiaries, you may find you need more in-depth support than a final review can offer. If that sounds like you, it’s a good idea to schedule a consultation to discuss your needs.

Breaking Down the Price: How Much Does Trust & Will Cost?

Let’s talk about the bottom line. When you’re planning for the future, the last thing you want are surprise fees or a complicated price list. One of the main draws of online services like Trust & Will is their transparency when it comes to cost. They offer a tiered pricing model that lets you choose the level of estate planning you need without having to guess what the final bill will be. This is a significant departure from the traditional attorney route, where costs can vary widely based on hourly rates and the complexity of your case.

With Trust & Will, you’re looking at a flat-fee structure for its documents. This means you know exactly what you’re paying for upfront, whether you need a simple will or a more complex trust. This approach makes estate planning more accessible, especially if your needs are relatively straightforward and you feel comfortable managing the process online. It removes a major barrier for many people who have put off estate planning due to concerns about high or unpredictable legal fees. Below, we’ll get into the specific numbers for each plan so you can see how it all breaks down and decide if it’s the right financial fit for you.

Pricing for Individual Wills

If you’re looking to create a basic estate plan for yourself, the Individual Will is the starting point. Trust & Will offers this option for a one-time fee of $199. This plan is a great fit for individuals who want to outline their final wishes, name guardians for their children, and specify how their assets should be distributed without the added complexity of a trust. It’s a simple, direct way to ensure your affairs are in order. The service guides you through each step, making the process of creating a will feel much less intimidating than you might think. It’s a solid choice for those with uncomplicated financial situations who want to get their essential documents in place.

Costs for Joint Wills and Trusts

For couples planning their estate together, Trust & Will provides a Joint Will for $299. If your situation requires a more robust plan, you might consider a trust. A trust can help your loved ones avoid the lengthy and often expensive probate process. The cost for an Individual Trust is $499, while a Joint Trust for couples is priced at $599. These trust-based plans include everything you get with a will, plus the documents needed to establish and fund your trust. This comprehensive approach is designed to give you and your partner peace of mind by providing a more detailed framework for managing your assets both during your lifetime and after.

Finding Available Discounts

Beyond the initial setup fee, it’s worth knowing about ongoing costs and potential savings. Trust & Will offers an optional membership that allows you to make unlimited updates to your documents. This costs $19 per year for Wills and $39 per year for Trusts. Life changes, and this feature ensures your estate plan can change with it without requiring you to start over from scratch or pay a large fee for minor adjustments. While the company doesn’t always have public discounts, it’s a good idea to search for promotional codes before you buy, as online services often run specials or have partner deals that can lower the initial cost of your plan.

The Pros and Cons of Using Trust & Will

Online estate planning tools can be a fantastic resource, but it’s smart to weigh the benefits against the drawbacks before you commit. Like any service, Trust & Will has clear advantages and some limitations you should be aware of. It’s designed to make creating legal documents straightforward and affordable, which is a huge plus for many people. However, its streamlined approach might not be the right fit for everyone, especially if your financial or family situation is a bit more complicated.

Understanding both sides of the coin will help you decide if an online platform meets your needs or if your situation calls for more personalized legal advice. Let’s break down what we like about the service and what you should watch for.

The Good Stuff: What We Like

The biggest draw of Trust & Will is its simplicity and accessibility. The platform is known for being incredibly user-friendly, guiding you through the process with simple questions to help you create legal Wills and Trusts online. You don’t need a law degree to get started; the service is designed for clarity and focuses solely on estate planning, which keeps the experience from feeling overwhelming. Their documents are created by legal experts and are legally valid for your state, giving you peace of mind. Another major benefit is security. The company uses bank-level security measures to protect your personal information, which is crucial when you’re dealing with sensitive data.

The Not-So-Good: What to Watch For

While Trust & Will is great for simple situations, it may not be the best choice if you have a complex estate. If you own multiple properties, have significant assets, or have a complicated family dynamic (like a blended family), an online template might not be detailed enough for your needs. For these more intricate cases, it’s often better to get personalized estate planning advice from an attorney who can account for every nuance. There are also a few practical details to consider. You only get free updates for the first 30 days; after that, you’ll have to pay an annual fee to maintain access and make edits.

What Are Customers Saying About Trust & Will?

When you’re considering a service for something as important as your estate plan, hearing from people who have already used it can be incredibly helpful. It gives you a real-world look at what works well and what might fall short. We’ve gathered feedback from various sources to give you a clear picture of the customer experience with Trust & Will, from how easy the platform is to use to what people think about their attorney support. This isn’t just about star ratings; it’s about understanding the nuances of the service so you can decide if it truly fits your needs.

Feedback on User Experience and Reliability

One of the most consistent points of praise for Trust & Will is its user-friendly design. Customers often report that the website is simple to work with, guiding them through the process with clear, straightforward questions. You don’t need a legal background to understand what’s being asked of you. Many users appreciate that they can complete their documents quickly, often in less than 30 minutes. This efficiency is a major draw for people who want to get their affairs in order without a lengthy, complicated process. The platform is built to be intuitive, making online estate planning accessible even for those who aren’t tech-savvy.

Thoughts on the Attorney Review Process

For those who want an extra layer of confidence, Trust & Will offers the option to have a licensed attorney review your documents for an additional fee. This feature is a middle ground between a pure DIY service and hiring a traditional lawyer. When you add this service, an attorney checks your estate plan to ensure it’s customized correctly for your situation. While this is a valuable feature, it’s important to remember that this is a one-time review, not ongoing legal counsel. It’s different from building a relationship with a local attorney who can understand the full context of your life and provide personalized guidance from start to finish.

Common Praise and Complaints

Customers frequently praise Trust & Will for its affordability and convenience. It’s often seen as a great choice for people with straightforward estates who want an easy, at-home way to create their will or trust. However, the platform’s simplicity can also be its biggest drawback. Many reviews point out that if you have a complex estate—such as owning a business, having properties in multiple states, or needing to plan for a child with special needs—Trust & Will might not be detailed enough. In these situations, the potential for error or oversight is higher, and most experts agree that it’s better to work directly with an attorney to ensure your wishes are fully and legally protected.

Is Trust & Will the Right Choice for You?

Deciding how to create your will or trust is a big step, and the right path depends entirely on your personal circumstances. While online platforms offer a convenient starting point, they aren’t a one-size-fits-all solution. Thinking through your assets, family dynamics, and long-term goals will help you determine if a service like Trust & Will meets your needs or if you require more personalized legal guidance. Let’s break down who these services are best for and when you should consider working directly with an attorney.

Who Benefits Most from an Online Service?

Online will-makers like Trust & Will are most effective for individuals with straightforward financial and family situations. If you have a simple estate and want to create a basic will quickly, this can be a great option. The process is designed to be user-friendly, helping you document your wishes without complex legal terminology. For someone with minimal assets and clear beneficiaries, these platforms provide an accessible and affordable way to put essential legal documents in place, offering peace of mind without the time and expense of hiring a lawyer.

When to Hire a Traditional Attorney Instead

An online service may not be sufficient if your situation has any layers of complexity. You should hire an attorney if you have significant assets, own multiple properties, or have a blended family. Other situations that call for professional legal advice include planning for a dependent with special needs or owning a business. An experienced lawyer can provide the tailored estate planning necessary to handle these nuances, helping you address potential tax implications and family disputes. A DIY document simply can’t account for the unique variables an attorney can anticipate.

Clearing Up Common Myths About Online Wills

One of the biggest misconceptions about wills is that having one automatically helps your estate avoid probate court. This isn’t true. A will is essentially a set of instructions for the probate court to follow. Whether you create your will online or with an attorney, it will likely still go through this public process. If your goal is to bypass probate, you’ll need a more comprehensive strategy that may involve creating a trust. This is where an attorney’s guidance becomes invaluable, as they can help structure your estate to meet your goals and protect your family’s privacy.

How to Start Your Estate Plan with Trust & Will

Getting your estate plan in order might feel like a huge task, but online platforms like Trust & Will are designed to make the process much more approachable. They break everything down into manageable steps, guiding you from start to finish. While it’s a different experience from sitting down with an attorney, it can be a solid starting point for many people. Think of it as a guided checklist that helps you organize your wishes and create the legal documents to back them up.

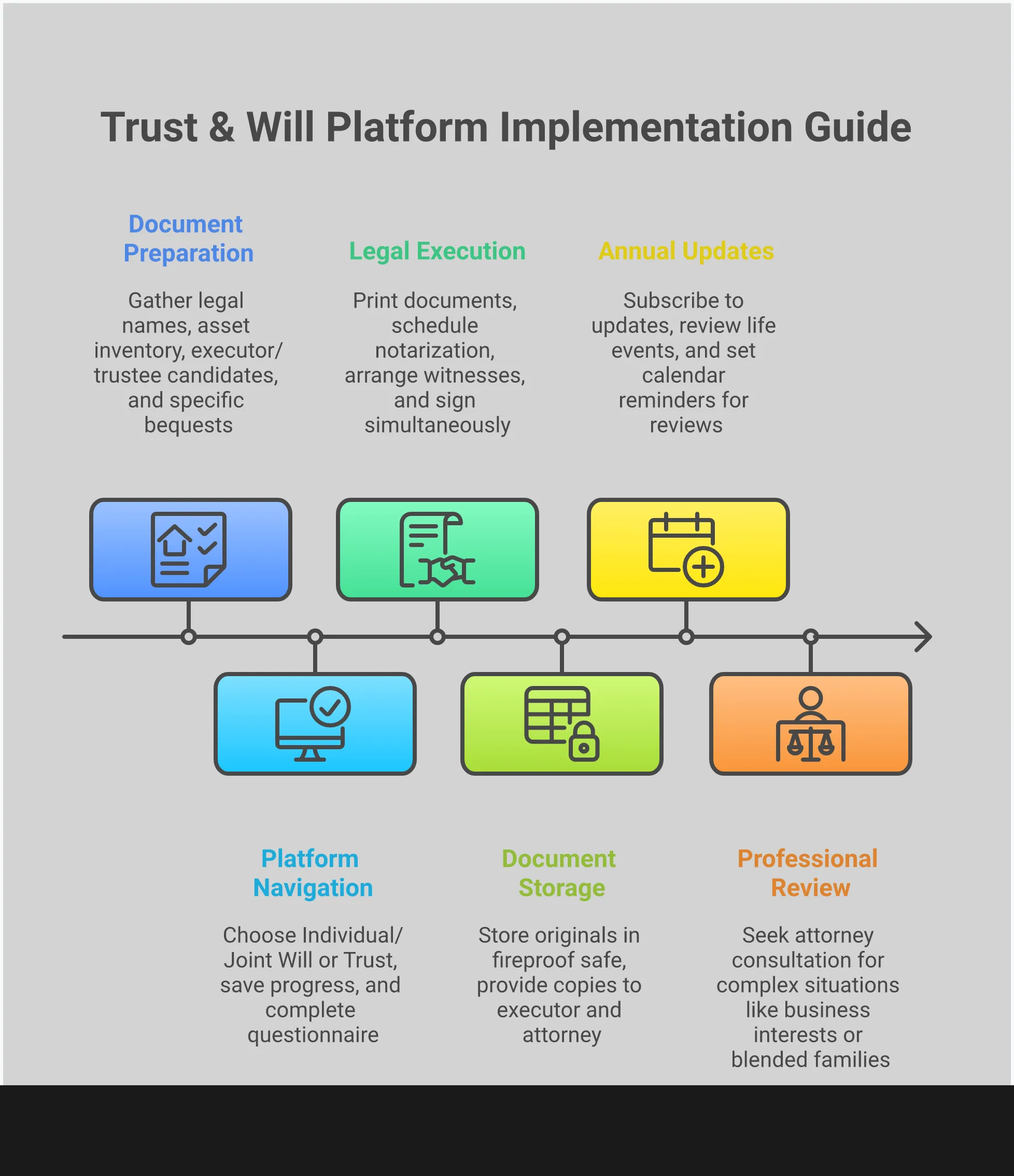

Your Step-by-Step Guide

One of the biggest draws of a service like this is its simplicity. As Trust & Will explains, their goal is to help you “create legal Wills and Trusts online” as “an easy and affordable way to plan for your future and protect your family.” The process generally follows a clear path. First, you’ll choose the product that fits your needs, whether that’s a will or a trust. From there, the platform walks you through a detailed questionnaire about your assets, family, and final wishes. Once you’ve answered all the questions, the system generates your legal documents. The final, crucial step is to print, sign, and have your documents notarized according to your state’s laws to make them legally binding.

What to Gather Before You Begin

To make the process as smooth as possible, it’s a good idea to do a little homework first. Having your information organized before you sit down to fill out the questionnaire will save you time and ensure you don’t forget anything important. With these services, you can make important documents like wills, living trusts, and powers of attorney, and you can also name a guardian for your children.

Before you start, try to gather the following:

- The full legal names and birthdates of your beneficiaries.

- A clear idea of who you want to serve as the executor of your will or the trustee of your trust.

- The name of the person you’d like to appoint as a guardian for any minor children.

- A general inventory of your major assets, like property, bank accounts, and investments.

Keeping Your Documents Up-to-Date

An estate plan isn’t a “set it and forget it” document. Life changes—you might get married, have a child, or acquire new assets—and your plan needs to reflect those updates. Trust & Will addresses this with a subscription model. Their platform “helps keep your plan updated as your life changes” by providing “unlimited updates, can share access with trusted people, and receive smart alerts.” This feature allows you to log in and make changes whenever a major life event occurs. While this digital convenience is helpful, it’s always a good practice to have an attorney review your documents after significant changes to ensure everything is still aligned with your goals and current laws. If you ever need a professional review, our team is here to help.

Related Articles

- When Life Changes: Revising Your Estate Plan – The Law Office of Chad G. Mann, LLC

- Digital Assets and Estate Planning: A Missouri Law Perspective – The Law Office of Chad G. Mann, LLC

- Estate Planning Digital Assets: Missouri Law Explained

- Missouri Estate Planning Guide – Understand Its Importance

- Estate Planning in Missouri: A Simple 7-Step Guide – The Law Office of Chad G. Mann, LLC

Frequently Asked Questions

Are the documents I create on Trust & Will actually legally binding? Yes, they are. The platform generates documents that are designed to be legally valid in your state, as long as you follow the final instructions correctly. The critical part is on you—you have to print them and then sign them in front of witnesses and a notary, exactly as your state law requires. The service provides the template, but you’re responsible for making it official.

What if my situation is more complicated than I realize? Can I mess this up? That’s the main thing to be careful about with any DIY legal tool. The platform is great for straightforward situations, but it can’t ask follow-up questions or give strategic advice like a person can. If you own a business, have a blended family, or want to set up care for a child with special needs, a template might not cover all the important details. In those cases, working with an attorney is a safer bet to ensure your plan does exactly what you intend it to.

If I use Trust & Will, does that mean I don’t need an attorney at all? Not necessarily. Think of Trust & Will as a tool for creating the initial documents. Many people use it successfully for simple estates and never need more. However, if you have questions along the way or if your life circumstances change significantly, it’s always a good idea to have an attorney review your plan. The platform’s add-on attorney review is a quick check, not a substitute for building a relationship with a lawyer who understands your full story.

Why would I choose a trust over a will on their platform? The main reason to choose a trust is to help your family avoid probate court, which is the public legal process for settling an estate. A will guides your assets through probate, while a trust allows them to be managed and distributed privately and often more quickly. A trust is a more involved document and costs more, but it offers greater control and privacy for your beneficiaries.

You mentioned needing a notary and witnesses. Is that difficult to arrange? It’s a straightforward but essential step. A notary is an official who verifies your identity and witnesses your signature. You can usually find one at a bank, a shipping store, or a local government office. Your witnesses just need to be adults who aren’t inheriting anything from you. The key is to gather everyone in the same room to sign at the same time. Trust & Will provides specific instructions, so just be sure to follow them to the letter.