You’ve sent the reminders. You’ve made the phone calls. You’ve been patient, but the debt remains unpaid, and you’re running out of options. When your own collection efforts hit a wall, it’s easy to feel stuck. So, what’s the next move? It’s time to shift from personal requests to legal action. Hiring an attorney collect promissory note is the most effective way to show the debtor you are serious about recovering your funds. This guide is your clear roadmap for what comes next, covering everything from the initial demand letter to enforcing a court judgment.

Key Takeaways

- An attorney escalates your claim with legal force: When your own collection efforts fail, a lawyer can secure a court judgment and use powerful tools like wage garnishment or property liens to ensure you get paid.

- You must act within Missouri’s legal timeframe: The state has a 10-year statute of limitations for promissory notes. Waiting too long to take action after a default can permanently close the door on your ability to collect through the courts.

- Specialized experience is key to a successful outcome: Look for an attorney who focuses specifically on creditor representation and debt collection. Their knowledge of local courts and proven strategies provides a significant advantage in recovering your money.

How Do You Collect on a Promissory Note in Missouri?

When someone owes you money and fails to pay, it can be frustrating and stressful. If you have a promissory note, you have a legally recognized agreement that can be enforced. The collection process in Missouri follows a specific path, starting with understanding the document itself and the laws that govern it. Knowing these key steps can help you prepare to recover the money you are owed.

What is a promissory note?

Think of a promissory note as a formal, legally binding IOU. It’s a written document where one party (the borrower) promises to pay a specific amount of money to another party (the lender) by a certain date or on demand. To be valid, it must be signed by the borrower and clearly state the terms of the loan, including the total amount, interest rate, and repayment schedule. Because it’s a formal contract, a promissory note gives you a clear legal path to follow if the borrower doesn’t hold up their end of the deal. This document is the foundation of your entire collection effort.

Understanding Key Terms in Your Note

Before you can enforce a promissory note, you need to know exactly what it says. These documents often contain specific legal terms that dictate your rights and the borrower’s obligations. Getting familiar with the fine print is the first step in building a strong collection strategy. Two of the most important terms you’ll encounter are the acceleration clause and the grace period. Understanding how these work is crucial because they define when you can take action and what kind of action you can take. This knowledge empowers you to act correctly and within the bounds of your agreement when a payment is missed.

The Acceleration Clause

An acceleration clause is a powerful tool for a lender. This provision states that if the borrower misses even one payment, you have the right to demand that the entire remaining loan balance be paid immediately. Instead of just collecting the missed payment, you can “accelerate” the debt and call the whole thing due. This is a significant step, and it’s important to know that the statute of limitations for collection might not start until you officially declare the full amount due. This clause adds a serious consequence for default and gives you substantial leverage when pursuing what you are owed.

Grace Periods

Many promissory notes also include a grace period. This is a short, specified amount of time after a payment’s due date during which the borrower can still make the payment without facing any penalties, like late fees. For example, if a payment is due on the 1st of the month and there’s a 10-day grace period, the borrower has until the 11th to pay without consequence. As a lender, you need to be aware of this window because you generally cannot consider the loan in default or apply penalties until the grace period has expired. It provides a bit of flexibility for the borrower but also clearly defines when a payment officially becomes late.

When is it time to collect?

The time to start the collection process is as soon as the borrower misses a payment and violates the terms of the note. This is known as defaulting on the loan. While your first instinct might be to go to court, the initial step is usually more straightforward. You should send the borrower a formal, written demand letter. This letter officially notifies them that they are in default and that you demand payment according to the note’s terms. It shows you are serious about collecting the debt and creates a paper trail that can be useful later if legal action becomes necessary.

What Are Missouri’s Debt Collection Laws?

When collecting a debt, you have to follow the rules. In Missouri, debt collection practices are primarily governed by the federal Fair Debt Collection Practices Act (FDCPA). This law prevents abusive or deceptive collection tactics. It’s also crucial to know your deadline for taking legal action. In Missouri, the statute of limitations for written contracts, including promissory notes, is 10 years from the date the borrower defaulted. This means you have a decade to file a lawsuit to recover your money. If you wait longer than that, you may lose your right to collect through the courts.

How Can an Attorney Help You Collect a Promissory Note?

Trying to collect on a promissory note can be frustrating, especially when your requests are ignored. While you can make calls and send emails, an attorney has legal tools at their disposal to compel payment. Bringing in a legal professional signals to the debtor that you are serious about recovering what you’re owed. They can manage the entire process, from initial contact to enforcing a court order, giving you a much stronger chance of success. An experienced collections attorney understands the specific laws in Missouri and can apply them to your situation, ensuring every action taken is both legal and effective. They take the emotion out of the process and approach it with a clear, strategic plan. This not only increases your chances of getting paid but also saves you the stress and time of pursuing the debt yourself.

Sending a Formal Demand Letter

The first official step an attorney often takes is sending a formal demand letter. This isn’t just another reminder; it’s a legal document that clearly states the amount owed, references the promissory note, and sets a firm deadline for payment. It also outlines the legal consequences of non-payment. Coming from a law office, this letter carries significant weight and shows the borrower you are prepared to take legal action. For many debtors, receiving a formal request for payment from an attorney is the motivation they need to finally settle the debt without things going any further.

Validating Your Legal Documents

Before taking action, a skilled attorney will review your promissory note to make sure it’s legally sound and enforceable in Missouri. They’ll check that the terms are clear, the signatures are valid, and the document complies with state laws. This step is crucial because any ambiguity or error in the original note could jeopardize your case if it goes to court. By validating your documents upfront, an attorney ensures you’re building your collection efforts on a solid legal foundation, preventing potential issues from derailing the process down the line. This proactive review saves you time and strengthens your position.

Representing You in Court

If the demand letter doesn’t result in payment, the next step is often filing a lawsuit. An attorney will handle every aspect of the legal proceedings for you. This includes preparing and filing the necessary court documents, presenting your case before a judge, and arguing on your behalf. Their expertise in courtroom procedures and debt collection laws is invaluable. Their goal is to obtain an official judgment from the court that legally confirms the debtor’s obligation to pay you. Having a professional represent you in court removes the burden from your shoulders and ensures your case is presented effectively.

Enforcing a Court Judgment

Winning a lawsuit is a major victory, but the court judgment itself doesn’t automatically put money in your bank account. You still have to collect it. This is where an attorney’s help is essential. They can take legal steps to enforce the judgment and collect the funds you are owed. One common method is placing a judgment lien on the debtor’s property. This means if the debtor sells their real estate, your debt must be paid from the proceeds. An attorney knows exactly how to file these liens correctly to secure your claim against the debtor’s assets.

Using Post-Judgment Depositions to Find Assets

What happens when a debtor simply refuses to disclose where their money is? A court judgment is powerful, but it’s not a magic wand that makes assets appear. This is where a post-judgment deposition becomes an invaluable tool. Think of it as a formal interview where your attorney can question the debtor under oath about their financial situation. They are legally obligated to provide truthful answers about their bank accounts, employment, property, and any other assets they own. This process cuts through the excuses and provides a clear map of where their resources are located, allowing your attorney to take targeted action, like garnishing wages or levying a bank account.

Taking Action Against Fraudulent Transfers

It’s a frustratingly common scenario: you win a judgment, and suddenly the debtor claims to be broke. In some cases, they may have tried to hide their assets by transferring them to someone else, like a family member or a newly created company. This is called a fraudulent transfer, and it is illegal. An attorney can investigate these suspicious transfers and, if necessary, file a separate legal action to have them reversed. By proving the transfer was made specifically to avoid paying the debt, a court can void the transaction, bringing the assets back into the debtor’s name so they can be used to satisfy your judgment.

Pursuing Wage Garnishments and Asset Seizures

When a debtor still refuses to pay after a judgment, an attorney can pursue more direct collection methods. With a court order, they can initiate a wage garnishment, which requires the debtor’s employer to withhold a portion of their paycheck and send it directly to you. Another powerful tool is asset seizure, where the court authorizes the sheriff to take possession of the debtor’s non-exempt property, such as bank account funds or vehicles, to be sold to satisfy the debt. These are complex legal actions that require an attorney to execute properly, but they are often the most effective ways to recover your money.

How to Choose the Right Missouri Collections Attorney

Finding an attorney is one thing, but finding the right one to handle your promissory note collection is what truly matters. Not all lawyers have the specific skills needed to successfully recover the money you are owed. You need a partner who understands the ins and outs of debt collection in Missouri and is prepared to advocate for your financial interests. Think of this as a hiring process—you’re looking for a professional with the right experience, a solid reputation, and a communication style that works for you. This decision shouldn’t be rushed. The attorney you choose will be your guide and representative through a potentially complex legal process.

They will be responsible for communicating with the debtor, filing legal documents, and arguing your case in court if necessary. A good fit means more than just legal qualifications; it means finding someone you trust to handle your financial matters with diligence and professionalism. The right attorney can turn a frustrating, stalled collection effort into a successful recovery. Taking the time to carefully vet your options by looking at their specific experience, reputation, communication style, and local knowledge will make a significant difference in the outcome of your case and your peace of mind.

Look for Specific Debt Collection Experience

When you need to collect a debt, you don’t want a generalist; you want a specialist. An attorney who focuses on creditor representation will have a deep understanding of the laws and strategies that are most effective. Debt collection attorneys have more power than collection agencies. They can take your case to court, file lawsuits, get official judgments, and even seize assets to make sure you get paid. This specialized experience means they know how to handle debtor excuses and legal roadblocks, giving you the best possible chance of recovering your funds.

Check Their Reputation and Client Reviews

An attorney’s reputation is a powerful indicator of their effectiveness and professionalism. Before you commit, do some research. Look for online reviews and testimonials from previous clients. A firm with many positive reviews from clients who say the lawyers and staff are professional, knowledgeable, and helpful is a great sign. This feedback gives you a glimpse into the client experience you can expect. A strong track record shows that the attorney not only knows the law but also knows how to treat clients with respect throughout the legal process.

Assess Their Communication Style

The collections process can sometimes be lengthy, so you need an attorney who communicates clearly and consistently. Your initial consultation is the perfect opportunity to gauge their approach. During your first meeting, don’t be afraid to ask about their experience, how they plan to handle your case, and how they’ll keep you updated. You should feel comfortable with them and confident that they will be responsive to your questions. A good attorney will take the time to explain your options in plain English, ensuring you feel informed and in control every step of the way.

Confirm Their Knowledge of Local Courts

Legal matters are often influenced by local rules and relationships. An attorney who regularly practices in Southwest Missouri’s court system will have a home-field advantage. They understand the specific procedures of local courts and may be familiar with the judges and opposing counsel. This local insight can be invaluable in creating a strategy tailored to your specific situation. It’s important for creditors to have experienced lawyers to protect their interests, and that experience is even more powerful when it’s rooted in the community where your case will be heard.

What Does It Cost to Hire a Collections Attorney?

When you’re trying to recover money you’re owed, the last thing you want is to be surprised by unexpected legal bills. Understanding how attorneys charge for their services can help you make an informed decision. The cost of hiring a collections attorney in Missouri depends on their fee structure, which typically falls into one of two categories: hourly or contingency. It’s also important to account for other case-related expenses that may arise.

How hourly rates

Some attorneys charge by the hour for their work. This means you pay for the actual time the lawyer spends on your case, whether they are drafting documents, making phone calls, or appearing in court. In Missouri, an attorney’s hourly rate can vary based on their experience and the complexity of your case. Your attorney should give you an estimate of how many hours they expect your case will take. This approach is common in legal matters where the time commitment is difficult to predict.

How Contingency Fees Work

A more common arrangement in debt collection cases is the contingency fee. With this structure, the attorney’s fee is a percentage of the money they successfully recover for you. If they don’t collect anything, you don’t owe them a fee for their time. This can be an attractive option because it requires no upfront payment and ensures their goals are directly aligned with yours. The specific percentage will be clearly laid out in your fee agreement, allowing you to pursue a claim without financial risk as the attorney assumes the risk of an unsuccessful outcome.

Accounting for Court Costs and Other Fees

Beyond attorney fees, you’ll also have other case-related expenses. These are separate from the lawyer’s payment and cover the direct costs of the lawsuit. Common expenses include court filing fees, the cost of having the debtor formally served with legal papers, and fees for expert witnesses if needed. In Missouri, these court costs are set by the state and are a necessary part of the legal process. Your attorney should provide a clear explanation of these potential costs so you can budget for them.

Why a Clear Fee Structure Is Essential

Before you hire an attorney, it’s essential that you receive and review a written fee agreement. This document is your contract with the lawyer and should clearly outline how they will be paid and what expenses you will be responsible for. Don’t hesitate to ask questions if any part of the agreement is unclear. A reputable attorney will be happy to walk you through the details. A transparent fee structure is the foundation of a strong attorney-client relationship and prevents misunderstandings, allowing you to focus on recovering your money.

What Does the Attorney Collection Process Look Like?

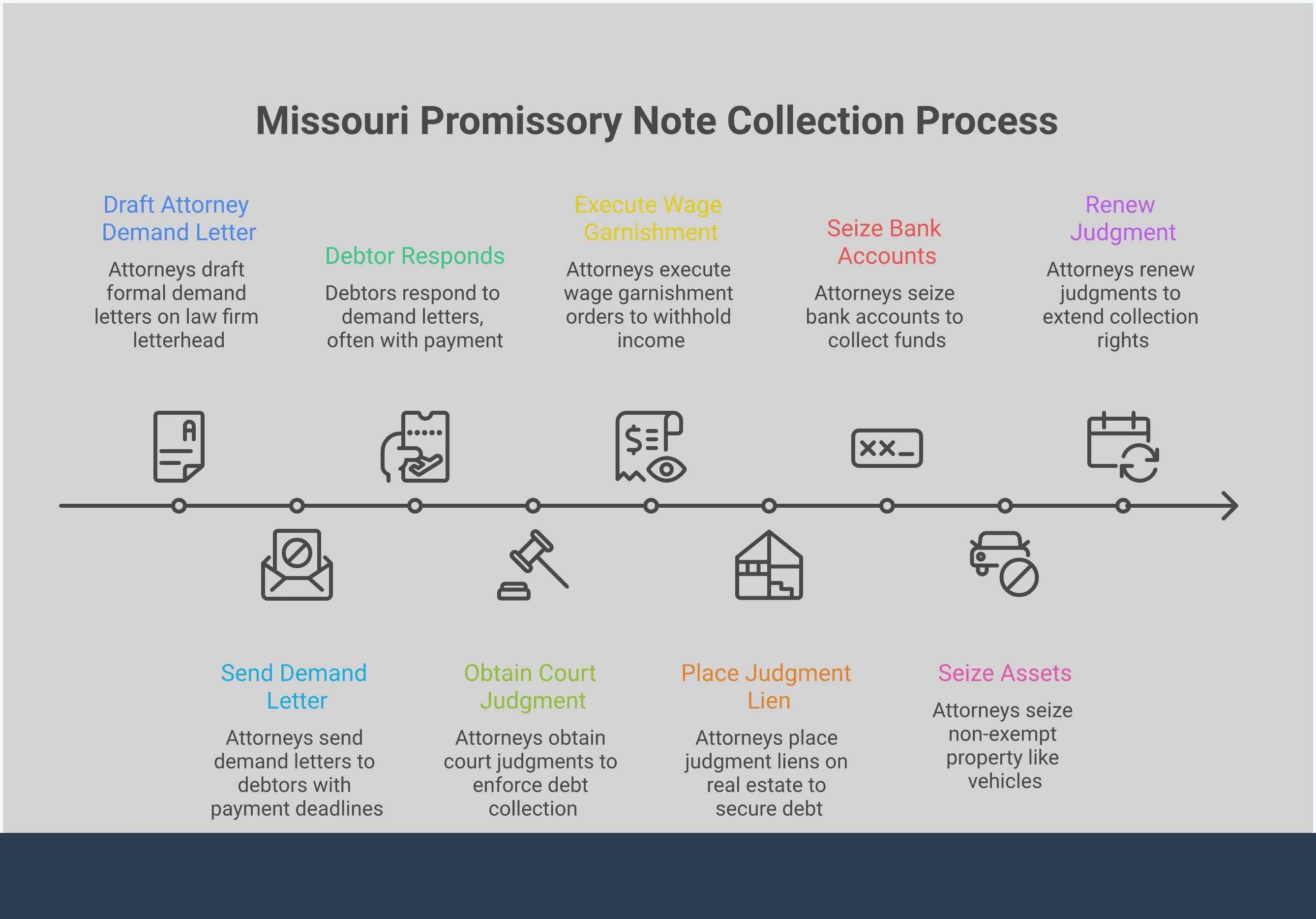

When you decide to work with an attorney to collect on a promissory note, you’re taking a significant step toward recovering what you’re owed. While every situation has its own unique details, the legal process generally follows a structured path. Understanding these steps can help you feel more confident and prepared for what’s ahead. From the initial meeting to enforcing a court order, your attorney will handle the complexities, allowing you to focus on your business. Let’s walk through the typical four-step process an attorney uses to collect a debt.

Step 1: Your Initial Consultation and Case Review

Your first meeting with an attorney is all about getting on the same page. This is your opportunity to share the full story, present the promissory note, and provide any records of communication or payment attempts. The attorney will listen, review your documents, and assess the strength of your case. Don’t hesitate to ask questions about their experience, their proposed strategy, and what their services will cost. A good attorney will be transparent about the process and potential outcomes. This initial review is crucial for building a solid foundation and ensuring your attorney has everything they need to move forward effectively.

Step 2: Sending the Formal Demand Letter

Once your attorney has reviewed your case, the first official action is usually sending a formal demand letter to the debtor. This isn’t just another reminder—it’s a legal document sent on law firm letterhead, signaling that you are serious about collection. The letter clearly states the amount owed, references the promissory note, sets a firm deadline for payment, and outlines the legal consequences of not paying, including a potential lawsuit. Often, this formal communication is enough to prompt a response and payment from the debtor, as it shows you have legal representation and are prepared to escalate the matter.

Step 3: Filing a Lawsuit if Necessary

If the demand letter doesn’t result in payment, the next step is to file a lawsuit. This is where an attorney’s power truly comes into play. Unlike a collection agency, an attorney can take your case to court to seek a legal judgment. The process involves drafting and filing a formal complaint with the appropriate Missouri court and legally serving the documents to the debtor. The goal is to obtain a judgment from a judge, which is an official court order declaring that the debtor is legally required to pay you the specified amount. This judgment is a powerful tool that opens the door to more forceful collection methods.

The Possibility of a Default Judgment

After your attorney files a lawsuit, the debtor has a specific window of time to respond. But what happens if they simply ignore the legal notice? In this scenario, your attorney can ask the court for a default judgment. This is a legal win that occurs when the other party fails to show up and defend themselves. The court essentially rules in your favor because the debtor didn’t contest the claim. It’s important to remember, though, that a judgment is a court order, not a check. While it’s a major victory that legally confirms the debt, the judgment itself doesn’t automatically transfer money into your account. You still have to collect the funds. This is where the enforcement phase begins, and having an experienced attorney is critical to turn that legal win into a financial recovery.

Step 4: Enforcing the Court’s Judgment

Receiving a court judgment is a major victory, but the work isn’t over until the money is in your hands. The final step is enforcing that judgment. Your attorney has several legal tools at their disposal to make this happen. They can pursue wage garnishment, where a portion of the debtor’s paycheck is sent directly to you. They can also place a levy on the debtor’s bank accounts or even seize assets to satisfy the debt. These are powerful legal actions that compel payment and are only possible after a court has ruled in your favor. An experienced collections attorney knows how to use these tools to ensure you finally recover what you are owed.

What Challenges Might You Face During Collection?

Collecting on a promissory note sounds simple on the surface, but the process can be filled with unexpected hurdles. From legal red tape to the debtor’s financial situation, several factors can complicate your efforts to recover what you’re owed. Understanding these potential challenges ahead of time can help you prepare and decide on the best course of action. It’s not just about asking for the money; it’s about knowing how to respond when things don’t go as planned.

Navigating these issues often requires a deep understanding of Missouri law and a strategic approach. Whether you’re dealing with a debtor who has disappeared, filed for bankruptcy, or is simply refusing to pay, being aware of the landscape is the first step toward a successful collection. Let’s walk through some of the most common obstacles you might encounter.

Anticipating Potential Borrower Defenses

It’s important to be prepared for the possibility that the borrower will try to fight the collection. They might raise certain legal defenses to argue they don’t have to pay. For example, a borrower could claim you didn’t give them proper notice that they were in default, or that the terms of the promissory note were too vague to be enforced. They might even argue that you, the lender, acted unfairly or that they made a payment you failed to record. This is why having a well-drafted note and keeping meticulous records is so important. An experienced creditor representation attorney can review your documents to anticipate these defenses and build a strong case to counter them, ensuring you’re ready for any argument the debtor might make.

Impact of Default on a Borrower’s Credit Score

A default on a promissory note doesn’t just affect the borrower’s relationship with you; it has serious financial consequences that can follow them for years. When a debt goes into default, it is often reported to the major credit bureaus. This negative mark will significantly damage their credit score, making it much harder for them to secure future loans for a car, a house, or even a credit card. Any credit they are able to get will likely come with much higher interest rates. This long-term financial impact is a powerful motivator for many debtors to resolve the issue before it reaches that point, and it’s a key piece of leverage in the collection process.

Dealing with Changing Collection Laws

Debt collection is a highly regulated field, governed by a complex web of federal and state laws that are constantly changing. These rules are designed to protect debtors from harassment, but they can also create a minefield for creditors. A simple mistake, like contacting a debtor at an inappropriate time or making a misleading statement, could put you in legal jeopardy. Staying current with these regulations is a challenge in itself. An experienced attorney who focuses on creditor representation can help you follow the law to the letter, ensuring your collection efforts are both effective and compliant.

Secured vs. Unsecured Debt: What’s the Difference?

Not all promissory notes are created equal. The biggest difference lies in whether the debt is secured or unsecured. A secured loan is backed by collateral—something valuable like a car or a piece of property. If the borrower defaults, you have a legal right to seize that asset to cover the debt. An unsecured loan, on the other hand, is based solely on the borrower’s promise to pay. If they default on an unsecured note, you can’t just take their property. Your primary path to collection is filing a lawsuit to get a court judgment, which can be a longer and more involved process.

What happens if the debtor files for bankruptcy?

A bankruptcy filing can bring your collection efforts to a screeching halt. As soon as a debtor files for bankruptcy, an “automatic stay” goes into effect, which legally prohibits you from trying to collect the debt. What happens next often depends on whether your debt is secured or unsecured. Lenders with secured notes are in a much stronger position and are more likely to be paid, at least partially, through the bankruptcy process. Unsecured lenders are further down the priority list and, in many cases, may not recover anything at all. Navigating a bankruptcy case requires specific legal knowledge, so it’s wise to contact an attorney immediately if you receive a notice of bankruptcy.

How Secured vs. Unsecured Notes Are Treated

The path to collecting your money changes significantly based on whether the note is secured or unsecured. A secured loan is backed by collateral—a specific asset like a car or property. If the borrower defaults, you have a direct legal right to take possession of that asset to cover the debt. This makes the collection process more straightforward. In contrast, an unsecured note is based only on the borrower’s promise to pay. With no collateral to seize, your primary recourse is to file a lawsuit. Only after you win in court and obtain a judgment can you use powerful collection tools like wage garnishments or bank account levies, making it a longer and more complex legal journey.

Understanding Missouri’s Statute of Limitations

In Missouri, you don’t have an unlimited amount of time to take legal action to collect a debt. The law that sets this deadline is called the statute of limitations. For written agreements like a promissory note, you generally have 10 years to file a lawsuit. The tricky part is figuring out when that 10-year clock starts ticking. It could be from the date the last payment was made or when the contract was first broken. If you wait too long and the statute of limitations expires, you lose your right to use the courts to enforce the note, and the debt can become legally uncollectible.

For Installment Notes

Many promissory notes are set up for installment payments, meaning the borrower pays back the loan in smaller, regular amounts over time. For these types of notes, the 10-year statute of limitations works a bit differently. Instead of a single deadline for the entire loan, the clock starts running separately for each individual payment that is missed. For example, if a payment was due in June 2020 and was missed, you would have until June 2030 to sue for that specific payment. If another payment was missed in July 2020, you would have until July 2030 for that one. This is a critical detail because it means you may still be able to collect on more recent missed payments even if the time has run out on earlier ones.

When an Acceleration Clause is Triggered

An acceleration clause is a term in a promissory note that gives the lender the right to demand the entire remaining balance of the loan be paid immediately if the borrower defaults. Once you officially “accelerate” the loan, the 10-year statute of limitations begins for the full outstanding amount on that date. However, Missouri has a specific rule you must follow. Before you can accelerate the loan due to a missed payment, you are required to give the borrower a 20-day notice of their right to cure the default. This means you must formally inform them of the missed payment and give them 20 days to fix the issue before you can demand the full balance and start the 10-year clock on the entire debt, as outlined in the Revised Statutes of Missouri.

What’s Legally Required to Enforce a Promissory Note in Missouri?

Before you can successfully collect on a promissory note, you need to make sure your legal ducks are in a row. Missouri law has specific requirements for a note to be enforceable, and overlooking any of them can complicate the process or even prevent you from recovering the debt. Think of it as building a strong case from the very beginning. By ensuring you meet these legal standards, you create a solid foundation for any collection actions you might need to take down the road. Let’s walk through the key legal pillars you need to have in place.

Start with a Clear, Written Agreement

It might seem obvious, but the foundation of any enforceable promissory note is the note itself—in writing. An oral promise is incredibly difficult to prove in court. A promissory note serves as a legal document that outlines the terms of the loan, including the amount borrowed, interest rates, and repayment schedule. This written agreement acts as a binding contract, ensuring that both you and the borrower clearly understand your obligations. Without a signed document that details these terms, you leave the door open for disputes and make it much harder to legally enforce the debt. A well-drafted note is your first and best tool for collection.

Ensuring a “Sum Certain” is Stated

For a promissory note to hold up in court, there can’t be any guesswork about the money involved. The document must clearly state the exact amount of money owed, a concept known as the “sum certain.” This isn’t just the initial loan amount; it should also detail how interest is calculated and specify any penalties or late fees that could be added. This level of clarity is what makes the note legally binding and enforceable. When every dollar is accounted for in writing, it eliminates ambiguity and prevents the borrower from disputing the total amount due. Think of it as the financial blueprint of the agreement—the more precise it is, the stronger your position will be.

Obtaining Signatures from All Parties

A promissory note is ultimately a promise, and a signature is what makes that promise legally official. For a note to be valid, it must be signed by the person who is borrowing the money. This signature serves as undeniable proof that the borrower has read, understood, and agreed to the terms of repayment. Without it, you have a document outlining a loan, but no formal commitment from the other party. The signatures of all parties involved are what transform the note from a simple IOU into a contract that can be upheld in a Missouri court, making it one of the most critical elements for future collection efforts.

Meeting Missouri’s 10-Year Statute of Limitations

Time is of the essence when it comes to debt collection. In Missouri, the statute of limitations for enforcing debts based on written agreements, such as promissory notes, is 10 years. This means that creditors have a decade from the date the borrower first defaults on the payment to initiate legal action. If you wait longer than 10 years, you may lose your right to sue for the debt, regardless of how strong your written agreement is. Understanding this timeframe is critical. It’s important to monitor your accounts and act promptly when a default occurs to protect your ability to collect what you are owed.

Why You Need to Keep Detailed Records

When it comes to legal matters, documentation is everything. Maintaining detailed records is vital when enforcing a promissory note. You should gather and organize all relevant documents related to the debt, including the original signed promissory note, a clear history of payments made, and copies of any correspondence about the loan. These records are essential if you need to take legal action, as they provide the evidence needed to prove the debt and the borrower’s failure to pay. Strong records make the job of debt collection attorneys much more straightforward and significantly strengthen your position in court.

Complying with All Collection Laws

As a creditor, you have rights, but so does the debtor. When collecting on a promissory note, it is crucial to comply with all applicable collection laws, such as the Fair Debt Collection Practices Act (FDCPA). This federal law outlines what collectors can and cannot do, ensuring that collection practices are fair and ethical. Violating these rules can lead to serious legal trouble for you, including fines and even the dismissal of your collection case. This is an area where hiring an experienced attorney is invaluable. They can help you pursue the debt effectively while making sure you stay on the right side of the law.

What Are the Potential Outcomes?

When you decide to hire an attorney to collect on a promissory note, you’re opening the door to several possible resolutions. The path your case takes will depend on the specifics of your agreement and the debtor’s financial situation, but having a legal professional on your side significantly broadens your options for recovering the money you are owed. Let’s walk through the most common outcomes.

Recovering the Full Debt

The best-case scenario is recovering the entire amount owed to you. While sending letters and making calls on your own might not have worked, an attorney has the power to use the legal system to compel payment. If a lawsuit is successful, the court will issue a judgment in your favor. This is more than just a piece of paper; it’s a powerful legal tool. An attorney can use that judgment to secure a lien against the debtor’s property, initiate a wage garnishment to collect directly from their paycheck, or levy their bank accounts. These are serious, legally-enforceable actions that can lead to the full recovery of your funds.

Reaching a Negotiated Settlement

Sometimes, going through a full court battle isn’t the most efficient path, especially if the debtor has limited ability to pay. In these situations, a negotiated settlement can be a great outcome. Your attorney can act as a professional mediator, communicating with the debtor or their legal counsel to reach a compromise. This often involves the debtor agreeing to pay a lump-sum amount that is less than the full balance or committing to a structured payment plan. An experienced creditor representation attorney can often expedite this process, helping you recover a significant portion of the debt without the time and expense of a trial.

Through a Forbearance Agreement

A forbearance agreement is essentially a new, legally binding promise to pay. This is a practical tool when the debtor is willing to cooperate but can’t meet the original payment terms. Instead of heading straight to court, your attorney can negotiate a new payment plan that might include collateral, like property, or a personal guarantee to secure the debt. This revised agreement is put in writing and signed by both parties, creating a clear and enforceable path forward. It’s a proactive solution that gives the debtor a realistic way to pay while providing you with stronger protections than the original note may have offered.

Through Mediation or Arbitration (ADR)

If direct negotiations stall, another option is Alternative Dispute Resolution (ADR), which includes mediation or arbitration. These methods involve a neutral third party who helps you and the debtor resolve the issue outside of a formal courtroom setting. ADR is often much faster and less expensive than a traditional lawsuit. It allows both sides to work toward a mutually agreeable solution without the stress and public nature of litigation. Your attorney can represent you during these proceedings, ensuring your interests are protected while you work toward a fair and final resolution to the debt.

Recovering Legal Fees and Other Damages

Did you know you might be able to recover more than just the original loan amount? Many promissory notes include a clause that holds the borrower responsible for any collection costs, including attorney’s fees and court costs, if they default on the loan. A skilled attorney will carefully review your promissory note to see if this provision is included. If it is, they will work to ensure these expenses are added to the total amount you recover, whether through a court judgment or a settlement. This can make the decision to pursue legal action much more financially sound, as you won’t be paying for the collection process out of your own pocket.

Securing Long-Term Rights to Collect

What if the debtor simply doesn’t have the money to pay right now? A promissory note is a legally binding document, and obtaining a court judgment secures your right to collect for years to come. In Missouri, a judgment is enforceable for ten years and can even be renewed, giving you a long window of opportunity. This means if the debtor’s financial situation improves in the future—if they get a new job, buy a house, or receive an inheritance—you can enforce the judgment then. An attorney can help you monitor the situation and take action when the time is right, ensuring a temporary setback for the debtor doesn’t mean a permanent loss for you.

Selling the Debt to a Collection Agency

Another route you might consider is selling the debt to a collection agency. In this scenario, you sell the promissory note for a fraction of its value—often just pennies on the dollar—and the agency takes over ownership of the debt. The main appeal is that you get a small amount of cash immediately and can wash your hands of the collection process. However, this also means you give up your right to ever collect the full amount. Unlike hiring an attorney who works on your behalf to recover what you are owed, selling the debt is a final transaction. The collection agency then pursues the debtor for its own profit, and you are no longer involved. This option can be a quick exit, but it comes at a significant financial cost.

When Should You Call a Collections Attorney?

Deciding to involve a lawyer can feel like a big step, but sometimes it’s the most practical one you can take. You’ve loaned money in good faith, and you have a right to be repaid. While handling it yourself might seem easier at first, there are specific moments when bringing in a professional is crucial for protecting your financial interests. Knowing these signs can save you time, stress, and money in the long run. If you find yourself in any of the following situations, it’s a strong indicator that it’s time to seek legal advice.

When Your Own Collection Efforts Aren’t Working

You’ve sent emails, made phone calls, and maybe even mailed a formal letter, but you’re either being ignored or getting flat-out refusals. When your own attempts to collect are going nowhere, it’s time to consider legal recourse. A promissory note isn’t just a casual IOU; it’s a legally binding document. An attorney can step in to show the debtor you’re serious about enforcement. They can formalize the process and apply legal pressure that you can’t on your own. Don’t feel discouraged if your efforts haven’t worked—that’s exactly what legal professionals who handle creditor representation are here for. It’s about moving from polite requests to decisive action.

When You’re Facing a Legal Deadline

Time is not always on your side when it comes to debt collection. In Missouri, you have a limited window to take legal action to enforce a promissory note. This is called the statute of limitations, and for written contracts, it’s generally ten years. If you wait too long, you could lose your legal right to collect the debt forever. Understanding the specific statute of limitations for collecting debts in Missouri is critical. A collections attorney will know these deadlines inside and out and can ensure a lawsuit is filed before your time runs out, preserving your ability to recover what you’re owed. Acting promptly is key to a successful outcome.

When the Debtor’s Finances Are Complicated

Sometimes, the issue isn’t just a simple refusal to pay. The debtor might own a business, have assets tied up in trusts, or be trying to hide their money to avoid payment. They might even be threatening bankruptcy. These complex financial situations are difficult to sort through without specialized knowledge. An attorney has the resources to conduct asset searches, untangle complicated business structures, and represent your interests if the debtor files for bankruptcy. They can handle debts related to business loans, accounts receivable, and other intricate agreements. When the financial picture is messy, you need an expert who can create a clear strategy for recovery and guide you through the process.

Related Articles

- Collecting Debt in Missouri: Your Legal Step-by-Step Guide

- Missouri Business Debt Collection Laws: A Practical Guide – The Law Office of Chad G. Mann, LLC

- B2B Collection Best Practices for Missouri Businesses – The Law Office of Chad G. Mann, LLC

Frequently Asked Questions

Is it worth hiring an attorney if the amount owed isn’t very large? This is a practical question that really depends on your specific situation. For smaller debts, the cost of legal action is a major consideration. However, many collection attorneys work on a contingency basis, meaning they only get paid if they successfully recover money for you. Also, a formal demand letter from a law firm can be surprisingly effective on its own and is often a less expensive first step. It signals that you are serious, which can be enough to prompt payment without ever going to court.

What if the person who owes me money has moved or is hard to find? This is a common and frustrating problem, but it doesn’t have to be a dead end. Attorneys have access to professional resources, like skip-tracing services, that are designed to locate individuals and their assets. Finding the debtor is a necessary first step before any legal action can be taken, and it’s a standard part of the service a collections attorney provides. They can often find people that you wouldn’t be able to on your own.

Why should I hire an attorney instead of just using a collection agency? The biggest difference comes down to legal authority. A collection agency is limited to calling and sending letters. An attorney can do that, too, but they also have the power to take the debtor to court. Only an attorney can file a lawsuit, obtain a legally binding judgment from a judge, and then use that judgment to enforce payment through actions like wage garnishment or placing a lien on property. This legal leverage is something an agency simply doesn’t have.

What happens if we get a court judgment but the debtor still refuses to pay? Winning in court is a critical step, but it’s not the final one. A court judgment is the legal tool that gives your attorney the power to collect the debt. If the debtor still doesn’t pay, your attorney can begin enforcement proceedings. This involves asking the court for permission to garnish the debtor’s wages, levy their bank accounts, or seize and sell certain assets to satisfy the amount you are owed. The judgment ensures you have a legal right to the money for years to come.

How long does the legal collection process typically take? The timeline can vary quite a bit. In some cases, a strong demand letter from an attorney is all it takes, and the matter can be resolved in a few weeks. If a lawsuit is necessary, the process will take longer. It can take several months to get a court date and obtain a judgment, especially if the debtor tries to fight the case. An experienced attorney can give you a more realistic timeline based on the specifics of your case and the local court’s schedule.