It’s easy to put off estate planning. Many people think it’s only for the wealthy or something to worry about much later in life. These common myths can prevent us from taking crucial steps to protect our loved ones. The truth is, every adult can benefit from having a plan. It’s not about the size of your bank account; it’s about making sure the people you care about are provided for and your wishes are respected. This guide is here to clear up the confusion and show you how straightforward the process can be with the right professional help from a Springfield MO estate planning attorney.

Key Takeaways

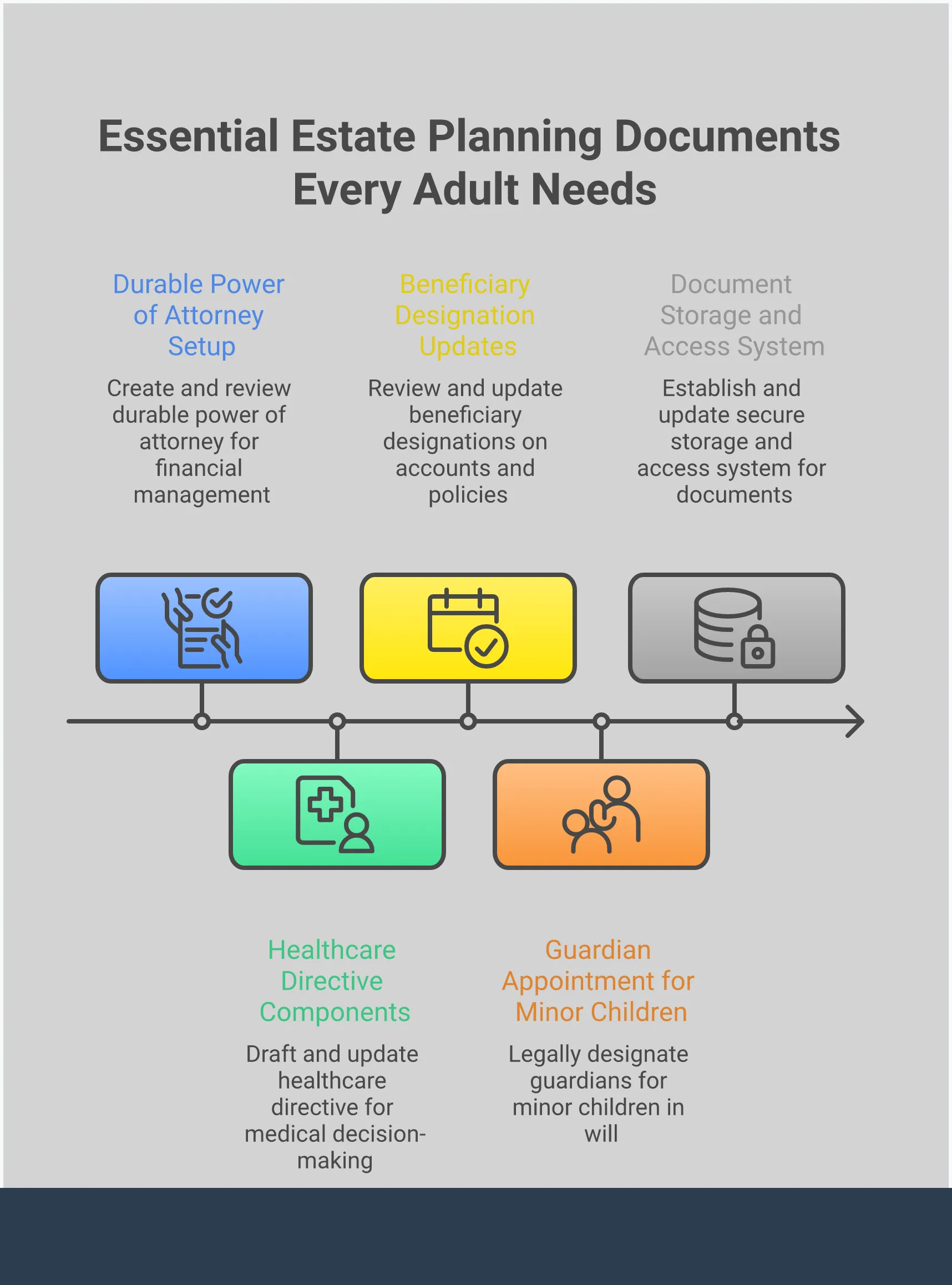

- Go Beyond a Basic Will: A truly effective estate plan protects you during your lifetime, not just after. Ensure your plan includes a durable power of attorney and a healthcare directive to safeguard your financial and medical wishes if you become unable to make decisions for yourself.

- Partner with a Local Specialist: The attorney you choose is your most important asset. Select a lawyer who specializes in Missouri estate law to get expert advice and avoid common pitfalls, ensuring your plan is legally sound and tailored to your specific needs.

- Keep Your Plan Up to Date: An estate plan is not a “set it and forget it” document. Review and update it every few years or after any major life event—like a marriage, birth, or divorce—to ensure it always reflects your current wishes and protects the right people.

How Can a Springfield Estate Planning Attorney Help?

Thinking about estate planning can feel overwhelming, but it’s one of the most thoughtful things you can do for yourself and your family. An experienced attorney does more than just draft documents; they act as your guide, helping you create a clear, legally sound plan that protects your assets and ensures your wishes are honored. They help you prepare for the unexpected, giving you and your loved ones invaluable peace of mind. From simple wills to more complex trusts and healthcare directives, a local attorney can help you build a comprehensive strategy tailored to your specific situation.

Draft Your Will and Testament

A Last Will and Testament is the cornerstone of any estate plan. This is the document where you officially state who should receive your property after you pass away. If you don’t have a will, Missouri state law will decide how to distribute your assets, and that outcome might not align with your intentions. An attorney ensures your will is drafted correctly, clearly states your wishes, and meets all legal requirements to be valid. They can help you address complex family dynamics, appoint a guardian for minor children, and make sure your final wishes are documented in a way that minimizes confusion and potential disputes for your family down the road.

Establish and Manage Trusts

Trusts are powerful legal tools that hold and manage your assets on behalf of your beneficiaries. While not everyone needs a trust, they offer significant advantages for many people. For instance, assets held in a trust can often avoid the probate court process, which saves your family considerable time, money, and stress. Trusts can also provide tax benefits and give you more control over how and when your assets are distributed. A skilled attorney can explain the different types of trusts and help you determine if one is a good fit for your estate planning goals, then handle the legal work to set it up properly.

Prepare Powers of Attorney and Healthcare Directives

A good estate plan doesn’t just cover what happens after you die—it also protects you if you become unable to make decisions for yourself. A Durable Power of Attorney lets you appoint someone you trust to manage your financial affairs if you become incapacitated. Similarly, a healthcare directive outlines your wishes for medical treatment and appoints someone to make healthcare decisions on your behalf. Without these documents, your family may have to go to court to get the authority to help you, a process that can be both costly and emotionally draining. An attorney will help you prepare these critical documents to ensure you’re protected.

Guide Your Family Through Probate

After a person passes away, their estate typically goes through a court-supervised process called probate. This process can be complicated and lengthy, involving validating the will, paying off debts, and distributing the remaining assets to the heirs. An estate planning attorney can be an invaluable resource for your family during this difficult time. They can guide the executor of your will through each step, handling court filings and ensuring all legal requirements are met. This support lifts a significant administrative burden from your loved ones, allowing them to focus on grieving while knowing your affairs are being handled correctly and efficiently.

How to Choose the Right Estate Planning Attorney in Springfield

Choosing an attorney to handle your estate plan is a deeply personal decision. This is the person you’ll trust with your family’s future, your financial legacy, and your most sensitive information. It’s not just about finding someone with a law degree; it’s about finding a partner who understands your goals and can translate them into a solid legal strategy. The right attorney will listen to your concerns, explain complex topics in a way that makes sense, and give you peace of mind.

To find the best fit for you and your family, you’ll want to focus on a few key areas. Think about their specific experience in estate law, how well you communicate with them, and how they structure their fees. Taking the time to vet your options carefully will ensure you build a relationship with a professional you can rely on for years to come. This isn’t a one-time transaction but the start of an important professional relationship that will help protect you and your loved ones through all of life’s changes.

Look for Specialized Experience

When you’re creating a plan to protect your assets and family, you want an attorney who lives and breathes estate law. While many lawyers have a general practice, estate planning has specific complexities that require dedicated focus. An attorney who specializes in this area will be up-to-date on Missouri’s inheritance laws and tax regulations. Their experience helps them anticipate potential issues and craft documents, like a will or trust with a no-contest clause, that are less likely to face legal challenges down the road. Choosing an inexperienced lawyer can lead to costly mistakes, so it’s worth finding someone whose primary practice area is estate planning.

Prioritize Clear Communication and Transparent Fees

You should feel completely comfortable talking openly with your estate planning attorney. This person will be asking you about your finances, family dynamics, and personal wishes, so a strong rapport is essential. A compatible lawyer fosters a better partnership, leading to a more effective and personalized plan. Don’t forget to discuss costs during your first meeting. Many attorneys offer flat fees for standard documents, which makes budgeting much easier. Getting clarity on all potential fees upfront ensures there are no surprises, allowing you to focus on what truly matters: creating a secure future for your family. Feel free to contact us to start the conversation.

Ask These Questions in Your First Consultation

Your initial consultation is the perfect opportunity to interview a potential attorney and see if they’re the right fit. Come prepared with a few questions to guide the conversation. Start by asking, “What is your specific experience with estate planning?” This helps you understand their background and the depth of their expertise. Another great question is, “Based on my situation, what documents do you think I need in my estate plan?” Their answer will give you insight into their approach and whether they are truly listening to your unique needs. Getting to know your potential attorney and their qualifications is a critical first step.

How Much Does Estate Planning Cost in Springfield?

One of the first questions on everyone’s mind when they think about estate planning is, “What’s this going to cost me?” It’s a fair question, and the honest answer is: it depends. The cost of creating an estate plan isn’t a one-size-fits-all number. It varies widely based on your unique family situation, your assets, and your long-term goals. Think of it like building a house—a simple, one-story home will have a very different price tag than a custom-built mansion with unique features.

The good news is that you have options. The price is directly tied to the complexity of the plan you need. A straightforward will is much different from a comprehensive plan involving multiple trusts and business succession strategies. The key is to understand what you’re paying for: peace of mind and a clear, legally sound plan that protects you and your loved ones. An experienced attorney can walk you through the options and provide a transparent breakdown of the fees, so you know exactly what to expect before making any commitments.

A Look at Typical Costs for Wills, Trusts, and More

To give you a general idea, a simple estate plan in Missouri usually costs between $500 and $1,500. This type of plan might include a basic will and powers of attorney. For a more complete or advanced plan that includes documents like a revocable living trust, you can expect the cost to be somewhere between $2,000 and $5,000. These more comprehensive plans offer greater control over your assets and can help your family avoid the probate process. For very complex estates with significant assets, business interests, or intricate family dynamics, a plan could range from $6,000 to $10,000 or more.

Factors That Influence Your Attorney’s Fees

Several key elements can influence the final cost of your estate plan. The complexity of your estate is the biggest driver; if you have numerous properties, investments, or specific goals like minimizing taxes, your plan will require more detailed work. The type of plan you choose also matters—a trust-based plan is generally more involved than a will-based one. Other factors that influence legal fees include the attorney’s experience and the fee structure they use, whether it’s a flat fee or an hourly rate. Special circumstances, like planning for a blended family or a dependent with special needs, also require more specialized attention.

The Difference in Cost: Simple vs. Complex Estates

So, what separates a simple estate from a complex one? A simple estate might belong to a single individual with one home, a retirement account, and clear beneficiaries. In this case, a basic will and powers of attorney might be sufficient, keeping costs on the lower end of the spectrum. In contrast, a complex estate could involve business ownership, properties in multiple states, or the need to establish special trusts for asset protection or charitable giving. These situations demand more sophisticated legal strategies, which naturally increases the cost. The best way to get an accurate quote is to schedule a consultation to discuss your specific needs and get a clear, personalized estimate.

Don’t Believe These Common Estate Planning Myths

When it comes to estate planning, there’s a lot of misinformation out there that can stop people from taking important steps to protect their families. These myths often make the process seem more complicated or less necessary than it truly is. The truth is, a well-crafted estate plan is one of the most thoughtful things you can do for your loved ones, providing clarity and security during a difficult time. It’s not about how much money you have; it’s about making sure your wishes are respected and the people you care about are taken care of.

Let’s clear up some of the biggest misconceptions. Thinking you’re too young, not wealthy enough, or that a simple will covers everything are common reasons people put off planning. But these assumptions can lead to unintended consequences, like family disputes, unnecessary legal fees, or your assets not going where you intended. By understanding the reality of estate planning, you can feel empowered to make informed decisions for your future and your family’s well-being. We’ll walk through these myths one by one to give you the confidence to get started.

Myth #1: “Estate planning is only for the wealthy.”

This is one of the most persistent myths, but it couldn’t be further from the truth. Estate planning is for anyone who has assets they want to protect and loved ones they want to provide for. Many people assume that if they don’t have a mansion or a massive investment portfolio, they don’t need a plan. However, your estate includes everything you own—your home, car, bank accounts, and even personal belongings. An estate plan ensures these assets are distributed according to your wishes, preventing potential conflicts and confusion for your family down the road. It’s about protecting what you have, for the people you love.

Myth #2: “A will is all I need.”

While a will is a cornerstone of any good estate plan, it’s often not enough on its own. A common misconception is that having a will allows your family to bypass the probate process. In reality, a will is essentially a set of instructions for the probate court. Probate can be a time-consuming and public process that may drain your estate’s resources. To ensure a smoother transfer of assets and maintain your family’s privacy, you might need additional tools like trusts. An experienced attorney can help you understand all your legal options and create a comprehensive plan that truly protects your assets.

Myth #3: “I’m too young to need an estate plan.”

It’s easy to think of estate planning as something for your retirement years, but life is unpredictable. Unexpected events can happen at any age, and without a plan, you leave important decisions in the hands of the courts. If you have minor children, an estate plan is the only way to legally name a guardian for them. It also allows you to create directives for your medical care and finances if you become unable to make those decisions yourself. Putting a plan in place now is a responsible and caring step that provides peace of mind for you and your family. If you’re ready to start the conversation, you can contact our office to learn more.

Critical Mistakes to Avoid in Your Estate Plan

Creating an estate plan is a huge step toward securing your family’s future. But it’s not just about having a plan; it’s about having the right plan. A few common missteps can unfortunately undermine even the best intentions, leading to confusion, conflict, and legal headaches for your loved ones down the road. The good news is that these mistakes are entirely avoidable with a bit of foresight and the right guidance. By understanding what to watch out for, you can create a solid plan that truly protects your assets and honors your wishes. Let’s walk through some of the most critical errors people make and how you can steer clear of them.

Hiring an Attorney Who Doesn’t Specialize in Estate Law

This is probably the most significant mistake you can make. While a general practice lawyer might be great for other matters, estate law is a highly specialized field with its own complex rules and tax implications. Think of it this way: you wouldn’t see a general doctor for heart surgery. A qualified estate planning attorney brings deep expertise to the table, helping you handle legal complexities and crafting a plan tailored to your unique needs. They stay current on ever-changing laws to ensure your documents are effective and legally sound, preventing costly errors that a non-specialist might overlook. Working with an expert ensures your plan will function exactly as you intend when it’s needed most.

Forgetting to Update Your Plan After Life Changes

Your estate plan shouldn’t be a “set it and forget it” document. Life is dynamic, and your plan needs to reflect that. Major life events—like getting married or divorced, having a baby, a beneficiary passing away, or a significant change in your financial situation—are all crucial moments to review your documents. An outdated plan can cause serious problems. For example, an ex-spouse could unintentionally inherit assets, or a new child might be left out. It’s a good practice to review your plan with your attorney every three to four years, even if you don’t think anything major has changed. This ensures your plan always aligns with your current life circumstances and wishes.

Overlooking Beneficiary Designations and Incapacity Planning

A will is a cornerstone of an estate plan, but it doesn’t control everything. One of the most common mistakes is failing to update beneficiary designations on accounts like 401(k)s, IRAs, and life insurance policies. These designations supersede your will, so if they’re outdated, your assets could go to the wrong person. It’s also vital to plan for incapacity—the possibility that you might be unable to make your own financial or medical decisions. This involves creating documents like a durable power of attorney and a healthcare directive. And if you have minor children, assigning a guardian is absolutely essential to ensure they are cared for by someone you trust. A comprehensive plan covers you while you’re alive, not just after you’re gone.

Why Choose a Local Springfield Attorney for Your Estate Plan?

When you start thinking about an estate plan, you’ll find countless online services offering quick, fill-in-the-blank templates. While these might seem convenient, they miss a critical element: the human touch and local expertise. Estate planning is deeply personal, and the laws governing it are specific to Missouri. Working with a local Springfield attorney means you’re not just getting a legal document; you’re gaining a trusted advisor who understands both the law and the community you call home. This local connection can make all the difference in creating a plan that truly protects your family’s future and gives you peace of mind.

Deep Knowledge of Missouri Estate Laws

Estate laws aren’t one-size-fits-all; they change from state to state. An attorney based right here in Springfield has a deep and practical understanding of Missouri’s specific statutes, from probate court procedures in Greene County to unique state inheritance rules. This isn’t just textbook knowledge—it’s hands-on experience from helping your neighbors navigate these exact same issues. A local expert can provide tailored advice that a generic online service simply can’t match. Choosing someone you can speak with honestly about your goals is crucial, and a local attorney ensures your will, trusts, and directives are built on a solid foundation of current Missouri law, giving you confidence that your plan will hold up when it matters most.

Accessible for Ongoing Support and Updates

Creating an estate plan is a major step, but it’s not a one-and-done task. Your life is always changing—you might get married, welcome a new child, start a business, or experience other significant shifts. Each of these events can impact your estate plan. One of the biggest benefits of working with a local attorney is having an accessible partner for the long haul. You can schedule a face-to-face meeting to review your documents and make necessary updates. This ongoing relationship ensures your plan evolves with you, preventing it from becoming outdated. Instead of trying to handle complex updates alone, you have a professional you can easily contact for continued guidance and support.

A Partner Invested in Your Community and Your Future

A local attorney is more than just a legal professional; they’re a member of your community. They understand the local landscape and the specific challenges that families in the Springfield area face. This shared context means they’re personally invested in their clients’ well-being. They’re not an anonymous voice on a helpline; they’re a neighbor dedicated to helping you secure your family’s future. By choosing a local attorney like Chad G. Mann, you’re partnering with someone who is committed to the community and has a genuine interest in seeing you and your loved ones thrive for generations to come. This personal investment translates into more thoughtful, empathetic, and effective legal guidance.

Related Articles

- Missouri Estate Planning Guide – Understand Its Importance

- Estate Planning in Missouri: A Simple 7-Step Guide – The Law Office of Chad G. Mann, LLC

- Estate Planning in Missouri: Comparing Wills & Trusts

- How to Find a Trust Lawyer in Springfield, MO | A Guide

Frequently Asked Questions

I don’t have a lot of assets. Do I really need an estate plan? Absolutely. Estate planning is less about the size of your bank account and more about making sure your wishes are respected and your loved ones are cared for. A plan allows you to name a guardian for your children, specify your healthcare preferences, and decide who receives your sentimental belongings. It provides clarity for your family during a difficult time, which is a valuable gift regardless of your net worth.

What happens if I die without a will in Missouri? If you pass away without a will, Missouri’s state laws will determine how your property is divided. This legal process doesn’t consider your personal relationships or intentions. Your assets will be distributed according to a predetermined formula, which may not be what you would have wanted. This can create unnecessary stress and potential conflict for your family, who will have little control over the outcome.

How often should I review my estate plan? A good rule of thumb is to review your plan with an attorney every three to four years. However, you should update it immediately after any major life event. This includes getting married or divorced, having a child, the death of a beneficiary, or a significant change in your financial situation. Keeping your plan current ensures it always reflects your life and your wishes.

What’s the main difference between a will and a trust? Think of it this way: a will is a set of instructions for the court that takes effect after you die. It goes through a public court process called probate to be validated and executed. A trust, on the other hand, is a private legal tool that can manage your assets both while you’re alive and after you’re gone. Assets held in a trust typically avoid the probate process, saving your family time, money, and privacy.

Can I just use an online template for my will? While online templates seem convenient, they carry significant risks. These generic documents can’t provide the personalized advice needed for your unique family and financial situation. They often fail to account for the specifics of Missouri law, which can lead to invalid documents or legal challenges down the road. Working with an attorney ensures your plan is legally sound and truly protects your family as you intend.