It’s tempting to download a generic Healthcare Power of Attorney form online and call it a day. These DIY solutions seem quick and affordable, but they come with serious risks. When it comes to your health, a one-size-fits-all document often fails to cover your unique wishes or meet Missouri’s specific legal requirements. A small mistake in wording or how it’s signed can make the entire document invalid, leaving your family in the exact difficult position you were trying to avoid. This is why professional guidance is so important. An experienced attorney for setting up healthcare POA ensures your document is custom-built, legally sound, and ready to work when you and your family need it most.

Key Takeaways

- Appoint a Trusted Advocate to Speak for You: A Healthcare Power of Attorney lets you choose a specific person to make medical decisions on your behalf if you can’t. This ensures your care is guided by someone who understands your values, preventing confusion and potential court intervention.

- Work with an Attorney to Avoid Costly Mistakes: Missouri has specific legal requirements for creating a valid POA, and DIY forms can easily miss the mark. Professional legal guidance ensures your document is correctly drafted, signed, and witnessed, making it legally enforceable when needed.

- Equip Your Agent Through Open Conversation: Signing the document is only the first step. Have a detailed discussion with your chosen agent about your medical wishes and quality-of-life values, then give them and your doctor a copy. This conversation gives them the confidence and clarity to advocate for you effectively.

What is a Healthcare Power of Attorney?

Thinking about a time when you can’t make your own medical decisions is tough, but preparing for it is one of the most considerate things you can do for yourself and your family. A Healthcare Power of Attorney (POA) is a legal document that lets you name a trusted person—often called an agent or proxy—to make healthcare choices for you if you become unable to. This isn’t just about end-of-life care; it covers any situation where you might be temporarily or permanently incapacitated, like after a serious car accident or during an unexpected illness.

By creating a Healthcare POA, you’re putting your care in the hands of someone who knows you and understands your values. This person becomes your advocate, empowered to speak with doctors, access your medical records, and make decisions that align with your wishes. It removes the burden of guessing from your loved ones and prevents potential disagreements during an already stressful time. Without this document, decisions might be left to a court-appointed guardian or family members who may not agree on the best course of action. Setting up this document is a key part of a comprehensive estate planning strategy, giving you control over your future and ensuring your voice is heard, no matter what happens.

How is a Healthcare POA Different From a Living Will?

It’s easy to confuse a Healthcare POA with a Living Will, and while they’re related, they serve different functions. Think of a Living Will as your instruction manual. It’s a document where you state your specific wishes for medical treatments you would or would not want if you are terminally ill or permanently unconscious. For example, you can specify your preferences on life support or tube feeding.

A Healthcare POA, on the other hand, doesn’t list specific treatments. Instead, it names the person you authorize to make those decisions for you. Your agent can use your Living Will as a guide, but they also have the flexibility to make choices about situations you didn’t anticipate. The two documents work best together to provide a complete picture of your wishes.

When Does Your Healthcare POA Become Active?

Your chosen agent doesn’t get to start making medical decisions for you the moment you sign the papers. A Healthcare POA only becomes active when your doctor determines that you are “incapacitated,” meaning you are unable to understand your medical situation or communicate your own choices effectively. Until that point, you are always in charge of your own healthcare.

This is a critical safeguard that ensures your autonomy is respected for as long as possible. The document is designed to be a safety net, not a surrender of your rights. Once your doctor certifies that you have regained the ability to make decisions, your agent’s authority is paused, and you are back in control.

Missouri’s Legal Requirements for a Healthcare POA

When you create a healthcare power of attorney (POA), you’re giving someone you trust the authority to make medical decisions for you if you can’t. To ensure this document holds up when it matters most, Missouri has specific legal requirements you need to follow. Think of these rules as safeguards that protect your wishes and prevent potential disputes down the road. Getting these details right from the start is crucial for making your healthcare POA legally binding and effective.

What Documents Does Missouri Require?

In Missouri, a healthcare power of attorney is the legal document that lets you name a trusted person—your agent—to make health care decisions on your behalf. This is a core part of any solid estate planning strategy. The document officially grants your agent the power to speak for you when you are unable to communicate your own wishes, whether due to an illness or injury. It ensures that decisions about your medical care align with your values, even when you can’t voice them yourself. This simple document provides clarity for your family and medical team during difficult times.

Following the Rules for Witnesses and Notaries

Simply signing a form isn’t enough to make it official in Missouri. Your healthcare POA must be signed according to state law, which typically requires witnesses. These witnesses confirm that you signed the document willingly and were of sound mind when you did so. While the exact rules can feel a bit technical, they are designed to prevent fraud or coercion. Following these signing protocols for healthcare powers of attorney is a critical step in making sure your document is legally valid and can be enforced by medical providers when needed.

Meeting the Mental Competency Standard

To create a valid healthcare POA, you must be mentally competent at the moment you sign it. This means you need to have the capacity to fully understand what the document is, what powers you are granting, and the consequences of your decision. If someone is already incapacitated, they cannot legally appoint an agent. This standard protects individuals from being taken advantage of and ensures the POA genuinely reflects their own intentions. An experienced attorney can help confirm that all legal standards, including competency, are properly met and documented.

Why Work With an Attorney to Set Up Your Healthcare POA?

Deciding who will make medical decisions for you if you can’t is a deeply personal process. While it might be tempting to download a generic form online, creating a Healthcare Power of Attorney (POA) is one of those times when professional guidance is invaluable. Working with an attorney isn’t just about filling out paperwork; it’s about creating a legally sound document that truly reflects your wishes and protects you and your family from confusion and conflict down the road.

Think of an attorney as your strategic partner. They help you consider situations you might not have thought of, ask the tough questions, and translate your answers into clear, legally binding language. This process ensures your document is tailored specifically to you. An experienced lawyer also guarantees that your POA complies with all of Missouri’s specific laws, so there are no surprises when it’s needed most. Ultimately, investing in legal help provides peace of mind, knowing your wishes are protected and your loved ones have a clear path to follow.

Get Expert Help Drafting Your Documents

A one-size-fits-all template can’t capture the nuances of your life and your specific healthcare wishes. An attorney helps you create a custom document that addresses your unique circumstances. They will walk you through various medical scenarios, helping you define what quality of life means to you and what treatments you would or would not want. This expert guidance helps you make informed decisions, ensuring the document gives your agent the clarity they need to act confidently on your behalf. A lawyer’s job is to anticipate potential ambiguities and close any loopholes, creating a document that is both personal and powerful.

Ensure Your POA is Legally Sound in Missouri

Each state has its own set of rules for creating a valid Power of Attorney, and Missouri is no exception. These laws cover everything from who can serve as a witness to how the document must be signed and notarized. If you miss a single step, the entire document could be invalidated by a court, leaving your family in a difficult position. An attorney who specializes in estate planning knows Missouri’s requirements inside and out. They will oversee the entire process to ensure every legal box is checked, giving you confidence that your Healthcare POA will be honored when the time comes.

Prevent Future Legal Headaches

Without a clear, legally valid Healthcare POA, decisions about your medical care could fall to a court-appointed guardian. This means a stranger might be put in charge, and you lose the ability to choose who speaks for you. This process can also be stressful and expensive for your family, sometimes leading to disagreements among loved ones who believe they know what’s best. By working with an attorney to formalize your wishes now, you prevent this difficult scenario. You provide a clear roadmap for your family and medical team, minimizing conflict and ensuring your care aligns with your values.

Common Myths About Using a Lawyer for Your POA

One common misconception is that the “attorney” in “Power of Attorney” must be a lawyer. In this context, “attorney-in-fact” simply means your designated agent—the person you choose to represent you. While you can name a lawyer, most people select a trusted family member or friend. The lawyer’s role isn’t to be your agent, but to be your advocate in drafting the document. They ensure your chosen agent is legally empowered to act on your behalf. Their expertise is in creating the legal framework, not in making the medical decisions for you.

The Risks of a DIY Healthcare Power of Attorney

It’s tempting to think you can save a little time and money by downloading a healthcare power of attorney form from the internet. These DIY documents promise a quick and easy solution, but when it comes to your health and future, cutting corners can lead to serious problems. A healthcare POA is one of the most important documents you’ll ever create, giving someone you trust the authority to make medical decisions for you if you can’t.

The reality is that a generic, one-size-fits-all form often fails to account for your unique personal wishes and the specific legal requirements of Missouri. A small mistake in how the document is worded, signed, or witnessed can render it completely invalid. When that happens, the very people you were trying to protect are left without clear guidance and may face a stressful court process to get the authority to act on your behalf. This is the exact situation a POA is designed to prevent. Investing in professional legal help ensures your document is solid, clear, and ready to work when you need it most.

The Pitfalls of Handling Complex State Laws Alone

Every state has its own set of rules for creating a valid healthcare power of attorney. According to legal resource Justia, “The rules for signing a health care power of attorney are different in each state. Usually, you must sign the document in front of witnesses.” Missouri is no exception, with specific requirements for how many witnesses you need and whether the document must be notarized. Trying to sort through these legal technicalities on your own is a huge risk. An experienced estate planning attorney understands these local laws and will make sure every detail is handled correctly, so your document is legally sound from the start.

Why a Generic Form Might Not Be Enough

A generic form you find online can’t possibly capture your specific values and wishes for medical care. It also might not hold up if you need medical attention while traveling. As legal publisher Nolo explains, while many states accept directives from other states, “this is not always the case.” Some states will only honor out-of-state documents if they comply with their own laws. An attorney can help you create a comprehensive POA that clearly outlines your preferences and is drafted to be as portable as possible. This personalized approach ensures your agent has the specific guidance they need to honor your wishes, no matter the circumstances.

The Danger of Creating an Invalid Document

The biggest risk of a DIY healthcare POA is that it might not be legally valid when your family needs it. A simple mistake, like using a family member as a witness when it’s not allowed or using ambiguous language, could give someone grounds to challenge the document in court. It’s a common misconception that you can simply use power of attorney documents from the internet without any issues. An invalid POA can cause confusion and conflict among your loved ones during an already emotional time. Working with an attorney provides the peace of mind that your document is properly executed and will stand up to legal scrutiny, protecting both you and your family.

How to Create a Healthcare POA With an Attorney

Working with an attorney to create your healthcare power of attorney turns a potentially confusing task into a clear, manageable process. Instead of trying to decipher legal jargon and state requirements on your own, you’ll have an expert guide to ensure every detail is handled correctly. An attorney will help you think through important decisions, translate your wishes into a legally sound document, and make sure the final paperwork is valid and enforceable. This partnership gives you the confidence that your healthcare preferences will be honored and your loved ones will be protected from difficult legal situations down the road.

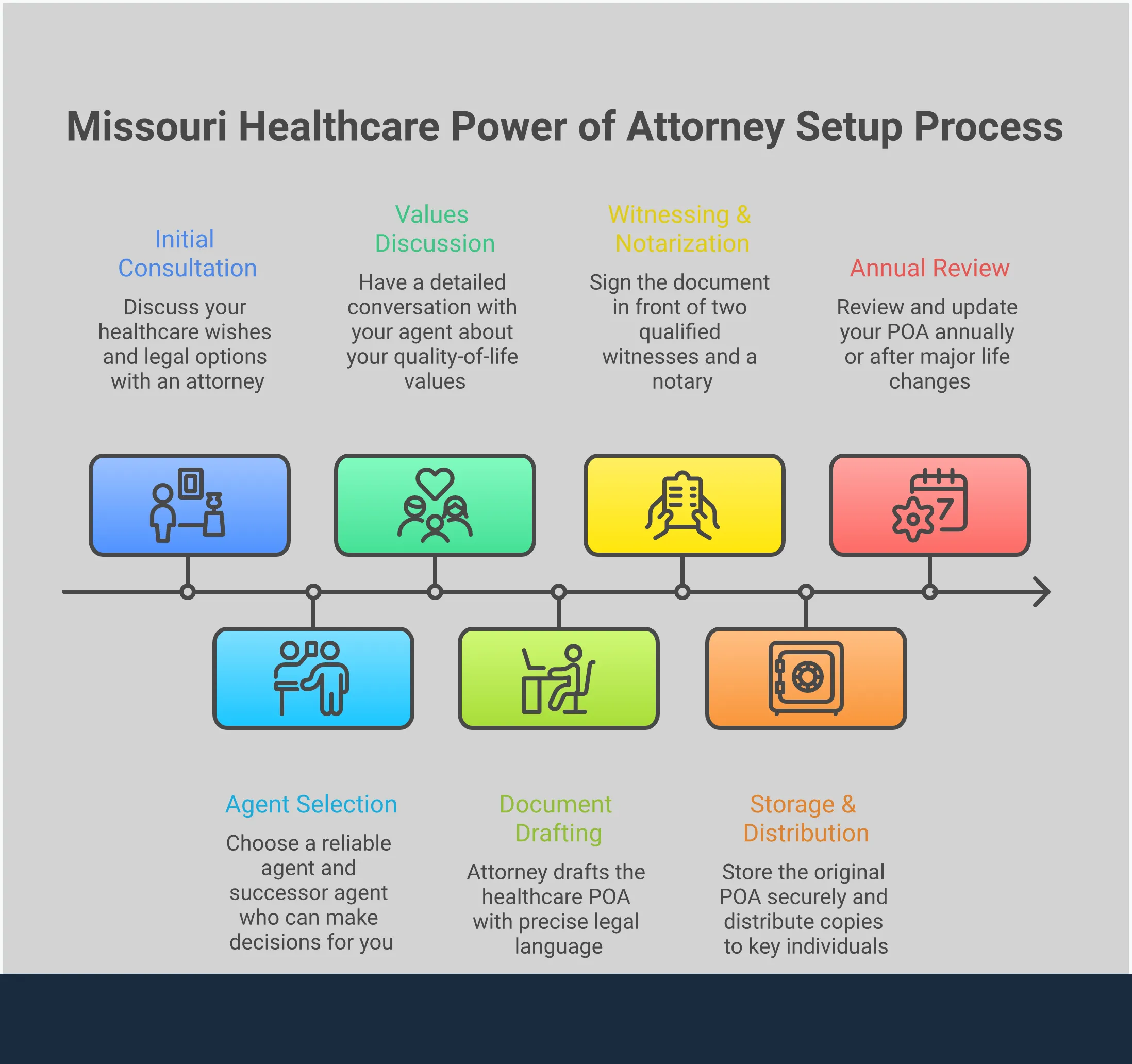

The process generally involves three key stages: preparing for your initial meeting, drafting and reviewing the documents with your lawyer, and then properly signing and storing your POA.

Prepare for Your First Meeting

Before you meet with your attorney, taking some time to prepare will make the process much smoother. Your main task is to think about who you want to appoint as your agent—the person who will make medical decisions for you if you can’t. Choose someone you trust completely to respect your wishes. It’s also wise to select a backup agent in case your first choice is unable to serve. You should also reflect on your values and preferences for medical treatment. You don’t need to have all the answers, but having a general idea will help your attorney draft a document that truly reflects what you want. Your lawyer will need to know that the power of attorney is being created for specific medical decisions you want your agent to handle.

Draft and Review Your Documents

Once you’ve discussed your wishes, your attorney will draft the healthcare POA document. This is where their expertise is invaluable; they will craft a document tailored to your unique circumstances, ensuring it complies with all Missouri laws. When you receive the draft, read it carefully. It is your agent’s responsibility to thoroughly understand the document, but it’s just as important for you to feel confident in what it says. Don’t hesitate to ask questions about any part you find unclear. A good attorney will walk you through each clause to make sure you understand the authority you are granting and that the document accurately captures your intentions. This review process is key to preventing any future misunderstandings.

Sign and Store Your POA Safely

Signing your healthcare POA is a formal process that must be done correctly to be legally valid. Your attorney will arrange for the signing to happen in front of the required witnesses and a notary public, handling all the legal formalities for you. Remember, this powerful legal document gives someone you trust the right to make healthcare decisions for you, but only when you are unable to make them yourself. After it’s signed, you’ll need to store the original in a safe yet accessible place. You should also give copies to your agent, your backup agent, and your primary care physician. Making sure the right people have a copy is crucial for the document to be effective when needed. If you’re ready to get started, you can contact an attorney to guide you.

How to Choose the Right Person as Your Agent

Choosing the person who will make medical decisions for you is one of the most important parts of this process. This person, known as your agent or proxy, becomes your voice when you can’t speak for yourself. It’s a role that requires immense trust and responsibility, so it’s worth taking the time to think carefully about who is best suited for the job. It isn’t always your spouse or oldest child; it’s the person you know will honor your wishes without hesitation.

What to Look for in a Healthcare Agent

Your agent will be responsible for making specific, and sometimes difficult, medical decisions on your behalf. You need someone who is not only trustworthy but also level-headed and capable of acting under pressure. Think about who in your life is calm in a crisis and can communicate clearly and assertively with doctors. Your agent should understand your values and be committed to advocating for them, even if they don’t personally agree with all of your choices. Proximity matters, too—it’s helpful if your agent lives nearby or can easily travel to be by your side when needed. This is a key part of our estate planning services.

How to Talk About Your Medical Wishes

Once you’ve chosen an agent, you need to have an open and honest conversation with them. A common fear is that creating a medical power of attorney means giving up your right to make your own decisions, but that’s simply not true. Your agent can only step in if a doctor determines you are unable to make decisions for yourself. Talk to them about your preferences regarding life support, pain management, and end-of-life care. The more they understand your values, the more confident they can be in carrying out your wishes. These conversations can be tough, but we can help you prepare the legal documents that make your choices official.

Why You Should Name a Backup Agent

Life is unpredictable, which is why you should always name at least one alternate agent. Your primary choice could become ill, move away, or be unreachable in an emergency. If your agent is unable or unwilling to serve and you don’t have a backup, your loved ones may have to go to court to have a guardian appointed, causing stressful delays in your care. Naming a successor ensures that someone you trust is always ready to step in. While you can change your POA at any time as long as you are mentally competent, choosing a solid primary and backup agent from the start provides a crucial safety net. An experienced attorney like Chad G. Mann can help you think through these important what-ifs.

What to Discuss With Your Healthcare Agent

Choosing your healthcare agent is a huge step, but the work doesn’t stop there. The most important part of this process is the conversation you have with them after you’ve signed the papers. This discussion is what transforms a legal document into a true reflection of your wishes, giving your agent the confidence to act on your behalf when you can’t speak for yourself.

Think of it as creating a guide for them. You’re not just handing over authority; you’re providing the context and personal values they’ll need to make decisions that align with what you would want. These conversations can feel heavy, but they are one of the greatest gifts you can give to the person you’ve entrusted with this role. It removes the burden of guessing and allows them to advocate for you with clarity and certainty. A well-informed agent is an empowered agent, and that’s exactly what you need during a medical crisis. Taking the time now to talk through your preferences ensures your voice will be heard, no matter what the future holds.

Share Your Values and Medical Preferences

This conversation goes deeper than just a checklist of medical procedures. It’s about sharing the core values that shape your life and your perspective on health. Your agent needs to understand what a good quality of life means to you. Talk about your spiritual or religious beliefs, your fears, and your hopes. Would you prefer to be at home, or are you comfortable in a hospital setting? What makes a day worth living for you? A health care advance directive gives your agent the power to manage these decisions, so they need to see the world through your eyes to make choices you would make for yourself.

Define Their Decision-Making Power

It’s crucial to be clear about the scope of your agent’s authority. Your POA document can be as broad or as specific as you want it to be. You can outline your exact wishes regarding life-sustaining treatments, pain management, or organ donation. The agent’s primary responsibility is to act in accordance with your instructions. If your wishes aren’t known, they must act in your best interest—which can be difficult to determine without your input. By clearly defining their power and your preferences, you give them a roadmap to follow, ensuring your care aligns perfectly with your values. An attorney can help you articulate these specifics in your estate planning documents.

How to Find the Right Attorney for Your Needs

Choosing an attorney to help with your healthcare Power of Attorney is a deeply personal decision. You’re not just hiring someone to fill out forms; you’re selecting a guide to help you plan for some of life’s most critical moments. The right lawyer will not only have the legal know-how but will also be someone you feel comfortable confiding in. Taking the time to find a good fit ensures your wishes are protected and gives you peace of mind. Think of it as finding a trusted partner who can help you navigate the legal details, so you can focus on what truly matters.

Look for Experience in Estate Planning

When you start your search, focus on attorneys with specific experience in estate planning. While many lawyers can draft a document, someone who specializes in this area understands the specific nuances of Missouri’s healthcare laws. They can provide tailored advice to make sure your POA is comprehensive and legally solid. An estate planning attorney stays current on any legal changes that could affect your documents and can anticipate potential challenges your family might face down the road. This expertise is invaluable in creating a POA that truly reflects your wishes and will hold up when it’s needed most.

Find Someone You Can Trust and Talk To

Legal qualifications are important, but so is your comfort level with the attorney. You’ll be discussing sensitive topics about your health and end-of-life preferences, so it’s essential to find someone you can trust and communicate with openly. A good attorney will listen carefully to your concerns, answer your questions without using confusing jargon, and make you feel heard. You can often get a sense of their approach by reading about their background and philosophy. The initial consultation is a great opportunity to see if their personality and communication style are a good fit for you.

Clarify Fees and Services Upfront

Before you commit, make sure you have a clear understanding of the attorney’s fees and what their services include. Don’t be shy about asking for details. Find out if they charge a flat fee for creating a healthcare POA or if they bill by the hour. Ask what the fee covers—from the initial consultation and drafting to any revisions and the final signing. A reputable attorney will be transparent about their costs and happy to explain their process. This upfront conversation prevents surprises later and helps you move forward with confidence. When you’re ready, you can contact a firm to schedule a meeting and discuss these details.

Common Mistakes to Avoid When Creating a Healthcare POA

Setting up a healthcare POA is a thoughtful process, but a few common missteps can undermine your efforts. Knowing what to watch out for helps ensure your document truly protects you and reflects your wishes when it matters most. By avoiding these pitfalls, you can create a POA that gives you and your loved ones peace of mind.

Mistake #1: Waiting Too Long

It’s easy to put off planning for a medical emergency, but waiting until you need a healthcare POA is often too late. If you become incapacitated without one, a court may have to appoint a guardian to make decisions for you. This process can be slow, expensive, and stressful for your family. More importantly, the person a court chooses might not be who you would have picked. Taking the time to create your estate planning documents now gives you control over your future, preventing potential disagreements among family members about your care.

Mistake #2: Forgetting to Update Your Documents

Your life isn’t static, and your legal documents shouldn’t be either. A major life event—like a marriage, divorce, or the death of your chosen agent—is a clear signal to review your healthcare POA. It’s also wise to revisit your documents every few years to make sure they still align with your wishes and relationships. As long as you have the mental capacity, you can change or revoke your POA at any time. Regular updates ensure the person you trust most is empowered to act on your behalf and that your medical directives are current.

Mistake #3: Being Vague About Your Wishes

A healthcare POA is not the place for ambiguity. If your instructions are unclear, your agent may struggle to make decisions, or worse, make choices that don’t reflect what you would have wanted. Be specific about your preferences regarding life-sustaining treatments, pain management, and other potential medical interventions. The more detailed you are, the easier it is for your agent to honor your wishes confidently and without confusion. Discussing these details with an attorney can help you articulate your desires clearly and effectively in a legally sound document. If you’re ready to get specific, you can contact our office to get started.

Keep Your Healthcare POA Valid and Accessible

Creating your healthcare power of attorney is a huge step toward protecting your future, but the work doesn’t stop once the ink is dry. Think of your POA not as a one-and-done document, but as a living part of your overall life plan. For it to work when you need it most, it has to be current, valid, and in the right hands. An outdated or inaccessible POA can cause the very confusion and conflict you’re trying to prevent. Taking a few simple steps now to maintain your document ensures your wishes will be honored and your agent can act confidently on your behalf. It’s all about making sure this powerful legal tool is ready to go when the time comes.

Store and Share Your POA Correctly

Once your healthcare POA is signed and notarized, you need a safe, accessible place to keep the original. A fireproof box at home or a safe deposit box are good options, but make sure your agent knows where it is and how to get to it. The most important step, however, is sharing copies. Your agent and any backup agents must have a copy. They can’t advocate for you if they don’t have the document that gives them the authority. It’s also wise to provide a copy to your primary care physician to add to your medical file. A POA is created for specific medical decisions, and ensuring the right people have it is key to making it effective.

Review and Update Your Documents Regularly

Life changes, and your healthcare POA should change with it. It’s a good practice to review your documents every few years or after any major life event, like a marriage, divorce, or a significant change in your health. Check that your chosen agent is still the right person for the job and is willing to serve. It’s their responsibility to fully understand the document and the authority you’ve given them. A quick review ensures your POA reflects your current wishes and circumstances. This simple habit helps you maintain control over your future healthcare and is a core part of sound estate planning.

Keep Your Doctors in the Loop

Your healthcare providers can’t follow your wishes if they don’t know what they are or who is authorized to speak for you. Providing a copy of your healthcare POA to your doctor ensures it becomes part of your permanent medical record. This simple action clears up any confusion about who has the authority to make medical decisions if you become incapacitated. A healthcare POA is a type of advance directive, so your medical team will know exactly what to do with it. Make sure your primary physician, any specialists you see, and the local hospital have a copy on file. If you have questions about this process, feel free to contact us for guidance.

Related Articles

- Missouri Power of Attorney Guide | Types, Laws & How to Set One Up

- Estate Planning in Missouri: A Simple 7-Step Guide – The Law Office of Chad G. Mann, LLC

- Understanding Living Wills & Advanced Healthcare Directives in Missouri – The Law Office of Chad G. Mann, LLC

- Missouri Living Will Guide 2024 | Chad G. Mann Law

Frequently Asked Questions

Does creating a Healthcare POA mean I give up control of my medical decisions now? Not at all. Your agent only gains the authority to make medical decisions for you after a doctor has determined that you are incapacitated and unable to make or communicate them yourself. Until that specific point, you are always in charge of your own healthcare. Think of it as a safety net that only activates when you truly need it.

What happens if I don’t have a Healthcare POA? If you become unable to make your own medical decisions without a POA in place, a court may have to appoint a legal guardian for you. This process can be time-consuming and stressful for your family. It also means a judge, who doesn’t know you, could end up choosing the person who will make these deeply personal choices for you, which may not be the person you would have selected.

Can I just use a form I found online instead of hiring a lawyer? While it might seem convenient, a generic online form can be risky. Missouri has specific legal requirements for signing and witnessing these documents, and a small error can make the entire form invalid. A lawyer ensures your POA is tailored to your personal wishes and complies with all state laws, giving you confidence that it will work when your family needs it most.

Who is the best person to choose as my agent? The best agent is someone you trust completely to honor your wishes, even under pressure. This person should be level-headed, a clear communicator, and assertive enough to advocate for you with medical staff. It doesn’t have to be your spouse or oldest child; it should be the person who understands your values and will put your preferences first, no matter what.

What if my agent and my family disagree on my care? This is exactly why a legally sound Healthcare POA is so important. The document gives your chosen agent the legal authority to make decisions, and medical providers are required to follow their instructions. By clearly outlining your wishes in your POA and discussing them with your agent beforehand, you provide a clear roadmap that minimizes confusion and prevents family disagreements from interfering with your care.