When you’re injured at work, it’s easy to feel powerless. Your employer and their insurance company seem to hold all the cards, and you might worry about losing your job just for filing a claim. But you have more control than you think. The Missouri workers’ compensation system gives you a specific set of rights designed to protect you. You have the right to proper medical care, the right to hire an attorney, and the right to be free from employer retaliation. Understanding these rights is the key to advocating for yourself and ensuring you receive the full benefits you deserve.

Key Takeaways

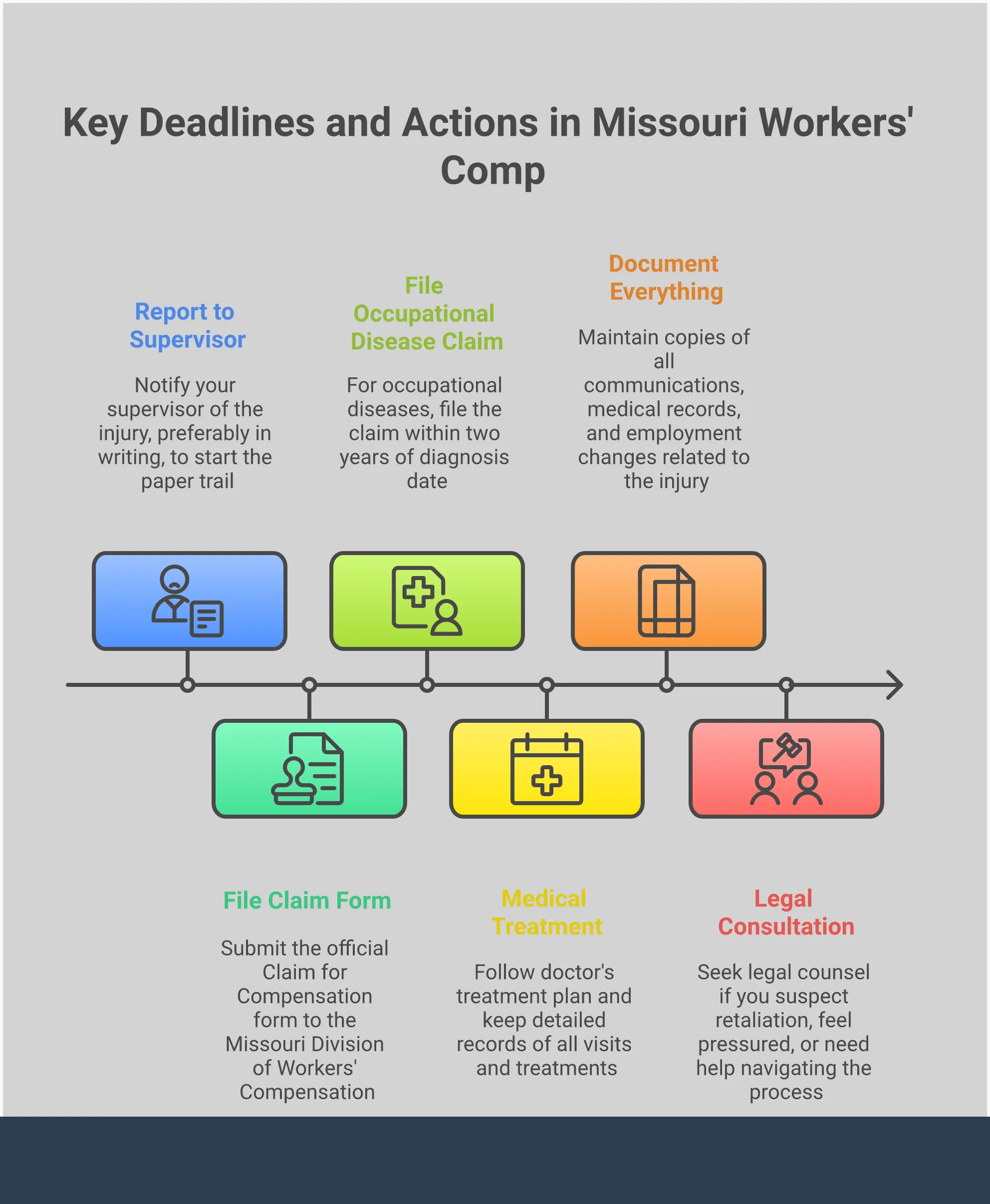

- Your first steps are the most important: You must report your injury to your employer within 30 days and file an official claim with the state within two years. Following these initial deadlines is the single most important thing you can do to protect your right to benefits.

- Benefits are designed for your total recovery: Workers’ compensation is meant to do more than just pay for doctor visits. It provides wage replacement to maintain financial stability, offers payments for permanent impairments, and can even include vocational training to help you return to work.

- You have the right to advocate for yourself: It is illegal for your employer to retaliate against you for filing a claim. You can also appeal a denial and hire an attorney to deal with insurance adjusters, ensuring you have a professional on your side to protect your interests.

What is Missouri Workers’ Compensation?

If you’ve been injured at work, you’ve probably heard the term “workers’ compensation,” but you might not be sure what it really is. Think of it as a safety net. Missouri Workers’ Compensation is a state-required insurance program designed to protect you if you get hurt on the job. It’s a specific area of law with its own rules and deadlines, which can feel overwhelming when you’re also trying to recover from an injury.

The system is meant to provide you with the medical care and financial support you need without having to file a lawsuit against your employer. Understanding how it works is the first step toward getting the benefits you deserve. Let’s break down the key things you need to know about this essential program.

Your Safety Net After a Work Injury

At its core, workers’ compensation is a “state-mandated, ‘no-fault’ insurance system that pays benefits to workers injured on the job.” This insurance, which your employer pays for, is designed to cover your essential needs after a workplace accident. The primary goal is to help you recover without the added stress of financial ruin.

The system provides specific benefits to cover your medical care, replace a portion of your lost wages while you’re unable to work, and offer compensation for any permanent disability resulting from your injury. By ensuring these critical expenses are handled, the system allows you to focus on what’s most important: your health and recovery. Navigating these practice areas can be complex, but the protection is there for you.

Understanding Missouri’s “No-Fault” System

The term “no-fault” is one of the most important concepts in workers’ compensation. It means that you don’t have to prove your employer did something wrong to cause your injury. Whether you slipped on a clean floor or were injured by faulty equipment, fault isn’t the deciding factor. As long as your injury happened while you were on the job, you are generally entitled to benefits.

This is a major difference from a personal injury lawsuit, where you would have to prove someone else’s negligence. The Missouri workers’ compensation law was created to take care of people who are hurt “through no fault of their own while on duty.” This no-fault approach helps injured workers get medical treatment and wage benefits much faster than a traditional lawsuit would allow.

The “Exclusive Remedy” Rule

The “no-fault” system comes with a trade-off, which is known as the “Exclusive Remedy” rule. This rule essentially means that because your employer provides workers’ compensation insurance, you cannot sue them in court for a work-related injury. While that might sound like you’re giving up a right, it’s the central agreement that allows the system to function. The purpose is to create a more direct path to getting help. Instead of facing a long and uncertain legal battle to prove fault, you are guaranteed access to medical care and wage benefits promptly. This trade-off is a fundamental part of Missouri’s workers’ compensation law, designed to make the process predictable for everyone involved.

Who Qualifies for Workers’ Comp in Missouri?

So, how do you know if you qualify for benefits? The main requirement is that your injury must “occur in the course and scope of employment.” This means you were doing something related to your job when the accident happened. This could be an obvious injury, like falling from a ladder on a construction site, or something less direct, like getting into a car accident while running an errand for your boss.

Most employees in Missouri are covered, but some exceptions exist, such as for independent contractors or certain agricultural workers. If you’re unsure whether your situation qualifies, it’s always best to get clarity. Don’t just assume you aren’t covered. You can contact our office to discuss the specifics of your case.

Employer Coverage Requirements

In Missouri, the law is quite specific about which employers must carry workers’ compensation insurance. Any business with five or more employees is legally required to provide this protection. The rule is even more stringent for the construction industry, where all employers must have coverage, regardless of how many people they employ. This is important for you to know because if your employer meets these criteria, you are entitled to workers’ compensation benefits if you are injured while working. This isn’t an optional perk your boss can decide to offer; it’s a mandatory safeguard required by state law.

Rules for Business Owners and Partners

The rules can get a little more complex for business owners themselves. Corporate officers are usually covered under workers’ compensation, with one key exception: they can be excluded if the company has only two owners who are also the only two employees. Similarly, members of an LLC are typically covered but can choose to opt out by completing a specific form. For sole proprietors and partners, coverage is optional. If they decide to include themselves, their insurance costs are calculated using a minimum payroll amount to ensure adequate coverage. These nuances highlight why it’s important for business owners to understand their rights and obligations, and if you have questions, it’s always best to seek clear legal advice.

Debunking Common Workers’ Comp Myths

Many people worry that their claim will be automatically denied, but that’s not usually the case. In fact, statistics show that “only about 13% of Missouri workers’ compensation claims are denied.” When denials do happen, they are often for preventable reasons. The most common issues include “missed filing deadlines, waiting too long to see a doctor, or failing to follow the doctor’s treatment plan.”

This is actually good news because it means you have a lot of control over the outcome. By acting quickly and responsibly, you can avoid these common pitfalls. Reporting your injury immediately, seeking prompt medical attention, and carefully following your treatment plan are three of the most important steps you can take to protect your right to benefits.

How the Workers’ Comp System Works for Employers

While your focus is rightly on your own recovery, it can be helpful to understand what’s happening on the other side of the table. Workers’ compensation is a system that employers must also follow, and they have their own set of responsibilities and financial considerations. Knowing a bit about their obligations can give you a clearer picture of the entire process and help you understand the motivations behind the decisions made by your employer and their insurance company. This isn’t about taking their side; it’s about arming yourself with knowledge.

How Insurance Costs Are Calculated

For your employer, workers’ compensation is a required insurance policy, and it’s a significant business expense. The cost of this insurance isn’t a flat fee; it’s calculated based on several factors. The primary elements are the company’s total payroll and the types of jobs its employees perform. Each job is assigned a “class code” based on its level of risk—for example, a construction worker’s code will have a much higher rate than that of a desk clerk. The insurance rate is then applied as a percentage for every $100 of wages paid to employees in that class. Additional state surcharges and fees can also be added to the final premium, making it a complex and costly obligation for businesses.

How to Check if a Business Has Coverage

In Missouri, most employers with five or more employees are legally required to carry workers’ compensation insurance. But how can you be sure your employer is covered? Thankfully, you don’t have to take their word for it. The state of Missouri provides a free online tool to check if a business has workers’ compensation insurance. You can search the database using your employer’s business name or their Federal Employer Identification Number (FEIN). This is an important step you can take to confirm that the proper protections are in place for you and your coworkers. If you find that your employer does not have coverage, it’s a serious issue, and you should immediately seek legal advice to understand your rights. You can contact our office to discuss the best course of action.

What Benefits Can You Receive?

If you’ve been hurt on the job, you’re probably worried about more than just your physical recovery. How will you pay your medical bills? What about your regular expenses if you can’t work? The Missouri workers’ compensation system is designed to address these exact concerns. It’s not just a one-time payment; it’s a safety net created to provide a range of benefits that support you through your recovery journey. Think of it as a comprehensive support system that helps you manage the financial and medical challenges that come with a work-related injury.

The primary goal is to ensure you get the medical treatment you need without drowning in debt, while also providing a level of income to keep your household afloat. Depending on the nature and severity of your injury, the benefits can extend to long-term disability payments and even assistance with returning to work. For families who have lost a loved one in a workplace accident, there are also provisions to help them through an unimaginably difficult time. Understanding these different types of support is the first step in making sure you receive everything you’re entitled to. The claims process can feel overwhelming, but knowing what’s available can empower you to advocate for your needs.

Getting Your Medical Bills Paid

One of the most immediate worries after an injury is the cost of medical care. Workers’ compensation is set up to cover 100% of your authorized medical treatment related to the on-the-job injury. This isn’t just for the initial emergency room visit. It includes all necessary medical care, such as follow-up appointments with doctors, surgeries, physical therapy, prescription medications, and even mileage reimbursement for your travel to and from appointments. The system is “no-fault,” which means you don’t have to prove your employer was negligent to receive these benefits. The focus is simply on getting you the care you need to recover.

Mileage Reimbursement for Medical Travel

The costs of driving to and from doctor’s offices, physical therapy sessions, and pharmacies can add up fast, creating another financial headache you don’t need. Thankfully, Missouri workers’ compensation includes reimbursement for this travel. The state sets an official rate, which currently stands at 67 cents per mile, to cover your transportation expenses for all authorized medical care. To ensure you receive this benefit, it’s crucial to keep a detailed log of every trip. Record the date, the location of your appointment, and the round-trip mileage. Submitting this log to the insurance adjuster is a straightforward way to get back the money you spent on travel, making sure that distance is never a barrier to your recovery.

How to Get Paid While You Recover

When a work injury prevents you from doing your job, the bills don’t stop. Workers’ compensation provides temporary disability benefits to replace a portion of your lost income while you’re recovering. In Missouri, this is typically two-thirds of your average weekly wage, up to a state-mandated maximum. These payments are meant to provide financial stability, allowing you to focus on healing without the constant stress of a lost paycheck. This support helps you cover essential expenses like your mortgage, utilities, and groceries, ensuring your family can maintain its footing during your recovery period.

Temporary Disability Benefit Rates

The amount you receive is based on a straightforward formula: it’s calculated as two-thirds of your average weekly wage from before your injury. However, there is a limit to this amount. Missouri sets a maximum weekly benefit, which is updated annually to reflect the State Average Weekly Wage (SAWW). This ensures that the workers’ compensation benefits keep pace with the state’s economic conditions. This structure is designed to provide a consistent and fair level of income replacement, helping you cover your living expenses so you can focus on your recovery without the added financial pressure.

What Disability Benefits Are Available?

Disability benefits are categorized based on the severity and duration of your injury. If you’re temporarily unable to work at all, you may receive Temporary Total Disability (TTD) benefits. If you can work in a limited or “light-duty” capacity for lower pay, you might get Temporary Partial Disability (TPD) benefits. For injuries that result in a permanent impairment but don’t prevent you from ever working again, you could be eligible for Permanent Partial Disability (PPD). In the most severe cases, where an injury leaves you unable to return to any type of work, Permanent Total Disability (PTD) benefits provide long-term support.

Permanent Partial and Total Disability Rates

When your injury results in a permanent impairment, the compensation you receive is based on specific rates set by the state. For Permanent Total Disability (PTD), where you are unable to return to any work, the maximum weekly benefit is the same as for temporary total disability, currently capped at $1,280.84. This higher rate reflects the complete loss of earning capacity. However, for Permanent Partial Disability (PPD), which compensates you for a specific loss of function but assumes you can still work in some capacity, the maximum rate is lower, at $670.92 per week. The total amount you receive for PPD depends on a complex formula involving your impairment rating and the body part affected. Understanding these different disability benefits can be challenging, but knowing the rates helps you see what financial support is available for your long-term recovery.

Support for Returning to the Workforce

The ultimate goal of the workers’ compensation system is to help you return to a productive life. For many, this includes getting back to work safely. If your injury prevents you from returning to your old job, you may be entitled to vocational rehabilitation services. This could involve career counseling, job placement assistance, or even retraining for a new position that accommodates your physical limitations. These services are designed to give you the tools and support needed to transition back into the workforce, providing a path forward after a life-altering injury. It’s a crucial benefit that focuses on your long-term well-being.

Support for Families After a Work-Related Death

In the tragic event that a work-related injury or illness results in death, workers’ compensation provides death benefits to the employee’s surviving dependents. This financial support is intended to help families cope with the devastating loss of income and manage expenses during an incredibly difficult time. These benefits typically include a one-time payment to help with burial costs and weekly payments to a surviving spouse and dependent children. While no amount of money can replace a loved one, these provisions ensure that a family is not left in financial distress. If you are facing this situation, it is wise to seek compassionate legal guidance by contacting a professional.

Death Benefit Rates

The weekly payments provided to families are based on the deceased employee’s average weekly wage, much like how temporary disability benefits are calculated. However, the state sets a maximum amount for these payments. For work-related deaths that occur on or after July 1, 2025, the maximum weekly death benefit is capped at $1,280.84. This cap provides a standard limit, but the actual amount a family receives will depend on their loved one’s earnings. These payments, combined with a one-time payment for funeral expenses, are designed to offer consistent financial support to the surviving spouse and dependent children. Because these situations are incredibly sensitive and the calculations can be complex, it is often helpful to discuss your specific situation with an attorney to ensure your family receives the full support they are entitled to.

How to File a Workers’ Comp Claim in Missouri

If you’ve been hurt on the job, the process of filing a workers’ compensation claim can feel overwhelming. You’re dealing with an injury, medical appointments, and potential time off work—the last thing you want is a complicated legal process. But it doesn’t have to be a source of stress. Think of it as a series of manageable steps. By following the correct procedure and keeping track of deadlines, you can protect your right to receive the benefits you deserve. It’s all about knowing what to do and when to do it.

The most important thing is to act quickly and document everything. Don’t wait to see if the pain goes away on its own or feel pressured to “tough it out.” Your health and financial stability are what matter most. Taking these initial steps correctly sets the foundation for your entire claim and can make a significant difference in the outcome. The Missouri workers’ comp system has specific rules you need to follow, and missing a step can jeopardize your case. We’ll walk through exactly what you need to do, from the moment the injury happens to filing the official paperwork. Here’s a straightforward guide to get you started on the right path.

Step 1: Report Your Injury to Your Employer

The clock starts ticking the moment your injury occurs. Under Missouri law, you must report your work-related injury to your employer within 30 days. This is a strict deadline. If you miss it, you could lose your right to benefits entirely. Reporting your injury means telling your direct supervisor, manager, or HR department exactly what happened. It’s always a good idea to do this in writing—even a simple email—so you have a record of the date and time you gave notice. Don’t downplay your injuries; be clear and honest about what happened and how you feel.

Step 2: Get Authorized Medical Treatment

After you report the injury, your next step is to get medical attention. In Missouri, your employer has the right to choose the doctor who will treat your work-related injuries. You can’t just go to your own family doctor and expect workers’ comp to cover it. You need to ask your supervisor for the name and location of their authorized physician or clinic. Following this rule is crucial for ensuring your medical bills are covered by their insurance. If your employer doesn’t direct you to a specific doctor, make sure to get that in writing before seeking care on your own, as explained by the Division of Workers’ Compensation.

What to Say to the Workers’ Comp Doctor

Your conversation with the workers’ comp doctor is one of the most critical parts of your claim, as their notes become official evidence. Be completely honest and thorough. Describe every symptom you’re experiencing, even if it seems minor or comes and goes. Explain exactly how the injury happened and, just as importantly, how it impacts your ability to perform your job duties. Instead of just saying “my back hurts,” explain that you can no longer lift heavy objects or stand for long periods. If you have a pre-existing condition in the same area, be upfront about it. Transparency builds credibility and prevents the insurance company from trying to use it against you later. The goal is to give the doctor a complete and accurate picture of your condition so they can provide the right treatment and document your limitations correctly.

What to Avoid Saying to the Doctor

Just as important as what you say is what you don’t say. Never downplay your injury with phrases like, “It’s not that bad” or “I’ll be fine.” Insurance adjusters can twist these comments to argue your injury isn’t serious. Also, avoid making promises about when you’ll return to work; let the doctor make that determination based on your medical progress. Be careful with absolute words like “always” or “never,” as symptoms can fluctuate. Finally, keep the conversation focused strictly on your medical condition. Do not discuss your workers’ comp claim, financial settlements, or legal representation. The doctor’s role is to treat you, not to offer legal advice. If you have questions about your claim, that’s what we’re here for. You can contact our office to handle the legal details so you can focus on your health.

Step 3: File Your Claim with the Division

Simply telling your employer about your injury isn’t the same as filing an official claim with the state. To formally start the process, you must complete and submit a “Claim for Compensation” form. This document is filed with the Missouri Division of Workers’ Compensation, not your employer. You can file a claim by completing the form found on the Department of Labor’s website. Be sure to fill it out completely and accurately before mailing it to the address listed. This official step is what legally establishes your claim within the state’s system and protects your rights moving forward.

Don’t Miss the Missouri Filing Deadline

Beyond the initial 30-day reporting window, there is another critical deadline you must not miss: the statute of limitations. In Missouri, you generally have two years from the date of the injury to file your official Claim for Compensation. If it’s an occupational disease that developed over time, the deadline is two years from the date it was diagnosed. This is a firm cutoff. If you fail to file your claim within this two-year period, you will likely be barred from ever receiving benefits for that injury. If you’re approaching this deadline or feel unsure about the process, it’s wise to seek legal advice to ensure your rights are protected.

Overcoming Common Workers’ Comp Hurdles

Filing for workers’ compensation should be a straightforward process, but it often feels like anything but. After you’ve been injured on the job, your focus should be on healing, not on fighting a complicated system. Unfortunately, many injured workers run into roadblocks that add significant stress to an already difficult time. You might be dealing with physical pain, financial worries from being out of work, and the emotional toll of the injury itself. The last thing you need is to feel like you’re being given the runaround by your employer or their insurance company.

Understanding these potential hurdles is the first step toward protecting your rights and getting the benefits you deserve. From outright claim denials to subtle pressure tactics from insurance adjusters, these challenges are designed to minimize the insurance company’s payout. As an attorney who has dedicated my career to helping injured people, I’ve seen these tactics play out time and again. Knowing what to look out for can help you prepare for bumps in the road and make informed decisions about your claim. This section will walk you through some of the most common issues injured workers in Missouri encounter so you can be ready for them.

Top Reasons Your Claim Might Be Denied

It’s incredibly disheartening to learn your claim has been denied, but it’s important not to lose hope. While most claims are approved, about 13% of Missouri workers’ compensation claims are initially rejected. Often, the reasons are preventable. Denials most commonly result from simple mistakes like missing the strict filing deadlines, waiting too long to see a doctor after the incident, or not following the doctor’s prescribed treatment plan. In other cases, an employer might dispute that the injury happened at work. If your claim is denied, you have the right to appeal the decision. The first step is to understand exactly why it was denied so you can build a stronger case. Our firm handles a wide range of practice areas and can help you figure out your next move.

Common Claim Exclusions

While Missouri’s “no-fault” system is designed to help injured workers, it isn’t a blank check. There are specific situations where your claim can be rightfully denied, even if it happened at your workplace. For example, if your injury occurred because you were under the influence of drugs or alcohol, or while engaging in illegal activities, your claim will likely be excluded from coverage. The same applies to injuries that happen when you intentionally break a clear company safety rule. These rules exist because the injury is seen as a result of serious misconduct, not a standard workplace accident. If your employer is arguing that one of these exclusions applies to you, it’s important to understand your rights and the specifics of the law.

Insurance Adjuster Tactics to Watch For

Soon after you file a claim, you will likely speak with a workers’ compensation adjuster. It’s crucial to remember that they work for the insurance company, and their primary goal is to resolve your claim for the lowest possible cost. Some adjusters use specific tactics that can make it harder for you to get the money you deserve. They might try to record your conversation, hoping you’ll say something that downplays your injury. They may also question how the accident happened or suggest your injuries aren’t as severe as you claim. Being aware of these workers’ comp adjuster tricks is key to protecting your rights. Always be polite but cautious, stick to the facts, and avoid giving a recorded statement until you’ve had a chance to seek legal advice.

What to Do When You Disagree on Medical Care

Your medical care is the foundation of your workers’ comp claim, but it can also become a major point of conflict. The insurance company has the right to question the treatment plan recommended by your doctor, often arguing that a specific procedure or therapy isn’t necessary. One of the most critical things you can do for your case is to follow your doctor’s instructions to the letter. Failing to follow your doctor’s treatment plan is a common reason for claims being denied. If you miss appointments, stop physical therapy, or don’t take prescribed medication, the insurance company can argue that you aren’t committed to your recovery and use it as a reason to cut off your benefits.

Should You Accept the First Settlement Offer?

If an insurance adjuster contacts you with a settlement offer shortly after your injury, you should be very cautious. It might feel like a relief to get a check in hand quickly, but these early offers are almost always far less than what your claim is actually worth. Adjusters know you’re likely worried about lost wages and medical bills, and they use that anxiety to pressure you into a quick settlement. The problem is, an early offer is made before anyone truly knows the full extent of your injuries, the amount of future medical care you’ll need, or how long you’ll be out of work. Accepting it means you forfeit the right to any future benefits for that injury. It’s always wise to contact us before signing any settlement agreement.

Is Work-Related Stress or Mental Health Covered?

Physical injuries aren’t the only harm that can happen at work. Missouri workers’ compensation law does provide benefits for mental health conditions, but there’s a catch: they must be a direct result of your job. For example, a single traumatic event at work that leads to post-traumatic stress disorder (PTSD) could be covered. However, these claims are often much more complex to prove than physical injury claims. You must show a clear, medically-supported link between your work duties or a work incident and your mental health condition. Because proving this causation can be so challenging, these are the types of cases where getting experienced legal guidance is especially important.

Your Rights as an Injured Worker in Missouri

When you’re hurt on the job, it’s easy to feel overwhelmed and unsure of what to do next. The workers’ compensation system can seem complicated, and you might worry about making a mistake that could jeopardize your benefits. But here’s the good news: you have specific rights designed to protect you. Understanding these rights is the first step toward taking control of your situation and ensuring you get the care and support you deserve.

Think of these rights as your personal toolkit for handling your claim. They cover everything from the medical treatment you receive to your ability to seek legal advice without fear of losing your job. Knowing that you can get a second opinion, that you’re protected from retaliation, and that you can appeal a denied claim gives you a solid foundation to stand on. It’s about making sure your voice is heard and your needs are met. We’ll walk through each of these key rights so you can feel confident as you move forward with your recovery and your claim.

Can You Get a Second Medical Opinion?

After a work injury, your employer’s insurance company will direct you to a doctor for treatment. While you must see their chosen physician initially, this doesn’t mean you’ve lost all control over your health care. The workers’ compensation system is designed to cover all necessary medical care to help you recover. If you feel the authorized doctor isn’t providing adequate care or you disagree with their diagnosis, you have the right to request a second opinion. This is a critical right that ensures you receive treatment that is truly in your best interest. Don’t hesitate to speak up if you feel your recovery is stalling or your concerns are being dismissed.

When Should You Hire a Workers’ Comp Attorney?

You are always allowed to hire an attorney to represent you in a workers’ compensation case. While the system is intended to be a “no-fault” process, it often involves complex legal procedures, strict deadlines, and negotiations with insurance adjusters who are trained to minimize payouts. Having an experienced lawyer on your side levels the playing field. An attorney can help you with the paperwork, gather the right evidence, and ensure your injury is properly documented as work-related. If you’re feeling lost or pressured, getting professional legal help can make all the difference. You can contact a legal expert to understand your options.

Can You Be Fired for Filing a Workers’ Comp Claim?

Many injured workers worry that filing a claim will put their job at risk. It’s important to know that Missouri law makes it illegal for your employer to fire, demote, harass, or discriminate against you in any way for exercising your right to file a workers’ compensation claim. This protection is in place to ensure you can seek the benefits you are entitled to without fear of punishment. If you notice any negative changes in your employment—like reduced hours, a sudden transfer, or unfair disciplinary action—after reporting your injury, you should document it immediately. This could be a sign of unlawful retaliation, and you have legal recourse.

How to Appeal a Denied Claim

Receiving a denial letter for your claim can be disheartening, but it’s not the final word. You have the right to appeal the decision. Claims can be denied for many reasons, from a missed deadline to a dispute over whether the injury was work-related. Sometimes, it’s as simple as the insurance company claiming you didn’t follow the doctor’s treatment plan. The appeals process has specific steps and deadlines, which is why this is another point where legal guidance is invaluable. An attorney can review the reason for the denial, file the necessary appeals, and represent you at hearings to fight for the benefits you need.

Helpful Resources for Your Return to Work

The ultimate goal of the workers’ compensation system is to help you recover and, when possible, return to work safely. As you heal, there are several resources available to support this transition. The Missouri Division of Workers’ Compensation offers information and assistance to injured employees. Your employer’s human resources department may also have return-to-work programs. These resources can help coordinate light-duty assignments, workplace accommodations, or vocational rehabilitation if you’re unable to return to your previous job. An attorney can also help ensure your return to work is handled properly and that your rights are protected throughout the process.

Related Articles

- Missouri Workers Compensation: A Simple Guide

- Missouri Workers’ Comp Guide: Know Your Legal Rights

- Your Guide to Workers Compensation Lawyers in Springfield MO

- Injured at Work in Missouri: Your Comprehensive Guide on What to Do Next – The Law Office of Chad G. Mann, LLC

- Missouri Workers Compensation Insurance: A Complete Guide

Frequently Asked Questions

What if my injury was my fault? Can I still get benefits? Yes, most likely. Missouri’s workers’ compensation system is “no-fault,” which means you are generally eligible for benefits even if your own mistake contributed to the accident. The system was designed to provide medical care and wage support without getting into a lengthy debate about who was to blame. As long as your injury happened in the course and scope of your employment, you should be covered.

My boss is telling me to just use my health insurance. Is that a good idea? This is not the correct way to handle a work-related injury. Workers’ compensation is the specific insurance that is legally required to cover on-the-job injuries. Using your personal health insurance could lead to your claim being denied by your health insurer later on, and you would miss out on other key benefits like payments for lost wages and compensation for any permanent disability. You should always report the injury and file a workers’ comp claim.

How much does it cost to hire a workers’ comp attorney? Most workers’ compensation attorneys, including our firm, work on a contingency fee basis. This means you don’t pay anything upfront. The attorney’s fee is a percentage of the benefits or settlement they help you recover. If you don’t receive a settlement or award, you typically don’t owe any attorney fees. This approach allows you to get experienced legal help without worrying about the cost while you’re already dealing with financial stress.

What happens if the doctor my employer sent me to says I’m fine, but I’m still in pain? You are not stuck with that one opinion. If you disagree with the diagnosis or treatment plan from the company-approved doctor, you have the right to seek a second opinion. It’s important not to ignore your symptoms or feel pressured to return to work before you are medically ready. An attorney can help you formally request a second opinion and ensure your medical needs are being properly addressed.

My employer is treating me differently since I reported my injury. What can I do? It is illegal for your employer to fire you, cut your hours, demote you, or otherwise retaliate against you for filing a workers’ compensation claim. Missouri law protects you from this kind of treatment. If you believe you are being punished for getting hurt and seeking benefits, you should document every incident carefully. This is a serious issue, and it’s a good time to consult with an attorney to understand how to protect your job and your rights.